Summary:

- Nvidia’s stock has outperformed expectations due to their dominance in AI, but delays in Blackwell chip could impact their market share and growth.

- Analysts remain bullish on Nvidia despite Blackwell delays, but competition from AMD and supply chain issues key risks to future growth.

- Nvidia’s high valuation and growth estimates may not be sustainable, with potential downside of 24.51% if shares adjust to more conservative valuation.

Antonio Bordunovi

Investment Thesis

Despite my personal bearish outlook on Nvidia (NASDAQ:NVDA) for most of this year, the AI giant’s shares have persistently outperformed the market and defied my personal beliefs that they are set to fall. The GPU maker’s gravity-defying performance this year is largely due to their dominance in AI through their data centers offerings, all of which, I’ll admit, continue to grow at an incredible rate as of their last quarterly report. Nvidia’s Q1 results sported a 262% year-over-year revenue increase, with the data center segment alone growing by 427%.

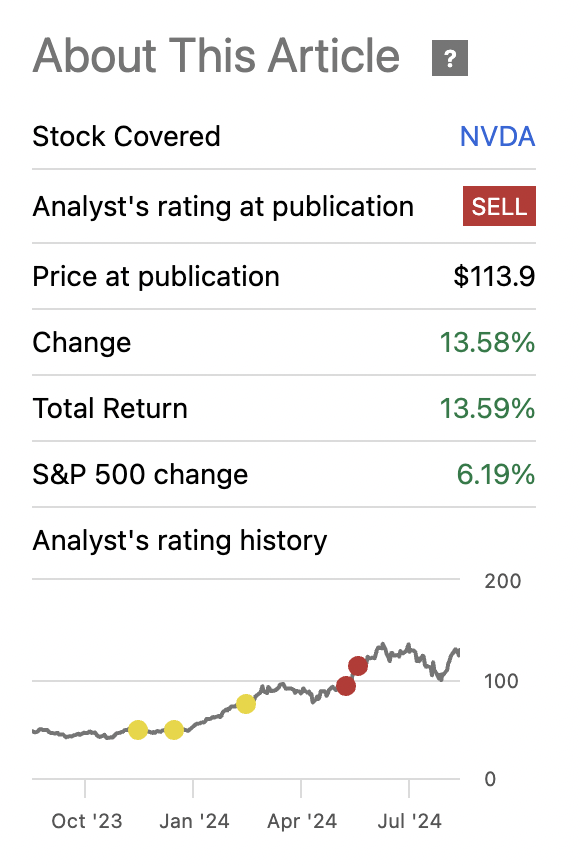

Nvidia Performance Since May (Seeking Alpha)

Their strong performance has surprised me, but it suggests that the market has consistently underestimated Nvidia’s growth potential, meaning upside had to keep getting priced in. The company’s recent stock split has similarly powered their shares to near all-time highs to a market capitalization exceeding $3 trillion, a level previously achieved only by tech giants like Apple (AAPL) and Microsoft (MSFT).

In essence, I think we are near peak bullishness. There have been a lot of catalysts to power the stock up, but I’m not sure the upward pressure exists anymore. The Blackwell chip delays could be the tip of the iceberg.

Nvidia has dominated the data center GPU shipments over the last year as ChatGPT has exploded, with 98% data center market share according to Wells Fargo. That means that if their flagship chip is delayed, the majority of the market (by market share since they share the same common GPU supplier) could look elsewhere to find new chips if Nvidia can only continue to offer the H200 (vs newer chips like their competitor AMD’s MI 300X).

My concern is the company’s Blackwell chip line has been reportedly delayed due to design flaws, and these setbacks will open up new market share for competitors to grab. These delays, which are estimated to be at least three months, could push back the deployment of the chips in major customers’ data centers, such as those of Microsoft, Google, and Meta, into Q1 of next year. Analysts have raised questions about the integrity of the chip’s design (given the complexity around the CoWoS-L they are using) and the readiness of Nvidia’s production processes they have deployed with Taiwan Semiconductor (TSM).

A company’s flagship product being delayed is typically a big deal to revenue forecasts, yet street expectations continue to drift higher. I think it is a recipe for extreme bullishness.

Nvidia’s growth estimates may be overly optimistic, given the delays in Blackwell and especially in light of increasing competition from AMD plus in-house development by major cloud providers like Amazon (AMZN). While Nvidia has dominated the AI chip market, these competitors have swiftly ramped up their own chip development. Amazon, for instance, is developing AI chips that promise to be cheaper and faster. I think that Nvidia’s growth may not be as robust as some projections indicate given the Blackwell hit on supply and the competitors chipping away demand given that market share is so high. It’s very hard to maintain 98% market share in anything. This may be the misstep Nvidia takes that gives their competitors and opening.

I think this quarter is crucial for understanding Nvidia’s future, since the delays and increasing competition will both impact the company’s goal to meet the lofty growth expectations currently priced into their stock. Given this, I continue to be a sell on Nvidia. Don’t get me wrong, it’s a great story and they make great products. I just do not like the stock.

Why I’m Doing Follow-Up Coverage

Since FY Q1 results in May (and my last coverage piece), Nvidia’s stock has remained robust, powered by a combination of high demand for AI infrastructure and the anticipation surrounding their next-generation Blackwell chips.

However, as I mentioned above, the unexpected delay, driven by design flaws and complications with newly implemented packaging technology (CoWoS-L), has caught both investors and major customers off guard. Nvidia has been riding a wave of market borderline euphoria, with large orders from tech giants like Microsoft, Google (GOOGL), and Meta (META), all of whom are betting heavily on the Blackwell architecture to power their AI initiatives. However, I think it’s obvious that a delay now puts those plans on hold, and could potentially disrupt the timelines for deploying these firms’ critical AI infrastructure across the tech industry. Google’s CEO Sundar Pichai noted on their earnings call that this is a time to over-invest in GPUs, not underinvest. They need to secure GPU capacity for their AI models. A delay does not help.

My goal with this analysis is to dive into the implications of this delay. I believe this is not just a minor hiccup, since it could have a massive impact on the company’s stock performance in the near term, as their competitors are also betting big in the AI chip market and could pounce.

Earnings Preview

As the company gears up for earnings after the bell Wednesday, the market is acutely focused on their EPS and revenue estimates. For this quarter (FY Q2), analysts expect EPS to come in at $0.64/share and revenue to reach $28.71 billion, which demonstrates 137.84% YoY growth despite headwinds.

This is the part I want to dive into: over the past few months, earnings estimate revisions have been overwhelmingly positive, with 30 upward revisions by analysts for Nvidia EPS and 28 upward for revenue (compared to 6 downward EPS revisions and 4 downward revenue revisions). This incredible bullish sentiment holds even in the wake of the delays associated with the Blackwell chip, and implies they have strong confidence in Nvidia’s ability to cover a Blackwell blackhole in their demand pipeline.

Blackwell Delays Are Big

To understand why this delay is a big deal, we have to look at Nvidia’s chief competitor (AMD). As I highlighted in my analysis of AMD’s AI inflection curve, Nvidia’s postponement opens a crucial window for AMD to gain market share in the AI chip sector (Nvidia’s pain could be AMD’s gain).

AMD’s new MI300X GPUs, has reportedly surpassed Nvidia’s current H100 (one of their current flagship chips) on many key benchmarks. With Blackwell delayed, AMD has a unique opportunity to grab market share and help accelerate their technology being entrenched in data centers and AI applications. Nvidia has a 98% market share here based on the research I’ve done. Losing any market share as growth slows is an issue. Nvidia really seems set-up here to lose market share here assuming their Blackwell delays are as bad as we assume, and assuming that AMD can jump on the opportunity (I think they can). In fact, Nvidia is already likely losing market share based on key recent deals AMD won (earlier in the Spring, Microsoft offered AMD GPUs for the first time as an alternative to Nvidia chips to customers). And this was before any effects of a Blackwell delay impacted their customers. The Blackwell delay certainly won’t help.

The delays in Nvidia’s Blackwell chip are rooted in challenges with the advanced fabrication technology employed by TSMC. Specifically, TSMC is using their Chip-on-Wafer-on-Substrate (CoWoS) packaging, a technique designed to integrate multiple chips on a single substrate to enhance performance and efficiency.

The move, however, has introduced unique technical difficulties with mismatches causing warping in the chips, which in turn affects the production yield.

Adding to this, the key circuit connecting the two Blackwell GPUs within their packaging was identified as another major flaw that further complicates mass production.

Even if this process was working smoothly, TSMC’s current production capacity for CoWoS-L is also insufficient to meet Nvidia’s aggressive demands, exacerbating the delays. The supply problems here seem to be compounding.

This delay has left billions of dollars in pre-orders from major tech companies like Microsoft, Google, and Meta in limbo. Google has reportedly ordered over 400,000 units of the GB200 chip, with total orders from the search giant exceeding $10 billion, while Meta and Microsoft have similarly placed multi-billion dollar orders, and pushed the deployment of their AI infrastructure into 2025. Any more Blackwell delays could make hyper-scalers highly inclined to try the latest GPUs from AMD, who does not appear to be struggling with this problem.

Valuation

Even with a Blackwell risk, Nvidia’s growth estimates for the next 12 months remain higher than the sector median. Analysts project a forward revenue growth rate of 84.04% for the company, much higher than the sector median of only 6.52%. What I find weird is that the ultra-bullish outlook remains even as production issues loom, and shows the market’s incredible confidence in the stock. Investor confidence can be stripped away in the event of expectations not meeting reality. Heading into the quarter, we may be seeing that here.

The high growth metrics (which may not be as robust as they appear on the surface) are for now powering Nvidia’s large valuation premium. The company’s forward P/E ratio of 47.12 is nearly double the sector median of 23.71, indicating that the market is pricing in exceptional growth expectations. On this same note, their forward price-to-sales ratio stands at 26.22, far exceeding the sector median of 2.99.

I think Nvidia shares need to come down to price in this risk. If Nvidia’s share price were to adjust to a more conservative valuation, such as a 50% premium to the sector median forward P/E, I think this would be a much better setup and potential entry point for investors. Here, in this case, this would imply a P/E of approximately 35.57. Even with this bump up in P/E, this adjustment would result in downside potential of roughly 24.51% from the current valuation.

Risks

Despite the delays with their Blackwell chips, Nvidia continues to show strong demand for their AI GPUs, driven by the very same aggressive spending from Big Tech firms on AI infrastructure that has also powered the Blackwell orders. Companies like Microsoft, Google, and Meta are investing billions into AI GPUs, with spending already at unprecedented levels.

On this note, given the demand, some Wall Street analysts remain optimistic since they believe the delays won’t have a huge dent on the chip giant’s revenue or demand (customers will buy more of the current models).

Herein lies the problem. We know big tech says they are overspending on AI chips and technology right now because they think it’s a winner take all market (Google’s CEO Pichai said they are probably overspending on AI on the investor conference call). What this means is that Google will likely have a day come where they have too many chips on hand and do not need to order as many.

At this point (as an investor) would you rather have them sitting on Blackwell chips, or would you rather have customers sitting on an H100/H200 stash?

I think a delay in Blackwell could make Nvidia customers buy cheaper GPUs now (at the expense of Blackwell chips later) or consider other GPU brands.

It’s true customers could simply just wait for the new Blackwell series to come out if the delay stays at 3 months.

But I actually think there is more downside risk in this statement to Nvidia than any of the other alternatives. Of these three options, the reason I think big tech not modifying their Blackwell chip orders is one of the less-likely options has to come back to one of the main reasons they are buying these chips: competition.

Over the last 6 months, something unique has happened. Meta (through their Llama series) has surpassed both Google’s Gemini and Microsoft’s OpenAI GPT models to now offer the best foundation models on the market. This has huge implications given that Llama is open-source but the other two are not.

Having the best foundation model is a key part of customers using your ‘AI-ecosystem’ in my opinion. OpenAI not having the best LLM makes it harder for Microsoft to argue they can do the best AI cloud integration when their enterprise clients can simply get their own Llama 3.1 model, upload it to a competing Amazon AWS instance, and use a third party to customize it.

Microsoft needs to help OpenAI get back in the lead. Right now, they can only offer last generation H200 chips to help train the model on.

Meta? Meta is using AMD’s new MI 300X chips to train Llama with. Microsoft is already buying MI 300X chips to offer to clients through Azure. What are the odds they swap out some Blackwell orders (because they cannot handle the delay) and choose to put more AMD GPUs into their ecosystem?

In other words, the market seems to be underestimating the impact of these delays. While demand is currently not the problem, the supply bottleneck could disrupt the company’s capability to capitalize on the current AI boom to their fullest. The earnings call guidance will be crucial to allow us to peer into a more cautious outlook, and that is part of what I am aiming to convey.

Takeaway

Nvidia faces notable operational mountains to climb despite their current strong demand for their GPUs, driven by Big Tech’s massive investments in AI infrastructure.

Delays in the Blackwell chip due to design flaws and supply chain issues just seem to present a major risk that the market is not pricing a lot of. Together with increasing competition from companies like AMD, I think this delay raises real concerns about Nvidia’s future growth among investors and analysts.

I have little doubt the company will record (what is for many F500 firms) strong revenue growth and better margins in the upcoming quarterly report. But I just don’t see how delays lead to helping Nvidia stock stay elevated. With this, I am still a sell on shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.