Summary:

- I reiterate a “Strong Buy” rating for Nvidia Corporation with a one-year target price of $160 per share due to robust growth in data center and networking.

- Nvidia’s data center revenue grew 154% YoY, driven by strong demand for H200, Blackwell, InfiniBand, and Ethernet for AI workloads.

- Nvidia’s gaming segment shows stable growth with a 16.7% YoY increase, supported by high-performance RTX 40 Series GPUs and GeForce NOW platform.

- Key risks include competition from big tech companies like Microsoft developing their own AI chips, though Nvidia remains ahead in GPU technology.

Antonio Bordunovi

I upgraded NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) to a “Strong Buy” rating in my previous article published in May 2024, highlighting the strong demand for H200 and Blackwell. The company released its Q2 result on August 28th after the bell, reporting 154% year-over-year growth in data center. I am impressed by the 114% of growth in their networking business, driven by adoptions of InfiniBand and Ethernet for AI. I reiterate a “Strong Buy” rating with a one-year target price of $160 per share.

Networking Growth and Blackwell Ramping Up

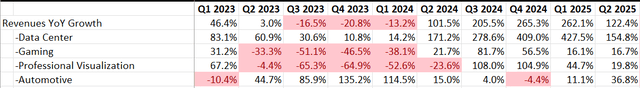

As detailed in the table below, Nvidia achieved 122% growth in total revenue, with 154% growth in data center business.

The strong growth in their data center is propelled by several factors:

- As communicated by the management, Nvidia began shipping Blackwell samples to their customers during the quarter, with the Blackwell production scheduled to ramp up in Q4. The company made a change in the GPU mask to improve production yield. Nvidia expects to deliver several billion dollars in Blackwell revenue in Q4. For Blackwell, each die is being paired with 4 stacks of HBM3E memory, providing high-performance computing for AI workloads. I am confident that Blackwell will be adopted by both cloud hyperscalers and enterprise customers.

- Nvidia continues to deliver strong revenue growth with its Hopper GPU computing platform, and the Tensor core technology supports both large-scale and small-scale of AI training and inference. Until Blackwell enters mass production, I anticipate Hopper architecture will remain favored for AI workloads. Additionally, Nvidia has made progress in the supply chain for the Hopper architecture over the past few quarters, enabling faster shipment to their customers.

- Lastly, my biggest takeaway from the quarter is their strong growth in the networking business, driven by adoptions of InfiniBand and Ethernet for AI. Nvidia has launched several new products for Spectrum-X end-to-end Ethernet platform. As discussed in my previous article, Nvidia and Arista Networks (ANET) are leading the competition in Ethernet solution for GPU and AI workloads, while Cisco (CSCO) is losing market share. It is evident that InfiniBand is gaining popularity among enterprise and hyperscalers. As a result, Nvidia’s Networking revenue reached $3.7 billion, an 114% year-over-year increase. Currently, networking represents more than 12% of total revenue for Nvidia. I expect networking business will become another major growth driver for Nvidia in the future.

Stable Gaming Growth

In Q2, Nvidia’s Gaming business grew by 16.7% year-over-year. Nvidia’s GeForce RTX 40 Series GPU products provide high-performance computing for gaming consoles. These AI-powered graphics enable gaming companies to develop virtual reality and other high-performance games.

On August 22nd, Nvidia introduced GeForce NOW, a platform for Xbox automatic sign-in in the cloud. There are several triple A games available on the platform in the cloud, including Black Myth: Wukong, FINAL FANTASY XVI, and Civilization VI, Civilization V and Civilization: Beyond Earth. The new game of Black Myth: Wukong has become a top game in China, and the gaming industry views it as a revolution in the China market. Considering Nvidia’s GeForce performance, I believe Nvidia’s Gaming business will sustain double-digit revenue growth in the near future.

Growth Projection and Valuation

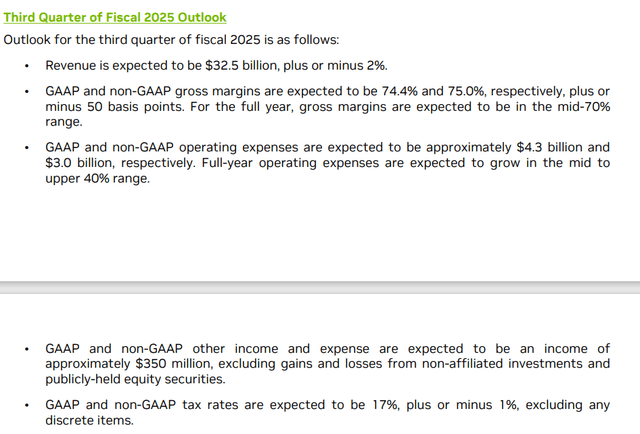

Nvidia is guiding for around 80% growth in revenue for Q3, as detailed below.

I am considering the following factors for their near-term growth:

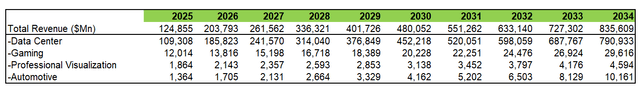

- Data Center: The segment represents more than 87% of total revenues, and Nvidia’s near-term growth will be primarily driven by Data Center segment. There are three major drivers within the segment: Hopper, Blackwell, and Networking. As discussed, Hopper architecture will remain the major growth contributor in FY25, in my view. When Blackwell production ramps up in Q4, it could potentially become a significant growth driver for Nvidia’s growth in FY26 and FY27. Lastly, I forecast Networking business will continue to grow rapidly due to the adoption of InfiniBand and Ethernet for AI/data centers. As discussed in my previous article, the number of parameters in ChatGPT-4 is expected to be 10 times larger than in ChatGPT-3, which will require a massive increase in GPU computing powers. Considering all these factors, I calculate Nvidia’s Data Center will generate $109 billion in revenue in FY25, and gradually grow to $790 billion by FY34.

- Gaming: I anticipate GeForce will continue to gain market share in the high-performance computing gaming industry, delivering 15% annual revenue growth in the near term, then moderate to 10% from FY27 onwards.

- Professional Visualization: I assume the company will sustain the growth momentum in Professional Visualization segment, delivering 20% growth in FY25, then moderating to 10% in the future.

- Automotive: It is a relatively small business for Nvidia, only representing around 2% of total revenue. I assume Nvidia will grow in line with the overall market growth, delivering 25% annual revenue growth.

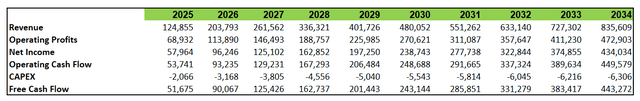

As such, I calculate Nvidia will grow their revenue by 105% in FY25, before moderating to 15% growth starting in FY31. The detailed breakdown is as follows:

Nvidia DCF Model – Author’s Calculations

Nvidia’s margin expansion will primarily come from operating leverage, as revenue growth is outpacing the growth in total operating expenses. I estimate the operating leverage will generate from SG&A expenses, contributing around 100bps expansion in FY25, 70bps in FY26, then moderating to 10bps from FY27 onwards.

With these assumptions, the discounted cash flow (“DCF”) summary can be found as follows:

Nvidia DCF Model – Author’s Calculations

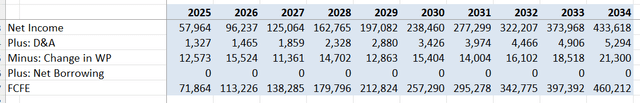

The free cash flow from equity is calculated as follows:

Nvidia DCF Model – Author’s Calculations

The cost of equity is estimated to be 16% assuming: risk-free rate 3.8%; equity risk premium 7%; beta 1.88.

Discounting all the FCFE, the one-year target price is calculated to be $160 per share, based on my DCF model.

Key Risk

I think the biggest risk for Nvidia is not coming from Advanced Micro Devices (AMD) or Intel (INTC) as Nvidia is far head in GPU technology, as analyzed in my previous articles. However, big tech companies such as Microsoft (MSFT), Meta Platforms (META), and Alphabet (GOOGL) are attempting to develop their own AI chips.

For example, on August 27th, Microsoft shared specifications for Maia 100, their first-generation custom AI accelerator designed for AI machine learnings in their cloud infrastructure. The chip utilizes TSMC’s N5 process technology. Although Maia 100 cannot compete with Nvidia’s current technology, I anticipate Microsoft and other big tech companies will continue to develop their internal AI chips to reduce the reliance on Nvidia in the future.

End Note

Hopper, Blackwell, and InfiniBand, along with Ethernet for AI, should continue to drive Nvidia’s Data Center business in the upcoming years, in my view. I reiterate a “Strong Buy” rating for Nvidia Corporation stock with a one-year target price of $160 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.