Summary:

- Nvidia Corporation’s Q2 ’25 earnings beat expectations with $30B in revenue and $0.68 in EPS, driven by resilient Data Center GPU demand.

- Nvidia announced a $50B stock buyback, doubling last year’s authorization, signaling confidence in future growth and enhancing shareholder value.

- Nvidia’s free cash flow surged 123% YoY to $13.5B, with stable margins, indicating strong business fundamentals.

- Despite a 7% post-earnings drop, Nvidia’s resilient demand, strong financials, and potential EPS estimate revisions make it a strong buy.

- In my opinion, the Nvidia stock sell-off makes very little sense and I believe investors should consider buying the pullback.

David Tran

Shares of Nvidia Corporation (NASDAQ:NVDA) fell 7% after the chipmaker reported another quarter of strong financial results, driven by red-hot demand for its graphics processing units for the Data Center market. Nvidia generated both a top and bottom-line beat, and, most importantly, issued a decent guidance for the third fiscal quarter. Further, Nvidia announced a massive $50B stock buyback, which could push shares of Nvidia into a new up leg… and which indicates accelerating capital return potential.

The market had been overly cautious ahead of the earnings release. It did not respond well to Nvidia’s actual results amid uncertainty about the Blackwell delivery time-line, but I believe Nvidia management has made clear that the Data Center business continues to benefit from surging GPU demand. With shares dipping after the Q2 ’25 earnings release, I am buying more Nvidia and upgrading my rating.

Previous rating

I rated shares of Nvidia a buy in August, chiefly because large tech enterprises did not appear to scale back their AI investment spending at all: “The AI Fatigue Myth.” Nvidia continued to see strong revenue growth in its Data Center business in Q2 ’25 and the Blackwell product launch, although delayed, could potentially drive a revenue acceleration for Nvidia’s core business. With the company also announcing a massive $50B stock buyback, double of what was in place before, I am upgrading Nvidia to strong buy.

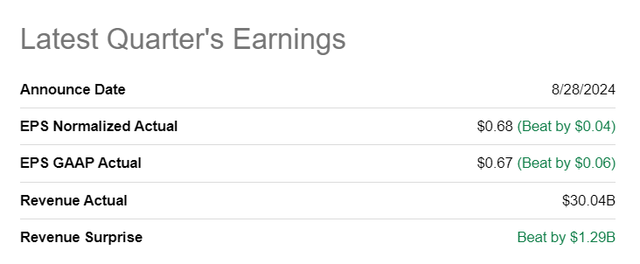

Top and bottom-line beat

Nvidia reported better than expected earnings for its second fiscal quarter, resulting in both top and bottom-line beat. Nvidia reported adjusted earnings of $0.68 per share, which beat the consensus by $0.04 per-share. Revenue came in at $30.0B, $1.3B better than expected.

The Data Center business has never looked better, Blackwell update

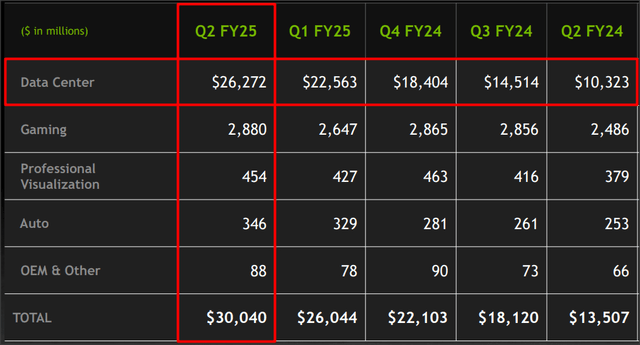

Nvidia generated $30.0B in revenue for the second fiscal quarter, 88% of which came from its Data Center operations. The chipmaker’s total revenues also came in ahead of the company’s own guidance, as well as my expectation of $28.8B.

The driving force behind Nvidia’s strong financial results, once again, has been strong execution in the company’s Data Center segment which generated 16% Q/Q as well as 155% Y/Y growth. Data Centers generated $26.3B in revenue in Q2 ’25 due to strong demand for Data Center GPUs, especially the H100. Nvidia also gave an update about its Blackwell product, the next-gen AI-focused GPU for which the company is seeing high levels of anticipation. Nvidia acknowledged manufacturing delays regarding Blackwell, but expects to ship billions worth of revenue in the fourth-quarter. The start of Blackwell shipments in Q4 would be a major catalyst for Nvidia and indicate the potential for the company to accelerate its top line and free cash flow growth.

Turning to free cash flow and Nvidia’s future use of it.

Nvidia once again generated impressive growth in its most important financial metric: in the second fiscal quarter, Nvidia generated $13.5B in free cash flow and FCF margins of 45%. On a year-over-year basis, Nvidia’s free cash flows therefore surged 123% compared to a top-line growth rate of 122%.

Stable free cash flow margins indicate that Nvidia is experiencing no deterioration in business fundamentals, especially in the Data Center market which is where the company dominates the sector with a more than 90% market share.

|

in $M |

FQ2’24 |

FQ3’24 |

FQ4’24 |

FQ1’25 |

FQ2’25 |

Growth Y/Y |

|

Net Revenue |

$13,507 |

$18,120 |

$22,103 |

$26,044 |

$30,040 |

122% |

|

Operating Cash Flow |

$6,348 |

$7,333 |

$11,499 |

$15,345 |

$14,489 |

128% |

|

Capital Expenditures |

($300) |

($291) |

($282) |

($409) |

($1,006) |

235% |

|

Free Cash Flow |

$6,048 |

$7,042 |

$11,217 |

$14,936 |

$13,483 |

123% |

|

FCF Margin |

45% |

39% |

51% |

57% |

45% |

– |

(Source: Author.)

This free cash flow has in the past been used for investments in the company’s AI products, to finance a dividend, and otherwise has accumulated on Nvidia’s balance sheet.

The company’s large free cash flows will now be returned to investors at accelerating rates as well: Nvidia’s board of directors just authorized a $50B stock buyback which allows the company, at a current price of $117, to buy back 427M shares, or approximately 2% of its outstanding shares. Nvidia spent $7.2B on stock buybacks in Q2 ’25 and has been ramping up its buybacks in the last year consistently as its free cash flow surged. With the latest $50B share repurchase plan, the chipmaker is doubling its buybacks from last year’s authorization of $25B. The doubling in the stock buyback authorization is the main reason why I am upgrading shares of Nvidia to strong buy.

Guidance for Q3 ’25

Nvidia submitted a decent guidance for its current third fiscal quarter as it expects total revenues of $32.5B +/- 2%. The revenue guidance implies a quarter-over-quarter revenue growth rate, at the mid-point, of 8%. The analyst consensus for third-quarter revenue was $31.7B which Nvidia beat.

Nvidia’s valuation and EPS estimate revision potential

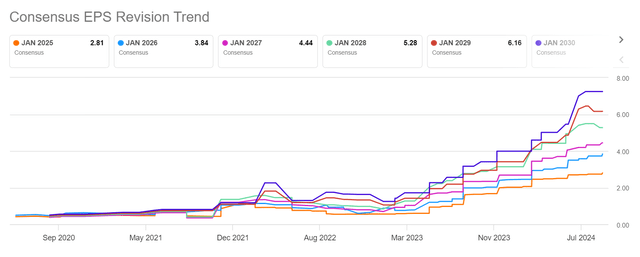

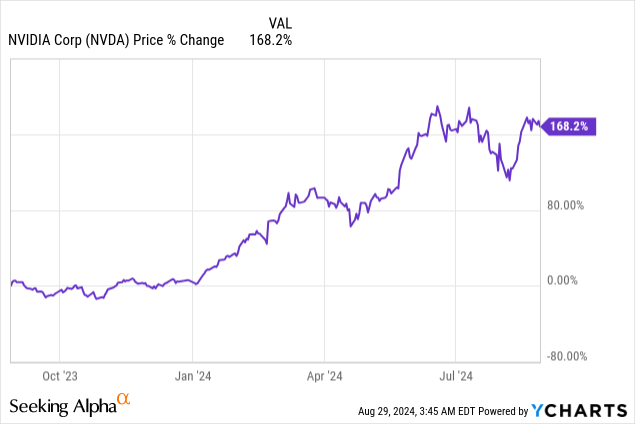

Plenty of investors have argued recently that Nvidia’s shares are priced for perfection, given a 170% increase in the company’s market cap in the last year.

However, Nvidia’s earnings and free cash flows are growing just as rapidly, indicating that Nvidia’s stock price surge does, in fact, have fundamental support. Further, analysts are likely to revisit their earnings estimates in the coming days, which could lead to a new round of EPS estimate upside revisions as well as new stock price targets for Nvidia’s shares. Currently, the EPS estimate trend is very bullish, and I expect more upside revisions following Nvidia’s better than expected Q2 ’25 report.

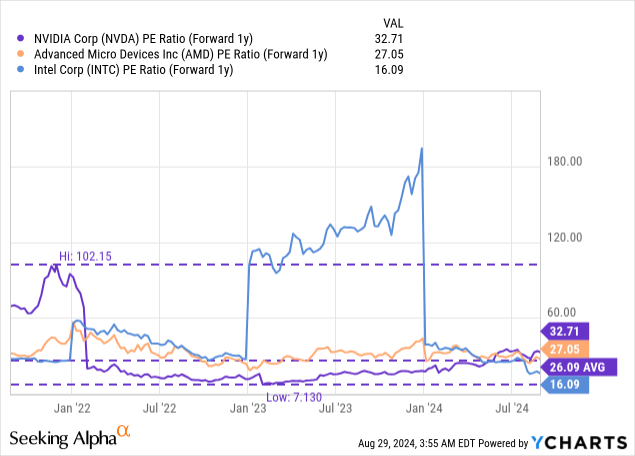

Currently, shares of Nvidia are trading at a P/E ratio (based off FY 2025 earnings) of 32.7X. This compares to a longer-term average price-to-earnings ratio of 26.1X. Advanced Micro Devices (AMD), by comparison, is priced at a 27.1X P/E ratio. The chipmaker has considerable potential to grow its revenue and free cash flows in the second half of the year, as AMD is ramping up deliveries of its MI300X chips for the Data Center market. This expected ramp in free cash flow is why I upgraded shares of AMD to buy at the beginning of the month: “The AI Boom Is Just Getting Started For AMD.”

Intel (INTC) is the cheapest chipmaker, but the company is more of a turnaround play now that Intel announced a new restructuring, including major lay-offs: “Disaster Strikes, What Now?”

In my last work on Nvidia, I calculated a fair value of at least $144 per-share. This was based on my expectation that Nvidia could grow its EPS at least 50% next year. Given the upcoming Q4 ’25 Blackwell launch, I still believe this EPS assumption is very reasonable.

Consensus estimates for this year stand at $2.81/share. Assuming a 50% growth rate in FY 2026, Nvidia could be on track to earn $4.22/share. Applying a 35X earnings multiplier yields a fair value of $148/share (+$4/share compared to my previous estimate). In my opinion, a 35X fair value forward P/E ratio can be justified given Nvidia’s strong GPU market position in the Data Center market, high (FCF) margins as well as a strong catalyst event related to the Blackwell launch.

Although some investors may see Nvidia’s Q3 guidance as weak, investors need to realize that the Blackwell product will launch only in Q4, which is set to lead to a potential revenue acceleration. Therefore, I am not concerned about Nvidia’s post-earnings drop, as I believe the chipmaker’s product pipeline as well as the financials are still looking really solid here.

Risks with Nvidia

Nvidia has generated such strong results over the course of the last year that investors are having increasingly high expectations… that are harder and harder to surpass. This creates a risk for Nvidia’s shareholders, as shares could slide even in case the chipmaker reports top results.

What would change my mind about Nvidia is if the company were to see a deterioration in its free cash flow margins. This is a key indicator that I am watching and that would be negatively affected if Nvidia were to see pricing weakness in its GPU Data Center segment. Further, a delayed Blackwell launch would likely be a highly negative short-term catalyst event.

Final thoughts

Nvidia Corporation submitted a strong earnings sheet for its second fiscal quarter that proved to investors that the AI hype is indeed not fizzling out. However, shares dropped after-hours, by 7%, indicating that it is getting harder to impress investors. I believe the price drop represents a new engagement opportunity and I would recommend investors to buy the pullback.

Nvidia’s guidance for the third-quarter shows that Nvidia continues to expect resilient demand for its Data Center GPU products, and the company is in its best financial shape ever. With the upcoming Blackwell launch in Q4, Nvidia also has a strong catalyst.

Being flush with cash, Nvidia now announced a $50B stock buyback, which, I believe, is a game changer for Nvidia. The chipmaker is set up for accelerating capital returns. In my opinion, Nvidia is going to see a significant amount of EPS estimate upside revisions in the coming days and week. As a result, I am not giving up a single share and will continue to add to positions on any persistent share price weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.