Summary:

- Nvidia Corporation’s revenue growth remains robust, adding over $12 billion to the topline for five consecutive quarters, with strong demand for Blackwell chips expected to drive future growth.

- Despite perceived overvaluation, Nvidia’s market potential is vast, supported by burgeoning AI investments and the company’s strategic positioning in the AI ecosystem.

- Nvidia stock’s decline post Q3 earnings is attributed to market fears about growth sustainability and conservative Q4 guidance, not a reflection of Nvidia’s long-term prospects.

- I maintain a Strong Buy rating for NVDA, believing the market’s fears are overblown and the company’s growth trajectory remains strong.

JHVEPhoto

Nvidia Corporation (NASDAQ:NVDA) investors are well aware of yesterday’s surprising turn of events. After a double-line beat by nearly $2 billion at the top and 6 cents on adjusted earnings per share, the stock actually declined. While that might seem surprising to bullish investors who noted the 94% YoY growth in total revenues and, in particular, the 112% YoY growth in the crucial data center segment, most investors seem to have focused on the $37.5 billion revenue outlook for Q4 25. At that level, the hypothetical growth rate on a YoY basis would be a mere 70%.

There are several major questions that now surround this $3.6 trillion enterprise that’s still, interestingly, a $3.6 trillion enterprise, even after what most growth investors would admit was a blowout quarter. Once these questions are answered, the noise dissipates and the investment case becomes much clearer. To that end, here are my thoughts on why I continue to rate NVDA a Strong Buy when the market is clearly hesitant to take it to the next level. To make my case, I present…

The Market’s 2 Biggest Fears Explored in the Context of Nvidia’s Q3 2025 Report

Fear #1: (Revenue) Growth Sustainability

Of the two biggest market fears around NVDA stock, I believe this is the harder one to argue against because it’s a trend that’s happening right in front of our eyes.

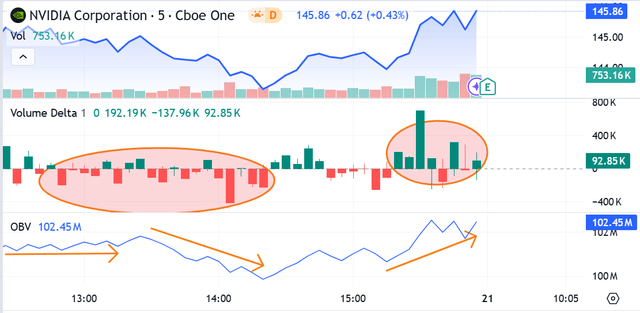

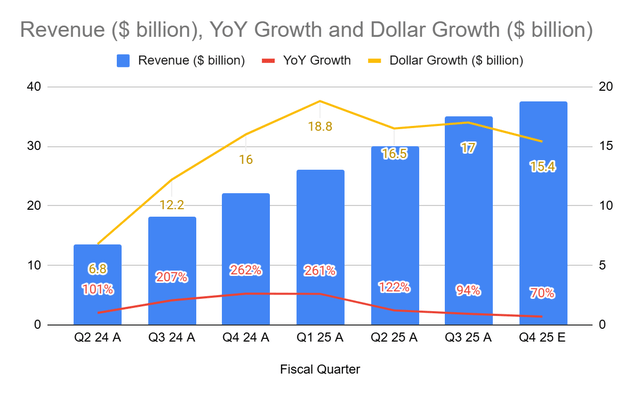

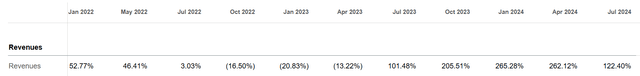

NVDA quarterly revenue growth YoY – SA

Growth rates at the top line have gone sequentially from 102% in the July 2023 quarter (Q2 24) to 206% (Q3 24) to a peak of 265% in Q4 24, thereafter declining slowly to 262% in Q1 25 and more rapidly to 122% in Q2 25 and now down to 94% as of Q3 25.

That’s not what the market wanted to see at all. Combined with a 70% growth rate guided for the final quarter, it put so much selling pressure on the stock. This is presumably from investors heading for the exits in a panic and others who simply took some profits off the table — that the bulls were unable to offset it, ultimately causing the stock to drop about 3.5% post-market. But what happened right before earnings were announced is interesting on its own.

If you look at two technical indicators, On Balance Volume or OBV, and Volume Delta or the net difference between bid and ask transactions, the tension between bulls and runaways (not necessarily bears but investors who decided to pull out before earnings) is almost palpable. The balance was held until about 1 pm Eastern, but selling pressure overwhelmed buying pressure. This eased off after about 2 pm Eastern, with buying pressure then taking over and then a final push by the bulls right before market close.

As of this writing, NVDA is about 3% down from yesterday’s close, and we could see a prolonged sideways movement until fresh positive news breaks or there’s some other major catalyst that appears on the horizon.

To me, that means the market is still bullish on the name but doesn’t have the confidence that revenue growth will be sustainable at these levels.

On the one hand, the declining YoY percentage growth does seem like revenue expansion is slowing down, but on the other, what’s missing here is the absolute dollar value that NVDA keeps adding to the top of the P&L funnel. Here’s a quick snapshot comparing these metrics.

I’d say that Q4 24 and Q1 25 were definitely outliers because they comped against much lower bases that were set in Q4 23 ($6.1 billion) and Q1 24 ($7.2 billion). As such, the +260% revenue growth rates in those quarters should be treated as the exceptions. I think that was a major misstep for the market, which ultimately led to the kind of price appreciation we’ve seen until now.

From another perspective, however, if you look at the absolute dollars added to the top, the company has been adding well north of $12 billion to the topline for the past five consecutive quarters. If NVDA meets its Q4 25 target of $37.5 billion against the current analyst consensus estimate of $37.8 billion, that’s six consecutive quarters of sequentially adding double-digit billions of dollars in revenue growth.

To me, that doesn’t look anything like unsustainable growth, at least in the medium term if not the long run. Moreover, we already know that Blackwell chips are seeing unprecedented demand because even some of their larger partners like Super Micro Computer Inc. (SMCI) are finding it impossible to get Blackwell inventory. In response to Barclays analyst George Wang’s question during the business update call on November 5, SMCI CEO Charles Liang had this answer (emphasis mine):

Just any kind of high level in terms of when do you think the Blackwell is going to show up in the P&L?

Charles Liang

Yes, very big question. Indeed, we’re asking NVIDIA every day. So I hope their production can go smooth and go for high-volume very soon. And once they have chip available, our solutions are full ready. So, we continue to work with them very closely to develop a current product, GB200, NVL72 and B200 nuclear-cooled and air-cooled. And we also designed some really enhanced rack scale solutions. So, in terms of total solutions, we have a very strong offering waiting for the chip. So, we need immediate and quicker support. Thank you.

It’s clear that Blackwell chips will be flying off the proverbial shelf in Q4; in fact, they won’t even make it to the shelf but get shipped as soon as they’re available. They’re already “in full production after a successfully executed mass change,” per EVP and CFO Colette Kress. That supports the assumption of yet another growth spurt coming up in Q4. It may not be that pronounced, which is why I think management is being a little conservative with its 70% growth rate guidance for Q4 revenues. Regardless, the set-up is perfect for record-beating quarters right through FY 25 and beyond.

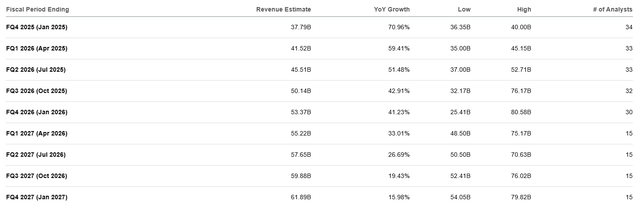

That’s why I find the declining consensus estimate of growth rates out to Q4 27 to be almost comically mathematical in nature, not to mention woefully misplaced, in my opinion.

In short, I’m not convinced that quarterly revenue will “only” grow to $62 billion by the end of FY 27. With both Hopper and Blackwell in full production over the next five quarters, I think we have some significant revenue surprises coming up beyond Q4 25.

Let’s also keep in mind one more lever that NVDA can pull to boost top-line growth. If you recall, gross margin is still at the 75% level, down from the 78% it reached in Q1 25. That’s “primarily driven by a mix-shift of the H100 systems to more complex and higher cost systems within Data Center,” again per the CFO on yesterday’s Q3 call. So, margins are being compressed from a shifting product mix, but I see that as a good thing.

Why? Allow me to elaborate.

We know that demand is moving up from the H100s to the H200s, which management indicated on the call. See the in-line quote above. This means the product shift is also one of the drivers of revenue growth — roughly 30% as Nvidia’s customers move from a product with an average price of about $30,000 to one with a $40,000 price tag. As H200 volumes ramp up, now that it’s in full production, it’s naturally going to flow to the top line. But the problem is that the H200 is far more complex, presumably requiring additional input costs, which puts pressure on gross margins.

Now, here’s where it gets really exciting because the price jump with Blackwell is significantly greater. At an expected per GPU price of $70,000, per that Tom’s Hardware article linked in the paragraph above, that’s a lot more than the 33% jump from H100 to H200. This is just back of the envelope stuff, but at $70k a GPU, that’s a 75% jump! With that kind of wiggle room, gross margins are likely to head towards 80% again.

Assuming a gradual ramp of Blackwell deliveries starting in Q4 25, and factoring in strong and sustained demand for the H200, I believe president and CEO Huang has a major lever to pull to show even stronger growth in coming quarters. That is both on the revenue front and regarding gross margins, which typically translates faithfully into bottom-line profitability because of Nvidia’s operational efficiency.

To round up this part of the bull case, I believe the question of revenue growth sustainability yields a positive answer. In my view, it’s not a downside that’s immediately relevant. Not in the medium term, and certainly not in the short term.

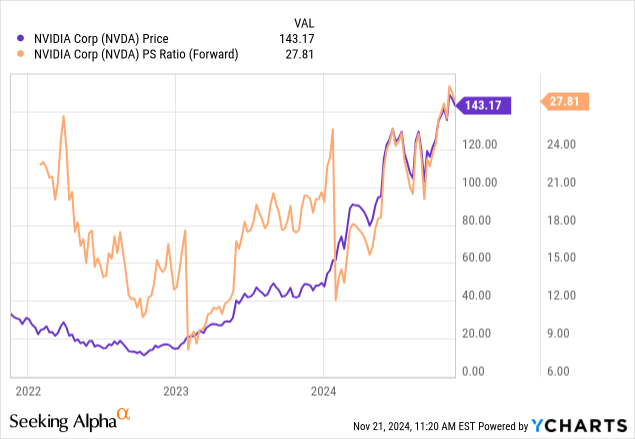

Fear #2: Perceived Overvaluation Of NVDA Stock

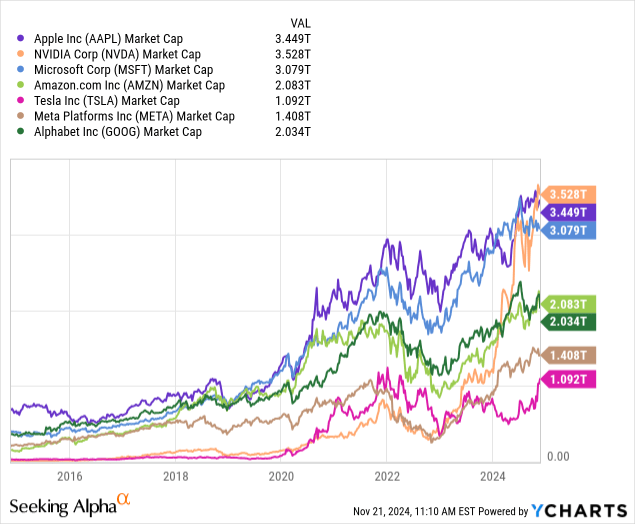

Another elephant in the room is the stock’s perceived overvaluation. One major argument supporting this view is that the entire AI market isn’t as big as NVDA’s market capitalization, so the stock must be overvalued. For instance, if you applied the current 28x forward multiple to estimated FY 30 sales of $300 billion, we’re talking about an $8.4 trillion market cap. The problem is that the entire AI market is estimated to grow to around $1.8 trillion by 2030, as assessed by Grand View Research and several other highly respected research firms.

I believe this estimate for the AI market as a whole is seriously flawed for several reasons, and among these are clues dropped by NVDA management on the Q3 call. One particular clue I’d like to draw your attention to is this one:

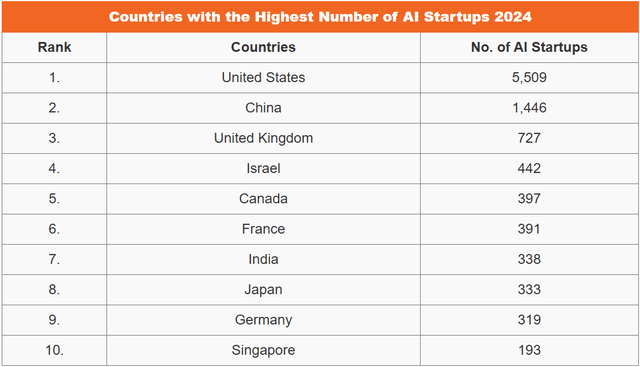

… Google, Meta, Microsoft, and OpenAI are the headliners and Anthropic, Perplexity, Mistral, Adobe Firefly, Runway, Midjourney, Lightricks, Harvey, Codeium, Cursor, and Bridge are seeing great success, while thousands of AI-native startups are building new services.

Being the curious type, I naturally dug into this nugget of information. I was pleasantly surprised at what I found. According to Crunchbase,

… there were at least 23 private, AI-focused startups funded in the past couple years that have raised over $1 billion in equity financing to date. Of those, five have raised over $6 billion.

In the United States, there were 5,509 AI startups in 2024-to-date alone, which is the highest, but even in these early days of AI, look at what’s happening around the world.

Not all of them will survive the year, of course, let alone stay in business through 2030; however, we must necessarily account for the additional market potential that these thousands of businesses will be creating in the next five to six years.

Originality.ai

We’re only beginning to scratch the surface of artificial intelligence capabilities with Gen AI. As more money pours into AI R&D (graph above), it’s going to create infinite opportunities that will eventually start contributing to the overall market like a thousand tributaries feeding into a massive river. That’s why I don’t buy current estimates. They’re extremely short-sighted, in my opinion.

That’s also why I believe NVDA is NOT overvalued by any measure.

Think of it this way. Until about 2018, a $1 trillion valuation was unheard of. Apple Inc. (AAPL) did it first, and others followed. Did you know the global smartphone market as a whole was estimated as “only” being worth a little over half a trillion dollars last year and won’t even breach $1 trillion by 2033? So, how did Apple, which gets the bulk of its revenues from iPhone sales, able to hold on to its $3 trillion plus valuation? And what’s going to stop NVDA from scaling even greater heights than AAPL?

The reality of valuation is that something is only worth what someone is willing to pay for it. If NVDA has buyers lining up at $140 at a valuation of nearly 30x next year’s sales, can we really bring a strong argument for why it can’t trade at $280 when revenues double from here by FY 27 or thereabouts? This is even under the very conservative assumption that quarterly growth rates are going to go downhill from the already low 70% guided for Q4 25.

Currently, it does seem that valuation has gotten ahead of revenue growth, and that the sequentially lower 94% quarterly YoY growth reported for Q3 is a continuance of a broader decline. In reality, with numerous growth drivers coming from all quarters of the AI universe, NVDA’s quarterly growth rates could well stay in the high double-digit percentages once we have at least a full quarter’s worth of Blackwell sales on the books. Regardless, let’s keep our eyes on the right ball — the dollars added to the top, not the percentage of increase alone.

That’s my argument against the fear of NVDA’s perceived overvaluation. There’s demand for the stock, which may have been tempered by the market’s knee-jerk reaction after seeing management’s Q4 guidance. However, there are also compelling indicators that the growth story is only beginning for Nvidia, as we’ve seen in this analysis.

Parting Thoughts

Yes, the market is fearful. Yes, analysts are pessimistic on forward growth over the next three full fiscal years, at the very least. Yes, it does look like revenue growth rates are slowing down. Sure, if you look at relative valuation, it’s insanely overpriced. Certainly, all of that risk is there.

The good part, though, is that everything is already baked into the stock’s price at $140. That’s why the selling pressure was only able to slightly offset bullish buying, in my opinion. There are more than enough market participants who will pay over $140 for this stock. How much more? That remains to be seen, but when you see articles from sites like Nasdaq that discuss a possible $10 trillion valuation for NVDA without batting an eyelid, I think we should stop, think, and BUY NVDA. I’ll share a compelling thought from that article, with my emphasis:

Investors should also be mindful that the innovation that leads to the first $10 trillion company may not even be visible now.

That’s where we are with Nvidia, in my humble but quite loud opinion. Some revenue growth opportunities haven’t even breached the surface yet. Therefore, I reiterate my Strong Buy. I will retain that rating until I see some real risks to Nvidia’s momentum from any one front — genuine growth problems, more fierce competition from the likes of Advanced Micro Devices (AMD), or even a fizzling out of the so-called AI bubble. None of these, by the way, I see as being anywhere close to being realized over the next five to ten years, at a minimum and if at all.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.