Summary:

- Q3 marks the ramp up phase of Nvidia Corporation’s Blackwell AI chips.

- There are still some technical issues and also business risks involved (with the uncertainties of its China exposure as a notable example).

- However, these downside risks are relatively minor compared to the key features of NVDA’s flagship AI chips, in particular computing performance, bandwidth, and energy efficiency.

Wavebreakmedia/iStock via Getty Images

NVDA stock: previous thesis and Q3 recap

I last analyzed Nvidia Corporation (NASDAQ:NVDA) back in October 2024. Under a title of “Nvidia: Latest Blackwell Developments Support One-Stop AI Shop Scenario,” I published an article to analyze the development surrounding the company’s Blackwell AI chips. I rated the stock as a Strong Buy based on the following considerations:

The recent Blackwell deployment by Microsoft and the integration with closed-loop liquid cooling suggest to me that Nvidia Corporation is poised for another ramp-up in its AI chip sales. The company could become a one-stop AI shop with Blackwell’s superior performance (both in terms of computing throughput and energy efficiency) and its software ecosystem. The upside from this scenario is too large to ignore and outweighs all the negatives (such as high P/E, antitrust concerns, etc.).

Since then, the company has released its Q3 earnings report (“ER”). The ER has provided various updates related to its flagship AI chips and thus motivated this following up coverage. In the subsequent sections of this article, I want to discuss its recent Q3 earnings and point out some signs/comments that have indicated the Blackwell chip ramp up in my assessment. These signs are highly encouraging in my view and led me to reiterate my strong buy rating on the stock.

The company announced its latest quarterly earnings on November 20th and beat expectations on both lines. The normalized EPS came in at $0.81, beating the estimate by $0.06 as seen. GAAP EPS was $0.78, also beating the estimate by $0.08. Revenue for the quarter reached $35.08 billion, surpassing expectations by $1.958 billion. Looking ahead to the upcoming quarter, analysts expect healthy QoQ growth in both lines. The normalized EPS is projected to reach $0.85 and total revenue is estimated at $38.038 billion. Also note that over the past 90 days, the EPS estimates have been dominated by upward revisions (32 upward vs. 5 downward).

Digging into the ER a bit deeper, I indeed see good signs to support the optimistic sentiment as detailed next.

NVDA stock: EPS outlook

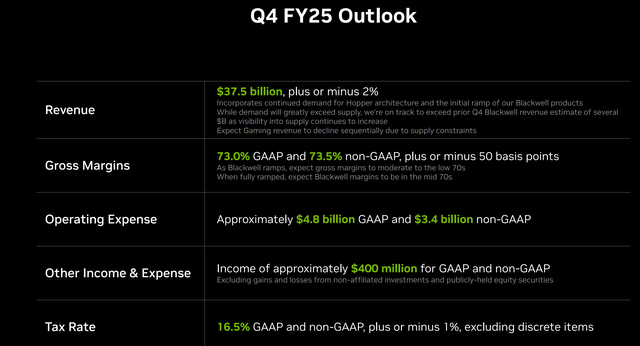

The company’s own projection is lower compared to the above analysts’ consensus. As seen in the ER slide below, it anticipates total revenue of $37.5 billion (plus or minus 2%) for the fourth quarter of fiscal year 2025 (vs. the $38+ billion consensus estimates). If you read the fine prints, this projection is based on the assumption of continued demand for Hopper architecture and the initial ramp-up of Blackwell products (and also the assumption that gaming revenue is to decline sequentially).

I think NVDA’s above projection is a bit on the conservative side and thus set the stage for an earnings surprise in its FY Q4 ER. I expect the Blackwell ramp up to continue at full speed and/or even further accelerate. In its Q3 ER report, the company commented that Blackwell ships are “in full production after successfully executed mask change.” Indeed, besides the production capacity ramp with Foxconn, there are other encouraging developments afoot and some examples are quoted below:

Seeking Alpha News: “NVDA specifically called out Foxconn’s production ramp in US, Mexico, and Taiwan; leveraging NVDA Omniverse for 3D factories design in order to stand up capacity as quickly as possible,” Wellsfargo analyst Aaron Rakers noted… The company also made several other announcements, including emphasizing its full-stack optimization; the importance of its Arm (ARM)-based 72-core Grace CPU in terms of power efficiency…

Next, I will concentrate on the power efficiency issue mentioned in the comments above and argue why this alone could sustain a strong demand for NVDA’s Blackwell (and other newer) AI chips.

NVDA’s Blackwell and AI energy issue

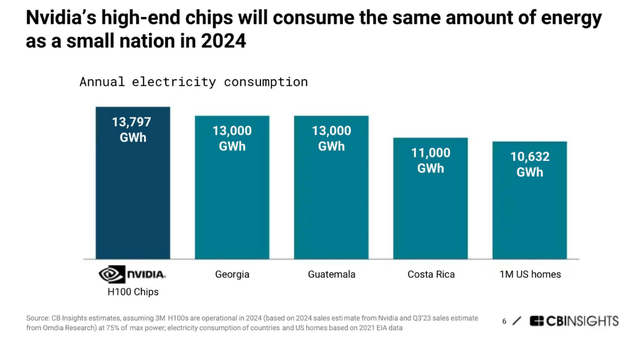

AI chips (such as NVDA’s Blackwell chips) are not only pricey to buy but also expensive to run at the current stage. A large part of the cost of running this chip comes from energy consumption. For instance, Nvidia’s early H100 chips have a unit power consumption of 700W, more than the consumption of the average American household. When thousands of these chips are employed, the energy demand of large-scale AI applications is simply mind-boggling at a macroscopic level. As you can see from the following chart, NVDA’s high-performance AI chips are projected to exert energy demand exceeding many small countries soon.

These statistics may be fun to read. However, for end users, they translate into a painful electricity bill. To estimate the magnitude of the bill, the following is my back-of-the-envelope estimate using these following parameters provided in a Forbes report. Note that the quotes were slightly edited by me and the emphases were also placed by me.

- The cost of the chips amounted to millions of dollars. According to a technical overview of OpenAI’s GPT-3 language model, each training run required at least $5 million worth of GPUs.

- These models require many, many training runs as they are developed and tuned, so the final cost is far in excess of this figure. When asked at an MIT event in July whether the cost of training foundation models was on the order of $50 million to $100 million, OpenAI’s cofounder Sam Altman answered that it was “more than that” and is getting more expensive.

- The cost doesn’t end there. Running inference on the models, once trained, is also expensive. Estimates suggest that in January 2023, ChatGPT used nearly 30,000 GPUs to handle hundreds of millions of daily user requests. Sajjad Moazeni, a University of Washington assistant professor of electrical and computer engineering, says those queries may consume around 1 GWh each day.

In the rest of my back-of-the-envelope estimate, I also assume the cost for electricity per kilowatt-hour (kWh) to be 14 cents (the U.S. average is somewhere in the range of 12–17 cents per kWh). Under this assumption, 1 GWh of electricity consumption translates into an energy bill of $140k per day! Or $51 million per year. If you recall, the GPUs “only” cost about $5 million upfront, a small fraction in comparison to the operating energy cost.

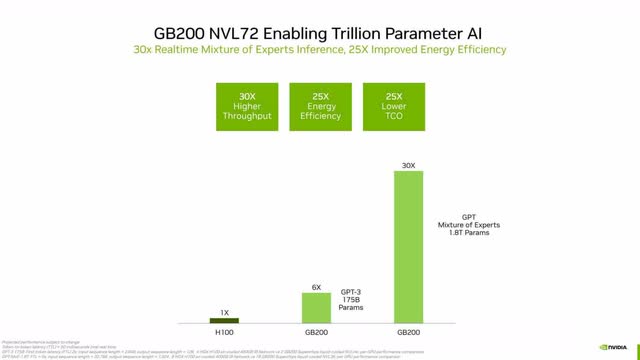

NVDA’s Blackwell chips (and other newer designs such as the Rubin) feature superior energy efficiency (on top of computing performance). As seen, Blackwell chip architecture has been shown to reduce power consumption by 25x. Using the parameters above, such a reduction could shrink the annual electricity cost to be lower than upfront investment in the chips and thus fundamentally change the cost structure of end users.

Source: NVDA investor presentation

I expect these improvements to not only help sustain NVDA’s dominant role in this space but also to make the use of its chips actually sustainable economically. Buying its chips is expensive but running them is even more so.

Other risks and final thoughts

In terms of downside risks, there are still some lingering technical issues with the Blackwell chips. For example, some overheating issues have been reported on Nvidia’s Blackwell AI chips when employed in servers. Meanwhile, Nvidia’s China exposure is a geopolitical risk that investors should not ignore, given the trade tension between the two major global economies. China used to be (and still is to a large degree) a key market for NVDA. For instance, in 2021, the company has a 25% exposure to its China market. Today, the figure is more than halved to 12% (but is still a sizable figure in absolute terms).

Finally, the stock also entails considerable valuation risks at this point. On the positive side, NVDA is projected to experience significant EPS growth in the coming years. As seen in the chart below, the EPS estimate for FY 2025 is $2.95, representing a YOY growth of 127%. Robust growth is expected to continue, with a projected 5-year CAGR of 18.6%. Despite such growth, the current FWD P/E is 46.93. With an 18.6% average growth rate for the next few years, the PEG ratio is about 2.5x, substantially higher than the 1x threshold many growth investors consider as the gold-standard.

All told, my verdict is that the upside far outweighs the downside under current conditions, leading to my strong buy rating. The technical issues are relatively minor in my view compared to the key features of its flagship chips, in particular computing performance, bandwidth, and also energy efficiency. The valuation risk is well compensated by its unique market position and also the nonlinear growth potential of the AI segment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.