Summary:

- Nvidia Corporation reported a double beat in Q3 earnings, but shares pulled back due to conservative guidance and investor expectations for a larger earnings beat.

- Revenue growth is decelerating, with Q3 showing a 90% year-over-year increase, down from 270% in Q4 last year, indicating a growth slowdown.

- Gross margins appear to have peaked at around 75%, limiting future profit growth; Q4 guidance suggests further margin compression.

- At over 50x net profits, NVDA’s valuation is high, and with slowing growth, it may not be an ideal buying opportunity right now.

BING-JHEN HONG

Article Thesis

Nvidia Corporation (NASDAQ:NVDA) reported its most recent earnings results on Wednesday afternoon. Despite a double beat, the company’s shares pulled back, likely due to guidance that wasn’t overly strong, while investors may have also hoped for a bigger earnings beat. While Nvidia remains a high-quality company, growth is slowing down, and shares remain pricey — which could mean that waiting for a better buying opportunity is a good idea.

Past Coverage

I have written about Nvidia in the past here on Seeking Alpha, most recently in August, when the company reported its previous quarterly earnings results. I gave the company a neutral rating back then. With the company coming out with its Q3 earnings results today, and with roughly three months having passed since my last article on Nvidia, it is time for an update on the chip company.

What Happened?

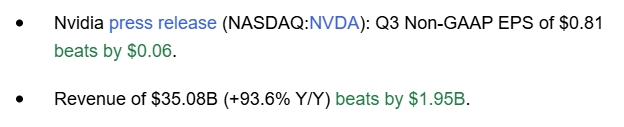

On Wednesday afternoon, investors got the company’s Q3 results and Q4 outlook. Nvidia’s earnings report featured the following headline numbers:

NVIDIA earnings data (Seeking Alpha)

As we can see, the company outperformed expectations by the Wall Street analyst community, delivering a double beat. This is, of course, nothing new for NVIDIA’s shareholders, as the company also beat expectations on both lines during the previous seven quarters. One could thus argue that another double beat was widely expected, which could help explain the stock’s reaction in after-hours trading — despite the double beat, shares pulled back (at the time of writing, this may change). This could be the result of investors hoping for an even wider earnings beat, and selling due to that not happening. Furthermore, some investors may have been unhappy with Nvidia’s guidance — more on that later — or it might be a sell-the-news event. No matter what, there was no enthusiastic reaction by shareholders. Otherwise, shares would have risen instead of pulling back.

NVIDIA’s Q3 Results And Q4 Outlook

Starting with the top-line performance, it is pretty clear that Nvidia did quite well. That was to be expected, of course, as the company continues to benefit from the massive AI chip spending by hyperscalers such as Meta Platforms (META), Alphabet (GOOG)(GOOGL), Amazon (AMZN), and so on.

Company-wide revenues were up by more than 90% year-over-year, largely driven by growth in the data center space, where Nvidia experienced a massive revenue increase of 112%. Nvidia’s data center business continues to grow much faster than Nvidia’s other business units. This would mean that the company becomes less diversified over time — growing dependence on a single business unit (data centers) is a good thing as long as that unit is doing well. However, if problems were to emerge in that area, Nvidia would not have a lot of diversification to balance things out.

Looking at the year-over-year growth rate over the last couple of quarters, we see that growth is decelerating: Revenues grew by 270% in last year’s Q4, by 260% in this year’s Q1, by 120% in this year’s Q2, and by around 90% in the most recent quarter. While that is still a strong growth rate, of course, it represents a substantial decline compared to the last couple of quarters. This isn’t overly surprising, as the comparison has gotten tougher, and since Nvidia can’t grow at a massive pace endlessly — the law of large numbers dictates that growth inevitably has to decline at some point. It looks like we are in this “growth slowdown area” right now, as Nvidia can’t grow at a 100% or 200% rate any longer.

We also see the growth slowdown when we look at Nvidia’s quarter-to-quarter growth rate: From Q2 to Q3, Nvidia’s sales grew by 17% — when we annualize that number, we get less than the year-over-year growth rate. As noted above, a growth slowdown has to be expected, as even a high-quality company like Nvidia can’t grow massively forever. But some investors may be unhappy about that, judging by the after-hours price action.

Looking at Nvidia’s guidance for the current quarter, its fiscal Q4, I get the impression that growth will slow down further. The company guides for revenues of around $37.5 billion, which would be up 7% from the tally seen in the third quarter. While Nvidia’s guidance is likely on the conservative side, a growth slowdown seems quite possible even when we account for that: Nvidia beat its Q3 guidance by $2.5 billion (the company had guided for revenues of around $32.5 billion earlier), so if Nvidia can beat its revenue guidance similarly during the current quarter, it will report revenues of $40 billion. That would be up 14% on a sequential basis, relative to the $35 billion in revenue Nvidia generated during Q3. While a quarter-over-quarter growth rate in the low-teens is quite attractive, it would still be lower than Nvidia’s growth in the recent past, which would be aligned with a “growth slowdown” trend. If Nvidia’s guidance is correct (instead of too conservative) and revenues rise by 7% on a year-over-year basis, that would make for a hefty decline in its growth rate and would be the worst growth performance since January 2023 when revenues rose by 2% sequentially.

Looking at Nvidia’s profit and margin performance during the third quarter, we see that the company was able to generate a gross margin of 75.0% on an adjusted basis. While this is strong in absolute terms, it was a little weaker than during the previous quarter, when Nvidia’s non-GAAP margin was 70 base points higher. This could be the result of Nvidia preparing for the Blackwell ramp-up during the third quarter, but it may also be because Nvidia has hit a gross margin ceiling. After all, suppliers and partners such as Taiwan Semiconductor Manufacturing Company (TSM) want to earn money as well, and may demand a larger portion of the pie.

If gross margins stabilize at 75%, that would not be bad — that would be a strong gross margin in absolute terms. But with gross margins not growing right now, earnings growth will be lower than it was in the past, when gross margin expansion was a tailwind for profit growth. Nvidia’s gross margin was flat from the previous year’s quarter, which is another data point that the mid-70s could be a ceiling for Nvidia’s gross margin. Nvidia’s guidance points to a gross margin of 73.5% for the current quarter, which would be below recent levels.

While I believe that there is a good likelihood that this forecasted decline in Q4 is due to the Blackwell ramp, this guidance point nevertheless isn’t positive. It seems like another indication that gross margin growth will not be an earnings tailwind going forward.

Operating income still grew faster than Nvidia’s revenue, thanks to tailwinds from operating leverage, but the difference is not as large as it was in the past. Operating income growth was around 10% higher than revenue growth, at 101%. One quarter earlier, operating income growth had been 156%, while two quarters ago, operating income growth had been a gigantic 492%. Like with revenues, operating income growth is slowing down, albeit still being quite high (just not as high as it used to be).

Is Nvidia Stock A Good Investment?

Nvidia undoubtedly was an excellent investment at almost every point in the past, at least for those who held on to the stock through its run over the last couple of years. That doesn’t mean that Nvidia is an equally good investment today, of course. Nvidia is the tech and market leader in the AI space, which is a great position to be in.

On the other hand, due to market growth decelerating, Nvidia’s growth rate isn’t as high as it used to be, and per the company’s guidance, we can expect further growth deceleration in the current quarter. Gross margins seem to have topped out for now, and profit growth, although still high, has declined considerably as well.

Currently, Nvidia trades at a little more than 50x net profits — which is far from cheap. It is possible that shares will rise higher from here, of course. However, buying a company with decelerating growth at an earnings yield of less than 2% does not seem like a great deal to me, which is why I wouldn’t call Nvidia Corporation stock a Buy right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!