Summary:

- Nvidia Corporation’s stock is experiencing transitory volatility despite stellar earnings, but it is likely to recover and potentially reach $180-200 by next earnings.

- The AI chip market is poised for explosive growth, with Nvidia dominating the enterprise/data center AI chip market and offering unparalleled potential.

- Nvidia’s Q3 earnings beat expectations with significant revenue growth, and its guidance suggests continued strong performance, making it a solid buy-and-hold stock.

- NVDA risks include potential slowdowns in AI infrastructure buildout, rising competition, and geopolitical challenges, but Nvidia’s long-term prospects remain robust.

Sundry Photography

Nvidia Corporation (NASDAQ:NVDA) has done it again, smashing sales and EPS estimates. The last time we discussed Nvidia, the stock had declined after reporting excellent Q2 results. I noted that Nvidia’s decline was likely transitory, and the stock should rebound from the $115-100 support range. Nvidia bottomed at $100, surging by 50% to its recent high of $150.

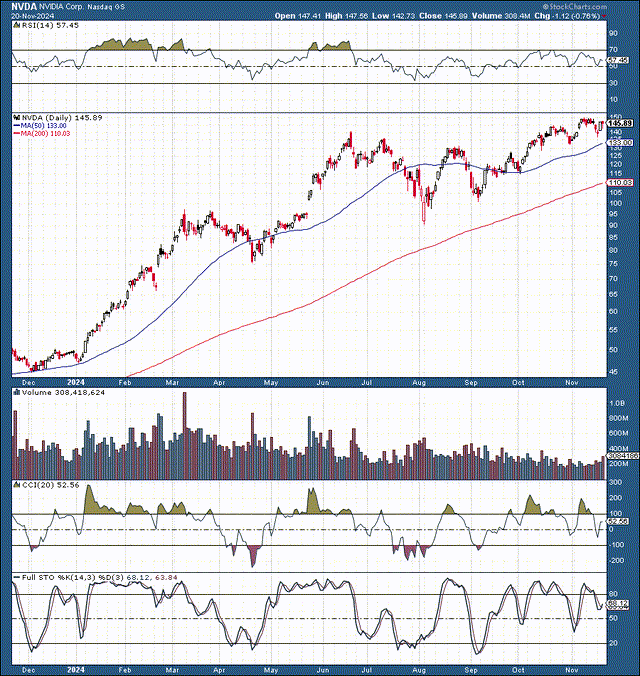

Nvidia 1-Year Chart

Despite another stellar earnings announcement, Nvidia’s stock is declining after its impressive run-up recently. The stock was down by 2-3% in post-market trade. While we could see transitory volatility bring the stock down to about the $140-130 support zone in the near term, Nvidia will likely recover and could break out to the $180-200 level by its next earnings announcement (2/21/25).

Technically, Nvidia is looking for a breakout. The stock is not significantly overbought, as it was earlier in the year. Nvidia has consolidated for about six months and has not made a meaningful new high since June. Therefore, there is a high probability for a considerable move higher into year-end and Q1 2025.

Moreover, Nvidia’s earnings are again the most instrumental earnings report of the season, as they demonstrate the enormous potential and continued demand in the lucrative AI enterprise market. This report solidifies the continued robust state of the market, pointing to significant future demand.

The report also diminishes AI growth fears, as demand remains insatiable, and any potential slowdown could be transitory. Thus, the Nvidia report provides a green light for the broader semiconductor rally into year-end and 2025.

The Demand Should Continue

Market dynamics suggest we are still relatively early in the AI ball game. To use a baseball analogy, we may be around the top of the fourth inning here, implying considerable growth ahead for Nvidia and other top global AI leaders. Thus, the demand should be there, and Nvidia could continue firing on all cylinders to meet the perpetual demand.

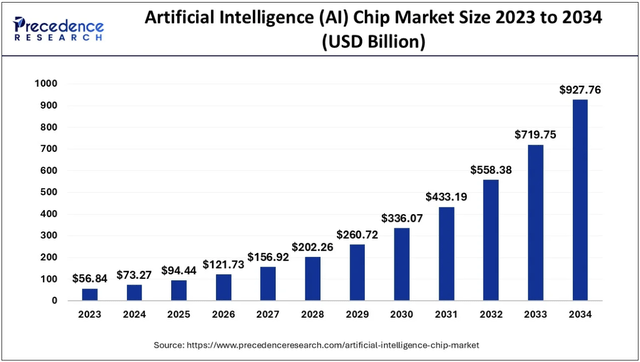

AI chip market estimates (Precedenceresearch.com)

The AI chip market is expected to explode in future years. Estimates suggest it could surge from about $73 billion in sales this year to nearly a trillion dollars by 2035. Nvidia now has an estimated 95-80% share of the enterprise/data center AI chip market and could continue dominating this enormous space for years.

Furthermore, it’s not just chips, as Nvidia’s preeminent AI position enables it to offer compelling AI-related software and services in addition to its market-leading hardware line. In my view, Nvidia is currently an AI/data center monopoly, a dynamic offering of Nvidia unparalleled potential in the broader AI space.

Despite several companies like Advanced Micro Devices (AMD) and Intel (INTC) competing on some level, no other company comes close to providing the “entire package” regarding enterprise AI. Therefore, despite a minor growth slowdown, Nvidia can continue increasing revenues and EPS substantially while maintaining an extremely high level of profitability as we advance.

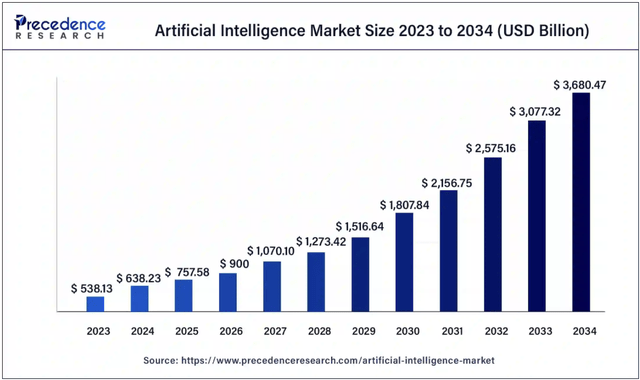

AI market growth prospects (Precedenceresearch.com )

While processors have massive potential, the chip segment is a relatively small sector in relation to the broader AI space. Fortunately, Nvidia and other AI-related semiconductor companies offer other hardware, software, and services with their chip offerings, and no one does this better than Nvidia. General AI-related sales could skyrocket to over $3 trillion by 2033, demonstrating roughly a 19-20% CAGR in future years.

Furthermore, I want to highlight high-quality AI chip stocks like AMD, Broadcom (AVGO), Micron (MU), Qualcomm (QCOM), and others. Nvidia’s beat and the continued strong demand and general performance of the AI market suggest that the recent growth slowdown may be transitory. The enormous AI buildout process should continue. Growth may reaccelerate in 2025 as new economic, fiscal, and monetary stimulus could enable an AI-Goldilocks environment in future years.

Wall Street Wanted Higher Guidance

Nvidia reported some of the best earnings in stock market history in 2023 and earlier this year. However, it’s unrealistic to expect this ultra-high level of outperformance to persist.

Still, Nvidia reported excellent earnings in Q3. It reported EPS of $0.81, beating the consensus estimate by six cents. Nvidia also delivered nearly $35.1B in revenues, about a $1.95B beat (94% YoY increase).

Yes, you read that correctly. Nvidia provided almost a $2B (6% beat) over the consensus estimate. This dynamic illustrates that Nvidia continuously sandbags its estimates, making it easy to beat in the end.

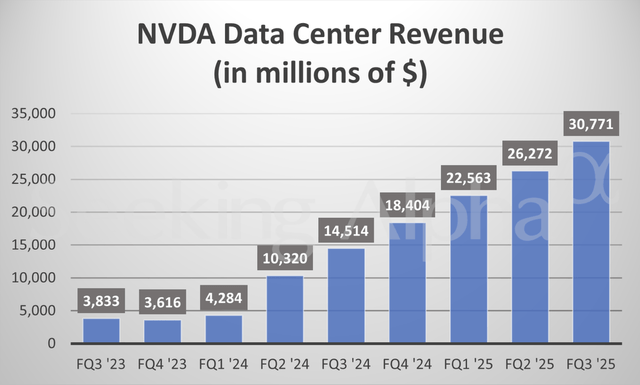

Nvidia also reported record quarterly data center revenue of $30.8B, up 17% QoQ and 112% YoY.

Data center sales growth (seekingalpha.com)

The growth remains phenomenal. Moreover, this isn’t just hardware, as Nvidia offers software and services in addition to its market-leading hardware line.

Guidance-wise, Nvidia expects Q4 sales to be around $37.5B, vs. the consensus estimate of $37.04B (plus or minus 2%). Wall Street likely wanted to see guidance around $38-38.5B.

However, Wall Street constantly wants higher guidance, so there isn’t anything new here. Furthermore, while Nvidia guided to $37.5B, we know about its sandbagging policy, and Q4 earnings could show sales of around $39-40B.

Ultimately, this may be enough reason to buy the stock here, expecting the share price to rise to the $180-200 range by next quarter’s earnings around February 21st, 2025.

Also, while data center AI steals all the limelight, we should consider Nvidia’s other segments’ continued growth and progress. Gaming revenue was substantial, coming in at around $3.28B, up about 14% QoQ and 15% YoY.

Nvidia’s professional and visualization segment increased sales by about 17% YoY, and it’s rapidly expanding automotive and embedded space provided 72% sales growth.

Margin-wise, Nvidia’s GAAP gross margin declined slightly from 75.1% in the previous quarter to 74.6%. However, its gross margin increased from 74% YoY despite the sequential decline. Next quarter, Nvidia anticipates a non-GAAP gross margin of 73-73.5%. While this represents a minor down tick, it’s still exceptionally high, and we should see margins remain solid moving forward.

Generally speaking, Nvidia continues firing on all cylinders, which could indicate that the AI chip space may have much more growth ahead.

Chip Stocks: Getting Ready For Take-Off

While Nvidia’s stock returned to its lost territory from the summer selloff, many high-quality chip stocks remain underappreciated and depressed. Here are some of the most prominent stocks in the industry and their declines from recent and 52-week highs:

- AMD: Down by 22% from its recent high and 40% from its 52-week-high.

- Qualcomm: Down by 16% from its recent high and 34% from its 52-week-high.

- ASML Holding (ASML): Down by 42% from its 52-week-high.

- Monolithic Power (MPWR): Down by 42% from its 52-week-high.

- Micron: Down by 20% from its recent high and 39% from its 52-week-high.

While these are only a handful of stocks, I think you understand. This crucial sector has been stomped on recently, and some people are still screaming bubble here. Conversely, if we were indeed around a top in the market, the underlying stocks would probably be trading around ATHs with sky-high valuations instead of being down by 30-50% and appearing relatively cheap.

Do You Want More Evidence?

Here is a brief valuation perspective on the highly lucrative AI chip industry. Furthermore, since it’s almost 2025, I am using consensus estimate 2026 EPS and EPS growth figures to provide forward (2026) P/E and PEG ratios.

AMD: Forward P/E ratio — 19.3, forward PEG ratio — 0.49. Can you say dirt cheap here? And AMD could surprise to the upside, potentially outperforming estimates, in my view.

- Qualcomm: Forward P/E ratio – 12.5, forward PEG ratio – 1.1.

- ASML: Forward P/E ratio – 21, forward PEG ratio – 0.77.

- Monolithic Power: Forward P/E ratio – 26, forward PEG ratio – 1.

- Micron: Forward P/E ratio – 7.7, forward PEG ratio – 0.2.

- Nvidia: Forward P/E ratio – 28, forward PEG ratio – 1.27.

- Broadcom: Forward P/E ratio – 22, forward PEG ratio – 1.22.

- TSMC (TSM): Forward P/E ratio – 18, forward PEG ratio – 1.

It’s challenging to consider an AI bubble when the most promising AI chip companies trade with P/E ratios around or below 20 and PEG ratios around or below 1 in many instances. Presumably, irrational exuberance would push valuations to extremes around a high point, which is far from the case now. This dynamic implies we witnessed a healthy pullback in the chip market and are now setting up for another considerable move higher.

Where Nvidia’s stock could be in future years:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (in billions) | $128 | $192 | $225 | $258 | $294 | $340 |

| Revenue growth | 110% | 50% | 17% | 15% | 14% | 15% |

| EPS | $3 | $4.80 | $5.75 | $6.85 | $8.20 | $9.40 |

| EPS growth | 130% | 60% | 20% | 19% | 18% | 17% |

| Forward P/E | 33 | 34 | 35 | 35 | 34 | 33 |

| Stock price | $158 | $196 | $240 | $288 | $320 | $360 |

Source: The Financial Prophet.

Due to Nvidia’s better-than-anticipated near-term growth, I’ve modestly increased my near-term sales and EPS estimates over my previous forecast. As a result, I’ve slightly increased my intermediate and longer-term price targets for Nvidia.

As Nvidia continues increasing sales, its EPS should continue rising, enabling Nvidia to sport an elevated forward P/E multiple of approximately 30-35, and potentially higher if the market becomes “frothy” in future years. Nvidia’s stock could advance considerably, reaching around $350-400 or higher by 2030.

Also, it’s important to highlight that these are base-case estimates, and in a bullish scenario, Nvidia’s stock could be substantially higher by 2030. This bullish intermediate and longer-term dynamic makes Nvidia a solid buy-and-hold stock.

Risks To Nvidia

The most significant risk to Nvidia and the broader AI chip and general AI space is the slowdown in the massive AI infrastructure buildout process. While a minor transitory slowdown phase may be inevitable, a more sustainable, significant, systemic slowdown poses a considerable threat to the high-quality AI chip space.

Company-specific threats for Nvidia include rising competition, potential decreases in gross and other margins, execution, and other factors. There have been reports of overheating and other issues which Nvidia must address. There are also geopolitical and demand-related risks that Nvidia must navigate, and a possible broad economic slowdown remains a risk. Investors should examine these and other risks before diving into Nvidia’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, MPWR, AVGO, MU, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!