Summary:

- Nvidia Corporation shows massive outperformance in nearly every key line item and metric following a monumental change in consumer focus.

- Language models and Generative AI solutions are writ large in its two largest segments, with end-user consumers almost exclusively corporate.

- However, the company and the stock have significant divergence, particularly given that the company’s P/E Ratio runs highly overvalued in a very competitive and evolving industry.

- Institutional holdings will likely continue to pare down to continue ratio rationalization while stock repurchase is expected to continue in 2024.

NurPhoto/NurPhoto via Getty Images

In this earnings season, NVIDIA Corporation (NASDAQ:NVDA) sits at the head of the “Magnificent Seven” group’s table. The latest earnings release gives company executives yet another cause to celebrate while giving many professional investors a reason to pause.

Company Line Item Trends: A Drilldown

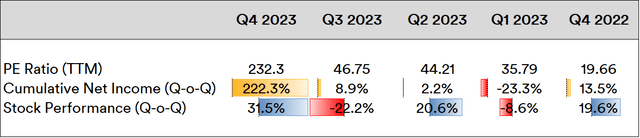

Key line items are examined with a “first-order” matrix to inspect their year-on-year change as well as a “second-order” matrix to winnow out sustained growth trends. The conclusions therein are singularly interesting:

Source: Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

After Fiscal Year (FY) 2022, the company’s first-order trends have had an explosive change from its previous broad sense of orderliness. In the present FY:

- Revenue growth outpaces the cost of revenue threefold while the cost of operations increases a paltry 2%;

- Gross Profit and Net Income have shaken off the slumps seen in the previous FY to exhibit a massive outperformance well exceeding that of revenue-related trends, while the Gross Margin shows a 30% improvement over the previous FY at 73.8%;

- Inventories are only up 2% while a massive pileup in Accounts Receivable pushes current assets to 5-year highs;

- Net Income Per Share (or diluted EPS) has shown the biggest outperformance over all other trends with a nearly 700% markup relative to the previous FY.

The second-order trends, however, indicate how singular this moment is relative to historical trends. Virtually no single line item shows a sustained growth trend in any way, shape, or form.

The company’s products had long been favored by gamers and crypto miners. Over the past couple of years, however, a shift in focus largely explains why second-order trends are in disarray: the company’s consumer mix has gone largely “corporate.”

- The data center segment registered a 217% first-order change to $47.5 billion, with collaborations made with Alphabet Inc. (GOOG, GOOGL) in language models as well as with Amazon.com, Inc. (AMZN) in cloud solutions. Numerous enterprise solutions were made for language models, generative AI, and medical applications.

- Language models and generative AI lie heavy on its next biggest segment – Gaming – which delivered $10.4 billion this year (15% first-order change). Here too, the shift in focus is palpable: the bulk of advances were attributable to increasing inroads with game developers.

- The second-largest first-order change (21%) and the smallest revenue contributor ($1.1 billion) was the automotive segment, with increased adoption by Chinese carmakers Great Wall Motors and Li Auto Inc. (LI) lying square and center.

However, the company’s massive boost in earnings doesn’t translate to a massive dividend bonus for long-term investors. With dividends staying at $0.04, the yield relative to price is at the 0.02% mark. The company spent $9.5 billion in stock repurchases over the year, which is a smidgeon lower than the $10 billion it spent in the previous FY.

Stock vs. Sector

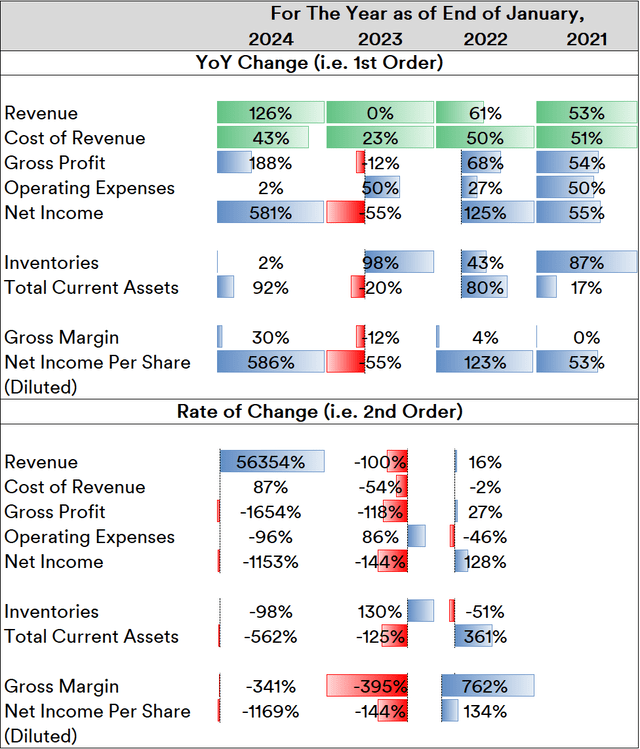

Investors have been increasingly focused on the semiconductor industry over the past couple of years, with “AI” being a dominant investment theme therein. The stock performance of a pool of 120 semiconductor/chipmaking-related stocks (which includes the company) highlights this in stark terms.

Up until Q4 2022, market participants were fairly measured in their outlook for this sector. Despite Q1 2023 being a relatively bad period for stock performance, investor vigor propelled Price-to-Earnings (P/E) Ratios to twice the value relative to the previous quarter. Barring a slight adjustment upwards in the next two quarters, massive net income accruals in Q4 2023 pushed the sector’s PE aggregate to a twelvefold of its value a year prior.

Here too, “corporate” lies heavy: virtually every sector of the global economy has been exploring means to incorporate AI towards improving process/service efficiency and even belaying human costs (particularly in the Western Hemisphere where increased affordability concerns continue to be manifest for at least three years now).

The company’s position within this sector, however, is mixed. As of the day before the earnings release, Nvidia ranked:

- 10th in PE Ratio. California-based “fabless” chipmaker SiTime Corporation (SITM) ranked 1st.

- 5th to Price to Sales (P/S) Ratio. Canada-based chip-scale photonic solutions provider POET Technologies Inc. (PTK:CA) ranked 1st.

- 5th in Price to Cashflow (PCF) Ratio. California-based semiconductor fabrication support specialist Ultra Clean Holdings, Inc. (UCTT) ranked 1st.

Given the middling position in ratio trends, one could argue that there’s ample room for the stock to grow in valuation. Investor behavior, however, indicates otherwise.

Stock vs. Investor

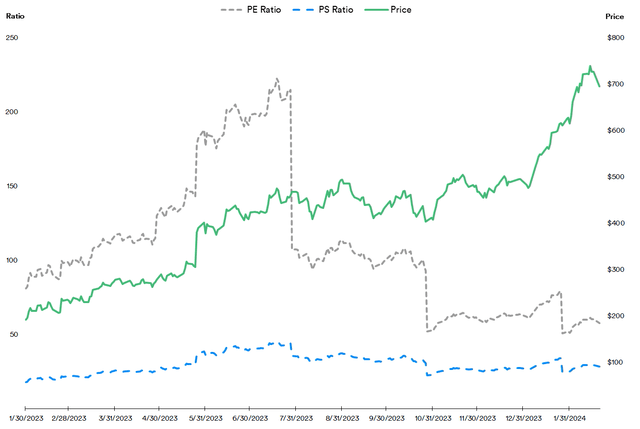

As the company went increasingly “corporate” over the past year, the company’s PE Ratio underwent a significant rationalization.

Source: Created by Sandeep G. Rao using data from Bloomberg

As of the day before the earnings release, the PS Ratio is down 38% from a high of 45.5 while the PE Ratio is down 74% from a high of 222.

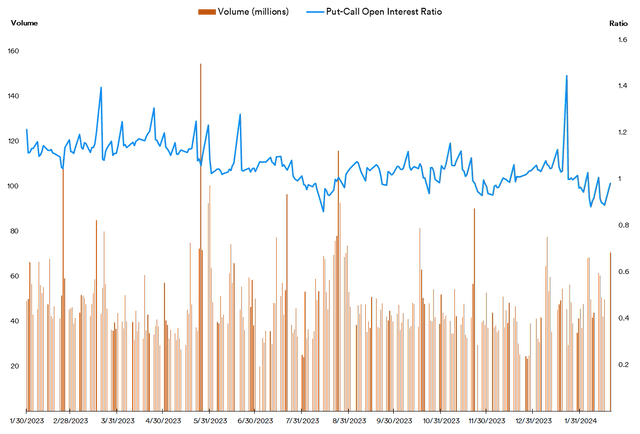

Over the past year, volume trends have generally been in the 45-65 million range except for days signifying options expiry/rollover and earnings release. When overlaid against the put-call interest ratio, the stock is increasingly even in terms of consideration. Through most of 2023, market participants were predominantly bearish on their outlook of stock valuation. In the current year, however, they have trended towards a ratio of 1.

Source: Created by Sandeep G. Rao using data from Bloomberg

As the PE Ratio rationalized, the Put-Call Ratio tended to stabilize. Recent trends indicate that there continues to be a push for further rationalizing the PE Ratio.

The company predominantly operates as a designer while the bulk of the manufacturing/assembly of disparate components is carried out by Taiwan-based Taiwan Semiconductor Manufacturing Company Limited (TSM). Given that there is no single correct “architecture” and design is highly dependent on the application, the company’s “high watermark” currently achieved via successful corporate outreach and collaborations comes with the caveat that its counterparts will constantly look towards optimizing cost and performance based on need.

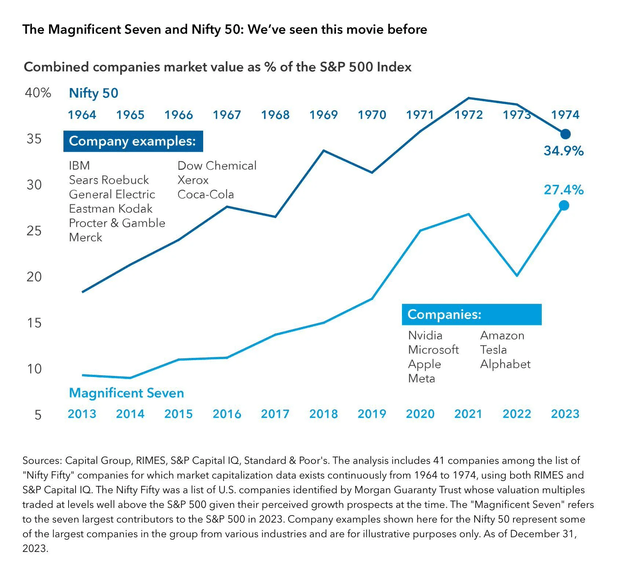

Another factor is the problem with the “Magnificent Seven,” which has become a refuge for hype-driven investors. Economist David Rosenberg contends that the Magnificent Seven’s frequent comparison with dot-com stocks at the turn of the century is incorrect since the former are actually profitable. Instead, they should be compared with the American “Nifty Fifty” of the 1960s and 1970s (not to be confused with the Indian index), which were also mostly profitable. Eventually, the “Nifty Fifty” tumbled over 60% between 1973 and 1975. Most of the companies, however, remained profitable all the way till the present, while the stock valuations (of those still around) have become mostly rational since.

Much like the “Nifty Fifty” of yore, the Magnificent Seven is the dominant driver of today’s market.

Much like the “Nifty Fifty,” a rationalization is due.

In Conclusion

As a company, Nvidia Corporation’s high earnings will likely stabilize on a forward-looking basis: corporate adhesion tends to be stable albeit subject to significant interplay with requirement scoping and cost. A diverse set of hardware solutions can also be expected to be deployed in the year to come.

As a stock, however, historically high ratio premia cannot be expected. Goldman Sachs reported that nearly every one of the 722 hedge funds surveyed with a total equity exposure of $2.6 trillion have been paring down their exposure to these stocks. A further 40-50% correction of the PE Ratio from the present level to the mid-twenties to early-thirties is likely on the cards and stock repurchases will likely continue.

All in all, a “wait and watch” is recommended.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.