Summary:

- My previous thesis about Nvidia Corporation has aged well, as the stock has appreciated by 27% since May 2, far outperforming the S&P 500.

- Nvidia continues to deliver remarkable growth in its key financial metrics, which enables the accumulation of resources to further accelerate innovation.

- My analysis indicates that Nvidia is still slightly undervalued, which means that the valuation is compelling for such an AI superstar.

Antonio Bordunovi

Introduction

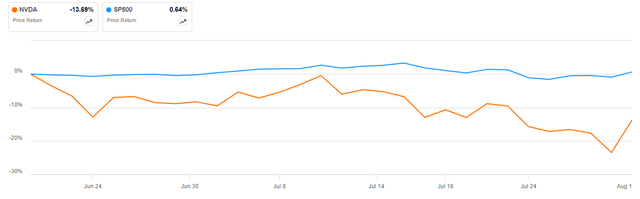

I shared a thesis about NVIDIA Corporation (NASDAQ:NASDAQ:NVDA) in early May 2024 with a “Strong Buy” rating. It appears that my optimism was justified because the stock has appreciated by 28% since May 2, while the S&P 500 (SP500) rose by 7%. Today I want to share my insights about recent developments around NVDA from the fundamental analysis perspective. The stock price dipped compared to its mid-June peaks, which is a good buying opportunity.

I am still bullish as the demand for GPUs, where Nvidia dominates, appears to be still robust. This relates both to the currently deployed H100 generation of accelerators and the brand-new Blackwell platform. Nvidia continues investing heavily in innovation, which will likely help the company maintain its position at the forefront of the AI revolution. My discounted cash flow (“DCF”) analysis suggests that the stock is slightly undervalued, and I am inclined to reiterate a ‘Strong Buy’ rating for NVDA.

Fundamental analysis

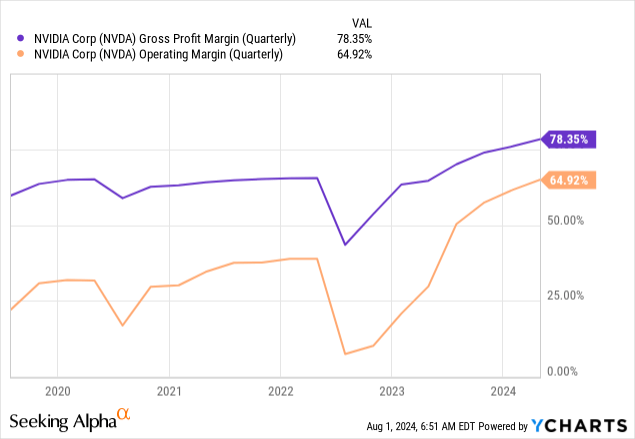

NVDA delivered another staggering quarter on May 22 with a $1.5 billion revenue beat against consensus estimates. The EPS beat has also been quite confident. Revenue grew by 262% YoY and the non-GAAP EPS skyrocketed from $0.88 to $5.16. The EPS profile improvement was achieved thanks to a massive operating leverage as NVIDIA’s profitability ratios demonstrated strong improvements shown below.

The company continues capitalizing on its dominance in the GPU space, where NVDA holds an 88% market share. The demand for GPUs is still robust as technological giants continue their artificial intelligence (“AI”) race. For example, during Tesla’s (TSLA) last week’s earnings call, Elon Musk announced that his company continues expanding its AI computing capacity for its FSD project with more H100 accelerators.

The demand for Nvidia’s brand-new Blackwell family of accelerators also appears to be hot, as the company recently increased its Blackwell orders from Taiwan Semiconductor (TSM) by 25%. According to Interesting Engineering, Elon Musk’s supercomputer will likely be powered by more than 300,000 Nvidia’s GPUs.

Let us also not forget that Nvidia’s GPUs are also used to train large language models (“LLMs”). The competition in this industry is also fierce, which is also beneficial for NVDA. Meta’s (META) Llama 3 is gaining momentum and Nvidia’s technological partnership with this LLM looks strong. It is important to mention that Nvidia does not only power Llama from the perspective of hardware, but also sells other tools like its NeMo end-to-end platform for developing custom generative AI. Involving customers deeper into its ecosystem of products and services highly likely creates stronger bonds with them, which fortifies the company’s moat.

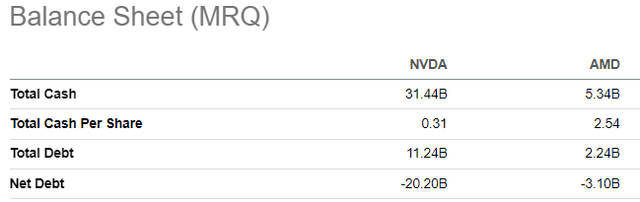

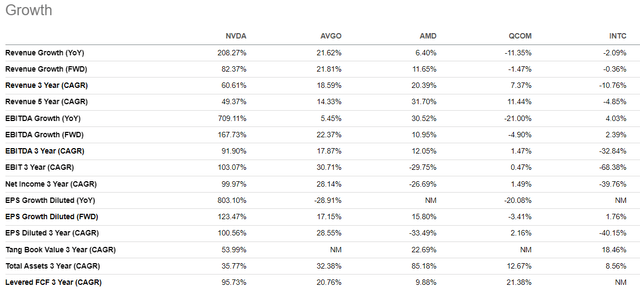

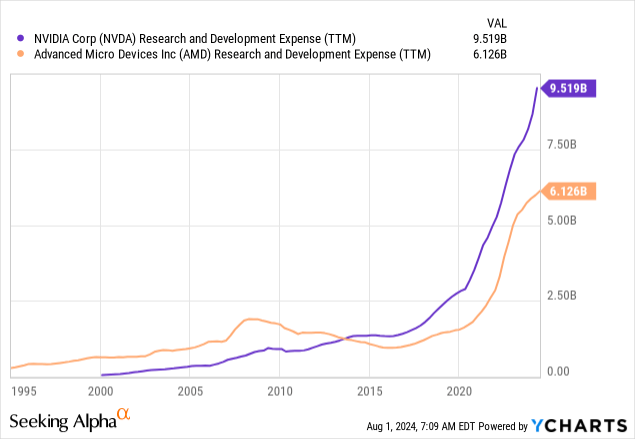

Another factor that I believe widens Nvidia’s moat compared to its closest rival in GPUs is the expanding gap in R&D spending. Nvidia’s EBITDA growth is unmatched, providing the company with more financial resources than Advanced Micro Devices (AMD) to accelerate innovation. Nvidia’s TTM R&D spending is around 50% higher compared to AMD, and this gap is likely to expand further in the future because AMD’s financial position is nowhere close to Nvidia’s. With around 6 times less cash and having a $2 billion TTM FCF compared to Nvidia’s $29 billion TTM FCF, AMD is poised to continue lagging in terms of investments in innovation.

Apart from innovating organically (in-house), Nvidia also expands its network of partnerships with other prominent technological companies. For example, in June Nvidia announced its joint project with Hewlett Packard Enterprise (HPE) to offer “a first-of-its-kind solution that provides the deepest integration to date of NVIDIA AI computing, networking, and software with HPE’s AI storage, compute and the HPE GreenLake cloud.” The ultimate goal of this partnership is accelerating the generative AI revolution, which will likely help in fortifying Nvidia’s position as one of the most important players in the secular AI shift.

Nvidia continues consistently rolling out new offerings to the market, and it unveiled the Omniverse Cloud Sensor RTX on June 17. This is “a set of microservices that enable physically accurate sensor simulation to accelerate the development of fully autonomous machines of every kind.” Nvidia’s developments in the field and strong demand for Nvidia’s chips to power Tesla’s FSD functionality, which I mentioned earlier in my analysis, are strong indications that the company can capitalize on the autopilot revolution in the EV space. According to Fortune Business Insights, the autonomous vehicles market is expected to deliver a massive 32% CAGR by 2030.

To summarize, Nvidia remains at the forefront of the AI innovation, and surging demand for its current H100 accelerators and the upcoming Blackwell architecture is still extremely hot. The company’s investments in R&D outweigh its closest GPU competitor, AMD, by billions of dollars, which likely helps the company to sustain its wide moat. I think that having a dominant position in the emerging industry will enable Nvidia to sustain its stellar pricing power, which will ultimately result in expanding profitability for longer.

Valuation analysis

Despite almost a 13.7% decline in the stock price compared to its peak levels of mid-June, NVDA still has a strong Quant Momentum rating. After the last 12 months’ 150% rally, the company’s market cap reached $2.88 trillion, and currently NVDA is the third largest U.S. company by market cap after Microsoft Corporation (MSFT) and Apple Inc. (AAPL).

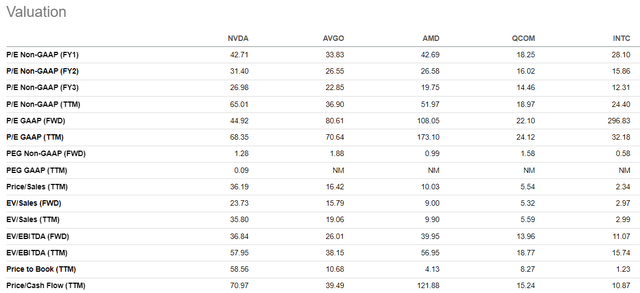

Some investors and experts consider NVDA to be substantially overvalued, but I do not think so. First, let me show you how NVDA’s forward valuation ratios look against other prominent semiconductor names. The company’s forward non-GAAP P/E ratios look approximately in line with Broadcom Inc. (AVGO) and AMD, and the non-GAAP PEG is also sound.

Of course, Nvidia’s TTM metrics are substantially higher than all rivals. Nvidia’s all valuation ratios are also sky-high compared to QUALCOMM Incorporated (QCOM) and Intel Corporation (INTC). However, TTM ratios give us a rear-mirror view, and investing in assets is all about their future potential to deliver growth and profitability. From the perspective of growth, none of the above-mentioned rivals are anywhere close to Nvidia. Therefore, I think that Nvidia’s high TTM metrics are justified, which we see from sound long-term forward metrics.

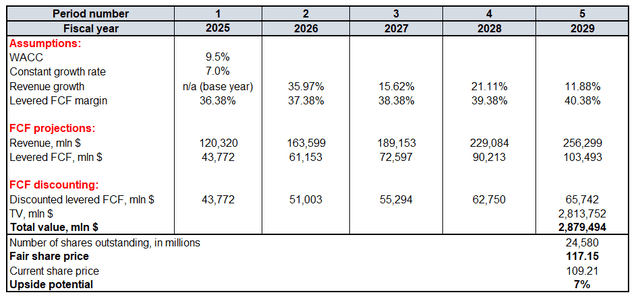

Now I must figure out my target price for NVDA, which I will do with the help of the discounted cash flow (“DCF”) model. Future cash flows will be discounted with a 9.5% WACC. Due to the positive factors for NVDA’s long-term prospects which I share in “Fundamental analysis,” I reiterate my aggressive 7% constant growth rate assumption which I used last time for the terminal value (“TV”) calculation. From the revenue perspective, I rely on consensus estimates for the base FY 2025 and project a 22.5% CAGR for the next five years. I use a 36.38% TTM levered FCF margin and expect NVDA to be effective in exercising its pricing power, which will help in expanding its FCF margin by 100 basis points yearly. According to Seeking Alpha, there are 24.58 billion outstanding NVDA shares.

My DCF model suggests that NVDA’s shares are currently slightly undervalued, with a 7% upside potential. For a stock like NVDA, such a discount means that the stock is attractively valued because it definitely deserves a premium over its fair share price due to its dominance in a thriving GPU market. That said, the stock is still attractively valued, which I see it both from the multiples and DCF points of view.

Mitigating factors

There is a great deal of geopolitical uncertainty not only caused by the complex relationships between China and the U.S., but also due to the historical tensions between China and Taiwan. This factor is crucial because Nvidia outsources its manufacturing to the Taiwan Semiconductor Manufacturing Company Limited (TSM) and the supply chain heavily depends on the stability of TSM’s operations. I agree that the probability of an armed conflict between China and Taiwan is extremely low, but recent years taught us that even non-military measures like economic sanctions might substantially disrupt business operations. I think that this risk should also be weighted by investors before they decide to opt into NVDA.

The American technology sector is full of bright and ambitious, visionary leaders. Not all of them like the monopoly of Nvidia in the GPU market, and I believe that Nvidia’s success is a good role model for the new generation of visionary CEOs. For example, Sam Altman from OpenAI wants to build his alternative to Nvidia in GPUs and reshape the industry. While his initiative apparently does not look like an overnight venture, I think that even potential positive headlines regarding Mr. Altman’s initiatives developing in this direction might be absorbed by the market as a mounting threat to Nvidia’s long-term prospects. That would likely undermine the stock price.

Conclusion

Nvidia is likely to remain the dominant force in the emerging advanced chips industry, thanks to its heavy investments in R&D and the visionary talent of its management. The demand for the most powerful GPUs appears to remain strong for longer, which is a big tailwind for NVDA. I think that NVDA is still a “Strong Buy,” also because of its still attractive valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.