Summary:

- Nvidia’s share price has been on a roll as investors celebrate the long-term potential of AI and the company’s leading positioning.

- Nvidia’s competition will be expected to grow rapidly as other tech companies start making their own dedicated AI processors.

- The company’s gaming division has been ignored with angered customers, hurting an important bedrock for the company.

Justin Sullivan

Nvidia (NASDAQ:NVDA) is the largest graphics card manufacturing company in the world with a market capitalization of roughly $600 billion. The company has seen its share price increase almost 70% YTD but it still remains almost 20% below its 52-week high. As we’ll see throughout this article, Nvidia is a top-tier company but doesn’t have the financials or assets to justify its valuation.

Nvidia Highlights

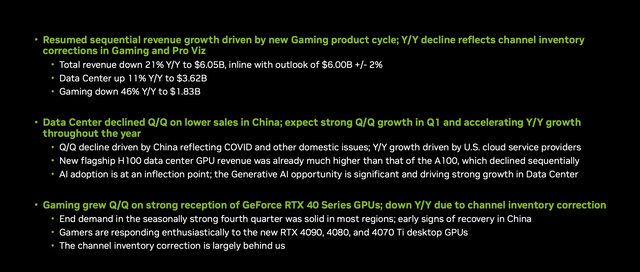

Nvidia’s aggressively reorienting itself as a data center and computing company versus its grassroots as a gaming company. That might be a strong move given where the market is headed.

Nvidia Investor Presentation

However, the company is still exceedingly susceptible to the gaming product cycle. The company’s need to reduce gaming channel inventory resulted in a 46% YoY decline to $1.8 billion. At the same time, the company had some datacenter impacts from China. Covid was the story last year but we expect export restrictions to be more of the story going forward.

The company has received anger from its customers for consistent GPU price rises, although right now its GPUs don’t have a lot of significant competition, especially on the top end. The company is focusing its long-term market opportunity on the advantage of AI compute.

Nvidia Burned Gaming Customers

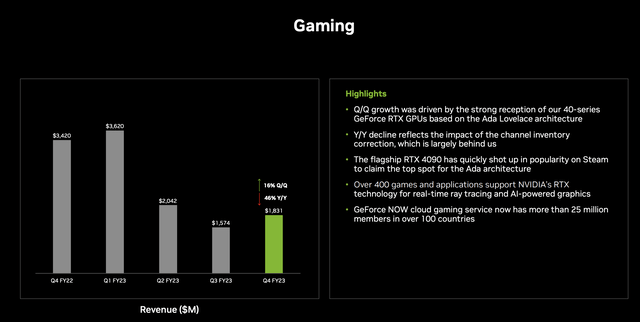

Nvidia’s gaming division has long been the company’s core although over the last few quarters that changed substantially.

Nvidia Investor Presentation

There’s no denying that Nvidia remains the king of high-end gaming GPUs. The company had some channel competition, however, that in of itself doesn’t change that story. What has affected the company was prices. During COVID-19 initially, component shortages gave the company substantial pricing power, however, it ended with a market correction for the company.

The company’s GPU price increase have angered customers substantially. For comparison in 2016 the 1080 launched at $699 and the comparable 4080 last year was $1199. Now the compute gains have gone up faster, but no one wants Moore’s Law to apply to pricing too. Fundamentally higher prices make competitor’s cards and consoles more appealing.

Higher prices also hurt customer loyalty which has traditionally helped Nvidia substantially in gaming.

Nvidia Fresh AI Competition

At the same time, in Nvidia’s core AI market, we expect competition to increase substantially.

Google (see here), Microsoft (see here), and Amazon (see here), are all building their own AI accelerator chips. Given Nvidia’s continued use of TSMC to manufacture their chips, the raw compute power provided by transistor size is available to all of these companies. Unfortunately for Nvidia, all the big tech companies have the financial strength to compete.

As these large companies build more and more purpose-specific AI chips and computing becomes more concentrated on the cloud, we expect Nvidia’s competition to get tougher and tougher. This risk is important because one of the things that helps to support Nvidia’s financials is their hefty margins. Even being forced to lower prices could have a large impact.

The company had 64.1% gross margins with $6.5 billion in profits. We’ll discuss the profits the company needs to sustain its valuations below, but for perspective Intel has a 40% gross margin, similar to AMD’s gross margins. Such a drop in gross margins would cut the company’s

Nvidia Outlook

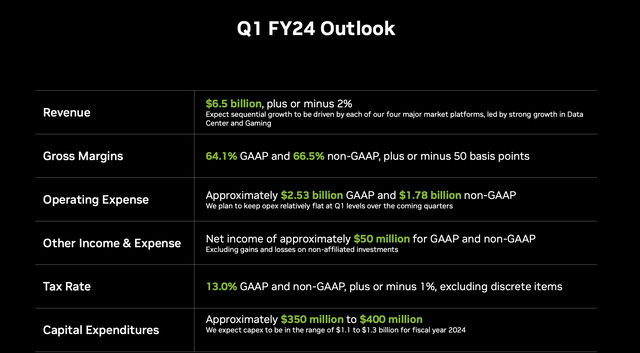

Nvidia’s outlook shows respectable strength in the recovery, but also shows how expensive it is.

Nvidia Investor Presentation

Nvidia expects $6.5 billion in revenue with 64.1% GAAP margins and $2.5 billion in GAAP operating expenses. A lot of this is either sequential growth or flat. The company’s capital expenditures will be ~$375 million and tax rates will be 13%. The net result though for the quarter though is roughly ~$2 billion in net income per our expectations.

That’s annualized net income of ~$8 billion which gives the company a P/E of almost 100 at its current share price. To justify that valuation, especially in a volatile industry, the company needs an eventual path to growing its profits to $50+ billion. If it takes a decade+ to do that, the company needs to grow profits towards $100+ billion.

The company’s outlook indicates some recovery, but it also indicates how far the company is from where it needs to be.

Our View

Nvidia is a quality company. The company did a lot of great engineering work and positioned itself well. The AI revolution is likely to continue as new applications are found. Still, however, it’s not just about finding a great company, it’s about finding a great company at a reasonable price. Nvidia doesn’t meet that bar.

The company has a $600 billion market capitalization which means at some point in the future it needs a path to $10s of billions in profit. The company has ignored gaming users and the revenue collapsed year over year. It might recover but right now the path is uncertain. We’re not saying that the company doesn’t continue to build market leading GPUs.

The company has done the following:

– The company has rapidly ramped up GPU prices.

– Rumors are that the company is holding back a strong GPU skew in case AMD ramps up.

That has hurt goodwill, which could hurt the size of the future business recovery as the market recovers.

At the same time, some of the company’s largest customers are building their own AI processors. Combined with the move of computing increasingly to the cloud and we expect that Nvidia’s competition will increase and demand will decrease. That risk is worth paying close attention to and we feel it’s something that customers haven’t.

Thesis Risk

The largest risk to our thesis is that Nvidia is meeting an unmet need. The company is right that GPUs or more specialized compute cards that can do the simple calculations that AI needs in massive volume are the future. However, it also has massive risk from other technology companies and a high valuation that could hurt its ability to drive future returns.

Conclusion

Nvidia has an impressive portfolio of assets. The company has a $600 billion market capitalization and a dividend yield <0.1%. Its share price is up almost 70% YTD indicating the celebration around AI and its impact on the overall markets. However, eventually the company will need $10s of billions of earnings to justify its valuation.

We expect that the company will struggle to get its gaming division back to prior levels. Additionally, we expect that the company’s AI division will suffer as compute additional move to cloud companies that’re building their own processors. As a result, we recommend against investing Nvidia at this time, as an overvalued company.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.