Summary:

- Nvidia and Sherwin Williams will enter the Dow Jones Industrial Average later this month, replacing laggards Intel and Dow.

- This represents a key event in an ongoing evolution of dividend investing, in which the markets do not reward that style like they used to.

- There’s no bad news in that, as long as investors adjust their approach to meet what the market now rewards when it comes to investing for yield.

MCCAIG

You might have missed it when the news broke late Friday, but the committee that oversees the construction of the Dow Jones Industrial Average made an important announcement. Later this month, it will remove Intel (INTC) and Dow Chemical (DOW) from the 30-stock index, and replace them with Nvidia (NASDAQ:NVDA) and Sherwin Williams (SHW).

From the standpoint of indexed investing and its major impact on the stock market, this is a non-event. There’s so much more money invested to track the S&P 500 index than the Dow. However, there is a signal in this announcement which to me, as an ardent dividend investor, screams of the end of an era. What era just ended? The one in which investment markets prioritize dividend income. Allow me to explain.

Seeking Alpha news

Why this change in the Dow is so significant

I wrote about Nvidia recently, explaining how I’m investing in it in a way that best fits my Yield At a Reasonable Price (YARP™) dividend stock approach that governs how I manage most of my assets. By indirectly accessing NVDA via NVDY, a covered call ETF, I trade off big upside potential for big current income.

I’m good with that tradeoff, since I’m very willing to trade off big price upside for big current income. I’m at the stage of life where growth is always nice to have, but never at the expense of major risk. And I do think that at some point the Magnificent 7 stocks will pivot and become the “maleficent seven,” replaying in some form what we saw from 2000 to 2003, the dot-com bubble. I just don’t have any idea when that will actually occur, following several “bend but don’t break” events for the NASDAQ 100 and the S&P 500, including a 5-week, 33% decline in the latter index in early 2020, and a 25% drop during 2022. But the recoveries from those selloffs were relatively quick. It took investors nearly a decade to recover from what happened during the dot-com period.

Frankly, that recent NVDA article was far more narrow in scope than this one. And it is less about Nvidia’s stock than the broader issue of how dividend investors will replicate the relative ease of which they have been able to earn competitive dividend income from their stock portfolios, grow that income consistently, and avoid sustained major drawdowns in price.

Because with this announcement yesterday about a membership change in that 128-year old index that I still consider to be very relevant to equity investors, I think we’ve entered a new phase. It has been a gradual transition, but now it is clearly accelerating. By replacing a high yielding stock and another one that used to be a strong yielder, and adding two more low-yield stocks to a Dow Industrials index, that market measure is past the point of no return when it comes to its ability to produce a “livable wage” versus what it used to be. That ushers in a new level of urgency for those seeking to navigate the world of dividend investing.

If this were contained with the Dow Industrials, there would be no reason to write this article. But I think this was the very last shoe to drop, which is why I reached out to my editors at Seeking Alpha on a weekend to publish this one. For dedicated, disciplined dividend investors, I think it is an essential topic of discussion. And since I’m about to begin leading an investing group dedicated to “doing dividends differently,” I’m starting the discussion in earnest.

Index impacts, and why the Dow looks more like the S&P 500

These adjustements to the Dow 30 are significant in another way. They arguably modernize the Dow by adding a forward-looking company (Nvidia) in place of a business (Intel) that is past its prime and will need a giant reshaping to bounce back.

Seeking Alpha Quant Factor Grades help us to see this clearly. The growth grades for the 2 new members are A+ and B- and the 2 stocks being replaced are rated F and D-. That’s a big difference. And while all 4 are still quite profitable, that’s a backward-looking analysis.

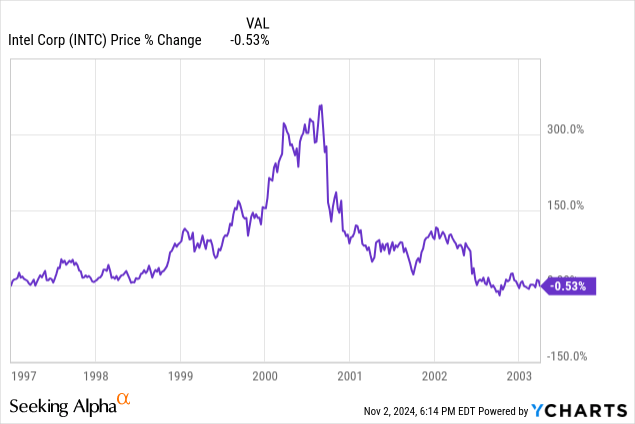

One risk when the Dow committee makes changes like this is what we saw with some past adjustments, in which the stocks that entered were “hot” movers and the ones that exited soon became strong contrarian situations. INTC’s addition to the Dow just before it peaked in 2000 is one example. XOM’s exit and recovery is another that comes to mind.

The SA momentum grades show this possibility with 2 strong momentum stocks replacing a pair of stocks with terrible momentum. INTC is about 55% off its 52-week high, and DOW is 19% lower from its recent price peak. SHW is up 43% from its 52-week low and of course NVDA has been a beast, up more than 200% since it bottomed. So this all goes to the idea that like the S&P 500 and Nasdaq, the Dow’s fate going forward will lean more on what has worked. That is great track to follow in strong markets, but if things reverse sharply, it could be terrible timing. This is why stock selection has become so important at this potentially late phase of the stock market cycle.

There is another impact we could see over the next few weeks. We will likely see increased buying pressure for NVDA and SHW as all the ETFs that track the Dow Industrials will have to buy shares in order to match the index’s composition. This is known as the “Index Effect”. There will likely be increased selling pressure on Intel and Dow as the ETFs unload shares to purchase NVDA and SHW. The temporary increase in buying pressure for NVDA and SHW should abate once the actual inclusion takes place, and it’s not uncommon to see a stock’s price drop slightly once the effective date occurs. The opposite is true for stocks being removed from an index, selling pressure increases in the weeks leading up to the effective change date and then the pressure decreases once the change is actually made. Because there are fewer Dow tracking ETFs compared to the S&P 500, the Index Effect may not have as much of an impact.

The tale of the tape

Hopefully my fellow Wall Street veterans will see the tongue-in-cheek reference there, since there was a time long ago where instead of looking up stock quotes on our phones, investors sat in their offices receiving them via a ticker tape machine. Today’s market climate and many public companies treat dividend investing and investors less seriously than I’ve seen in my 38 years in the investment business. So here is a quick summary of the notable aspects of this swap of two laggard stocks for a staid chemical stock better known for its retail presence in the paint business.

1. Nvidia is essentially the superstock of superstocks. Since its debuted as a public company nearly 26 years ago, its stock price has risen by 332,000%... give or take. See chart below. But its dividend yield is 0.03%, which signals to me that the company figured that issuing a tiny dividend would help it qualify for funds and institutions that require all equity holdings to be “dividend-paying stocks.” Hey, it pays a dividend! Good luck finding it, though.

Seeking Alpha

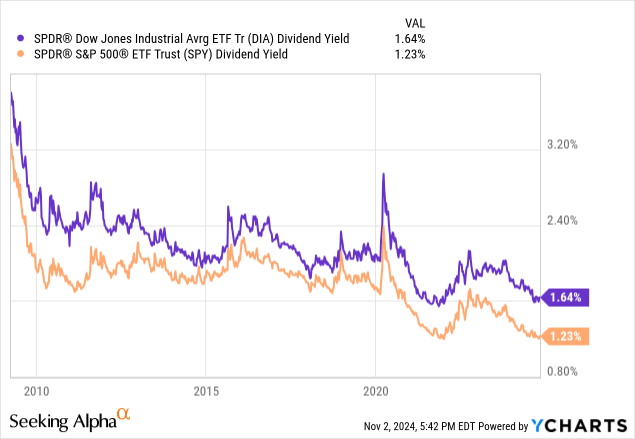

2. Nvidia entering the Dow is a clear sign to me that the market is no longer pretending to care as much as they used to about dividend investing. This has been a gradual thing, starting with companies buying back stock with profits instead of returning cash to shareholders in the form of dividends. This is what the path of the dividend yields of the Dow and S&P 500 ETFs look like since early 2009.

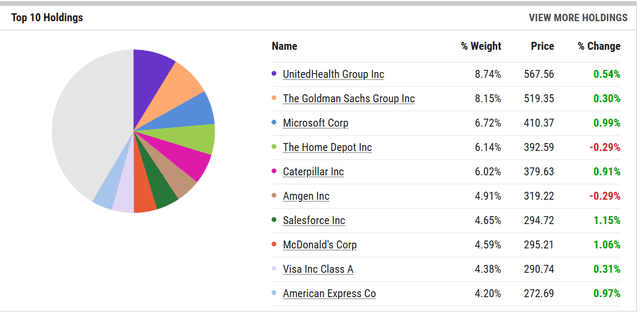

3. Here’s a look at the seven biggest Dow Industrials holdings and their dividend makeup. These stocks account for more than 45% of the Dow by weight. Only Amgen (AMGN) yields even more than 2.5%. The Dow used to be chock full of stocks yielding 3-4% or more, and all members paid dividends.

Now, two holdings do not pay a dividend and seven others yield less than 1%. DOW, at a 5.7% dividend yield, is second only to Verizon (VZ) in the 30-stock index. The days of the Dow being the major index that had some yield to it have passed.

If we do happen to get a dot-com-style 50%+ decline in the broad stock market, the Dow could yield 3% again. But that’s obviously a mixed blessing.

4. The Dow is a price-weighted index, rather than the more common capitalization weighted market measures. You can see that in the table below, in which the weighting of each stock in the top 10 (and, not pictured, the other 20 stocks too) is in descending order of their market prices.

So with Nvidia closing around $135 a share on Friday, it is likely to enter the Dow’s bottom 1/3 in terms of weighting. That should actually be a positive feature of the Dow, since it continues to be less concentrated among a handful of giant tech stocks, as is the case with the S&P 500.

As for Sherwin Williams, it would currently rank as the sixth biggest Dow stock, based on its $358 close on Friday. These changes are still a few weeks off, however.

Ycharts

Dow Chemical and Intel are two of the three smallest Dow Industrials components, so that’s notable. Verizon is in between them, and Coca-Cola and Cisco are just above them in the weightings. For those of us who remember when “upstart” Intel first entered the Dow back in 1999, Nvidia replacing it rings a bell. And not the one they ring at 9:30 and 4:00 at the New York Stock Exchange every trading day!

Here’s Intel’s rise into 1999 and then 2000, as it became a Dow member. And as we see, as of March of 2003, it had given back all 330% of its gain from the three years leading up to the bubble burst. I have no idea what will happen to Nvidia, but there’s an inescapable irony there.

5. While I won’t shed a tear for the two lagging stocks exiting the Dow, even though I currently own a small position in Dow Chemical stock, the changes speak volumes to me. It would be one thing if the Dow committee decided to boost the yield with these moves. Instead, they reduced it once again. That’s in the name of continuing what the Dow Industrials are supposed to be: a reflection of the US economy. And that’s exactly my point. Dividend investing has been such that it now requires more than just a simple stock screen to arrive at a competitive, total return portfolio. But now, that situation has reached a point of no return.

The takeaway for “modern” dividend investors

For those who embrace this ongoing pivot for what it is, and use it as an opportunity, this inevitable step the Dow has taken is a great event. But some perspective is required.

The idea is that by shrinking the amount of shares available it will unleash the powers of supply and demand to raise the price. I say “give me my dividend and I’ll decide what to do with the money.” Increasingly I believe I’m in the minority. Oh well, best to keep moving forward and figure out how to deal with what we can control.

To be clear, generally rising stock prices have also forced dividend yields down, since that’s how the math works. Same dividend per share divided by a higher price lowers the percentage yield, as long as the price grows more than the yield on an annual basis. I analyze that aspect of dividend investing every day, through the YARP framework, which starts with looking at the 7-year yield history of a stock and analyzing where it is on that spectrum. Stocks with yields toward the upper end of that range and heading south tend to be tipping off the presence of long-term value, even though it might take a little while to be realized via price appreciation. But that’s why the higher yield is so important. It provides a cushion while we wait for the total return from a recovering stock price to kick in. The other aspect of this strategy is to avoid “traps” in the form of stocks whose yield is high for a reason, and that reason is that the business is impaired.

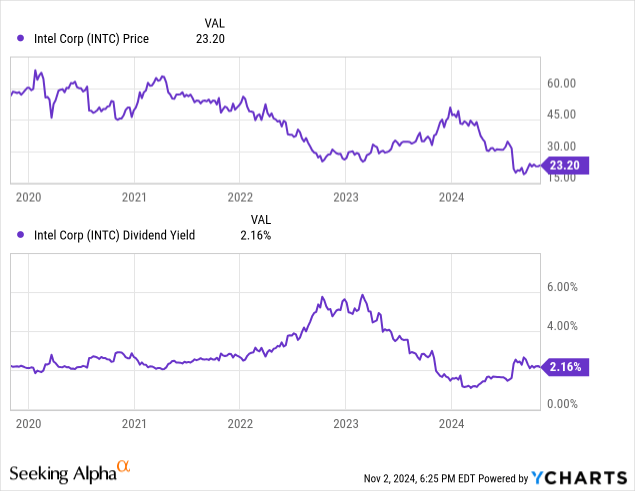

Case in point: Intel, before it reached the point where it merited being kicked out of the venerable Dow Jones Industrials. That 6% yield was a nice buy for a little while back in 2023, when the company was simply undervalued. But things kept getting worse, so the price appreciation of more than 50% from early 2023 to very early this current year was not sustainable.

The company reduced, then ultimately suspended its dividend, the latter step coming three months ago. That’s after paying a dividend for more than 30 years, and increasing its payout annually for 20 years. So much for those “dividend aristocrats.”

This is a new era for dividend investors. This article just scratches the surface, as this change in the Dow is a fresh new announcement. But importantly, it continues a trend I’ve been writing about here for more than two years.

Dividend investing is different now. Buying yield stocks and holding them is not respected by the markets nearly as much as it used to be. Algorithmic trading systems don’t devote much attention to yield, hedge funds are after maximum return and tend to conveniently forget the “hedge” part in pursuit of the highest returns, which beget higher fees to those funds. And options trading and other gamification of the markets has left us dividend investors as essentially the silent majority, at least among we semi-retired and retired types.

Great news for dividend investors

Yet there’s not an iota of bad news in there! This is an opportunity to take this quiet evolution of dividend investing, now made louder by the Dow committee’s Friday announcement, and embrace a more active, more wide-reaching approach to solving the “retirement income” challenge. This is especially the case for those like me who like dividend income, but have no patience for, or intention to, give back years worth of yield in the name of “long-term buy and hold” approaches that only work in bull markets. Thanks for the wakeup call, Dow Jones!

MY YARP PORTFOLIO IS COMING TO SEEKING ALPHA. Thanks for reading my research. My investment process and my personal YARP active, risk-managed, dividend and total return portfolio will soon be available as a Seeking Alpha Investing Group subscription service. We are launching within the next few weeks, and the first wave of subscribers will get a lifetime discount. Details coming soon, so keep reading my articles and be on the lookout for the launch announcement.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

NVDY is how I access NVDA. I also own DOW in small size.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.