Summary:

- Nvidia Corporation’s Q2 earnings beat expectations, but concerns about Blackwell chip delays and peaking U.S. revenue likely led to the post-earnings share decline.

- The lack of quantitative clarity on Blackwell chip sales numbers and the sequential drop in Hopper sales in the U.S. raises concerns about Nvidia’s growth prospects.

- Nvidia’s valuation, with a forward P/E of 41.33, appears overextended, suggesting a potential 28.10% downside if adjusted to a more realistic premium.

- Despite the AI revolution, Nvidia’s current market cap seems to overprice future growth, prompting my now strong sell opinion.

JHVEPhoto

Investment Thesis

NVIDIA Corporation’s (NASDAQ:NVDA) Q2 earnings report on the surface showed the tech company firing on all cylinders, with revenues and EPS surpassing both top and bottom-line expectations, respectively. The chip giant’s non-GAAP EPS of $0.68 beat estimates by $0.04, while revenue reached $30.04 billion, above expectations by $1.31 billion. Nvidia’s Data Center revenue hit a record $26.3 billion, up 154% year over year. The company also issued guidance for FY Q3 2025 with revenue expected to be $32.5 billion, which is slightly above the consensus of $31.75 billion.

Despite what appear to be strong figures, Nvidia’s shares fell after hours Wednesday, reflecting what, I think, is the market sniffing outgrowing concerns that have been simmering.

For those who haven’t followed my coverage of Nvidia, I have become increasingly skeptical about the chipmaker since I started writing about them last fall. My concerns (first pointed out in November) on competition seem to be coming true. The Blackwell chip delay seems to be the catalyst that caused the market share disruption I have been warning about all along.

I think the market is adjusting for potential challenges that Nvidia is facing under the hood, such as delayed plans to ship billions of dollars worth of Blackwell chips and concerns about revenue peaking in the United States (as noted in their 10-Q and on the earnings call).

While Nvidia is still confident about the Q4 delivery of Blackwell chips, the market’s skepticism is definitely higher than it was pre-earnings. There’s no doubt in my mind that Nvidia will figure out these chips and scale production. The question is if these chips will ship in the volume they estimate on the Q4 timeline they plan. What’s interesting about the admissions from the earnings call is that none of the concerns about a “three-month delay” like I covered before earnings seemed to have been dispelled. I (from my research) have said that Blackwell chips would ship late this Fiscal year. Management confirmed this on the call. But management was vague.

Without Blackwell, Nvidia will likely find it tougher to compete against Advanced Micro Devices, Inc. (AMD) given their MI 300X chips are now ramping production in key use cases.

Nvidia is heavily dependent on Blackwell’s success going forward. I think investors need to weigh the risks and consider the impact of a prolonged delay.

With this, Hopper sales (the immediate revenue solution to this delay) actually saw their sales peak in the United States (where the plurality of global Data Centers are located) sequentially 2 quarters ago. While overall Hopper sales increased, the sequential decline in revenue in this key market (I think) runs completely contrary to the Nvidia narrative that demand for Hopper is strong where the big customers are. Most of their large Hyperscaler customers (Big tech) are in the United States. They (on the whole) are buying less.

Despite my bearish stance on Nvidia heading into earnings, I actually anticipated slightly stronger Hopper performance this past quarter, given their (I’ll admit) strong momentum in AI and data center. I did not expect to see the sequential drop-off in Hopper sales just yet.

With this, while some saw the quarter as a beat, I think we actually have some structural issues underneath. I am downgrading my view on Nvidia from a sell to a strong sell.

Why I’m Doing Follow-Up Coverage

Last month, I wrote pre-earnings coverage that highlighted concerns I had about Blackwell chip delays and cautioned investors about potential revenue disruptions stemming from delays in Nvidia’s upcoming Blackwell chips. With the release of their Q2 results, my concerns were partially reflected in commentary on the call.

Despite management’s admission that the Blackwell chip design had to be reengineered (the foundation of why the chips were delayed), management provided limited clarity on the precise length of the delays, which I think left many investors with lingering concerns. Management talks about billions of dollars of revenue from Blackwell chips in Q4 FY 2025, but did not specify a number. Is this $3 billion? $8 billion? This chip is the future of Nvidia in many ways. The lack of clarity was frustrating.

With this, they have deflected concerns by talking about Hopper sales. I will go into this later, but I am not sure about the durability of this demand.

As with before earnings, I continue to be a contrarian to the market with my coverage. I know I am severely diverging from the bullish consensus on Wall Street. I think the little details add up here. The point of my follow-up coverage is to show why I am now more bearish and to give investors another viewpoint.

What Concerned Me About The Quarter

As with most quarters for Nvidia over the last two years, one of the key highlights in their Q2 results was the record Data Center revenue of $26.3 billion, which grew by 16% (on the whole) from the previous quarter and 154% from the prior year.

We have to dive into these details to get a better view of these sales, however.

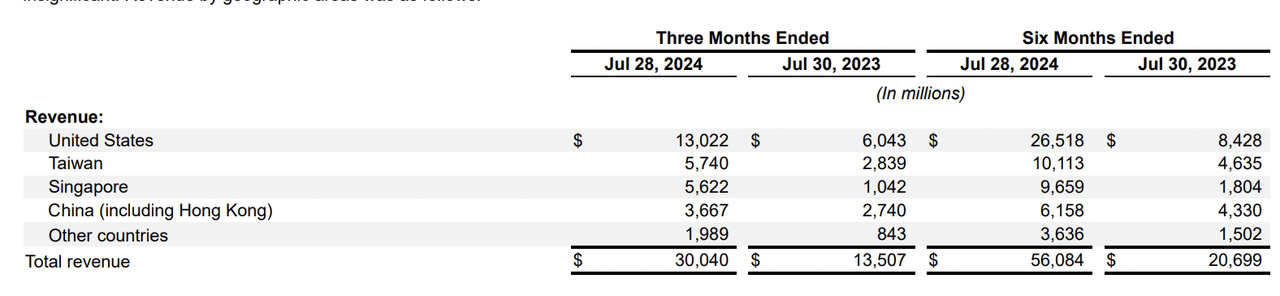

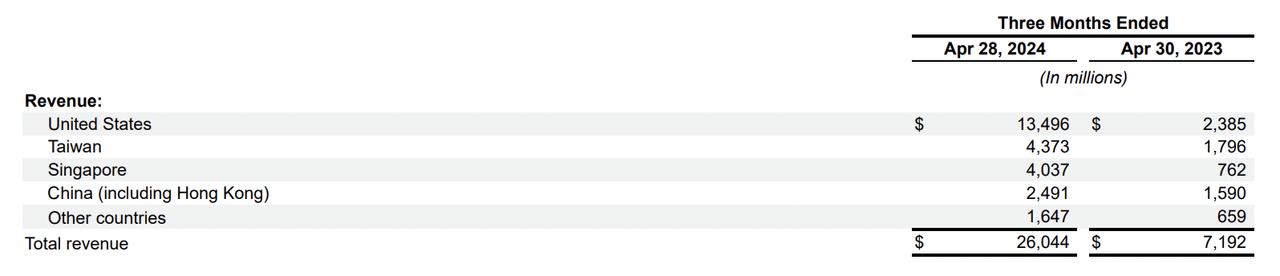

In their most recent 10-Q filing, it’s now clear that sales in North America have actually begun to decline, which could be attributed to potential market saturation, waiting for the Blackwell series, and increased competition within AI and data centers (see my research on AMD). This is compared sequentially to FY 25 Q1.

FY 2025 Q2 Revenue (Seeking Alpha) FY 2025 Q1 Revenue (Seeking Alpha)

When asked about this on the call, Nvidia’s CFO responded that where a customer’s revenue is booked may not be where the customer ends up using the product (as a deflection for why US revenue declined sequentially):

That’s not necessarily where the product will eventually be, and where it may even travel to the end-customer. These are just moving to our OEMs, our ODMs, and our system integrators for the most part across our product portfolio.

What’s notable about this quote, however, is that she is referring to her Original Equipment Manufacturers (OEMs) & ODMs (Original Design Manufacturers). Think companies like Super Micro Computer, Inc. (SMCI) and Dell Technologies Inc. (DELL). This does not appear to be the big tech companies we think of that have been some of the biggest buyers such as Microsoft Corporation (MSFT) or Meta Platforms, Inc. (META).

So, a sequential revenue decline can only be partially explained by OEMs and ODMs shifting purchases to non-US locations. I, personally, think ODM demand is less sustainable than direct-to-user demand like that of Big Tech. ODMs are technically resellers of Nvidia chips. If they see demand lighten up, they will cut orders to keep inventory lean. Big tech has already indicated (from their earnings calls) that they will overbuild for now.

Note as well that Nvidia’s CFO on the call provided no statement to analysts on whether this sequential drop would be just a blip or part of a new trend. My bearish belief (hence this article) is that this is not just a blip. She also implies this sequential sales drop is due to GPU/datacenter sales (vs. automotive or other category sales) because she said it was companies who build data center servers that were shifting their invoices.

Besides my concerns about Hopper sales, the Blackwell chip delays were touched on during the earnings call, and none of the executives were specific about the nature of the defect.

Instead, CFO Kress & Huang stated:

We executed a change to the Blackwell GPU mass to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. -Kress

The change to the mask is complete. There were no functional changes necessary. And so we’re sampling functional samples of Blackwell — Grace Blackwell in a variety of system configurations as we speak -Huang.

It’s bullish for Nvidia that they are figuring out how to scale the Blackwell chip. What is not bullish (in my opinion) is the level of vagueness on the magnitude of sales we will see from Blackwell this year.

Valuation

Despite the selloff following earnings, Nvidia shares continue to command a valuation far exceeding the sector median. Nvidia’s forward P/E ratio is approximately 41.33, which represents a 73.91% premium over the sector median forward P/E of 23.77.

While growth overall is strong, I really think their extended P/E multiple over the sector median really raises concerns now about the sustainability of where the stock is. This is especially true in an environment where growth expectations are being scrutinized by analysts and investors more rigorously. I, personally, found the analyst questions on this earnings call to be far more probing and specific than previous earnings calls.

Given Nvidia’s key performance in the US, I think there is a strong case to be made for a more conservative approach to valuing their shares. A more realistic stance, I think, would advocate for Nvidia trading at just a 25% premium to the sector median forward P/E.

If Nvidia’s forward P/E were adjusted to a 25% premium, this would imply a forward P/E of approximately 29.72, compared to the current forward P/E of 41.33. Specifically, if the market followed through and re-rated shares for this adjustment, it would result in a downside of approximately 28.10% for shares on top of the post-earnings drop. I truly believe the market may have overpriced Nvidia’s growth prospects relative to the sector.

Bull Thesis

During the earnings call, Huang emphasized that over $1 trillion worth of AI server infrastructure needs to be upgraded. He noted that as servers move away from CPUs to accelerated computing powered by GPUs, there’s a growing demand for more efficient and powerful computing solutions. He said on the call:

…the world is moving from general purpose computing to accelerated computing. And the world builds about $1 trillion dollars’ worth of data centers — $1 trillion dollars’ worth of data centers in a few years will be all accelerated computing. In the past, no GPUs are in data centers, just CPUs. In the future, every single data center will have GPUs. And the reason for that is very clear is because we need to accelerate workloads so that we can continue to be sustainable, continue to drive down the cost of computing so that when we do more computing our — we don’t experience computing inflation.

We are at the beginning of our journey to modernize a $1 trillion dollars’ worth of data centers from general-purpose computing to accelerated computing.

If the opportunity is as vast as suggested, it begs the question of why the United States, which houses more data centers within its borders than any other country, had revenue that dropped, let alone slowed notably last quarter.

I get that some ODM revenue might have been booked overseas, but in the US it just doesn’t make sense that revenue would even come close to peaking if the opportunity was so strong. GPU demand is seasonality agnostic (so this is not a seasonal fluctuation) and according to Huang, we are at the beginning of a computer revolution.

With this, while the potential $1 trillion opportunity is undoubtedly massive (and maybe I could be wrong it could be this big), the company’s current market capitalization is roughly three times the size of this entire opportunity. Usually, the total addressable market, or TAM, of your market is bigger than the net present value of future profits from the opportunity (the market cap).

Don’t get me wrong: the AI revolution is here and Nvidia will play a big part in it. I just think that Nvidia’s shares appear overvalued despite the opportunities in AI.

The discrepancy between the potential market and Nvidia’s current valuation suggests (to me) that the stock price already prices at an unrealistic level of success, leaving little room for error or market disruptions.

Bottom Line

While beating estimates on the top and bottom lines, Nvidia Corporation’s valuation remains a concern to me, especially given the sequential decline in their United States revenue. With no Blackwell sales expected for this current quarter, the near-term outlook appears bearish (and this could compound into the valuation).

The combination of these factors – potentially peaking US demand, and delayed new product contributions – reinforces my view that Nvidia’s shares are overvalued, prompting my strong sell belief.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.