Summary:

- Nvidia Corporation has performed exceptionally well in 2023, benefiting from the tailwinds of the AI frenzy sparked by the release of Chat-GPT last year.

- Despite its apparent rich valuation, Nvidia, with its market dominance and unique growth profile, is trading at a discount based on forward valuation metrics.

- Growing risks, including intense competition and US export restrictions, are putting pressure on Nvidia’s elevated profit margins and near-term stock price, with the long-term picture intact.

- Despite potential short-term volatility, I anticipate Nvidia to achieve a 28.4% annualized return until 2030, with the stock reaching nearly $1,200.

BING-JHEN HONG

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) has truly captured Wall Street’s attention in 2023, benefiting from the global artificial intelligence (“AI”) phenomenon sparked by the debut of Chat-GPT in November 2022.

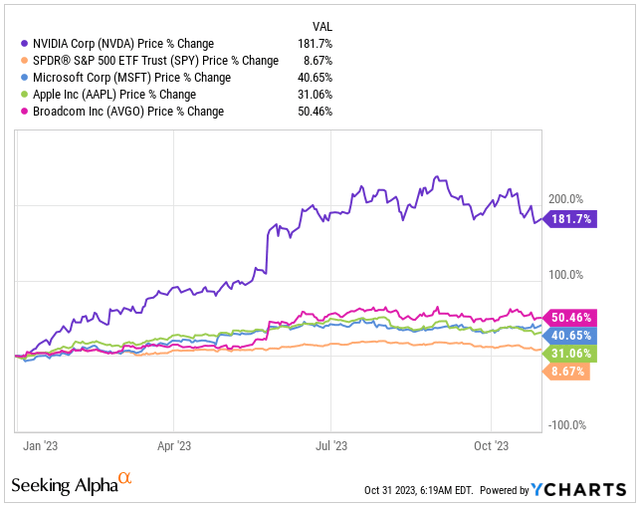

Throughout this year, Nvidia has shown remarkable performance, delivering a staggering 182% return. This achievement easily surpasses not only the S&P 500 Index (SP500) but also other tech giants like Microsoft (MSFT), Apple (AAPL), and Broadcom (AVGO), all of which have also performed impressively.

Looking at Nvidia’s current price of $400, it’s evident how volatile the market can be when we consider its recent history. In 2022, the stock plummeted to a low of $108 from its earlier peak of $346 during the COVID-driven trading frenzy, marking a significant 70% decline.

This drastic fluctuation highlights the market’s inefficiencies, demonstrating how stocks can be overvalued or undervalued at times.

However, the situation today is more nuanced. Despite its seemingly high valuation, Nvidia’s current price is only part of the equation. The company’s rapid growth justifies this valuation, and there’s more to the story. Nvidia appears relatively cheaper now because its forward sales and earnings multiples have decreased due to its exceptional growth in the last quarters.

Let’s have a look at whether Nvidia is still a good investment today.

Pioneer in the Industry with AI Tailwinds

Nvidia is the most valuable semiconductor company with a $1.02 trillion market cap. I would call it a pioneer in its industry, specializing in graphics processing units or GPUs.

Nvidia is globally recognized for its innovations in gaming, artificial intelligence, and deep learning. Their cutting-edge GPU solutions not only power gaming consoles but also drive advancements in data centers, autonomous vehicles, and numerous other fields.

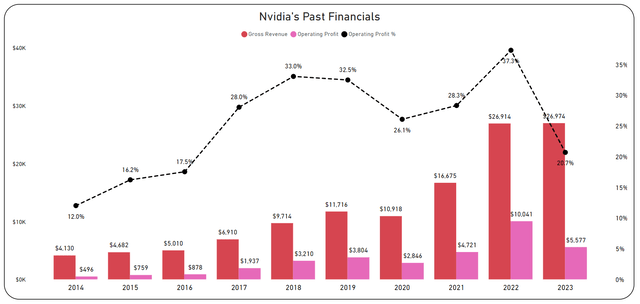

Nvidia’s pioneering role in a rapidly expanding digital world has translated into exceptional success. By the end of FY23, the company delivered impressive revenue, reaching $26.97 billion, reflecting annualized growth rate of 55.3% in the last decade. Even when we shorten the time horizon to the last 5 years, Nvidia has consistently upheld strong growth, averaging an annualized rate of 26% since 2019.

Despite ups and downs in its profit margin, Nvidia managed to maintain an average operating margin of around 25.2% over this period. However, FY23 faced challenges due to a general decline in electronics demand, impacting Nvidia’s operating margin significantly.

Nvidia’s Past Financials (Author’s Graph (Data SA))

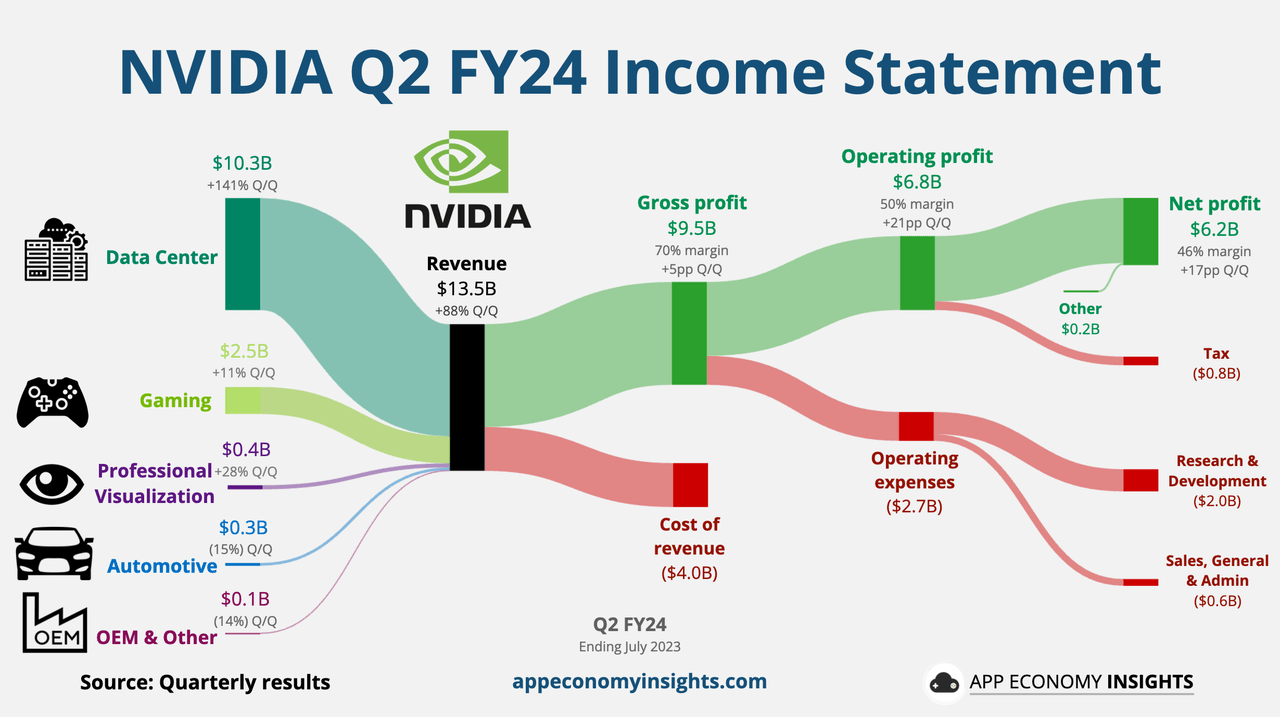

However, there’s a positive shift evident in Q2 FY24 for Nvidia. The company reported an outstanding operating margin of 50%, marking a significant recovery in the tech industry following the dip in electronics demand.

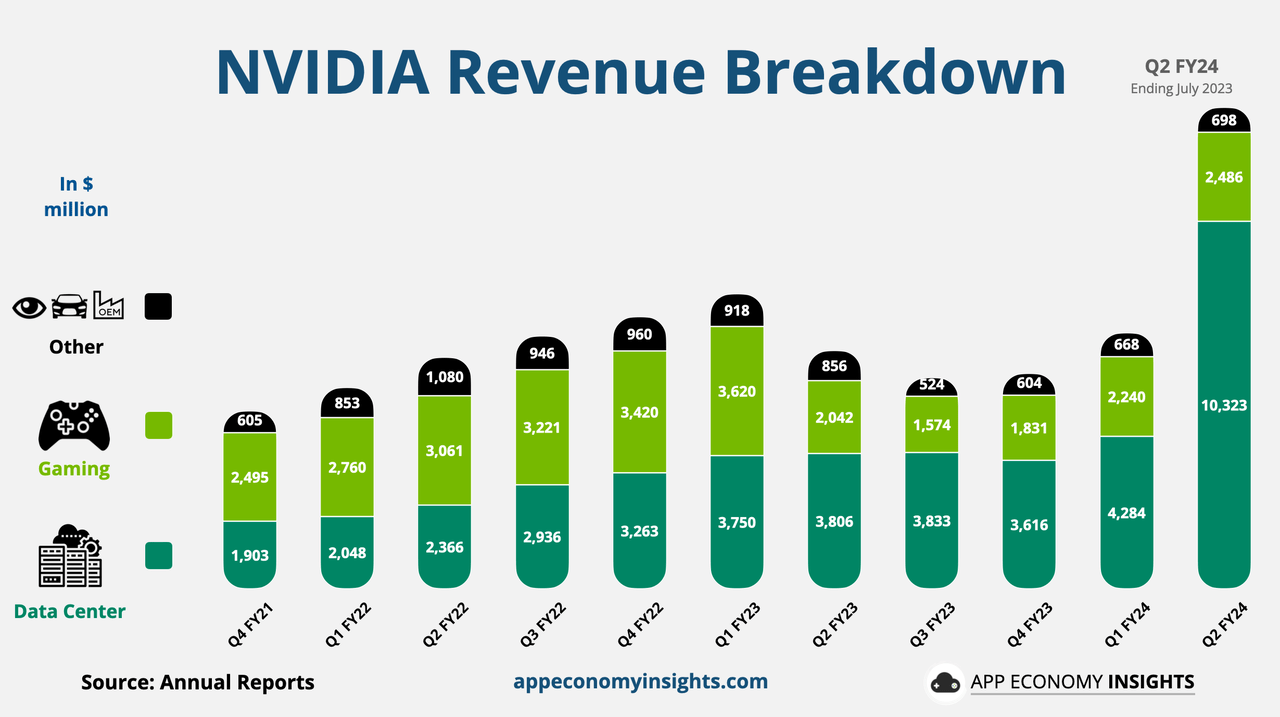

Nvidia successfully diversified its revenue streams, notably in Data Centers, which became the largest segment over the last years, generating $10.3 billion in revenue during the quarter, representing a remarkable 141% growth QoQ and contributing 76% to the total revenue.

Notably, the company’s total revenue surged by 101% YoY, reaching $13.5 billion, accompanied by an impressive net margin of 46%, underscoring Nvidia’s industry-leading efficiency.

Visualized Q2 Income Statement (App Economy Insights)

To gain deeper insights into Nvidia’s revenue distribution, referencing a graph similar to the one below proves invaluable. In Q2 FY22, Nvidia’s gaming sector constituted 47% of its revenue. Fast forward two years to Q2 FY24, and the gaming business now accounts for less than 18.4%.

This shift becomes crucial in light of the gaming market’s projected CAGR of 13.4% until 2030. However, the more lucrative data center market, especially focusing on AI, IoT, and Big Data, is anticipated to grow at a CAGR of 20.7% until 2030.

Given Nvidia’s position as a leader in the accelerated computing platform, empowering modern data centers with the capability to accelerate deep learning, machine learning, and high-performance computing workloads through products such as DGX Systems, HGX A100, EGX Platform, and vGPU solutions, it is anticipated that Nvidia will continue to maintain its dominance and experience even faster growth.

Revenue Breakdown (App Economy Insights)

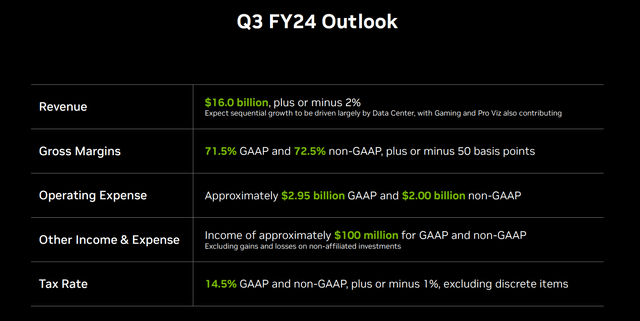

Considering these factors, it’s evident why Nvidia anticipates its momentum to persist in FY24. The company has projected Q3 revenue to hover around $16 billion, indicating a remarkable 169% growth from the same period last year, primarily propelled by the flourishing data center segment.

In line with this, I anticipate Nvidia’s Q3 FY24 EPS to be approximately $2.95.

Fierce Competition and U.S. Export Restrictions

Nvidia finds itself amidst a whirlwind of activity in the tech world. Following the immense success of OpenAI’s ChatGPT, technology companies and developers are eagerly integrating generative artificial intelligence into their applications.

This trend has proven to be a boon for Nvidia, whose high-end graphics processing chips, including the A100 and H100, remain the preferred choice for AI workloads.

However, despite Nvidia’s dominant position in the AI chip market, traditional chipmakers like Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD) are channeling significant investments to close the gap, recognizing the high stakes at play.

AMD recently introduced the MI300X chip, specifically tailored for large language model training and inference in generative AI workloads. With impressive specifications, including 192 GB of high-bandwidth memory-surpassing Nvidia’s H100 data center GPU’s 120 GB – AMD’s chip could pose strong competition to Nvidia.

Furthermore, tech giants such as Alphabet/Google (GOOGL) are intensifying their focus on AI and machine learning-related silicon. Google’s Tensor Processing Units are specialized integrated circuits designed for machine learning tasks. While Nvidia currently holds an edge in overall performance and utilizes proprietary software and programming languages to retain customers, the growing competition threatens Nvidia’s current trajectory, making its rapid growth and high-profit margins perhaps unsustainable in the long term.

Adding to the challenges, recent U.S. export restrictions on high-end chips might compel Nvidia to cancel billions of dollars worth of orders to China in the coming year. Nvidia had already fulfilled advanced AI chip orders earmarked for this year in China and had planned to deliver next year’s orders before the new restrictions took effect in mid-November. However, the Biden administration informed Nvidia last week that the export controls would be effective “immediately.”

Under these new restrictions, any company producing AI chips that surpass a performance benchmark must obtain a license from the U.S. Commerce Department before exporting to China and other specified countries, adding a layer of complexity and uncertainty to Nvidia’s future.

Nvidia seems expensive, but is it?

Many value-oriented investors quickly point out that Nvidia is trading at lofty valuations. Personally, I consider myself a conservative investor, but I believe it’s crucial to assess Nvidia within the context of its growth trajectory.

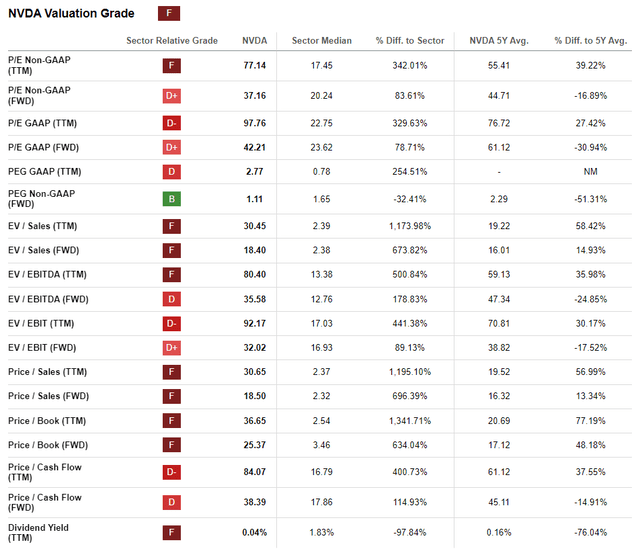

Since the summer, Nvidia’s stock has retraced from its all-time highs, currently trading at a P/E ratio of 77.14x, which is 39.2% higher than its 5-year average.

However, it’s essential to factor in Nvidia’s promising growth prospects. By doing so, Nvidia doesn’t appear as expensive when compared to its historical averages.

The Forward P/E Ratio now stands at 42.21x, marking a 31% decrease from its 5-year average of 61.12.

Additionally, the Forward EV/EBITDA of 35.58x is 24.9% lower than the 5-year average of 47.34x.

Considering the 1-year-forward basis alone, we can conclude that Nvidia is currently trading at approximately a 27.5% discount to its 5-year averages.

Valuation Grade (Seeking Alpha)

However, this perspective doesn’t encompass the entire valuation scenario.

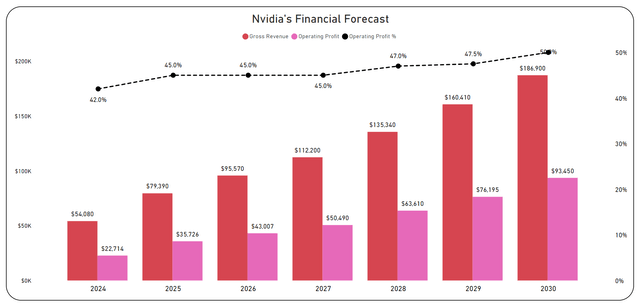

Analysts are anticipating Nvidia’s revenue to surge by approximately 100% from FY23 to FY24, reaching $54.08 billion. This projection closely aligns with the company’s performance in Q1-Q2 FY24 and its guidance for Q3.

Looking beyond the current year, from 2024 to 2030, expectations indicate Nvidia will experience an annualized revenue growth of 24.6% and a 31.1% growth in operating profit.

Under this assumption, I anticipate Nvidia to maintain an average 46% operating margin. While this figure is below the margins reported in FY24, I foresee intensified competition in the upcoming years, putting pressure on the inflated margins.

Financial Forecast (Author’s Graph)

If Nvidia manages to fulfill this scenario, I anticipate the EPS could reach $34.19 by the end of 2030. Assuming that the Forward P/E ratio contracts significantly and remains well below its historical average of around 35x earnings, it is reasonable to expect Nvidia’s stock price to reach approximately $1,197.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue ($b) | 54.08 | 79.40 | 95.60 | 112.20 | 135.30 | 160.40 | 186.90 |

| Revenue Growth | 100% | 47% | 20% | 17% | 21% | 19% | 17% |

| EPS $ | 10.90 | 16.66 | 20.49 | 24.00 | 28.90 | 32.20 | 34.19 |

| EPS Growth | 226.3% | 52.8% | 23.0% | 17.1% | 20.4% | 11.4% | 6.2% |

| Forward PE | 42.9 | 40.0 | 38.0 | 40.0 | 38.0 | 36.0 | 35.0 |

| Stock Price $ | 468 | 666 | 779 | 960 | 1,098 | 1,159 | 1,197 |

Without factoring in the exceptionally low dividend yield and considering Nvidia’s decision not to increase its dividend over the next decade, as the company prefers to invest in R&D to sustain its market dominance, I anticipate Nvidia’s stock could yield an annualized return of approximately 28.4% over the next 7 years.

Conclusion

Many skeptics argue that AI is just another hype and that the lofty valuations of tech giants will plummet once the excitement fades.

However, I don’t share that viewpoint.

Consider the tremendous boost in productivity computers provided over the past two decades. I believe AI is a similar catalyst that will usher in a new era of productivity throughout the 2020s and 2030s.

Nvidia stands at the forefront of this transformation, poised to seize the opportunity by providing essential infrastructure for AI solutions through its industry-leading data center products.

Despite what might appear as a high valuation, Nvidia is trading at a discount compared to its 5-year forward metrics.

With its unique market position and promising growth trajectory, I am confident that Nvidia Corporation can deliver annualized returns of 28.4% over the next 7 years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, MSFT, NVDA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.