Summary:

- Nvidia Corporation’s impressive growth and market dominance are attributed to its investment in innovation and leadership by CEO Jensen Huang.

- The company’s reliance on Taiwan Semiconductor for chip manufacturing poses significant geopolitical risks.

- Competitors, including AMD and cloud providers like Amazon and Microsoft, are developing their own AI chips, threatening Nvidia’s market position.

Justin Sullivan/Getty Images News

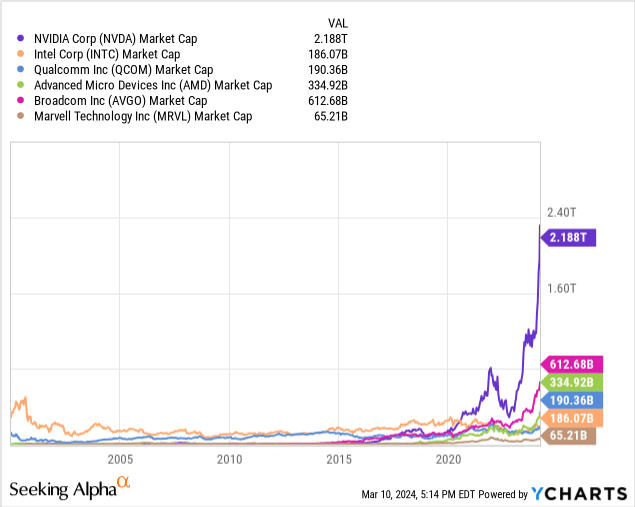

We have enormous respect for Nvidia Corporation (NASDAQ:NVDA) and its visionary and hard-working co-founder and CEO Jensen Huang. It shows what a company can achieve when it invests in innovation, and is led by someone that actually understands the underlying technology.

Some of its competitors have put in charge CEOs who were more concerned with making quarterly numbers, cutting costs, and did not have the engineering background needed to steer their companies to where the future was headed. As a result, Nvidia is worth more now than all its main competitors combined.

Still, as much as we admire the company, we are not convinced its “rocket ship” valuation is justified. While we are certainly not convinced that the excesses are now worse than those of the dotcom era, we do think that it is not a good sign when analysts start saying things like “the party is just getting started.” If anything, listening to these analysts makes us wonder if Cinderella’s carriage is now close to turning back into a pumpkin. As Fortune points out, Nvidia in just one day gained more in market cap than the total value of Coca-Cola (KO).

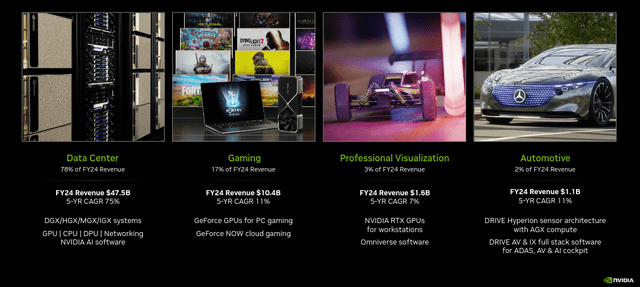

Company Overview

There is no doubt that Nvidia has become a very important company, enabling some of the most critical technology developments currently underway. While it started in the modest niche of developing chips for graphics cards, mostly to improve the video game graphics experience, it eventually realized its chips could be used for other applications.

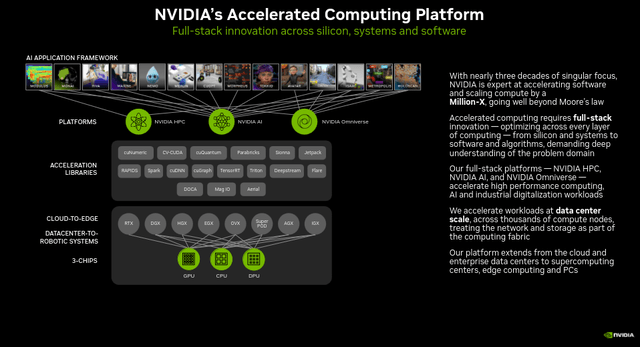

While the traditional CPUs used in computers and mobile devices are usually much more powerful, Nvidia GPUs allow for significant parallelism of relatively simple tasks, which turned out to be critical for AI applications. The company likes to say that it offers full-stack solutions that go beyond the chips, and include specialized algorithms and libraries. In a recent investor presentation, the company boasted that 1,600+ generative AI companies are building on Nvidia.

NVIDIA pioneered accelerated computing to help solve impactful challenges classical computers cannot. A quarter of a century in the making, NVIDIA accelerated computing is broadly recognized as the way to advance computing as Moore’s law ends and AI lifts off. NVIDIA’s platform is installed in several hundred million computers, is available in every cloud and from every server maker, powers over 75% of the TOP500 supercomputers, and boasts 4.7 million developers.

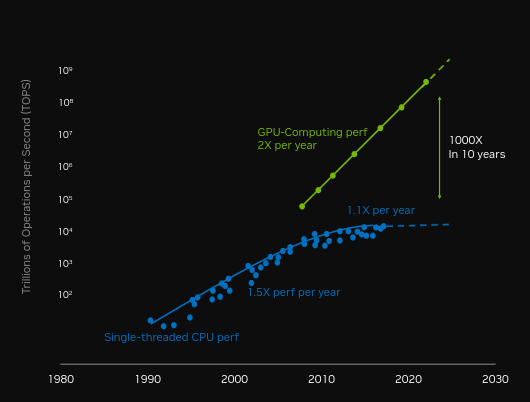

It also sees itself as the solution to the ending of Moore’s Law by providing a new strategy to keep computing power growing rapidly. The company showed how single-threaded CPUs performance has been stagnant in recent years when measured in trillions of operations per second, while GPU computing performance has been growing exponentially in recent years.

NVIDIA Investor Presentation

Geopolitical Risks

It is worth remembering that Nvidia relies on Taiwan Semiconductor (TSM) for most of the manufacturing of its chips. While the company has been a very reliable supplier, which has helped the company stay on the cutting-edge of chip technology, there is significant geopolitical risk. This appears to be reflected in TSM’s valuation, but not in Nvidia’s, despite the fact that if TSM had to stop production, Nvidia would be in almost as much trouble as TSM itself, as it would be extremely difficult to switch to another foundry, and probably impossible at the cutting-edge nodes.

Nvidia is also likely to suffer repercussions from U.S. policy of cutting access to China of the most advanced chips. It appears to have helped the company in 2023, as several Chinese technology giants like Baidu (BIDU), ByteDance (BDNCE), Tencent (OTCPK:TCEHY) and Alibaba (BABA) rushed to place orders last year, about $5 billion worth of chips, but those might not recur if restrictions on exports of AI chips to China get tougher, or if the government pushes them to use local alternatives like those being developed by Huawei, which even Nvidia’s CEO has called a “formidable competitor.”

Technology Moat

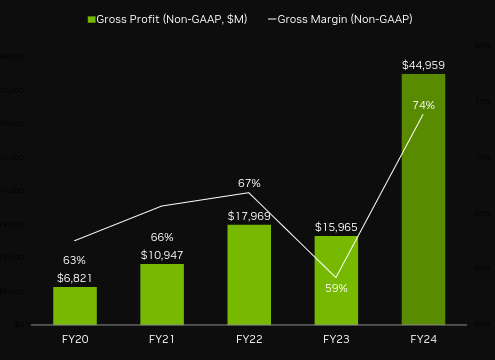

Just looking at Nvidia’s gross margins, it becomes clear that it benefits from a competitive moat. Otherwise, customers would not agree to pay roughly 4x the cost to produce these chips, as reflected in the ~74% gross margins the company has reached.

The competitive moat rests mostly on the design of the chip and the software ecosystem the company has developed around it, given their reliance on TSM for manufacturing. In particular, Nvidia’s CUDA programming platform and software ecosystem give the company its moat. Still, given the excessive prices the company is now charging, some customers are opting for custom ASICs, which are viable in certain applications. It is likely that the hardware will become commoditized at some point, likely over the next ten years, and to quote Ernest Hemingway, it will probably happen first gradually and then suddenly.

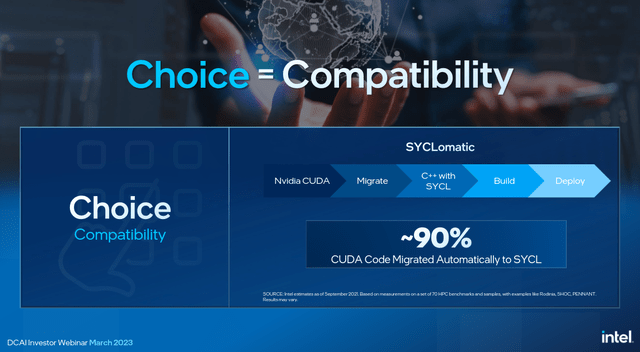

Competitors like Intel (INTC) are already coming up with solutions to help weaken the CUDA moat. For example, a recent Intel investor presentation talked about a technology that should help automatically migrate CUDA code.

Customers Don’t Like Being Held Over a Barrel

While competitors like Advanced Micro Devices (AMD) and Intel are working hard to come up with viable alternatives to Nvidia, it is perhaps its own major customers that the company should fear the most. Cloud providers like Amazon AWS (AMZN), Google Cloud Platform (GOOGL) (GOOG), and Microsoft Azure (MSFT) are realizing that they can invest in making their own AI chips, instead of paying Nvidia huge markups for the next few decades.

They have the resources to design chips themselves, and can call TSM for help with the manufacturing. Orders from Microsoft and Meta (META) were about a quarter of Nvidia sales in the past two full quarters, giving these companies a huge incentive to come up with alternatives. Microsoft and Amazon already have their own AI chips on the way for their cloud platforms. Microsoft’s new processors were optimized for OpenAI’s GPT models, and will be deployed in its Azure data centers next year. The AI chip is made by Taiwan Semiconductor using the foundry’s 5nm process.

Similarly, while still offering Nvidia based solutions to customers, Amazon has been developing its own chip alternatives, both for training and for inference. This is not the first time they look for opportunities to lower data center costs by designing their own chip alternative. In 2018, they launched an ARM (ARM)-based server chip called Graviton to rival x86 CPUs from companies like AMD and Intel, and a good number of customers have opted to use it. Finally, Google was perhaps one of the first cloud providers to start developing its own AI chips, or in their case Tensor Processing Units (TPUs), which were optimized for popular AI frameworks like TensorFlow.

Further flexing their muscles, several of these cloud giants are investing in some of the most promising AI startups and asking them to use their chips for their training. Apparently that was one of the conditions negotiated in the $4 billion Amazon investment into Anthropic, the creator of ChatGPT competitor Claude.

Competitors are Waking Up

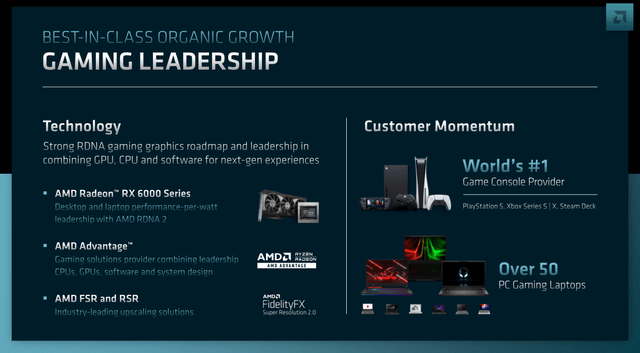

Amongst its traditional competitors, perhaps AMD is the one getting closer to matching Nvidia, with the company recently rolling out AI chips and its CEO Lisa Su making it clear that she sees AI as the future of computing. While closing the gap with Nvidia will likely prove hard, pricing is one place where Nvidia has left a lot of room for others to compete. People should also not underestimate AMD and its excellent CEO Lisa Su, as Intel learned the hard way. The company has even become the #1 player in game consoles like Sony’s (SONY) PlayStation, a key market for Nvidia, and until very recently its most important segment.

AMD also has some additional strengths it can leverage, such as its Xilinx acquisition which brought advanced field-programmable gate array (FPGA) technology, which adds a lot of adaptability to products, and can provide key differentiation in certain applications.

There are other companies that will fight for a piece of the market. Qualcomm (QCOM) should also be taken very seriously, and they appear particularly interested in being the ones performing inference at the edge (i.e. on your mobile device).

Meanwhile, semiconductor giants like Broadcom (AVGO) and Marvell (MRVL) are helping customers design their own custom AI chips. Broadcom expects roughly $7 billion of its 2024 revenue to come from helping just two major clients design custom AI chips. If that wasn’t enough, IBM (IBM) is doing R&D to come up with new more efficient AI chips, OpenAI’s Sam Altman is looking to raise billions for AI chip manufacturing, and SoftBank (OTCPK:SFTBY) wants to build a $100 billion AI chip company to complement ARM and compete with Nvidia.

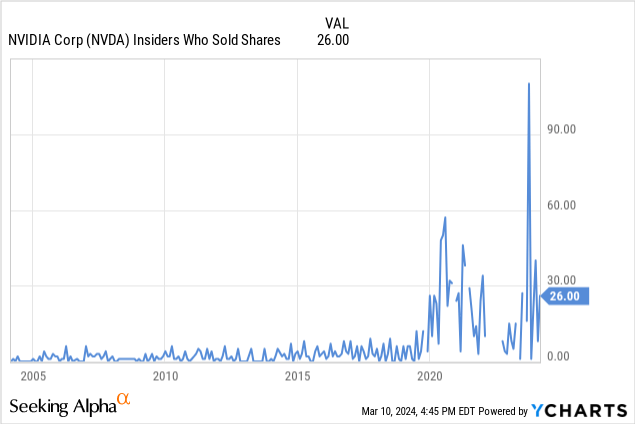

Insiders Selling

The number of insiders selling shares has significantly increased in recent years, and while they might be selling to buy a home or diversify their wealth, it is certainly not a very encouraging sign when some of the people who best know the company are selling.

The high share price has made some of its employees very financially comfortable and perhaps a little complacent, to the point that apparently CEO Jensen Huang told some of them to get back to work and to stop behaving as if they were semi-retired.

Financials

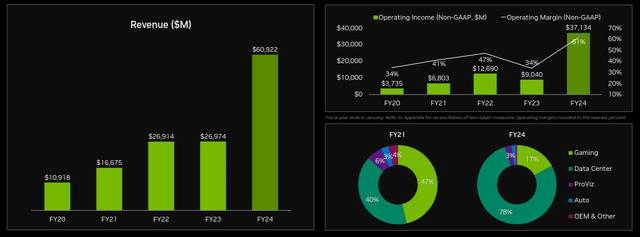

There is no denying that Nvidia’s financial achievements are impressive, and both profit and revenues have skyrocketed. Still, with all the competitive forces we have previously discussed, we believe it will be extremely difficult for the company to maintain gross profit margins above 74% for very long.

NVIDIA Investor Presentation

It is also concerning how dependent the company has become on the data center end-market, especially when its customers there are looking to replace them with their own designs. Also concerning is that the company plans to use a significant portion of its earnings towards share repurchases. It used $9.5 billion on repurchases in FY24, and had a $22.5 billion remaining authorization at the end of Q4. With competitive pressures drastically increasing, it would probably be smarter to double down on R&D.

Growth

Outside of the data center segment, which as usually happens with many infrastructure build-up projects could not necessarily recur once enough capacity has been added, has been relatively anemic. Some investors like to use the “picks and shovels” gold rush analogy, saying that selling the equipment can be more lucrative than the main activity.

While this might be true in many cases, it is important to remember that once someone “buys a shovel,” he might not need to buy one again until it breaks. Right now, there is a huge rush to build AI computing capacity, but eventually enough infrastructure will have been built, and growth will significantly moderate. Gaming revenues have actually declined about 20% from the FY22 peak, similarly reminding us that people don’t buy a new game console every year.

Automotive growth looks more promising, with the company working with over 40 customers, including 20 of the top 30 EV makers, 7 of the top 10 truck makers, and 8 of the top 10 robotaxi makers. Still, none of the other markets comes anywhere close to the growth data center has experienced, making the company highly dependent on a relatively small group of customers.

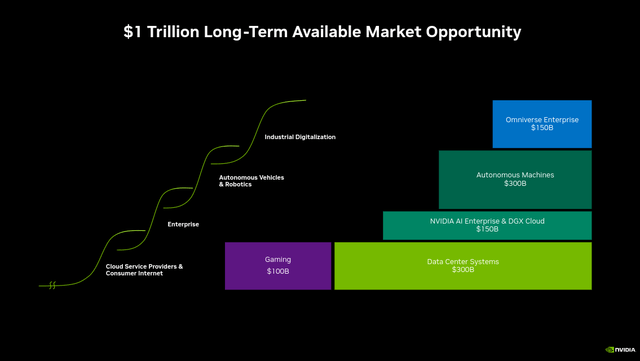

TAM Too Much?

The company is talking about an enormous future target addressable market, or TAM, that could reach $1 trillion. We have difficulty believing that “Autonomous Machines” will become as big as the Data Center segment, and we are even less confident about the “Omniverse Enterprise” opportunity.

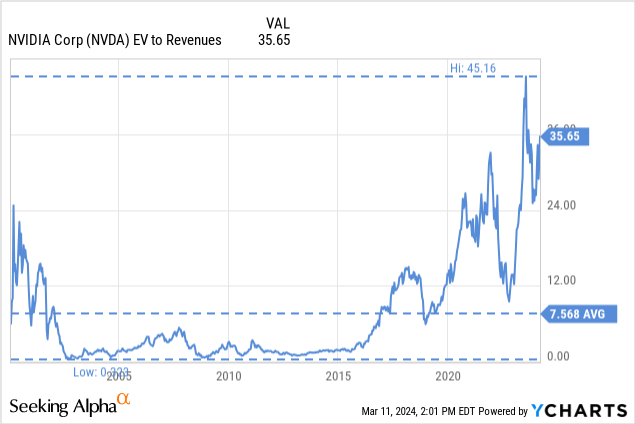

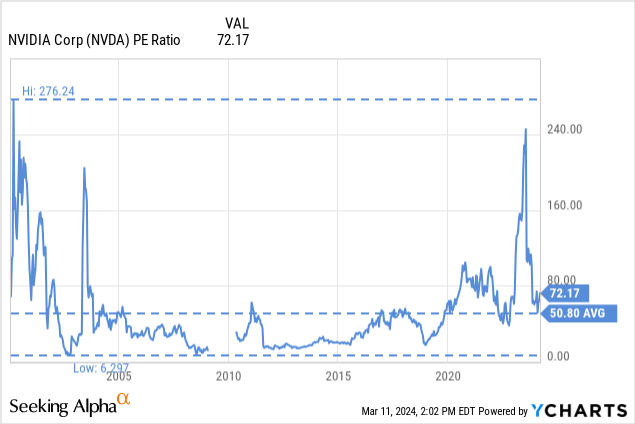

Valuation

The rocket ship share price has resulted in exploding valuation multiples, and Nvidia shares now trade at an eye-watering EV/Revenues multiple of 35x. This is more than 4x its historical average, and while profit margins have certainly expanded it remains to be seen how long they can be sustained.

Similarly, Nvidia is trading with a Price/Earnings ratio considerably higher than its historical average. Many will justify it based on the incredible growth it has recently delivered, both on revenues and earnings. The problem we see is that we do not think the company can maintain the revenue growth and the profit margins at these levels, while its competitors and customers go on the offensive.

Risks

The main risk we see with an investment in Nvidia is that it trades at a very high valuation, while its competitors are getting more aggressive and its customers are looking for ways to replace them. Competing with competitors is usually hard enough, competing with your customers, which have billions to fund their efforts, adds an extra level of difficulty. We also see a risk that some of its employees might be getting complacent, and they might think they can coast for some time on past efforts. Other risks include a recent copyrights lawsuit, and SoftBank pouring billions to compete with them. Further out, we see risks that there might be a new paradigm shift in how computing gets done, with quantum computing and neuromorphic chips continuing to make important advances.

Conclusion

As famous economist John Maynard Keynes said, “the market can stay irrational longer than you can stay solvent.” While we are rating Nvidia shares with a “Strong Sell,” given the excessive overvaluation and that we are seeing increased competition from peers and customers, we would not short the company. We believe it is usually a bad idea to short fundamentally sound companies, even if their valuations have gotten ahead of where they should be. We admire Nvidia and the CEO for what they have achieved, but do think the valuation has gotten excessive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.