Summary:

- The performance of Nvidia Corporation’s stock after the recent earnings result is a strong warning to the bullish investors.

- The stock had a 20% dip despite beating estimates on almost all major metrics.

- Close to 50% of the data center revenue comes from large cloud providers, who are getting warning signals from Wall Street regarding their capex trajectory.

- We have not seen a big revenue or margin improvement from cloud providers in the last few earnings, which can force them to rein in their AI spending.

- The stock is trading at over 26 times forward P/E for the fiscal year ending Jan 2027, and any margin pressure would reduce the upside potential in the stock.

BING-JHEN HONG

Nvidia Corporation’s (NASDAQ:NVDA) recent earnings result is a big warning for bullish investors and analysts. The company was able to beat estimates on revenue and EPS while also giving strong forward guidance. The revenue surprise was $1.29 billion, which was enormous and showed a strong trajectory in this metric. However, Wall Street ended up correcting the stock by close to 20%. Since the dip, Nvidia has recouped most of the losses and is again close to the $125 level. But we can see several red signals that are flashing and need to be closely looked to gauge the long-term returns potential of the stock. In our previous article, it was mentioned that we would see margin pressure in Nvidia.

In the Q1 earnings, Nvidia’s CFO mentioned that close to 50% of the data center revenue came from large cloud providers like Amazon’s (AMZN) AWS, Google Cloud (GOOGL) (GOOG), and Microsoft Azure (MSFT). Most of the recent growth in Nvidia’s revenue has been driven by these cloud companies trying to ramp up their AI services. But this has come at a cost of massive capex for even the larger companies. Most of these cloud companies have themselves seen a correction after recent earnings as Wall Street is worried over their capex trajectory. On the other hand, these large cloud providers are not showing a big improvement in their revenue and margin trajectory. If these large players scale back their investment over the coming quarters, we could see a big headwind for Nvidia’s revenue and margin.

The forward EPS growth projection of Nvidia are not strong. For the fiscal year ending Jan 2027, the consensus EPS estimate is of $4.71 which gives the stock a forward P/E of 26.2. Any margin decline could lead to big EPS downward revisions. Competition from Advanced Micro Devices (AMD) is heating up, and the company is continuously increasing its AI revenue estimate almost every quarter. While Nvidia has a big lead, it is highly likely that it will see strong margin headwinds as other players ramp up their AI chips. Looking at this macro picture, Nvidia stock does not seem to be cheap, and it has a limited upside potential.

Looking beyond Nvidia

To gauge the growth potential of Nvidia, we need to look at the recent performance of some of its biggest clients. Most of the top management of large cloud providers have been very optimistic about their AI services, but Wall Street is having second doubts about their future projection. We have already seen this in the recent earnings season, where big cloud players have not performed well.

Nvidia Filings

Figure: Nvidia’s CFO remarks in Q1 earnings. Source: Nvidia filings.

In the Q1 earnings, Nvidia’s CFO Colette Kress mentioned that large cloud providers contributed in the mid-40s as a percentage of Nvidia’s Data Center revenue base. If these large cloud providers see a strong backlash from Wall Street due to their AI spending, it will inevitably hurt Nvidia.

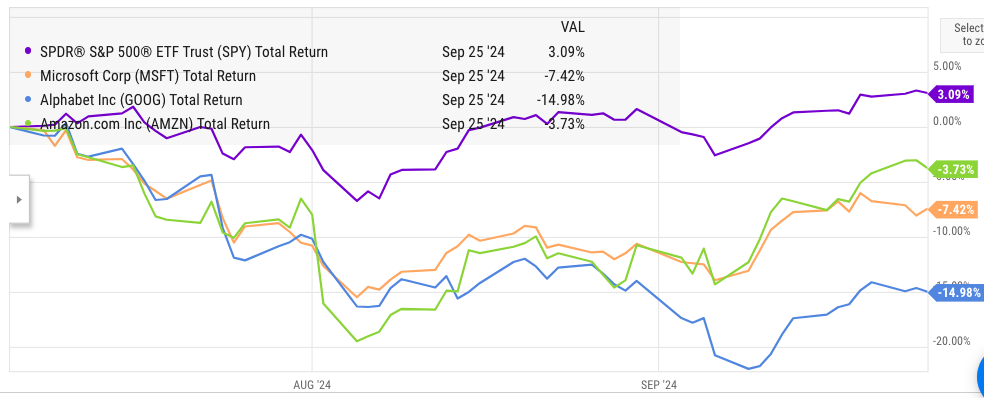

YCharts

Figure: Stock performance of top cloud services. Source: YCharts

The big three cloud providers have not fared well in this earnings season. All of them are significantly lagging the broader market. They have company-specific issues, but one of the common bearish arguments for them is the massive capex spending on AI, which has not delivered an improvement in margin and revenue trajectory.

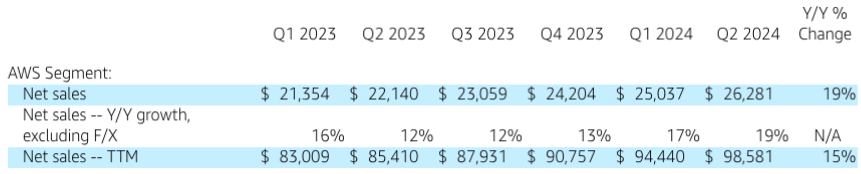

As an example, we can look at the revenue trend of Amazon’s AWS in the last few quarters.

Amazon Filings

Figure: AWS revenue trend in the last few quarters. Source: Amazon filings.

AWS has been spending heavily on AI in the hopes of launching new AI services and attract more clients. However, this has not significantly increased the revenue trajectory for the company. A similar trend can be seen in Google Cloud and Microsoft’s Cloud.

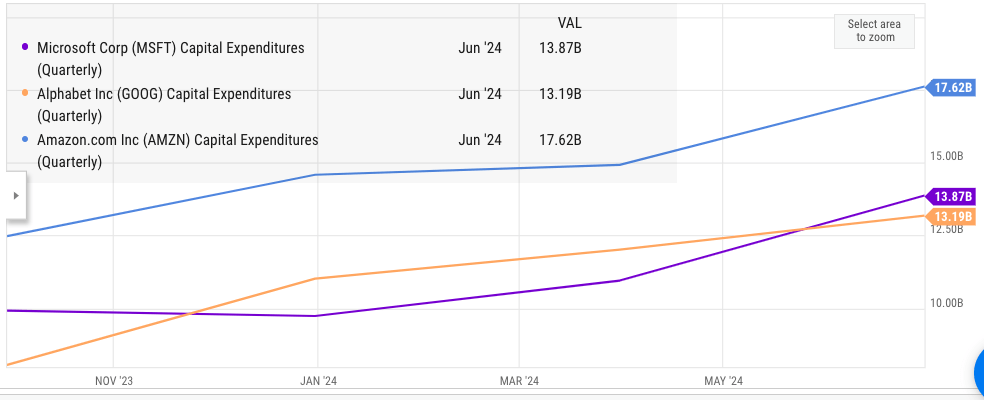

YCharts

Figure: Quarterly capex of large cloud providers. Source: YCharts

There has been a strong inflection in capex of the big three cloud providers in the last few quarters, and each of them is now estimating close to $50 billion in capex for this fiscal years. A bulk of the incremental spending has gone to building the AI services and buying the expensive chips from Nvidia. However, if we do not see a material improvement in the margins and revenue of these cloud players, Wall Street could turn very bearish towards these investments.

Nvidia’s management is betting that the AI demand will continue to increase over the coming quarters. However, this is not guaranteed when we look at the macro picture and the performance of some of its major clients.

Margin pressure from competition

Nvidia will inevitably face margin pressure as more competitive chips are launched in the market. AMD is projecting AI chip revenue of $4.5 billion for 2024. This estimate has continued to increase over the last few quarters. At the end of 2023, AMD was estimating AI chip revenue of only $2 billion. It is possible that the final results for 2024 will easily cross $5 billion level. This is still a small fraction of Nvidia’s revenue base, but we can see a clear trend. If AMD’s current growth trajectory continues in 2025, we could see a major headwind for Nvidia’s margin. Despite the higher market share of Nvidia, Wall Street could become increasingly cautious about the ability of the company to retain its juicy margins.

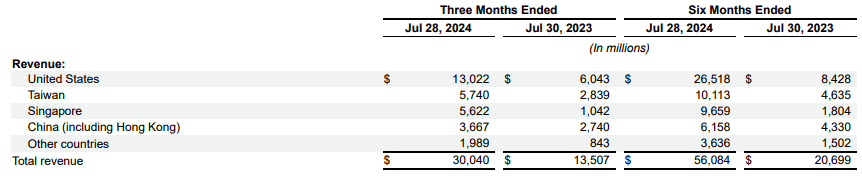

There has been a sequential decline in US revenue in the recent quarter. The US revenue of Nvidia was $13.5 billion in Q1 2025 while it was $13 billion in Q2 2025.

Nvidia Filings

Figure: Nvidia’s revenue base in different regions. Source: Nvidia Filings.

One possible explanation for this sequential decline is that the big tech clients have started reassessing their AI spend. It is certainly possible that this QoQ decline continues for the next few quarters, which will be a revenue headwind for the company.

EPS growth trend does not look very promising

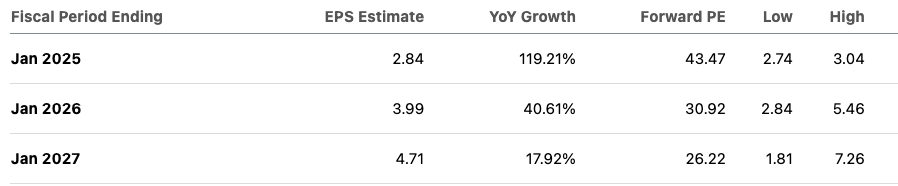

Beyond 2025, Nvidia’s EPS growth trajectory starts looking more modest. The consensus EPS estimate for fiscal year ending Jan 2027 is $4.71 which is equal to 17.9% YoY growth.

Seeking Alpha

Figure: EPS estimate for next few years. Source: Seeking Alpha.

It should also be noted that there is a huge difference between the low and high EPS estimate for fiscal year ending Jan 2027. The low EPS estimate is $1.81 while the high estimate is $7.26 which is 4 times the low estimate. Very few big tech companies have this level of difference in forward EPS estimate. This gives an additional risk to the stock. Nvidia is trading at 26 times the consensus EPS estimate for fiscal year ending Jan 2027. This is a high number for a company which is facing several headwinds.

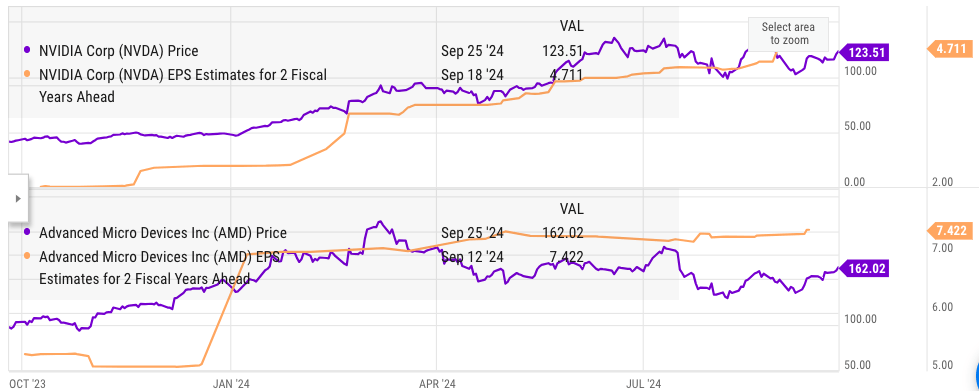

YCharts

Figure: Nvidia and AMD’s EPS estimate for 2 fiscal years ahead. Source: YCharts

AMD’s EPS estimate for 2 fiscal years ahead is $7.4 which gives the stock a forward P/E valuation (FY 2026) of 21.5. This is 20% lower than the 26.2 forward P/E valuation of Nvidia for fiscal year ending Jan 2027. I also believe that Nvidia has a higher risk of EPS down revisions as the margin pressure continues to build on the company for the next few quarters.

Nvidia is at a large revenue base, with quarterly revenue of close to $30 billion. It is facing competitive, regulatory and client-specific headwinds. On the other hand, the upside is limited, which changes the risk/reward dynamics of the stock.

Investor Takeaway

Nvidia delivered a great earnings result, beating both the revenue and earnings estimate. However, the stock corrected by close to 20% post-earnings, which is a strong red flag for the company. Despite making up most of the losses, the stock is still below the pre-earnings high of close to $130. Nvidia gets a bulk of its Data Center revenue from big cloud players like Amazon, Google, and Microsoft. All of them have seen their stocks underperform significantly after the recent earnings as Wall Street gets more cautious over the massive capex trajectory of these companies. There is a strong possibility that the management of these tech companies will need to downscale their AI spending, which should hurt Nvidia’s revenue and margins estimate.

Nvidia is already facing a margin pressure, and it is difficult to see how the company can retain its market share and margins in the upcoming quarters. AMD will likely deliver over $5 billion in AI chip sales for 2024 and there is a strong growth momentum for its chips. Nvidia stock is also not cheap as it is trading at over 26 times the EPS estimate for the fiscal year ending January 2027 compared to only 21.5 for AMD. The upside is limited while the company faces massive headwinds, which makes the stock a Sell at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.