Summary:

- Nvidia Corporation’s customer concentration poses a significant risk, with a substantial portion of revenue coming from the datacenter, limiting future growth prospects.

- Despite impressive YoY and QoQ growth, Nvidia’s margins are stagnating, indicating a plateau in profit growth and a potential future downturn.

- Nvidia’s current P/E ratio of 50x is unsustainable without substantial long-term profit growth, making the stock significantly overvalued.

- Increased competition and eroding pricing power threaten Nvidia’s future profitability, suggesting a potential share price drop to less than half its current value.

JHVEPhoto

After an incredibly strong start to the year, Nvidia Corporation (NASDAQ:NVDA) has seen its share price stagnate, dipping almost 2% after-hours once the company announced earnings. We’ve been bearish on the company before, recommending that investors sell it earlier this month on the bounce following its inclusion in the Dow Jones Industrial Average (DJI). Trading at a P/E of just under 50x based on its announced earnings, with substantial risks, Nvidia stock, as we’ll see throughout this article, is overvalued.

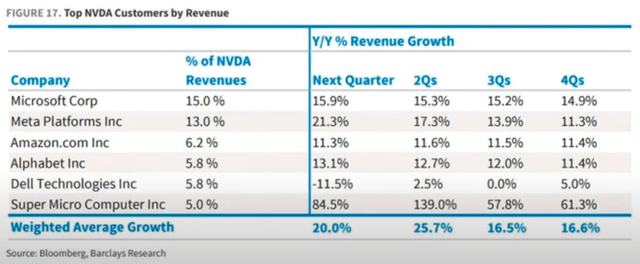

Nvidia Customer Concentration

The biggest concern we have is Nvidia’s customer concentration. Reading the company’s earnings, that becomes even more clear. I estimate almost 88% of the company’s revenue comes from “Data Center” — it is certainly a substantial proportion — and the largest U.S. corporations account for almost half of Nvidia’s revenue (see illustration below). References to that may be seen peppered through the company’s earnings release.

For example:

- Foxconn (OTCPK:FXCOF) is building the fastest supercomputer in Taiwan with 4608 GPUs.

- Nvidia is building Denmark’s fastest AI supercomputer with 1528 H100s.

At the same time, xAI, a U.S. startup led by Tesla (TSLA) CEO Elon Musk, is building the largest AI supercomputer with 100K H100 GPUs. Interestingly, there was no mention in the earnings release of xAI’s announced plans to upgrade the computer to 200-300K GPUs. However, given the estimated cost of $3 billion for the first 100K GPUs, and that xAI just raised $5 billion in a new funding round, whether the cash is there remains to be seen.

xAI, a single U.S. company’s supercomputer, is almost 20x as big as the combined fastest supercomputer in Taiwan and Denmark.

Bloomberg, Barclays Research

Our takeaway is clear. Nvidia’s revenue is being driven by a handful of major U.S. corporations. That means Nvidia’s future growth is predicated on both:

- Growing large orders from these companies.

- No competition from these companies.

We see this as a major risk to Nvidia’s future.

First, these companies already admit that they might be spending too much on Nvidia GPUs. There’s a bit of an arms race going on, no company wants to be left with insufficient GPU supply should AI threaten their core technology business. Given each company has $10s of billions in quarterly cash flow, spending some billions on “insurance” earlier is worth it.

Second, these companies are technological powerhouses themselves. Open AI and Microsoft, two of Nvidia’s largest customers, are working together to build a $100+ billion supercomputer by 2028 that might not be powered by Nvidia GPUs at all. More traditionally, Microsoft Cloud already offers AMD AI chips as an alternative to Nvidia.

Google’s top TPUs are competitive with Nvidia for inference, and as models standardize inference computing demand is expected to grow faster than training.

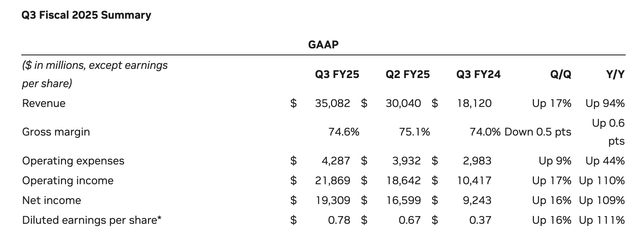

Nvidia Q3 2025 Fiscal Results

Nvidia’s announced results show impressive YoY and QoQ growth. However, they also show some concerns.

The company grew revenue by 17% QoQ and 94% YoY. However, gross margin is down 0.5% QoQ and up only 0.6% YoY. That implies, in our view, that the company has effectively hit hard limits on its margin growth going forward. That means profit growth will no longer come from growing margins and revenue but will instead be much closer to revenue growth.

The story in net income is clear as well, net income is up 16% QoQ (1% below revenue growth) but up 109% YoY (15% above revenue growth). Given that our view is that the company is plateauing at a peak, this is not at all surprising. The company is still growing revenue and rumored demand for Blackwell is high, but it’s no longer “we will pay any price for that GPU” high.

Going into the upcoming years, as companies build out their existing AI supercomputers, competition ramps up, and SW libraries compete more with CUDA, we see this as a clear plateau that will go into a downturn.

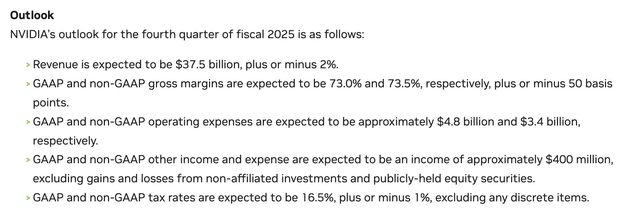

Nvidia Guidance

At a P/E of 50x, Nvidia needs 50 years of its current profits to break-even for investors. That’s a much higher valuation than the S&P 500 (SP500), which has historical returns of ~10%, and in a market that major investors think is overvalued already.

So Nvidia needs to have a path to grow profits to 2-3x current levels and then sustain them for a decade+ on end to earn the profits to justify its valuation. The company is guiding for $37.5 billion in revenue, around a tight range, or roughly 7% QoQ growth. Annualized, virtually every company would be jealous of this growth, but it’s from a company that’s doubled revenue YoY.

Additionally, the company is expecting GAAP margins at 73% +/- 0.5%, versus 74.6% in the most recent quarter. That’s a much quicker slowdown in margins than what was seen in the most recent quarter, and it will result in the company’s margins declining both QoQ and YoY. With the company’s Blackwell shipments expected to double QoQ, it confirms exactly what we’ve always believed.

- Blackwell is an impressive GPU, but it’s not leading to more demand. Instead, demand for H100 and H200s is being shifted to Blackwell.

- Nvidia’s pricing power is eroding as the company’s margins are starting to show weakness. The company’s GAAP EPS growth next quarter we expect to come in at low single-digit QoQ growth given the company’s guidance.

This is precisely what we would expect based on our thesis above, where Nvidia has concentrated customers who are starting to have enough GPUs for their tasks and competition is ramping up. For comparison, peer Advanced Micro Devices (AMD) which reported earnings just a few weeks back, is guiding for double-digit QoQ revenue growth, with a gross margin in the mid-50s.

Companies can afford to be picky, and Nvidia’s customers are big enough to work around Nvidia’s moats when it comes to SW to save on GPU prices.

Our View

At the end of the day, we get a lot of feedback from Nvidia bulls in our comments on prior short articles. One question we consistently ask them is:

“At what point will Nvidia be fairly valued?”

If your argument is that Nvidia is a fantastic company making fantastic cutting-edge GPUs, we’d have to say we agree with you 100%. However, our name is “The Value Portfolio,” and every company has a price at which it’s overvalued. The reason we’re short Nvidia is that the company is far, far past that price.

Our bold prediction is that:

Nvidia’s profits in 2030 will be lower than Nvidia’s profits today.

Why do we think this? We do expect Nvidia to keep building cutting-edge GPUs, and we expect Nvidia to remain very relevant.

However, we expect Nvidia’s competition to push down profits. Open AI’s CEO is looking to fund an Nvidia competitor. That will push down Nvidia’s margins substantially. These companies are spending many billions to compete. Microsoft’s $100 billion Stargate project to reduce Nvidia dependence, albeit light on detail, by 2028 is $25 billion/year or 3x Nvidia’s annual R&D budget.

The bare minimum is Nvidia’s margins will compress, which we’re already seeing. Combined with a slowdown in revenue growth or even revenue, and we expect Nvidia’s valuation to collapse from a P/E of 50x, which is clearly too high in such a scenario. That would lead to a rapid decline in Nvidia’s share price. Nvidia’s P/E in the early 2010s was in the mid-teens.

Applying such a P/E with an EPS of $1/share/quarter (stagnation at 30% above current profit levels) implies a share price of ~$60 or less than half its present share price. We wouldn’t find such a drop surprising.

Thesis Risk

The largest risk to our thesis is an AI breakthrough that reignites the AI wave. LLMs have several limitations, and many would argue are not and will not lead to general AI. However, should such a breakthrough occur, that could lead to another round of frenzy for Nvidia GPUs, perhaps pushing up revenue and profits even further.

Conclusion

There’s no denying Nvidia is a fantastic company. One of the toughest parts to explain, when we say we’re shorting Nvidia, is that we don’t want the company to fail, and it’s not that we don’t think it has a remarkable product. We simply think its present valuation is devoid of any basis in reality. If you disagree and think Nvidia is undervalued, we ask a simple question, “At what price would Nvidia be fairly valued and why?”

Nvidia faces numerous threats, including increased competition, questionable long-term demand, and eroding pricing power. The company’s guidance for Q1 2025 indicates that the company might have hit a plateau, with AMD’s revenue growth guidance higher. We think Nvidia is at more than double a reasonable fair value, and as a result, recommend against investing in it at this time.

For those who have been invested for years, pat yourself on the back, you did well, and sell the stock.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.