Summary:

- Nvidia reported Q1 results that were better than expected.

- The Q2 guidance was more impactful, however.

- Nvidia is expensive.

architectnine/iStock via Getty Images

Article Thesis

Nvidia Corporation (NASDAQ:NVDA) reported its most recent quarterly earnings results on Wednesday afternoon. The company’s shares soared following better than expected results and due to pretty strong guidance for the current year. That being said, results during the most recent quarter were still down on a year-over-year basis. With Nvidia trading at a very elevated valuation right now, it does not look like a very attractive investment to me at all.

What Happened?

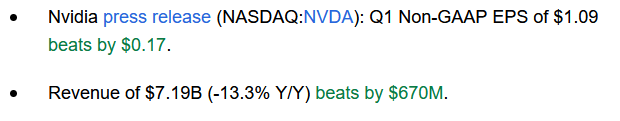

On Wednesday, following the market’s close, Nvidia reported its first quarter earnings results. The headline numbers can be seen here:

Seeking Alpha

We see that Nvidia grossed revenues of $7.2 billion, which was around 10% more than expected. At the same time, revenues were still down by double-digits compared to one year earlier. For a growth company such as Nvidia, this is not a strong result in absolute terms.

Looking at Nvidia’s net profits on a per-share basis, we see that the semiconductor giant was able to beat estimates easily as well, by around 20%. Earnings per share were down 20% year over year, indicating that the company was still struggling during the period.

The market reacted very positively to these results, sending Nvidia’s shares higher. At the time of writing, NVDA is up 18% in post-market trading, which equates to a share price of more than $360. If that holds in regular hours on Thursday, it will not only be a new 52-week high for the semiconductor giant but also a new all-time high. The after-hours price action represents an addition of well more than $100 billion to Nvidia’s market capitalization, which is impressive for sure, although one can argue about whether it’s also justified.

Nvidia’s Operational Results

Let’s delve into the numbers. Nvidia’s different business units did not all perform equally well during the quarter – which can be expected, of course. Nvidia’s data center business grossed revenues of $4.3 billion during the first quarter, which represents a new record high. Data center demand is not very cyclical, and companies kept investing in new equipment despite a potential recession being on the horizon. This can be explained by the fact that data centers are mission critical for many companies, so they don’t really have a lot of choice when it comes to allocating capital to this space. Strong data center sales also have been seen in the results of other chip companies such as Advanced Micro Devices (AMD). Both Nvidia and AMD also were able to benefit from the weak performance of their competitor Intel (INTC), as Intel has been losing market share in the data center space in recent quarters due to self-inflicted problems and an unconvincing product line-up.

Nvidia is a major graphic chip or GPU player and is thus heavily impacted by the performance of related end markets. This includes both cryptocurrency mining and gaming. While some cryptocurrencies can’t be mined with GPUs economically, such as Bitcoin, others, such as Ethereum, can be mined with GPUs. Ethereum moved from a proof-of-work model to a proof-of-stake model in the fall of 2022, but some miners still use GPUs for Ethereum mining. Not surprisingly, Nvidia’s sales to this end market depend on the price for cryptocurrencies – when cryptocurrencies are expensive, miners are more eager to acquire additional GPUs and they may also be willing to pay high prices for them. During times when cryptocurrencies are less expensive, mining is less profitable, and GPU demand from cryptocurrency miners wanes. This has had an impact on Nvidia’s sales in the past and likely played a role in Nvidia’s Q1 sales as well.

GPU sales have been under pressure in recent quarters due to lower demand by gamers as well. Many that like to play video games upgraded their hardware during the lockdown phase of the pandemic when staying at home meant that consumers had more time for video games. With many gamers having relatively new equipment, demand has declined in the recent past. At the same time, inflation pressures consumers’ ability to spend on discretionary goods. On top of that, some consumers prefer to spend their money on experiences over things now as there are no lockdowns or travel restrictions in place any longer. All in all, this has resulted in a difficult macro environment for Nvidia’s gaming business.

Combined, the headwinds for the gaming market and the cryptocurrency market explain why Nvidia’s sales and profits kept declining during the most recent quarter, relative to the results the company was able to generate one year earlier. The strong performance in the data center space was not enough to offset the headwinds Nvidia experienced in other areas.

Nvidia’s Guidance For Q2 Is Strong

Nvidia‘s Q1 results were better than what analysts had predicted. But they weren’t great – revenues and profits still were down on a year-over-year basis, and well below the peaks seen in the past.

However, Nvidia’s guidance for the current quarter, its fiscal Q2, was great. The company forecasts revenues of $11 billion, plus or minus 2%. The plus or minus 2% doesn’t really matter, though, as Nvidia’s Q2 revenue guidance was 52% ahead of the $7.1 billion consensus revenue estimate for the quarter. At the midpoint of the guidance range, revenues would be 55% higher compared to what analysts were predicting. That’s one of the best guidance announcements ever, by any company. The $11 billion revenue guidance is also way higher compared to the highest quarterly revenue Nvidia has generated so far – that was in Q1 of 2023, or one year ago.

The guidance thus implies that the year-over-year declines Nvidia has experienced in the recent past have ended for good and that sales will be strong both on an absolute basis, as well as on a year-over-year basis.

Based on the other guidance data Nvidia has supplied for the second quarter, i.e. a gross margin of 70%, operating expenses of $2.7 billion, other income of around $90 million, and a tax rate of 14%, we can estimate the net profit and hence also the earnings per share for Nvidia during the current quarter. Net profit should total a little more than $4 billion, which is pretty strong for sure. Earnings per share could be in the $1.75 range. Annualized, that’s around $7 – way more than the earnings per share pace seen during the first quarter. But on the other hand, what share price is justified for a company that generates $7 per share in profit — and we don’t know whether Q3 and Q4 will be equally strong, or whether the Q2 results will be above-average, e.g. due to everyone “trying out” AI.

Nvidia Trades At A Very High Valuation

Based on an after-hours share price of around $360 and a $7 per share profit estimate on a next-twelve months basis (Q2 guidance annualized), Nvidia trades at well above 50x forward net profits. That’s expensive both relative to how the broad market is valued, and relative to how other semiconductor companies are valued today.

And since Nvidia has not generated this profit yet – the FY earnings per share consensus estimate is $4.60 – the actual valuation could be even higher. Based on the analyst consensus estimate, the forward earnings multiple is around 80 right now.

Nvidia is a high-quality company for sure, it’s active in growth markets, and the guidance for the current quarter is impressive. But that does not mean that NVDA is a buy at every price and at every valuation. The last time Nvidia was trading well above $300, those who bought the stock at the highs lost a lot of money, as NVDA eventually pulled back to the low $100s. The same may not happen again, but it could happen – stocks with a high valuation are vulnerable to multiple compression, even if underlying business growth remains attractive. I thus do not want to buy Nvidia at the current price and believe that investors should consider the risks of investing in a company with an earnings multiple of 50-80.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!