Summary:

- NVIDIA Corporation’s Data Center business has experienced significant growth, driven by accelerated computing and generative AI.

- Quarterly revenues have surpassed $20 billion, but guidance beats have become smaller in recent quarters.

- Revenue growth rates are expected to significantly slow, with history suggesting shares need to adjust to this next stage.

Justin Sullivan

Last week, one of the great growth stories of our time continued when NVIDIA Corporation (NASDAQ:NVDA) reported its fiscal fourth quarter results. The chipmaker has seen its Data Center business soar thanks to a boom in accelerated computing and generative AI, sending shares to new heights. At this point, however, things are looking a little frothy, and history suggests that there is reason for a little caution moving forward.

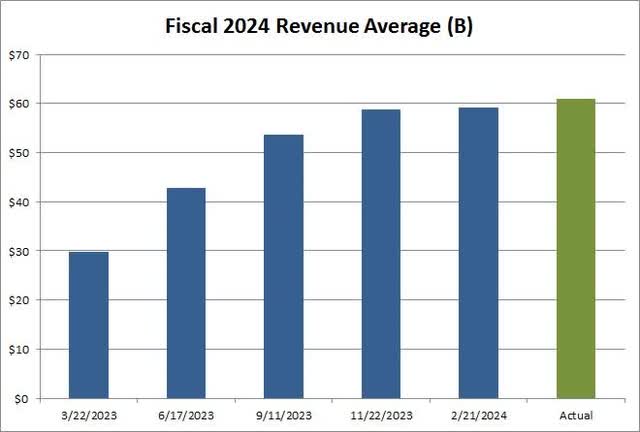

When I last covered the name in November, shares were under $500 and quarterly revenues hadn’t hit $20 billion yet. At that point, revenue growth rates still seemingly had room to rise, and the valuation wasn’t terrible as compared to industry peers. As the chart below shows, Nvidia delivered almost $61 billion in fiscal year revenue, still beating estimates that had basically doubled over the past 11 months.

Nvidia vs. Revenue Estimates (Seeking Alpha, Company Q4 Report)

Full year Data Center revenue rose 217% to a record $47.5 billion, and management said that demand is still greater than supply. For Q4, revenue beat the Street by more than a billion and a half dollars, although that was the smallest beat since this growth boom took off. Non-GAAP gross margins soared by more than 10 percentage points over the prior year period, while operating expenses rose at a small fraction of the revenue growth rate. In the end, adjusted EPS of $5.16 was up 486% year-over-year, with the bottom line result crushing the analyst average by 52 cents.

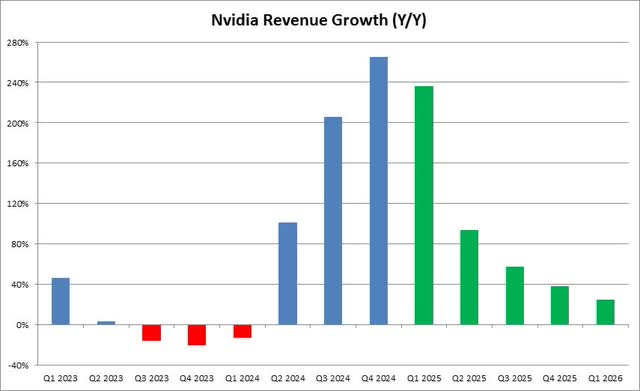

While Nvidia continues to report quarterly records for revenues and earnings, growth rates will become harder to come by moving forward. The surge in the stock price also pushes expectations even higher, and analysts are raising their numbers to more realistic levels. When the company announced the “shock and awe” guidance quarter for fiscal Q2 2024, management called for revenues that were $3.89 billion ahead of the Street, a difference of almost 55%. For the current fiscal Q1 2025 period we are in, the guidance of $26 billion did beat Street estimates, but the difference was less than $2 billion and 9%, respectively.

The amount Nvidia has beaten its own guidance has gone down over the last couple of quarters as well. Now, I’m not saying that Nvidia won’t be able to grow anymore or that its best days are behind us, but we are about to enter a very different stage of growth now. The chart below shows the last two years for top line increases (in blue) or decreases (in red), with analyst estimates moving forward in green. The revenue growth rate is expected to be more than half in the July 2024 calendar quarter (fiscal Q2 2025).

Nvidia Revenue Growth (Earnings Reports, Seeking Alpha)

It did worry me a little that Nvidia management didn’t back up its positive long-term outlook in the most recent quarter. Despite producing a free cash flow of more than $11.2 billion in Q4, less than $3 billion was spent on the buyback. I understand that shares have surged, but if things will be so much better moving forward, why not use that financial might now? The Nvidia balance sheet is in solid shape here, as the company finished the year with about $26 billion in cash and investments, with a bit less than $10 billion in debt.

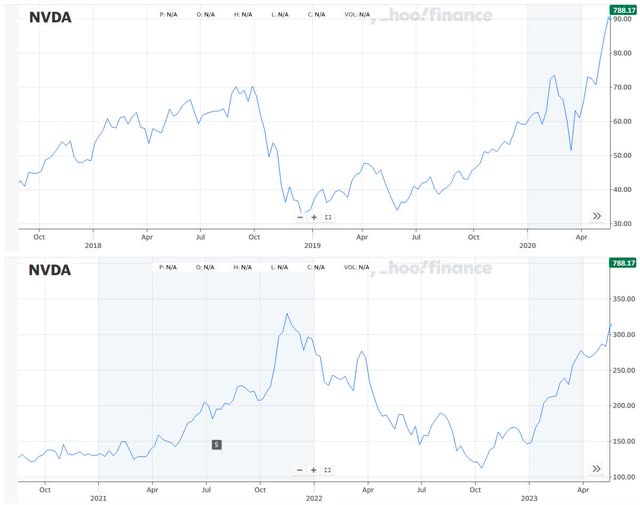

I bring up the idea of caution because the last two times we saw Nvidia show a large revenue growth percentage slowdown, the stock got whacked. This happened in late calendar 2018 through a chunk of 2019 before things improved, and then again from mid-2022 into 2023. In both cases, shares lost more than 50%, as seen in the charts below. I will point out that both of those instances saw large revenue growth turn into revenue declines, which isn’t expected this time. The company is a lot more profitable and producing a lot of cash flow now, so I don’t think we’ll see another 50% plus crash, but this history is part of the reason why I wouldn’t be rushing into shares right now.

NVIDIA Revenue Slowdown Periods (Yahoo! Finance)

The one thing that prevents me from going all the way to a negative rating on Nvidia today is that the valuation is still fair. Shares have gone from 27.5 times this fiscal year’s expected earnings to 32 since my last article. However, we’ve seen Intel Corporation (INTC) go from 25 to 31.5 times since, with Advanced Micro Devices, Inc. (AMD) going from 34 to 48.5. The two smaller names, by market cap, are expected to see their revenue and earnings growth accelerate over the next year or two. The discount Nvidia trades at the average to the other two has gone from 2 points to 8 since my previous coverage, so there is the potential for some further upside here. Additionally, Nvidia might get a sentiment boost if it decides to split its stock. The last split was announced in May 2021, which is the month when the company will next report quarterly results.

Because of the revenue growth percentage slowdown that is likely coming as we move forward, plus the surge in shares in recent months, I am lowering Nvidia to a hold today. The stock is also well above its 50-day moving average ($591), which itself is more than $100 above the 200-day.

For me to go back to a buy rating for Nvidia Corporation shares, I would like to see the valuation come back down a bit, preferably into the 25 to 30 times area, along with the technicals to be much less overextended. I do think there is the potential for the stock to make new highs in the short term, so I’m not calling to sell here, but I wouldn’t be rushing to add to positions after this large run. In the end, Nvidia has been a tremendous story in recent months, and while there still seems to be a lot of revenue growth ahead, some caution is warranted after such a large rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.