Summary:

- Nvidia Corporation’s financial situation is strong, with high liquidity and low debt, allowing for continued innovation and growth in the AI space.

- The company has seen exceptional revenue growth, with revenues doubling in the second quarter of 2024 and an 18% sequential increase expected in the third quarter.

- While the company’s current success is commendable, there are concerns about the sustainability of this growth and the potential impact of restrictions on China.

Daniel Megias

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) stock shot to the moon and has been one of the better performers this year on the back of AI-enabled data center products that the company is producing. This doubled the company’s revenues while costs remained low. I wanted to take a look at the company’s financial situation and what its potential may be for the future given reasonable revenue and margin assumptions going forward. Even with quite optimistic assumptions, the company is still overvalued right now and will need to prove the demand can be sustained for longer than I modeled. Therefore, I am giving the company a hold rating and any investment at these price levels is purely chasing momentum and is a huge gamble.

Financials

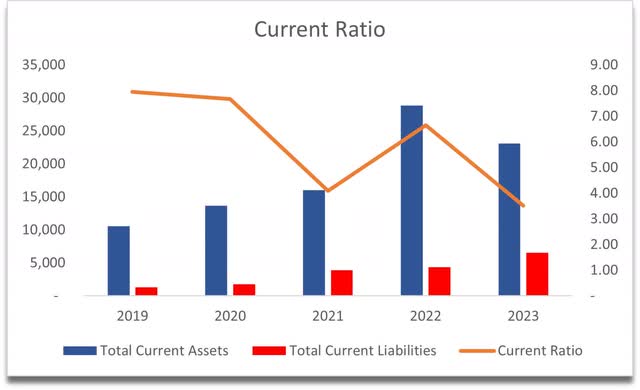

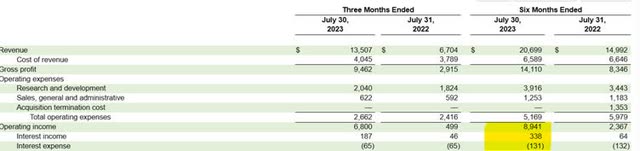

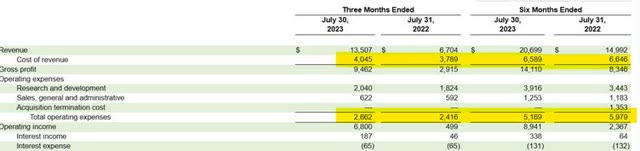

The company’s liquidity stood at around $16B as of Q2 ’24, against $8.4B in long-term debt, which has been reduced from $9.7B as of FY23, so that’s always nice when companies are taking care of the leverage. However, in the case of NVDA, this debt is insignificant when compared to its current market cap of over $1 trillion and EBIT of around $9B as of the 6 months ended July 30, 2023. The annual interest on that debt is negligible, and on top of that, the company’s marketable securities are earning more than double of what it has to pay out in interest expenses on leverage. Safe to say NVDA is at no risk of insolvency. The company has plenty of liquidity on hand to continue to innovate in the AI space and maintain its presumed lead and competitive advantage.

Insignificant interest expense (Nvidia 10Q)

The company’s current ratio has been very strong over at least the last 5 years. While it has come down significantly, it is still almost 3.0 as of the latest quarter. I prefer seeing a range somewhere between 1.5-2.0, as I believe that is the more efficient ratio. Anything too much over that range I believe is an underutilization of the company’s assets and a wasted opportunity. The downtrend in the ratio tells us that the company is being much more efficient than before. I would like to see the company using its liquidity to further the company’s growth, by either continuing its innovations of products or acquisitions.

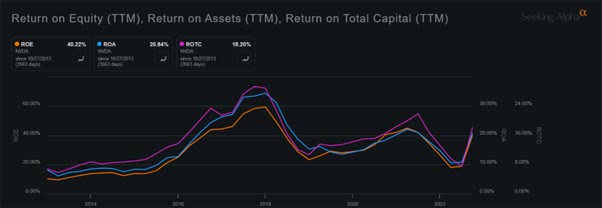

Continuing on efficiency and profitability, the company’s ROE and ROA have bounced back considerably in the last quarter, which all can be attributed to the boom in demand for data center AI-enabled products, as revenues for that segment skyrocketed. The same story can be seen in the company’s return on total capital driven by the same reason. In my model, I can see these metrics improve even more in the next two quarters, which tells me that the phenomenal demand for AI is going to continue for much longer and the company has an outstanding competitive advantage and a strong moat. I have to commend the management for seeing the massive opportunity in the data center AI space. In my valuation model, I have ROTC exceeding 30% for the year, which I believe is attainable seeing such a demand for the company’s products.

Profitability and Efficiency (Seeking Alpha)

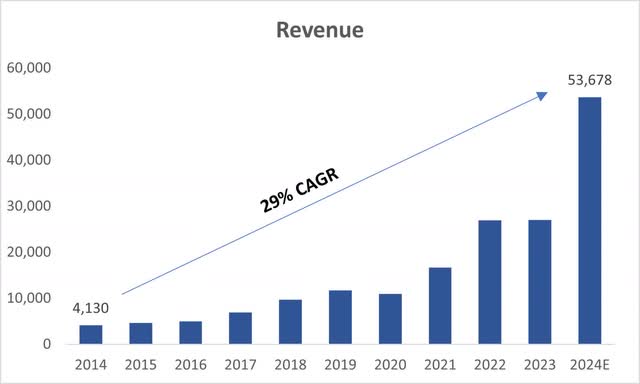

In terms of revenues, everyone was surprised at how the company has performed this year already. While many companies reported continuing low sales figures, especially in the semiconductor industry, with a slight recovery expected in the upcoming few quarters, NVDA had an outstanding first half of the year. In the 2nd quarter of fiscal ’24, the company saw its revenues double from the same quarter a year ago, and around 88% sequentially, which is phenomenal. In the press releases, the outlook for the fiscal third quarter is another 18% sequential increase in revenues to around $16B, which leads to around 170% y/y increase. With such numbers, I expect the company’s share price to skyrocket once again if it manages to beat these estimates. I estimate FY24 revenues to be around 100% higher compared to FY23, which is mindboggling.

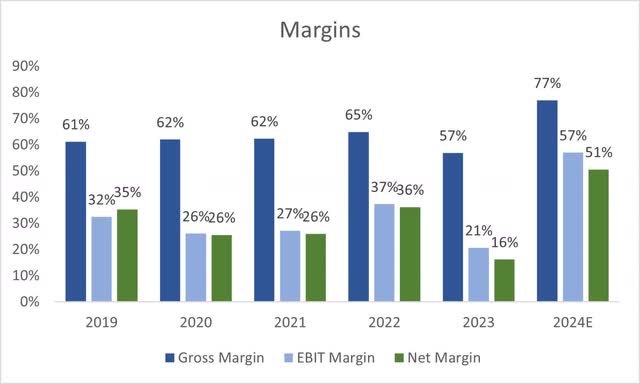

In terms of margins, these have gotten a massive boost just like the revenues did, and the best part about them is that the costs stayed relatively the same over time. This means the company has become operationally much more efficient because it managed to double its revenue while maintaining the same level of costs. The company was able to massively scale production without incurring significant costs, and that is going to benefit its long-term growth. It is hard to know how long this revenue growth can be sustained because the AI revolution is only around 6 months in, and it seems like it is just getting started.

NVDA’s Costs remained the same y/y (NVDA 10Q) NVDA’s Historical Margins and Estimated for FY24 (Author)

Overall, it seems we are seeing a brand-new company, which is much more profitable, efficient, and in a booming sector that, as I said, seems to be just getting started. The company’s investments early on in AI products have paid off massively this year and should continue to benefit for a long time. This is because of Nvidia’s competitive edge and a strong moat that was built up through the last couple of years by the management’s ability to foresee the upcoming boom in AI and data center demand, as if through a crystal ball, and that is commendable.

Comments on Outlook

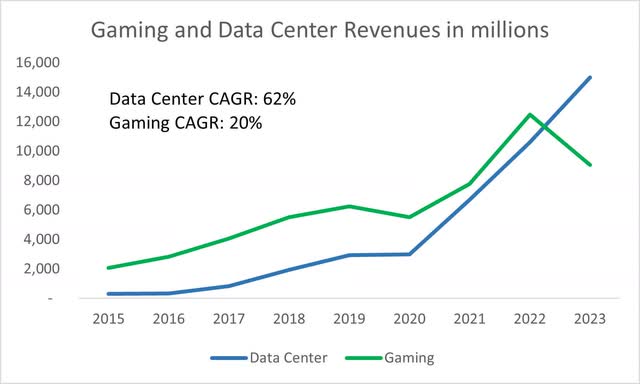

Not long ago, Nvidia Corporation was known for its gaming revenue segment through PC graphics. A pivotal shift happened about a year and a half ago when that revenue segment was finally taken over by the emergence of data center demand. Ever since then, the data center segment has seen amazing growth due to the pandemic, which shifted the way we approach work. Many enterprises scrambled to update their cloud infrastructure and the digital acceleration began. NVDA’s GPUs were at the forefront of many industries that require fantastic computational power, and the company’s expertise put them light years ahead of the competition.

Data Center Revenue overtaking Gaming (Author)

It is safe to say that NVDA has captured most of the growth in the digital transformation outlook and then some, since for the next 8 years, the CAGR is expected to be around 18%. This assumption is much more reasonable than what the company managed to do this past quarter, which as shown above is ridiculous growth, and I don’t expect the company to sustain it for a long period.

The recent emergence of AI and AI-enabled products has positioned the company very well because the management foresaw this boom in demand and allocated resources to these specific requirements. Mr. Huang’s strategy of pivoting away from the gaming segment and into something that turned out to be much more profitable was a great success. As you can see from the graph above, the data center segment experienced a massive boom since ’20. How sustainable is it going to be going forward? There’s a good chance that the company will have crazy growth for another couple of years as AI demand seems to be just getting started and companies are looking at AI as the main differentiator from its competitors.

I expect to see high-double-digit growth in data center revenue for maybe a couple of more years while the technology is still new and exciting, after that, I would expect it to normalize.

Further restrictions on China may dampen the company’s revenue potential quite considerably because, as of the 6 months ended July 30 ’23, around 21% of the company’s revenues come from China. Just recently, the U.S. added further restrictions on China, which meant that any sale of AI chips to China has been banned, specifically the company’s A800 and H800 chips. The company said that in the short run, it is not going to be affected since I assume the company already fulfilled a lot of the demand. However, I would expect to see some revenue dips in about a year from now.

In short, the company has been at the right place at the right time, and the management’s ability to foresee the explosion in data center and AI demand put the company at an advantage and gave it a massive competitive edge. However, the company is not immune to restrictions, and such explosion in revenues is not going to be sustainable for very long as the momentum will subside once the demand for these products reaches peak.

Valuation

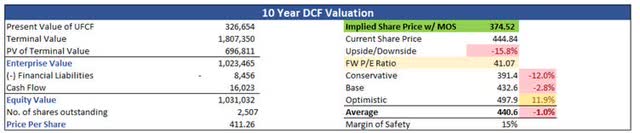

It is tough to estimate right now at what rate the revenues are going to grow. The analysts are estimating around 99% growth in revenues for FY24, which is what I have also, however, after that the estimates of growth do start to come down dramatically. That is because it is quite impossible to predict what kind of demand NVDA will see in the long run. We can make an educated guess, and also a conservative one for that bit of margin of safety.

Seeing that the next quarter will see around 18% sequential growth, it is not as bombastic as the sequential growth from the 1st quarter to the 2nd. The demand is not as robust as it was before, which tells me there is no way the numbers can be sustained for long, unless the next AI revolution comes about, and the company starts to produce even better products than it already has. For the base case scenario, I decided to go with around 27.5% CAGR, which is just a little under its historic average if we include the estimates for FY24. It is just above average without FY24 (it’s around 23%). Below are my assumptions for the three scenarios.

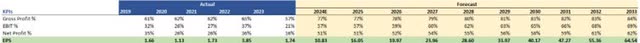

In terms of margins and EPS, I modeled that the company is going to be able to achieve these new margins going forward, just as analysts are estimating. The demand is robust for AI products, and the company is positioned very well to meet the demand. Below are my margin and EPS estimates for the next decade.

Margin Assumptions and EPS (Author)

On top of these estimates, I decided to add another 15% margin of safety for that extra cushion. The financials have improved substantially so quickly that I don’t think is going to be very sustainable and I expect growth to subside. For the discounted cash flow, or DCF, model, I used a 10% discount rate, which means that I’d want to at least get 10% from this investment. I’d aim higher but that would bring down the company’s intrinsic value even more. I also went with a terminal growth rate of 3% because I believe the company will be able to grow at a pace that is slightly higher than the average historical inflation.

With that said, NVDA’s intrinsic value is $374.52 a share, which means it is slightly too expensive to invest in the company now.

Closing Comments

Nvidia Corporation has a lot to prove going forward before I consider investing. The boost in revenues with minimal increases in expenses is very impressive. However, I don’t how sustainable it is going to be in the long run. These estimates I think are still very optimistic, and I would consider the company grossly overvalued and any further investment at this price would constitute gambling in the short run. If the company misses a couple of quarters, I could see a lot of investors/traders taking their profits and sending the share price much lower. Nvidia Corporation seems to be priced to perfection, and any misses will likely wreak havoc on the company’s share price.

NVDA is going to report 3rd quarter earnings in late November, perhaps November 21st. I would expect huge y/y increases once again, with not-so-impressive sequential growth. However, if the results do come in better than anticipated, expect another melt-up in share price as the company has momentum on its side.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.