Summary:

- We expect Nvidia Corporation to significantly outperform the S&P 500 over the next several years and deliver substantial Alpha to investors.

- Hedge fund manager Stanley Druckenmiller, who returned over 30% for 30 years, has Nvidia as his largest listed long position, believing in the potential of AI.

- We believe that investors are currently modeling their Nvidia Corporation EPS expectations based on limited/restricted demand, while actual unconstrained demand could be 50% higher.

Just_Super/iStock via Getty Images

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) has had a volatile few months, briefly surpassing the $500 mark and now experiencing a small pullback to $469 along with most other technology stocks on fear of a recession. We think this pullback is temporary and expect Nvidia to outperform the S&P 500 (SP500) by a significant margin over the next few years.

One hedge fund manager who has had 30%+ returns for 30 years in a row, namely Stanley Druckenmiller, has some very interesting opinions on Nvidia, which currently has his largest public held position. In our view, Nvidia’s dominance with CUDA, along with the shift in data centers to accelerated computing over the next decade and current EPS estimates based on Nvidia’s limited supply, make it a buying opportunity to hold for at least the next 2–3 years, not just a few months. Taking future unconstrained earnings into account, we also believe Nvidia has actually become cheaper, contrary to what many may think.

Since our “Buy” rating last November, Nvidia is up a whopping 192.71%, compared to 8.64% for the S&P 500, after which we gave it a “hold” rating last quarter pending more data on Nvidia’s prospects. This time, however, we have upgraded Nvidia to a “Strong Buy.”

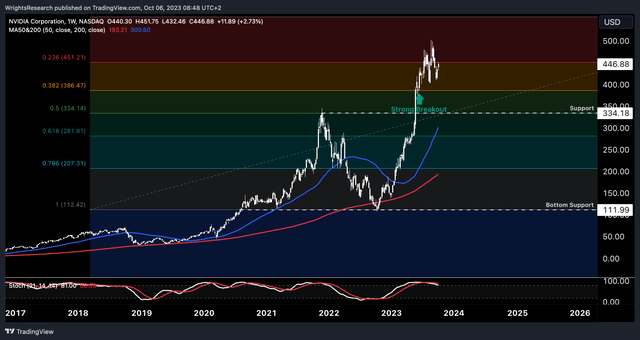

Wright’s Research, Tradingview

AI In A Recession

You might ask why invest in fast-growing stocks when the likelihood of a recession is increasing. In short, we think the answer lies somewhere between the fact that Nvidia is defying the current Macro cycle, given that demand for its H100 GPUs is still unprecedentedly high, and the fact that the company could very well behave like most other consumer staples during a recession. In fact, a great deal of the current demand comes from blue chip companies with significant CapEx budgets and cash reserves that expect a lower revenue growth profile in the coming quarters if we actually enter a recession.

Renowned hedge fund manager Druckenmiller also recently gave an interview with Bloomberg and seemed very optimistic about artificial intelligence (“AI”), despite the fact that he thinks a recession is likely. Currently, his long portfolio consists of AI stocks, with Nvidia being his largest position with a weighting of 14.9% according to the latest data, along with Coupang (CPNG) at 13.1% and Microsoft (MSFT) at 8.9%. His reasoning for meaningfully investing in AI, and which companies to choose, goes as follows:

All of AI is not going to make it through whether we have a recession or not because they haven’t separated the wheat from the chaff yet. But I do believe, unlike crypto, AI is real. It could be as transformative as the internet. And I think I’ve argued publicly that if staples can go up in price in a recession, why can’t a company like Nvidia if their orders and earnings go up 70% in a hard landing?

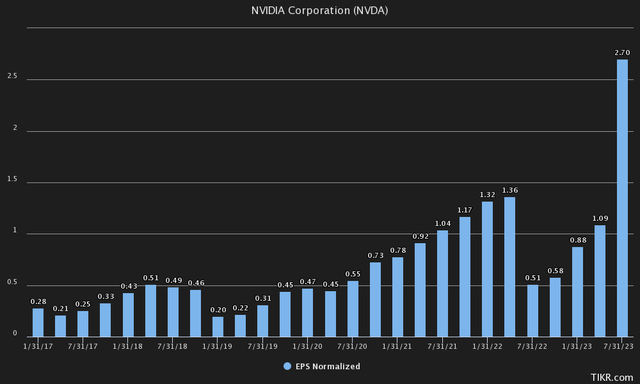

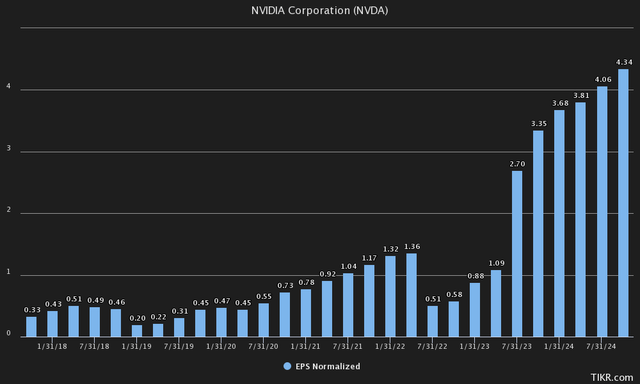

We fast-forward a few months, and it indeed appears that despite the sluggish earnings of other companies in a seemingly increasingly recessionary environment, Nvidia is completely defying the slow growth environment and growing their earnings per share at a mind-boggling pace, well above 70%. Judging from earnings expectations for fiscal year 2023, Nvidia’s earnings per share are expected to grow from $3.34 for the full year 2022 to $10.82 in 2023. To put things in perspective, next quarter they are expected to report an EPS (EPS) for the third quarter that is essentially the same as their EPS for the full year 2022.

As for the specific details on when Stan Druckenmiller bought Nvidia shares, he reportedly bought the initial position of 583K shares in Q4 2022, when Nvidia was in the trading range of $108-$188. He bought another 209K shares in the $140-$278 range in Q1 2023 and even more recently added 159K shares in the $258-$440 range in Q2. To put it another way, despite trading at $440 at some point last quarter, he still reported an increase in his position size. Currently, his position of 950,075 shares is worth $446.01M, making it his largest publicly traded long position.

Many market observers have also pointed out that they believe this latest Nvidia rally may be akin to the dot-com bubble. However, we believe that even though Nvidia has already had a huge run-up, this rally should actually be sustainable and supported by strong and solid fundamentals, as opposed to 2000, when the Nasdaq on average had companies with P/E ratios over 100 and most companies offered profitless technology. Druckenmiller seems to be of the same opinion, and said the following about the lessons learned from the dot-com bubble and the similarities to the current AI rally:

Don’t get emotional, don’t get crazy. But I will say this about AI: Nvidia bottomed in October in the low 100s, it’s true it’s 380 or 390 now, it’s in nosebleed territory. If this is a secular move, if this thing is real, you just don’t have 10-month moves. That’s not how it works, even the dot com bubble lasted 2-2.5 years, for many of the guts of the internet it lasted 4 years, like the Cisco’s and Sun Micro’s.

In other words, looking at previous rallies, this secular movement could easily last well beyond 2025, with the last quarter, which was spectacular, being just the starting shot. In fact, we believe Nvidia has never been so cheap in recent history, taking into account its earnings outlook and future growth.

Not As Expensive As It Seems

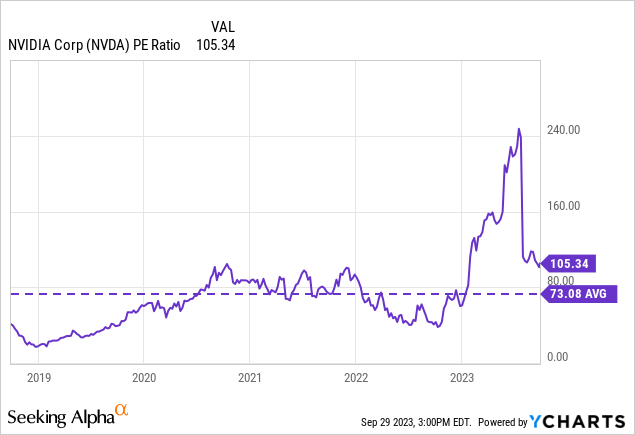

Which brings us to our next point, the fact that Nvidia may not seem as expensive as many think, especially when you consider its market cap of $1.16 trillion. For reference, Nvidia in recent history has always traded at a relatively high P/E ratio of 73.08 on average over the past 5 years. Its current P/E ratio of 105.34 may seem excessive until future earnings estimates are taken into account.

Right now, we have a very clear view of what earnings will look like next quarter, which are expected to be $3.35. On an annualized basis, that equates to earnings per share of $13.4, which means the company is only trading at a quarterly P/E ratio of 35.03. Which suddenly doesn’t seem so expensive given that Apple (AAPL) is trading at 29.58x forward earnings and is projected to only average low to mid-single digit revenue growth for the foreseeable future.

Even looking back to the previous quarter, when the consensus earnings per share EPS for the second quarter was $2.07, or $8.28 annualized, the stock initially rose to $380, which would imply an earnings multiple of 45.89x when looking at annualized earnings for the next quarter. In our view, we received confirmation that demand remains strong and is likely to remain strong in the coming quarters, while the stock became cheaper when looking at future earnings.

We actually have pretty good visibility for the rest of the year and even part of next year in terms of data center revenue. Many customers, including leading cloud GPU vendors, point out that Nvidia is fully allocated/sold out on infrastructure at least through 2024.

And given that demand is limited for at least the next few quarters, perhaps even well into 2024, we would follow semiconductor expert Hans Mosesmann in that demand is probably 50% higher than what people are currently modeling for. If demand has gotten stronger recently and lead times have gotten longer, perhaps we should be looking at unconstrained demand rather than the supply side, which is currently almost a given in the near future. Hans Mosesmann believes Nvidia’s EPS next year should be more in the high teens, with unconstrained EPS for 2025 into the high 20s. Currently, Rosenblatt’s price target of $1100 is derived from a 2025 EPS of $27.5 at a multiple of 40x.

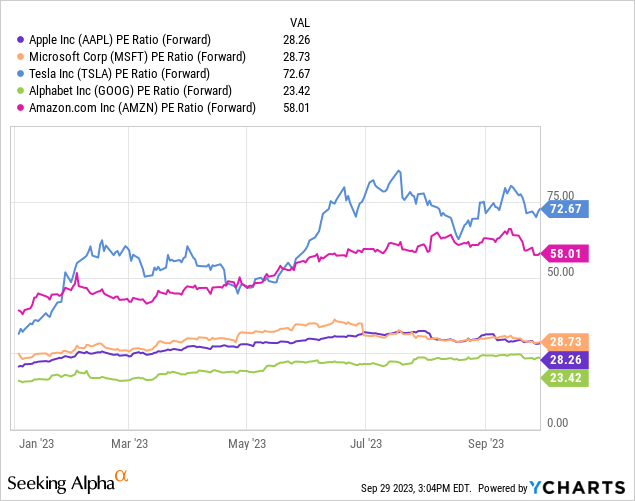

Right now, we see that the down case scenario is mainly that EPS remains flat after the next quarter, in which EPS is expected to come in at $3.35 or $13.4 year-over-year. If growth is much lower than expected, the stock should still quote $402 on a 30x forward multiple. However, we think earnings per share would be up if unconstrained demand grew to $25 in fiscal year 2025 and the stock traded at $875 on a 35x forward multiple. And while a 30-35x multiple may seem high at first glance, looking at other large caps, we think this is pretty conservative, given that Nvidia’s earnings per share is expected to grow at double-digit rates for the foreseeable future, while most large caps expect merely single-digit growth.

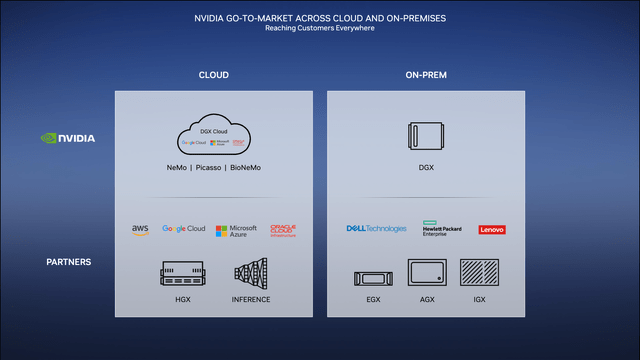

Looking at it from a top-down perspective, it is important to point out that Nvidia seems to have a monopoly on the market for accelerated computing hardware and software, while data centers are currently increasingly moving from normal computing to accelerated computing. Nvidia serves all types of companies across the board, from large cloud providers such as Google (GOOG), Microsoft, and Amazon AWS (AMZN) that have large CapEx budgets, to smaller startups offering cloud services. Not to mention installing on-premises installations for other large customers tailored to their needs. Speaking of which, UBS believes it would be “not hard to imagine” DGX Cloud generating $10BN in revenue, versus $1BN currently.

If we look at the world of data centers in the cloud, enterprises, etc., that amounts to $1 trillion in installed data centers, with about $250BN in capital spending per year, as CEO Jensen Huang revealed in his latest earnings call. If much of this market switches to accelerated computing because it is the most energy efficient and has the best performance, it is not so crazy to assume that Nvidia could go from $16BN in revenue next quarter to $25BN per quarter by the end of 2025, looking at consensus estimates.

$100BN annualized at the current 70% margin would mean $70BN worth of Operating Income on an annual basis, or a $2.1T valuation at 30x Operating Income. With 2.47BN shares outstanding, that would equate to approx. $850 per share.

This does mean that our thesis can only come true if Nvidia continues to see strong demand and does not experience margin pressure from slowing demand. But as we see it now, we already have enough data and visibility for the coming quarters to know that demand is unlikely to slow by any means and that this cycle is far from over.

Why “CUDA”?

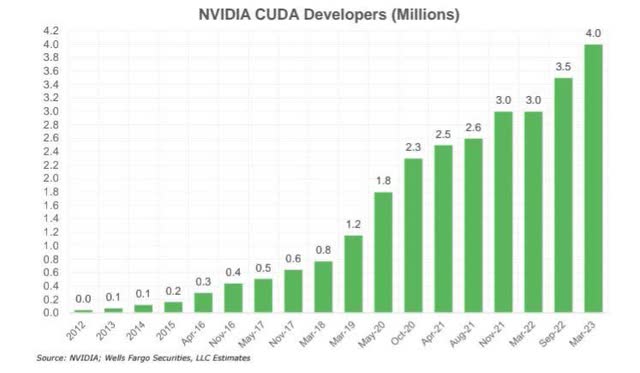

One of the risks to Nvidia some investors like to point out is competitors. But we see Nvidia’s moat with CUDA as protection against this downside risk, with CUDA still being the “gold standard” for parallel computing. One question investors should ask is, “Why is everyone using CUDA and not trying to replace it with cheaper alternatives?”

It is a combination of the fact that it is easy to work with, that everyone is already using it, and that it is highly compatible. They have an extensive library of developer tools and an extensive ecosystem with a huge number of active users. It just so happens that most of the advances and breakthroughs of the past decade in the field of AI are attributable to CUDA.

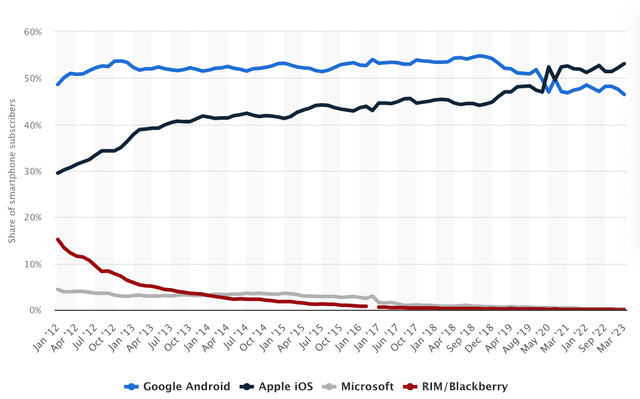

To put it in layman’s terms, we can compare it to Microsoft with Windows and Apple with IOS. You might ask, “Why do the majority of people in the U.S. use Apple iPhones when they are considered expensive and Android being a viable alternative?” The answer would be a combination of the extensive ecosystem, device compatibility, the fact that many other people use it, and the difficulty of switching to other ecosystems.

The same can be said about Microsoft and why the majority of users in the financial sector use Excel, PowerPoint, Word and the Windows operating system when there are probably cheaper alternatives that could get the job done as well. It’s just the fact that most have been using it for over a decade, that everyone uses it, knows how it works and just works great out of the box, similar to Nvidia with CUDA. So yes, we see Nvidia’s moat with CUDA in the same way that Apple does with IOS and Microsoft does with Windows and its Office suite. It’s just harder to fathom because we don’t see “CUDA” that much in our daily lives yet, even though some of the most productive tools like ChatGPT are built on those platforms.

For those reasons, the competition right now is mostly Advanced Micro Devices (AMD), and perhaps in the distance Intel (INTC). We pointed out in a previous article why we think AMD is also a strong buy, even though we think they have some catching up to do with ROCm and that it will be difficult to penetrate Nvidia’s current moat when you consider the cost of switching to a different ecosystem for researchers/developers, whether that’s time savings or price. They would have to provide superior products on both the hardware and software side to compete with Nvidia, which currently does not seem to be the case if you look at the number of users of Nvidia’s ecosystem versus AMD’s.

Nvidia, Wells Fargo Securities, LLC Estimates

To find out if Nvidia is a secular trend and not a bubble, we can also look at the use case scenarios needed for sustainable demand for Nvidia. The biggest risk we see is that the end user is not getting added value, after which we should see demand slow dramatically. Even though we are starting to see AI everywhere, making everything easier, faster, more productive and creative.

It can already be found in law/legal, accounting, writing, medical, research, autonomy (driving, robots, programming), content creation, video editing, animation, virtual assistants and many other areas. And unlike cell phones, which can increase productivity but are often proven distracting, AI seems to have the ability to increase productivity exponentially by virtually replacing labor or reducing the workload involved, similar to the revolution in automation with robotics.

The Bottom Line

We believe AI is the real deal and see more upside prospects, even in a recessionary environment. We have raised our rating from “Hold” to “Strong Buy.” While Nvidia could certainly fall in the short term and have a volatile few months, we believe the recent upward surge points to a longer-term positive trend, rather than being a bubble as many market participants believe. This is probably an investment idea we want to go long on for at least the next 2–3 years, if not longer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.