Summary:

- Nvidia continues to dominate the AI chips industry, expanding its market share to a staggering 88% in the GPU industry in calendar Q1 2024.

- The company continues to cement its position in the market, and its brand-new Blackwell platform will likely help it exercise even more pricing power.

- Demand for GPUs is surging as recent news suggests that Taiwan Semiconductor is struggling to meet chip production needs.

- My valuation analysis suggests that Nvidia’s fair value is close to $5 trillion, which is 62% higher than its current market cap.

JasonDoiy

Investment thesis

My previous bullish thesis about NVIDIA (NASDAQ:NVDA) aged well, as the stock gained 37% since early March, by far outperforming the broader market. The company released its quarterly results a couple of weeks ago and several other developments happened as well, which I want to discuss in my new analysis.

The competition in GPU’s looks dead after NVDA’s market share in GPU moved closer to 90% after all the largest semiconductor stocks published their Q1 earnings. NVDA continues cementing its intact position in AI chipsets industry with the recent release of the Blackwell platform. This will likely be substantially higher priced than H100, meaning immense pricing power. The demand for AI chips will also likely remain higher for longer as technological companies continue their fierce fight and ramp up investments in data centers. Strong demand together with unmatched pricing power is a massive mix of catalysts to drive further revenue growth and profitability expansion.

The stock will see a 10-for-1 stock split today, which will highly likely help to attract new investors. I think that all these favorable factors will help NVDA its rally, as my valuation analysis indicates that the business’s fair value is close to $5 trillion, representing a 62% upside potential. All in all, I reiterate my “Strong Buy” rating for NVDA.

Recent developments

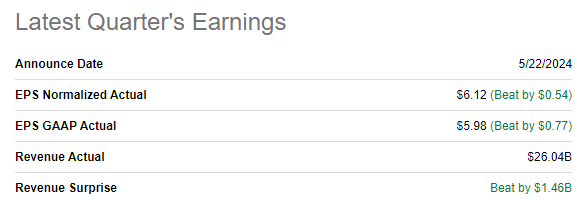

Nvidia released its latest quarterly earnings on May 22, significantly surpassing consensus estimates. Revenue grew by 262% YoY and the adjusted EPS almost sextupled. Nvidia’s latest earnings show accelerating momentum in the AI revolution, and the company is certainly the biggest beneficiary of this trend.

Seeking Alpha

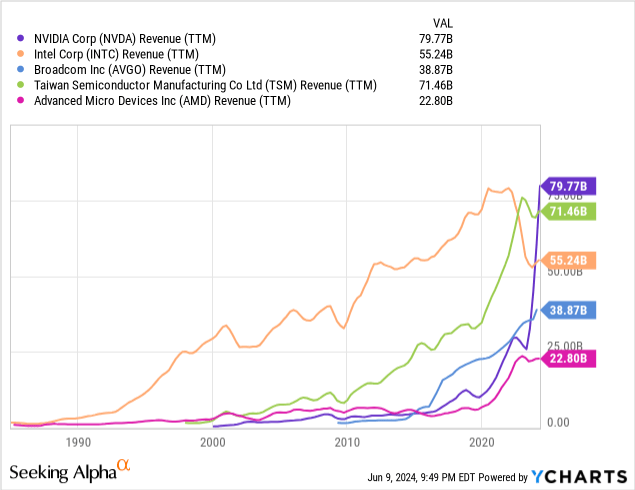

I say that Nvidia is the greatest beneficiary of the AI-driven boom in demand for chips because after fiscal Q1 earnings release, the company became the world’s number one semiconductor company by revenue on a TTM basis. In 2020 Nvidia was far from joining top-3 from revenue perspective, lagging far behind Broadcom (AVGO), Taiwan Semiconductor (TSM), and Intel (INTC).

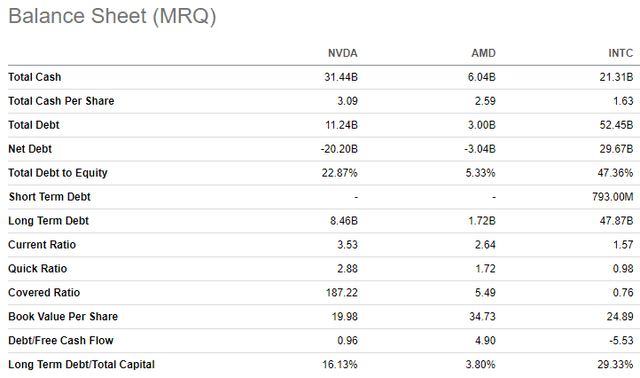

The operating margin more than doubled on a YoY basis, from 30% to 65%. Massive operating leverage allowed Nvidia to quadruple its levered free cash flow [FCF] in Q1, from $3 billion to $12 billion. As a result, Nvidia’s total cash grew sequentially from $25.9 billion to $31.4 billion. Total debt of $11 billion is immaterial compared to the company’s almost $3 trillion market cap.

Innovation is crucial in semiconductors and having more advanced technologies in GPU enabled NVDA to almost monopolize the industry. Therefore, another crucial bullish sign is that Nvidia’s financial strength is far above its major GPU rivals, Intel and AMD (AMD). Intel is in a deep net debt position and has a below one covered ratio. AMD’s balance sheet is much cleaner compared to INTC, but its cash pile is five times smaller than Nvidia’s. Therefore, it is apparent that Nvidia has much more potential to reinvest in R&D than rivals.

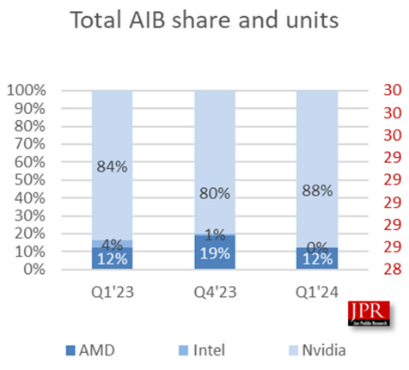

And the company indeed converts its unparalleled financial position into new jaw-dropping products. At the GTC 2024 conference, Jensen Huang presented the new Blackwell chip family. According to the source, the new platform performs AI tasks at more than twice the speed of Nvidia’s current Hopper chips, while using less energy and providing more bespoke flexibility. Analysts expect the new chip family to be around 40% pricier than the current range for H100. This indicates Nvidia’s massive pricing power and that competitors’ offerings are nowhere near close to Blackwell in terms of technology. In my opinion, this new release helps in cementing Nvidia’s leadership in GPU for AI. By the way, NVDA’s market share in the GPU add-in-board market expanded to a staggering 88% after calendar Q1 2024, indicating that the competition is likely dead, in my opinion. That said, NVDA commands almost a 90% market share in the market, which is projected to reach $773 billion by 2032.

JPR

Any company’s top line in most cases is driven by only two variables: the selling price and the selling volume. In the previous paragraph I described why pricing will be favorable for Nvidia, now let me talk about the demand side. As the fierce AI fight between the most technologically advanced companies continues, all hyperscalers are ramping up their investments in AI. It is widely known that Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL) all plan to invest hundreds of billions of dollars in building data centers across the world in the next ten years.

Also, there are other companies beyond this big three that boost the demand for Nvidia’s GPUs. Elon Musk’s xAI startup develops a large language model [LLM] called Grok. According to Mr. Musk, the LLM will require around 100,000 Nvidia’s H100 chips to train. Another Elon Musk’s company, Tesla (TSLA) also bets on AI heavily and its full-self driving [FSD] technology will also likely require 50,000 more H100 chips this year.

The fact that the demand for AI chips is strong is underscored by the information that Taiwan Semiconductor struggles to keep up with AI processor demand. Generative AI is a young technology and only scratches the surface, but it already helps people to save loads of hours per week to automate completing routine tasks. As generative AI pioneers continue investing billions in the technology, we can expect more sophisticated applications of AI-powered tools, which will help to “accelerate every workload possible”. We already see how AI capabilities are expanding to enterprise users’ world, which is evident from the Nvidia’s partnership with SAP (SAP). The partnership aims to Accelerate Generative AI Adoption Across Enterprise Applications Powering Global Industries.

The last, but not least, highly likely strong positive catalyst is a 10-for-1 split. When a stock trades at such a high price per share, it limits the ability of some low-deposit retail investors to buy it. Therefore, splitting the current above-$1000 share by ten times will likely help attract more investors. Trading is expected to commence on a split-adjusted basis at the open on June 10.

Valuation update

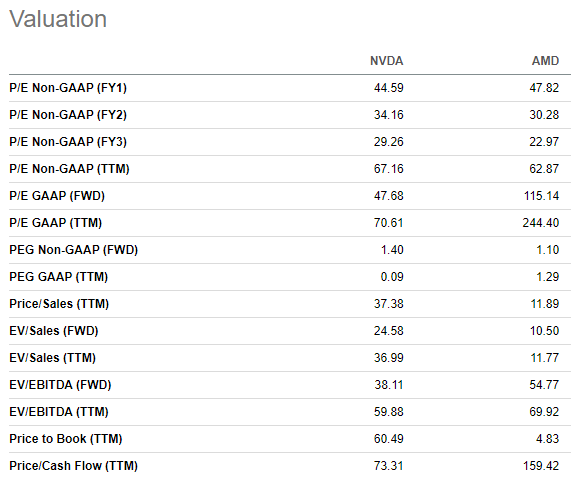

As usual, let me start with looking at valuation ratios. NVDA traditionally has the lowest possible “F” valuation grade for Seeking Alpha Quant because its multiples are far above the sector median. On the other hand, NVDA is a company with unique positioning in the AI revolution. Therefore, comparing to the sector median is not fair enough. It is better to look at NVDA’s current multiples compared to historical ones. From this perspective, the stock looks attractively valued. Moreover, from the P/E and P/Cash flow ratios perspective, NVDA looks notably cheaper than AMD. I am not including INTC in my comparison of valuation ratios because one of the above screenshots suggests that its market share in GPUs is close to zero, meaning that at the moment it cannot be considered a significant player in the most thriving segment of the semiconductor industry.

Seeking Alpha

The upside potential that I forecasted in the previous thesis was 34%, meaning that the stock surpassed the target and I have to update my discounted cash flow [DCF] model in line with the changing landscape.

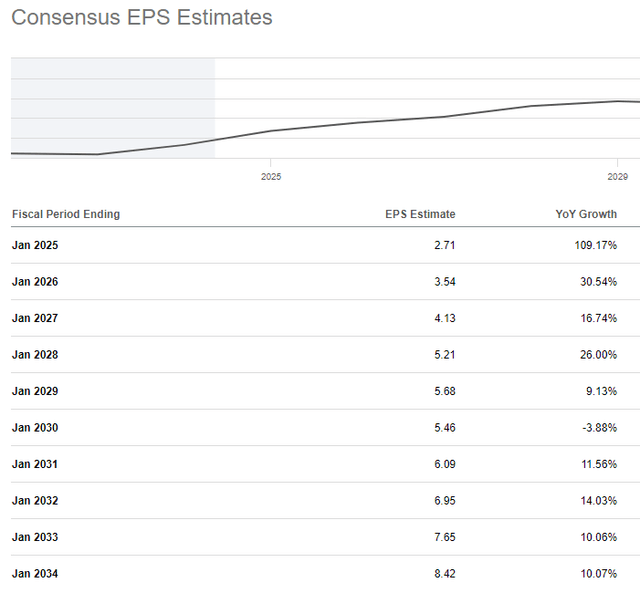

I am not relying on consensus forecasts projecting a 14% CAGR for the topline. I think that this CAGR is unfairly low because the GPU market is projected to compound with a 31.5% CAGR by 2032.

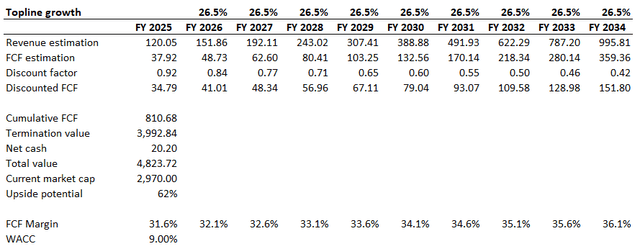

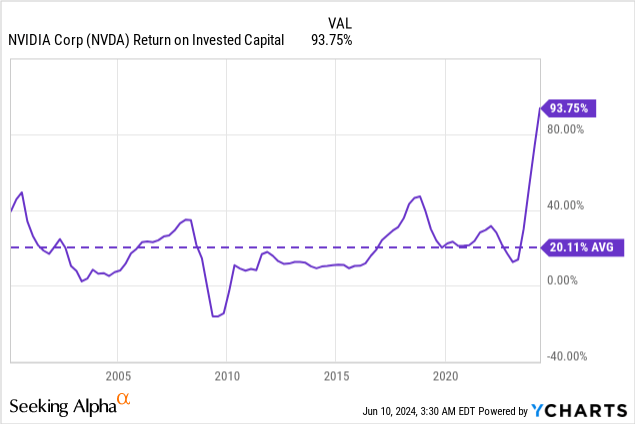

Of course, the rule of big numbers will apparently start working against NVDA sooner or later. Moreover, AMD and Intel continue to invest billions in R&D, which means that there is a risk of losing market share. I think that implementing a 5% haircut to the industry CAGR is conservative enough for my base case scenario. That said, I use a 26.5% revenue CAGR. Moreover, let us not forget that NVDA will highly likely reinvest its substantial profits into new ventures and growth drivers will likely expand far beyond AI applications. NVDA’s historically high ROIC gives high confidence in the company’s ability to unlock new profitable revenue growth drivers over time.

The TTM FCF ex-SBC margin is 31.6%. The level is high, and it will be quite difficult to expand at a rapid pace further. However, with NVDA’s strong pricing power for GPUs, I think that a 50 basis points yearly FCF expansion is doable. My confidence in NVDA’s ability to further expand its free cash flow margin is also backed by the EPS forecast from Wall Street analysts indicated above. The EPS is expected to triple over the next decade, which equals to a 12% CAGR for the bottom line.

With a 26.5% revenue CAGR, the business’s fair value is not far from $5 trillion [in relative terms]. My fair value estimate is 62% higher than the current market cap, meaning that the upside potential is still immense.

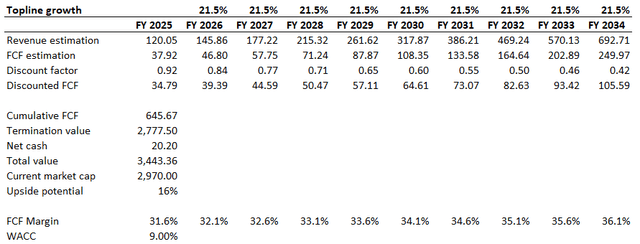

NVDA bears will likely destroy me in comments for a 26.5% revenue CAGR. Therefore, I want to simulate the second scenario with a 10% haircut to the projected GPU industry growth, i.e., will use a 21.5% revenue CAGR. All other assumptions are untouched.

As shown in the second scenario, even with a 21.5% revenue CAGR, NVDA’s fair capitalization is $3.4 trillion higher than the current one. There is a 16% upside potential left under my conservative scenario.

Risks update

NVDA holds a massive 88% market share in GPUs, which makes it almost a monopoly. The industry is thriving, and the chip war between the U.S. and China suggests that it is the matter of the national security. Therefore, there is a significant risk that NVDA will face much more antitrust scrutiny. According to Reuters, the U.S. already sets the stage for antitrust probes into all the hottest AI-exposed companies, including NVDA, MSFT, and OpenAI. While increased antitrust scrutiny does not equal disruption to the company’s operations, it might cool the market’s sentiment for NVDA, which will not help in the rally continuation.

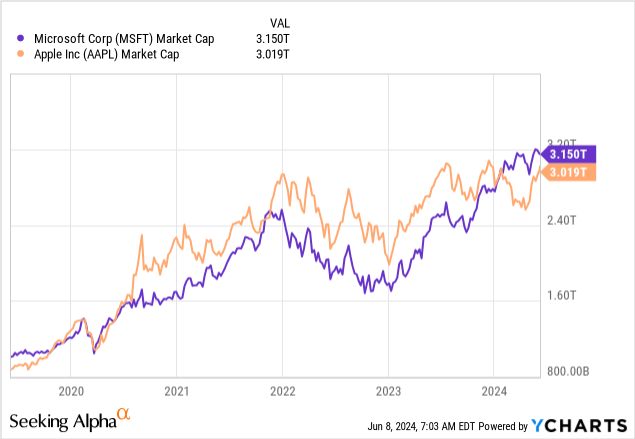

It seems that a $3 trillion market cap is a strong psychological level for the stock market, I would even call it a resistance level. None of the companies in history was able to grow its market cap far above $3 trillion, and I think that this might be a struggle for NVDA’s share price over the short term. Share price growth is never linear and before heading towards a $4 trillion and $5 trillion market cap the stock might see a temporary pullback.

Potential adverse developments in the macro environment are always a risk for any business, and NVDA is not an exception. The global economic growth is expected to slow down in 2024, and energy prices are still relatively high as OPEC members extend oil output cuts into 2025.

Macroeconomic uncertainty might adversely affect the share price. However, from a fundamental perspective, I believe that NVDA’s earnings might be protected from macroeconomic downturns because generative AI will likely help businesses boost productivity. Workloads optimization will help enterprises to drive down costs over the long term, which means that investments in generative AI capabilities will likely not suffer much from a potential economic downturn.

Since NVDA outsources manufacturing to TSM’s foundries, complicated geopolitical condition around China-Taiwan is also a risk. However, I do not consider this risk substantial after Joe Biden’s recent reminder that the U.S. might use its forces to protect Taiwan in case of a Chinese invasion. In my opinion, public support from the president of the country with the most powerful military in the world is a big factor why military conflict between China and Taiwan is very unlikely to happen.

Bottom line

To conclude, NVDA is still a “Strong Buy”. Bears might call me crazy, but I have high conviction that the stock is still significantly undervalued. There are numerous catalysts to remain firmly bullish, as the company is uniquely positioned in the AI chips industry. The company’s revenue growth and profitability expansion amid the current AI boom is unmatched. This stellar growth is powered by vast pricing power and extremely high demand for the company’s AI chips. NVDA continued cementing its technological edge by releasing its Blackwell platform, which will likely be priced 40% higher than current offerings. That said, NVDA is well positioned to absorb accelerated spending in data centers and supercomputers by giants like AMZN, MSFT, GOOGL, and TSLA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.