Summary:

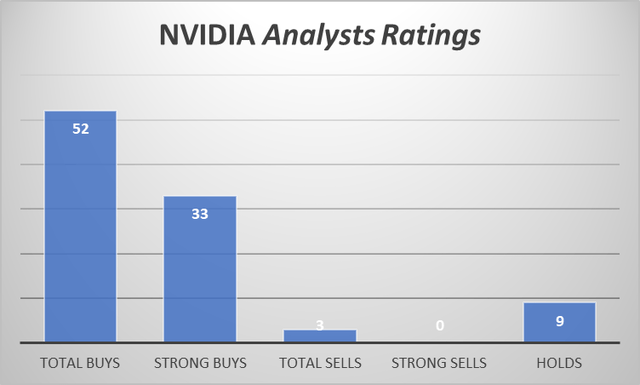

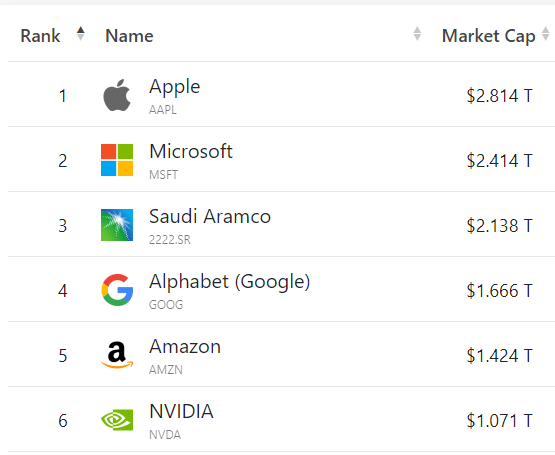

- Nvidia Corporation is now the 6th largest company in the world by market value, surpassing Tesla, Meta Platforms, and Taiwan Semiconductor Manufacturing Company.

- Studies show that companies with a price to sales ratio over 25 do not perform well over the next five years.

- Nvidia’s current price is plateauing, indicating that it may need to prove its worth before seeing significant upside.

Antonio Bordunovi

Chipmaker NVIDIA Corporation (NASDAQ:NVDA) is now the 6th largest company in the world by market value. Its market value has soared as the need for NVDA’s GPU (Graphic Processing Units) chips increased substantially with the expansion and use of AI (Artificial Intelligence).

Its market value is much larger than that of Tesla (TSLA), Meta Platforms Inc. (META), and Taiwan Semiconductor Manufacturing Company Limited (TSM).

companiesmarketcap.com

The question remains: is Nvidia stock overpriced even with the large future revenue potential for its GPUs in the AI marketplace?

In this article, we will look at 6 things that could affect the future pricing of Nvidia to try to determine whether it is a good investment at this point and time.

1. Recent studies show that companies with a price-to-sales ratio of over 25 do not perform well over the next five years

There has been a recent study done by Jeremy Siegel and Jeremy Schwartz outlining the risks of companies with a recent high price-to-sales ratio.

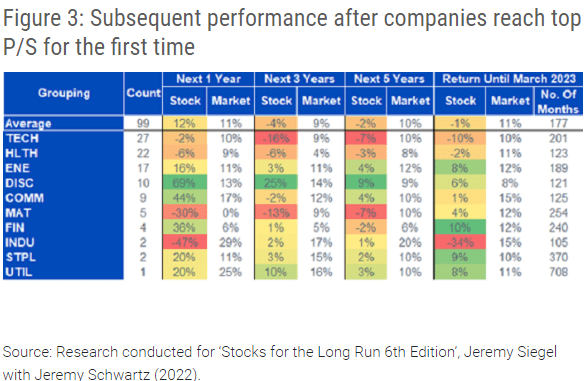

My first chart from that study shows that tech stocks in general underperform the market over several periods.

Siegel and Schwartz

Notice that when broken down into groups, on average tech stocks are one of the worst performers.

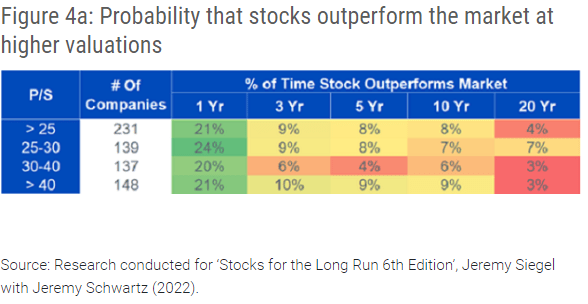

The second chart shows that of all stocks with price-to-sales greater than 25 only 21% outperform the market in the next year and only 9% after 3 years. This might be a point to consider when investing in NVDA right now.

Siegel and Schwartz

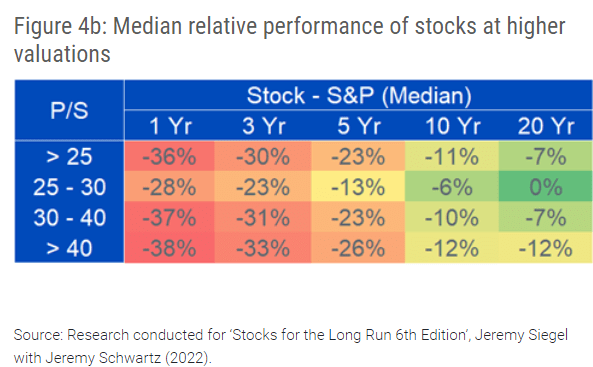

The third chart shows that all stocks with prices greater than 25x PS ratio, on average underperformed the S&P 500 (SP500).

Siegel and Schwartz

So, the point here is that very high P/S ratios should set off alarm bells for investors, although there are exceptions of course.

2. The idea that Nvidia is selling $10,000 GPUs has been greatly exaggerated

One of the main points in the lead-up to the huge price jump in NVDA shares was the widespread contention that the A100 GPU was selling for $10,000.

You only have to look as far as Amazon (AMZN) and you can see it currently has the Nvidia A100 GPU board for sale for roughly $6,800 – a very large discount from the theoretical $10,000 price.

Now, obviously very large companies like Meta Platforms (META), Google (GOOG), and Amazon would get huge discounts from that price so there is some exaggerated hype about the price of each of these boards going forward.

3. Competition in the GPU market is heating up

Besides the obvious competition coming from sources such as AMD and Qualcomm, there is also competition coming from customers themselves with Amazon, Google, and Meta all in the process or have already made their own processors both GPUs and CPUs.

Amazon has the Graviton ARM processor, Meta has its new MTIA (Meta Training and Inference Accelerator), and Google has its Tensor Chip which it says is faster and greener than the A100.

Advanced Micro Devices, Inc. (AMD) appears to be the leading source for at least some of Amazon’s new GPUs.

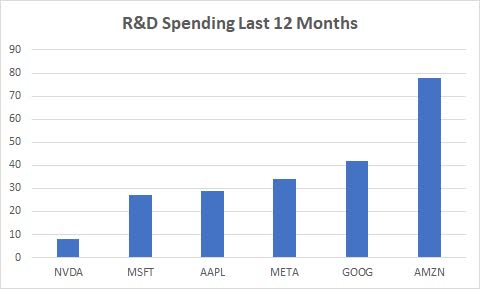

With the excessive price currently being quoted for Nvidia products that only makes sense plus custom products would fit their exact needs more than a generic product like the A100. Also, keep in mind that these companies have huge R&D budgets much larger than Nvidia’s and, therefore, can afford to do whatever research that’s necessary to produce a custom chip that exactly meets their needs.

Seeking Alpha and author

And finally relating to new competition is the coming ARM IPO with several large outside tech companies such as Intel, Google and perhaps even Nvidia itself being investors. ARM will certainly be a competitor to Nvidia in certain markets.

Of course, NVDA is not sitting still in its chase for more and more powerful GPUs. It recently announced that it is developing a new chip the GH200 Grace Hopper superchip. Supposedly, it will be in production by the end of Q2 2024, but that probably means sample/test chips with full production sometime after that. And one has to wonder: if you bought $100 million worth of A100 chips in 2023, are you going to replace them in 2024 with the new H200?

4. Nvidia’s current price is plateauing after its huge jump back in July

Looking at the chart below, we can see how Nvidia’s price is already below its high point. This may indicate that Nvidia is going to have to prove its mettle before there is any more significant upside to the share price.

The coming post-market earnings release on August 23rd will provide us with a lot more information but it will have to be even better than estimates to push the current price much higher than it is. Here’s fellow SA analyst A. J. Button’s analysis of the coming earnings release.

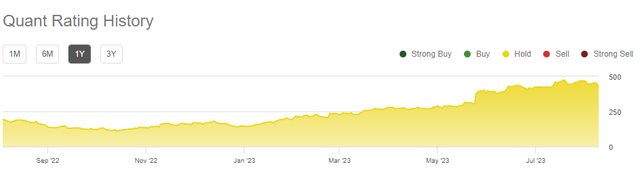

5. Seeking Alpha and Wall Street analysts are very optimistic about NVDA, but quants are less than enthused

Looking at how Seeking Alpha analysts and Wall Street analysts have rated NVDA shows most with very strong Buy ratings. With a combined 52 Buy ratings, including 33 Strong Buys, analysts are very upbeat about Nvidia’s future.

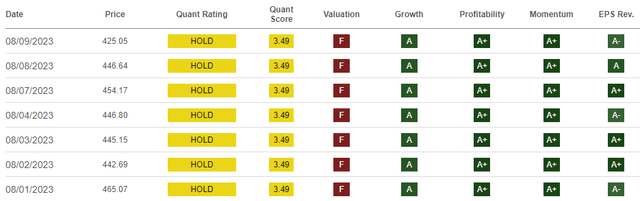

When it comes to the quant ratings, they currently have Nvidia rated as a Hold. They have had that rating for the last 12 months even after the prediction of very strong future results.

Looking at more detail, the quant ratings show an F rating for Valuation going all the way back to last year. Here’s the last week’s worth of detailed ratings.

Note all A’s except for that pesky Valuation rating, meaning the quants like NVDA a lot but think they are way over their skis when it comes to valuation.

6. The “China Put” is still lurking in the background

The “China Put” is the possible negative effect of decisions made by the Chinese government relative to any U.S. high-tech company. Recently, China restricted purchases of certain Micron (MU) products by Chinese firms.

And now we have the U.S. stepping in to restrict sales to China by U.S. chip stocks. So, now we have a two-edged sword aimed at the head of all U.S. chip companies.

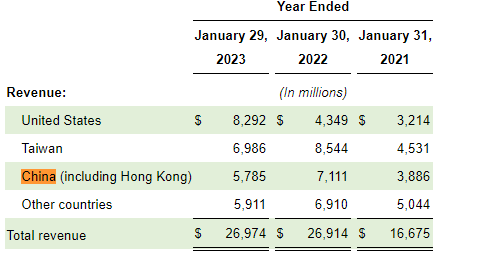

The word “China” is used 54 times in Nvidia’s most recent 10K. Note in the following chart that Chinese revenue fell from 2021 to 2022.

NVIDIA 10K

Conclusion

Investing in any stock involves an analysis of the valuation of the stock relative to all the other information available to the investor.

One way to do that is to look at the historical P/S ratio over a long period of time. The following chart shows NVDA’s P/S over the last 5 years.

Although the chart is based upon a TTM (Trailing Twelve Month) basis instead of 12-month forward earnings, it does show how exaggerated the curve has become. Now, perhaps NVDA will meet all expectations currently being expected of it but that chart above showing nosebleed valuations should give investors pause.

Due to the lofty valuation, I agree with the quants: Nvidia Corporation is a Hold until it proves its rich valuation is deserved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.