Summary:

- Nvidia holds a 90% market share in data center GPUs, driving dominance in AI hardware infrastructure for cloud providers.

- The AI chipset market is projected to grow at 34% annually from 2024 to 2032, fueling Nvidia’s long-term growth.

- Nvidia’s GB200 NVL72 system delivers 30x faster LLM inference, with 4x improvement in training speed and 25x energy efficiency.

- Projected quarterly revenue growth for Nvidia is 81.6% YoY for Q3 fiscal 2025, with 35.4% YoY growth by fiscal Q4 2026.

- Nvidia’s 820% market cap surge since 2023 versus the S&P 500’s 43% raises concerns of overvaluation and potential correction risks.

Vertigo3d/E+ via Getty Images

Investment Thesis

In our latest analysis of NVIDIA Corporation’s (NASDAQ:NVDA), we highlighted a potential rebound following a pullback in September, supported by technical indicators pointing to bottom formation. Since then, the stock has surged 15%, validating our expectations. Technical indicators suggest ongoing positive momentum, with no immediate signs of overbought conditions, implying room for further growth. Additionally, volume trends point to increased buying pressure, reinforcing the potential for continued price appreciation in the near term.

From a fundamental and long-term perspective, Nvidia remains unchallenged in AI hardware leadership, with an estimated market share of 90% in the data center GPU. This segment is fundamental to powering the AI infrastructure of major cloud providers. With AI chipset growth forecast to increase 34% per annum to 2032, Nvidia will be even more specialized to take advantage of such a trend and set up for continued revenue growth and dominance in the rapidly changing AI space.

Is Nvidia Stock Poised for a Breakout or Pullback?

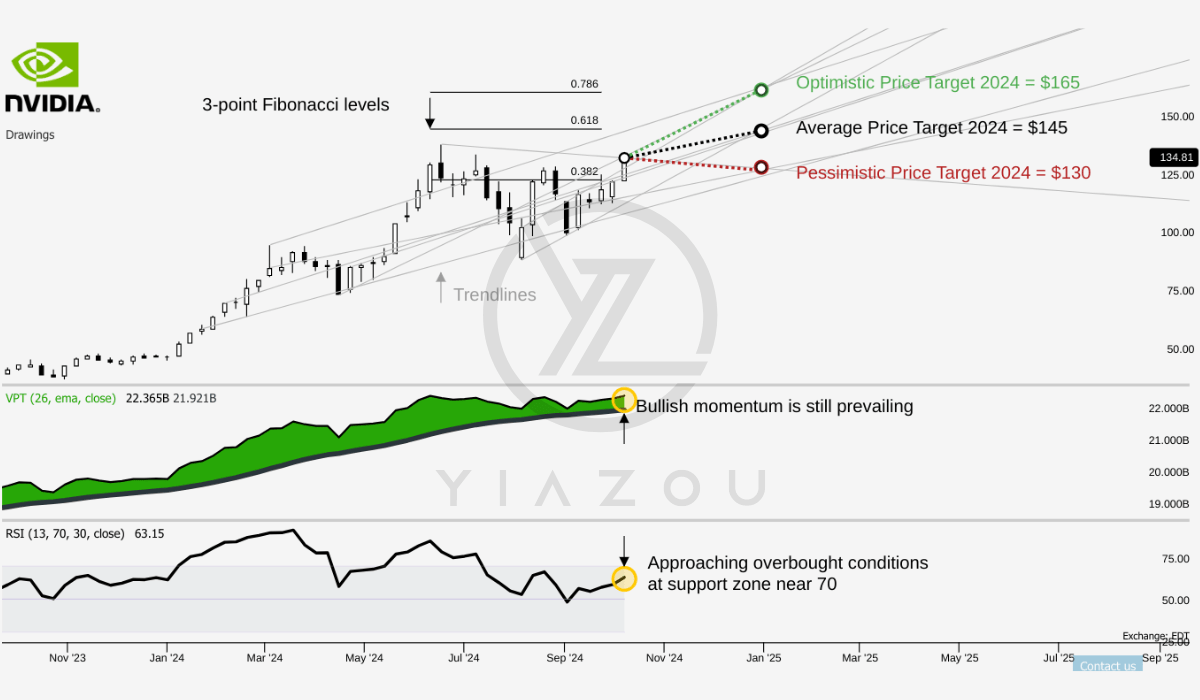

NVDA’s current price of $134 sits near the pessimistic target of $130, which aligns with the 0.382 Fibonacci level, suggesting potential downside risk if negative market forces prevail. However, the average price target of $145 aligns with the 0.618 Fibonacci level, which implies a moderate upward trend based on market recovery expectations. The optimistic price target of $165 reflects a more aggressive outlook consistent with the 0.786 Fibonacci level and indicates significant upward momentum if bullish market conditions dominate.

Moreover, the RSI of 62.29, with no visible bullish or bearish divergence, supports a neutral but gradually strengthening trend. The upward RSI line suggests growing momentum, though it remains below overbought territory (around 70). This indicates room for continued upward movement without the imminent risk of a correction.

Lastly, the Volume Price Trend (VPT) line further corroborates the upward bias, currently at 22.33 billion and above its average of 21.92 billion. This divergence points to increasing volume accumulation that signals buying pressure and potential for price appreciation in the near term.

Yiazou (trendspider.com)

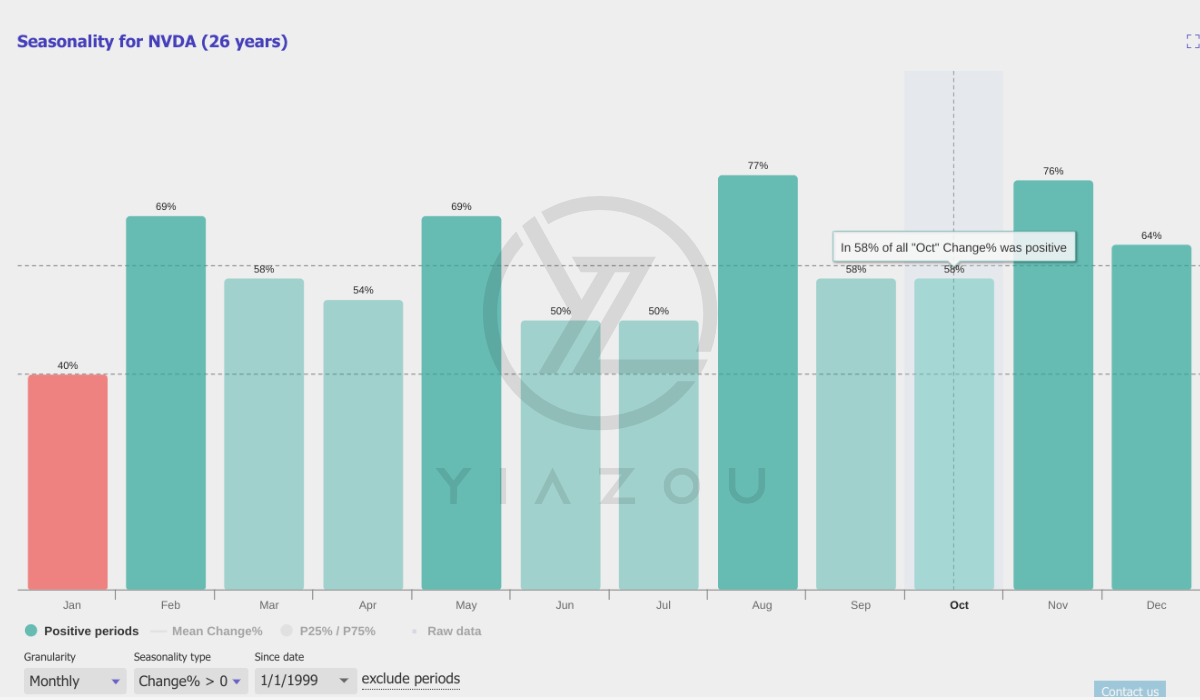

Based on the seasonality data over the past 26 years, NVDA shows a 58% chance of positive returns in October, which is favorable for short-term investors. This suggests a moderately optimistic outlook for the month, although the probability is lower compared to stronger months like August and November, where positive returns reached 77% and 76%, respectively.

Yiazou (trendspider.com)

Stable Leadership in the AI Hardware Market

One of Nvidia’s most compelling fundamental strengths is its stable lead in the AI hardware market. This is mainly in data center GPUs, which hold ~90% of the market share. The data center GPU market is vital for cloud computing providers such as Amazon (AMZN) AWS, Google (GOOGL) (GOOG) Cloud, and Microsoft (MSFT) Azure, which rely heavily on Nvidia’s AI hardware.

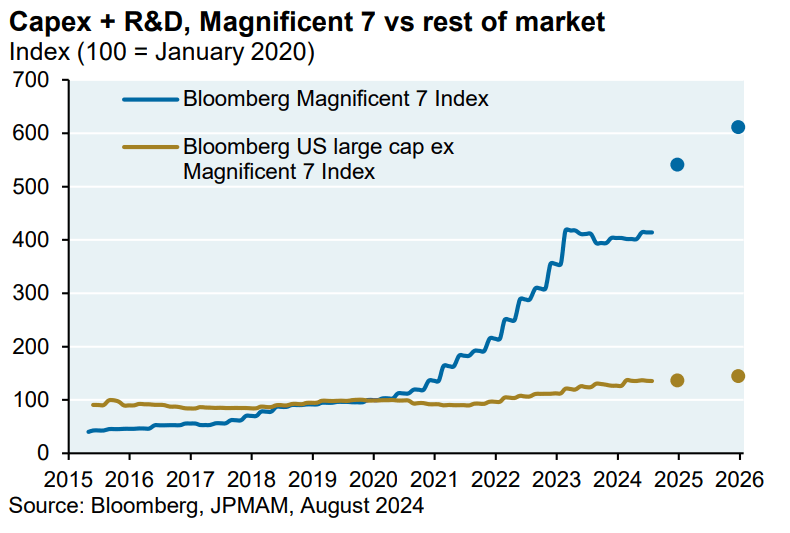

Since 2020, Nvidia and “Magnificent 7” have substantially increased their CapEx investment and R&D at a rate much faster than that of the rest of the large-cap market. In light of this recent spending spree, with Nvidia’s dominant share in the data center GPU market, it is showing that it will stop at nothing to protect its pole position in the AI hardware world.

JPMorgan

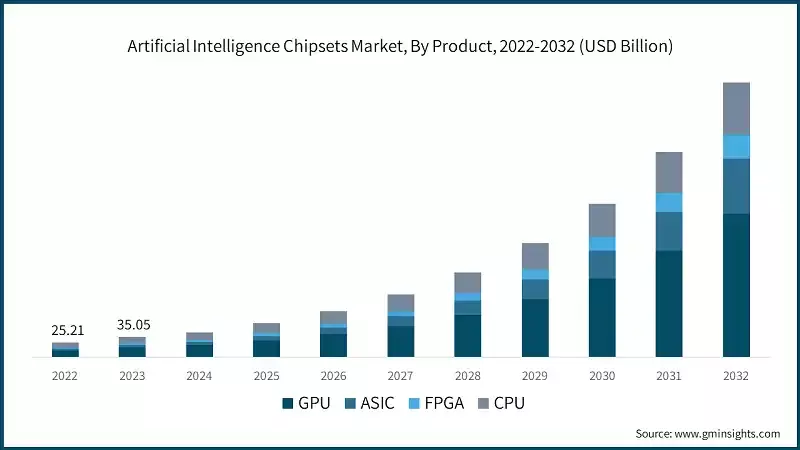

Despite some of these cloud giants and Nvidia’s competitors, such as AMD (AMD), trying to develop competitive and cheap AI chips, Nvidia’s lead remains largely unchallenged. The broader AI chipsets market may grow at an annual growth rate of 34% from 2024 to 2032, supporting Nvidia’s efforts to capitalize on the demand for AI hardware infrastructure.

gminsights.com

Nvidia’s revenue trends reflect its ability to support rapid growth. The company’s Q2 fiscal 2025 held staggering year-over-year (YoY) and quarter-over-quarter (QoQ) growth in its compute segment. This includes its core AI GPU business, which has reported $22.6 billion in revenue for Q2 with a 162.47% YoY growth and a 16.56% QoQ growth. This level of annual expansion points to massive AI computing solutions, particularly for large-scale models and training infrastructure.

Similarly, the networking segment also delivered robust growth, generating $3.7 billion in Q2 fiscal 2025 (+114.38% YoY and 15.67% QoQ). Nvidia has created a cohesive ecosystem for top-line growth by integrating networking solutions with its compute offerings. The ecosystem supports the end-to-end requirements of AI workloads, making it a fundamentally vital tech requirement for enterprises and cloud providers.

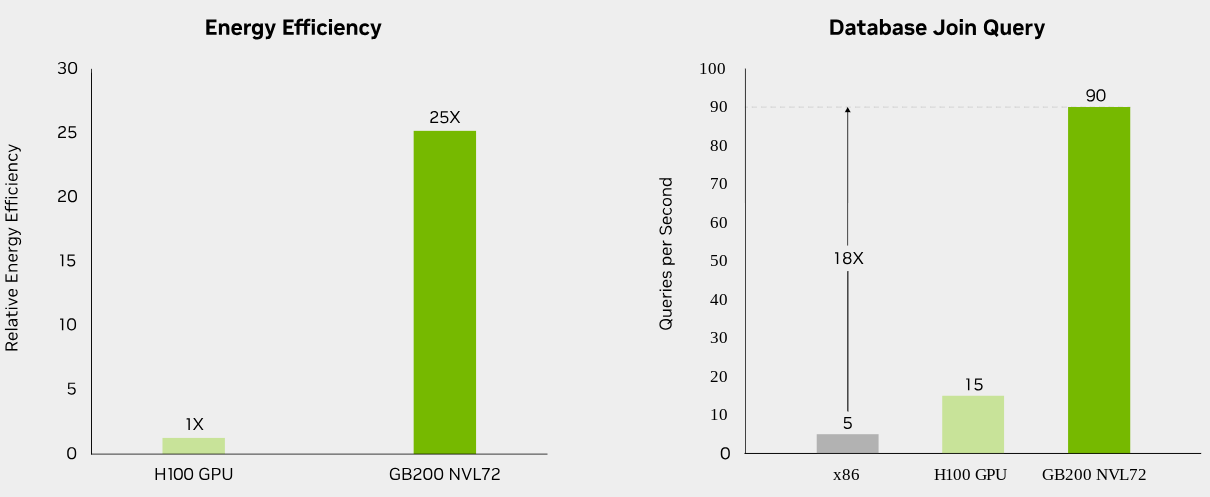

Nvidia’s GB200 NVL72: Revolutionizing AI Speed, Efficiency, and Market Growth

Technically, this pattern of rapid revenue growth across AI chip segments marks Nvidia’s scalable business model and its capability to release products to capture increasing demands from its clients. For instance, its new GB200 NVL72 system is designed to handle real-time trillion-parameter models. This system combines 36 Grace CPUs and 72 Blackwell GPUs in a rack-scale design with a liquid-cooled, high-performance infrastructure. This can deliver 30 times faster real-time large language model (LLM) inference against the Nvidia H100 Tensor Core GPU.

In terms of numbers, the GB200 NVL72 holds a 4X improvement in LLM training speed, a 25X increase in energy efficiency, and an 18X boost in data processing speed against CPUs like the Intel Xeon 8480+. These performance metrics are critical for enterprises and cloud providers that manage complex AI workloads. The energy efficiency gains, particularly, are vital as they address one of the most significant issues in AI hardware today (power consumption).

nvidia.com

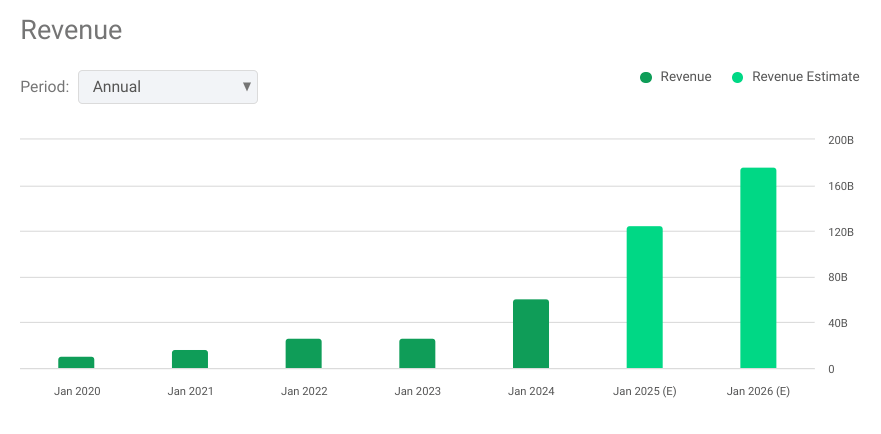

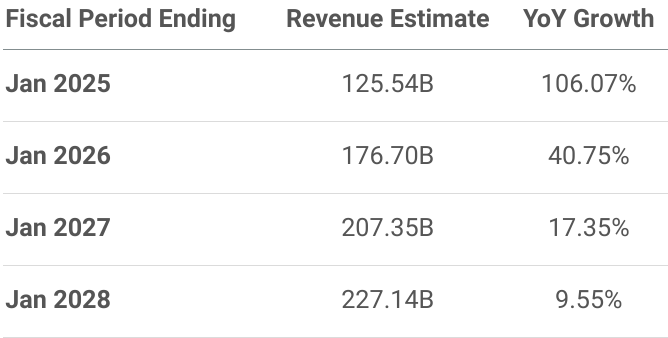

Furthermore, Nvidia’s strong market returns are also supported by earnings growth and the industrial benefit of the broader AI ecosystem. With quarterly revenue growth expected to hit 81.6% YoY for Q3 fiscal 2025, Nvidia’s top-line growth may remain robust. However, quarterly, its YoY revenue growth may hit 35.4% by fiscal Q4 2026 (Jan 2026) based on current market projections reflecting the potential of the company’s product pipeline. Similarly, annual consensus revenue estimates still hold triple-digit top-line YoY growth (106.07%).

seekingalpha.com

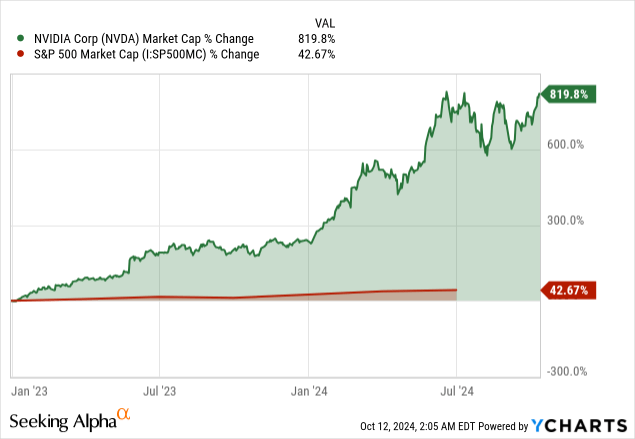

Nvidia’s 820% Surge: Is the AI Hype Setting the Stock Up for a Risky Fall?

Nvidia’s market value expansion led to a massive divergence relative to the overall US market performance (broader S&P 500 index). From January 2023 to June 2024 (18 months), Nvidia’s market capitalization surged by 820%, whereas the S&P 500 saw only a 43% increase in market cap over the same period. This stark contrast in growth rates indicates a significant decoupling between Nvidia and the broader market, raising concerns over whether the ongoing extreme AI spending and adoption benefits the market or only Nvidia. If it is just Nvidia, the stock performance may not stand over the long term.

Similarly, a surge of over 7X in the market cap means street expectations have elevated drastically. This may lead to a situation where Nvidia is priced for near-perfect execution and continued exponential growth. If Nvidia’s earnings, revenues, or growth trajectory falters (even slightly), its stock could face severe downward pressure due to the high expectations baked into its market valuation.

Nvidia’s high reliance on AI-related revenues presents another potential weakness based on the gap between expected revenues and the costs associated with AI infrastructure. The total costs for AI data centers with Nvidia’s GPUs may vastly outweigh the new revenues. As per Sequoia partner David Kahn, the annual spend on AI data centers will reach $500 billion, with the projected new AI revenues for companies like Google, Apple (AAPL), Microsoft, Meta (META), and others amounting to significantly less.

According to Cledara, while AI adoption has increased by 245% over the last 12 months, only 47% of companies see tangible value from their AI investments. Only a few companies-just 24%-are hitting cost reductions through greater operational edge. At the same time, only 11% of companies have yielded revenue growth. This disconnect between the required capital expenditure and the incoming revenue stream could limit growth potential.

Suppose these big tech companies cannot attain a return on investment in AI as fast as anticipated. In that case, it may become challenging for smaller firms to derive tangible benefits from AI spending. This may curtail spending on AI tech and directly impact Nvidia’s capability to sustain its recent rapid top-line growth.

Given its dominance in AI hardware, Nvidia’s revenue estimates are aggressive but plausible. Short-term growth projections of 106% for FY 2025 and 41% for FY 2026 reflect the current AI boom driven by high demand for its GPUs. Eventually, growth is expected to stabilize after 2027 as Nvidia matures, with YoY growth tapering to around 6-12% by 2030.

seekingalpha.com

Takeaway

Nvidia’s leadership in the AI hardware market and projected 34% annual growth in AI chipsets, positioning it for sustained success. However, Nvidia’s heavy reliance on AI and high market expectations present risks if growth falters, though current revenue estimates remain relevant.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.