Summary:

- Nvidia Corporation has experienced significant growth in stock price and financials, driven by the AI industry’s expansion.

- Nvidia dominates the AI chipset space, but is facing long-term competitive pressure from other players.

- Strong fundamentals and potential for more growth, but we examine its real value to see if it’s too risky for investors to enter at current levels.

Antonio Bordunovi

Nvidia Corporation (NASDAQ:NVDA) has seen huge growth recently, not only in its stock price but also in its company financials. The artificial intelligence (“AI”) industry has been compared to the Internet boom in the early 2000s, with continued growth in the total addressable market in the short and long term. Nvidia’s data center products have seen tremendous growth in annual reporting for 2023 and current quarters in 2024. Cost ratios during the annual 2023 report showed reductions as utilization of manufacturing lines drives efficient operations for the chipset industry. Overall, a strong 2023 year and continued expectation of growth are driving this company at the moment.

Short-term, Nvidia has dominated the chipset AI space. Long-term competitive pressure will increase as other players such as Advanced Micro Devices (AMD), Qualcomm (QCOM), Apple (AAPL), and others begin to enter or reduce their risk away from only Nvidia AI chipsets. Aside from the long term, recent quarters have shown some revenue decline from the previous highs, likely signaling a correction in the stock is due. Most growth has likely been baked into the stock now, making current levels risky for investors to enter. AI applications have also still lagged a bit in the industry, bringing skepticism to current total addressable market, or TAM, estimations. These headwinds can impact Nvidia in the short and long term.

When considering these current stories about Nvidia, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Nvidia has seen tremendous growth in its mainstream data center product due to AI. Expectations for this technology and increased sales have driven large gains in the stock. As the industry continues to grow and refine, Nvidia is well-positioned to capitalize on that growth. Some challenges that Nvidia will face come in the form of competitive pressure, recent quarterly earnings decline, and large growth already baked into the stock price. These competing outcomes put the stock in a very interesting position, with a focus on the short-term and long term being critical to evaluate potential outcomes.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Nvidia is currently trading at a bargain price. I provide various situations, which help estimate the company’s future returns. In closing, I will tell you my opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

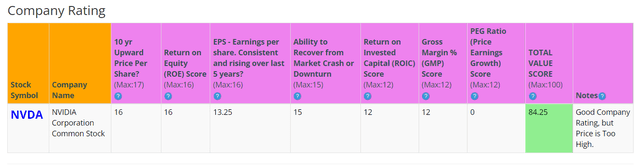

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Nvidia shows a rating score of 84.25 out of 100. In summary, Nvidia has strong fundamental financials.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

Fundamentals

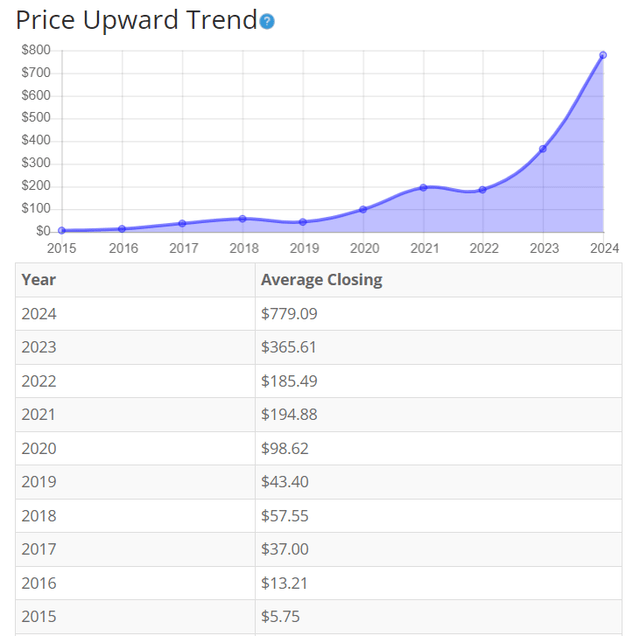

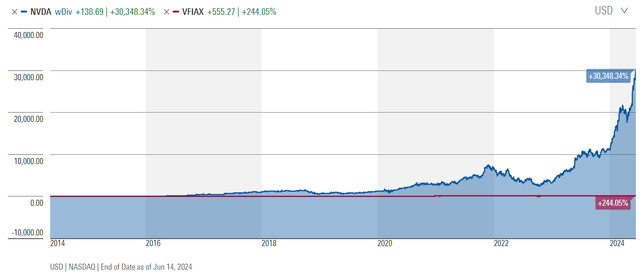

The share price has seen a continued rise every year over the last 9 years. The stock has continued to surge due to large sales beats for its data center business. Artificial intelligence continues to be all over Nvidia’s roadmap, which drives continued stock gains. The large exponential spike is mainly driven by a doubling of the company’s revenue due to AI chipsets. Nvidia also owns a competitive advantage in terms of performance over its nearest competitor. Overall, the share price average has grown by about 13,449.39% over the past 10 years, or a Compound Annual Growth Rate of 72.54%. This is an unheard-of return!

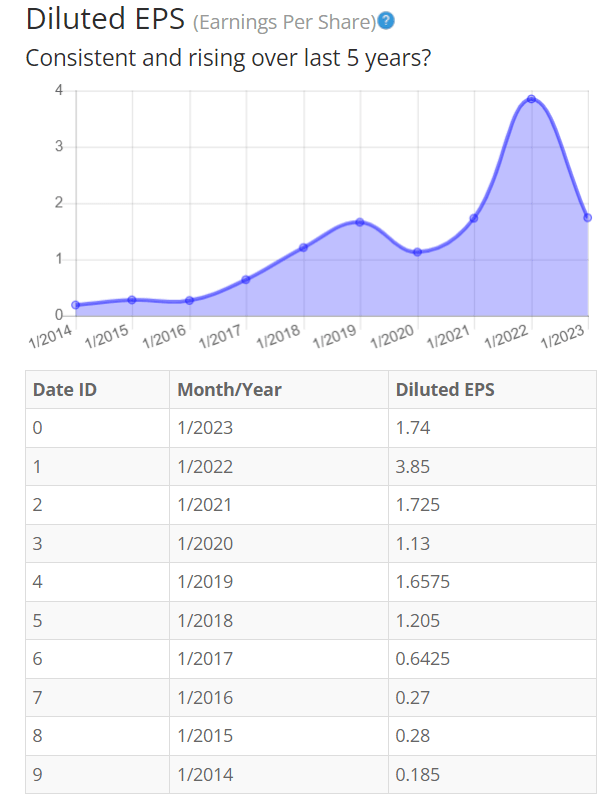

Earnings

Earnings per share have steadily risen, with down spikes before recovery. The company has continued to drive higher sales and earnings every year over the previous years. The main reason for EPS declines is due to stock splits the company has performed. The other reason was driven by chipset component supply chain shortages and increased research and development costs, impacting operating margin performance. In recent quarters, there has been a pullback from top-line growth and a recent stock split that will impact future EPS.

BTMA Stock Analyzer

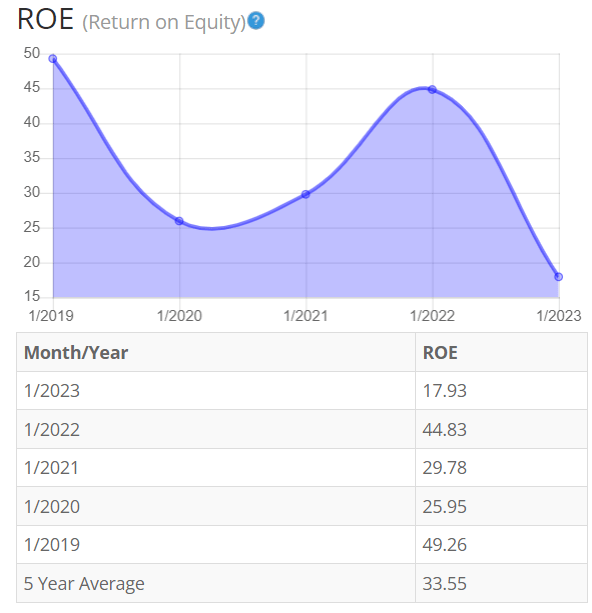

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

Return on Equity

The return on equity has fluctuated the last 5 years. Nvidia’s Data center solutions maintained good sales due to remote work driving adoption of cloud infrastructure in many large organizations. This explains the rise of ROE during the COVID pandemic, even with component supply chain shortages. Nvidia outpaces its closest competitors in the market by a sizeable margin. In essence, companies are willing to pay a premium for Nvidia’s chipsets. In the upcoming year, I expect ROE to rebound, but it may not hit its previous high due to large stock gains outpacing revenue growth. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Nvidia exceeds this requirement.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 63 Semiconductor companies is 12.61%.

Therefore, Nvidia’s 5-year average of 33.55% is far above its peers.

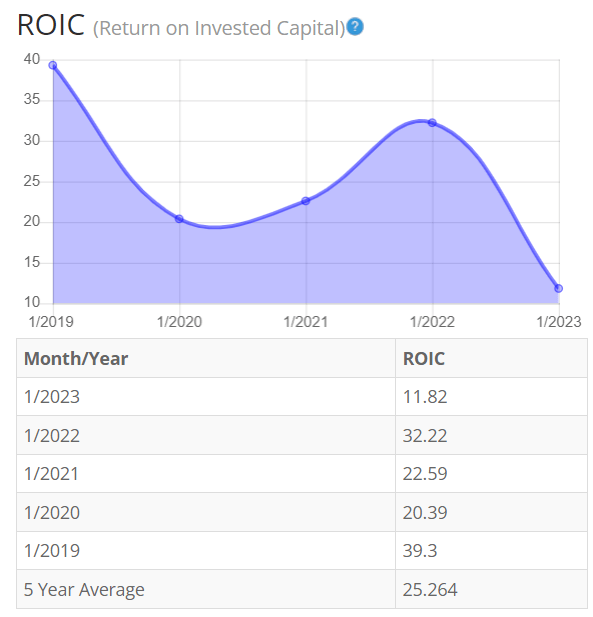

Return on Invested Capital

The return on invested capital follows a similar trend as the other fundamentals. The company has maintained a stable capital expenditure, continuing to invest in property, plant, and equipment to produce its chipsets. Since the invested capital has remained consistent, the ROIC is mainly driven by operating profit of the company. The operating profit for the company has hit record highs in 2023 and should see a large spike once updated in the chart. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, Nvidia exceeds this requirement.

BTMA Stock Analyzer

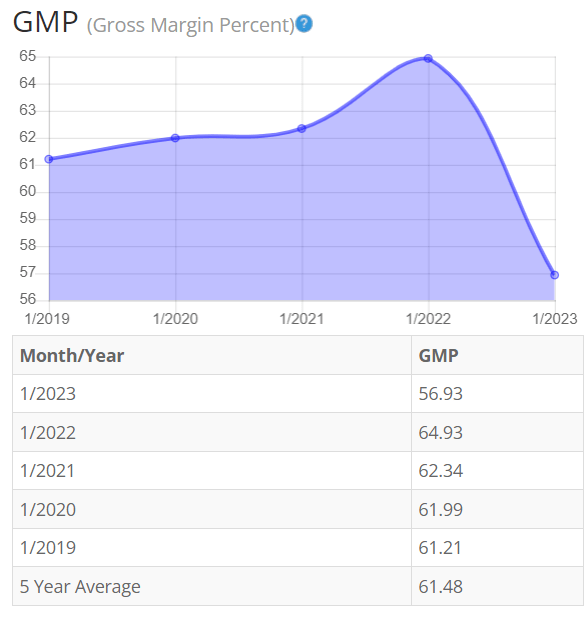

Gross Margin Percent

The gross margin percentage (GMP) has remained stable over much of the last 5 years, outside the recent year driving down the margin. Semiconductor manufacturing businesses tend to maintain high utilization to keep costs low. The driver of the down year for gross margin was mainly driven by component shortages driving direct costs higher. I expect a rebound in gross margin percentage in the next year as manufacturing utilization has continued to rise as Nvidia’s data center chipsets continue to grow sales.

I typically look for companies with gross margin percent consistently above 30%. So, Nvidia is above this criterion.

BTMA Stock Analyzer

Financial Stability

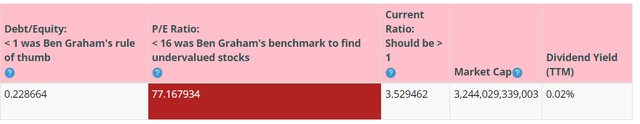

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. The company shows low long-term debt and the ability to raise more capital, if need be, in the future.

Nvidia’s Current Ratio of 3.52 indicates it can pay off short-term debt with its current assets.

Ideally, we’d want to see a Current Ratio of more than 1, so Nvidia exceeds this amount.

Nvidia shows a strong balance sheet, aside from being potentially overvalued with a high P/E ratio. The company would have to continue to grow and capture more of the AI industry as the size of the industry grows.

Nvidia does pay a tiny quarterly dividend. However, most investors buy NVDA for the stock growth, not the dividend.

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 77.16 indicates that Nvidia is overpriced when comparing Nvidia Ratio to a long-term market average P/E Ratio of 15.

The 10-year and 5-year average P/E Ratio of NVDA has typically been 55 and 75, respectively. This indicates that NVDA could be currently trading at a high price when comparing to its average historical P/E Ratio range.

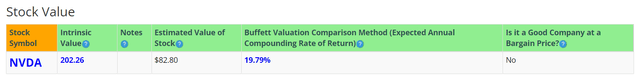

The Estimated Value of the Stock is $82.80, versus the current stock price of $131.25. This indicates that Nvidia is currently selling above its value.

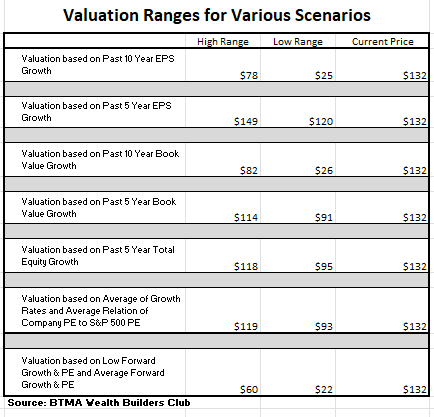

For more detailed valuation purposes, I will be using a conservative diluted EPS of 1.19. I’ve used various past averages of growth rates and P/E Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

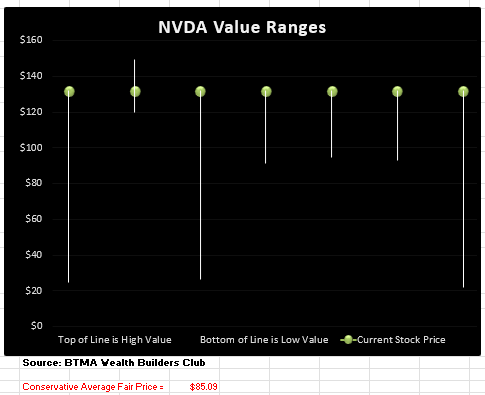

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

This analysis shows an average valuation of around $85 per share versus its current price of about $132, this would indicate that NVDA is significantly overpriced.

Summarizing the Fundamentals

After analyzing the fundamentals of Nvidia, I believe this company has a strong fundamental balance sheet with the potential for continued growth. Price per share has risen in the last 9 years as the AI movement and remote work have driven large sales in Nvidia’s chipsets. EPS, ROIC, ROE, and GMP have all fallen in 2023 due to increased costs from component shortages in 2022 and research and development costs. I expect a rebound of these metrics with the large revenue growth Nvidia has seen in 2023 that will show up in 2024’s annual report. Overall, the company maintains strong fundamentals with potential for continued growth.

In terms of valuation, my analysis indicates that the stock is significantly overpriced.

Nvidia Vs. The S&P 500

Now, let’s see how Nvidia compares versus the US stock market benchmark S&P 500 Index (SP500) over the past 10 years. From the chart below, Nvidia has crushed the overall market in returns, making the S&P look like it is a flat line. The stock growth has accelerated over the last year due to the AI boom and expectations of a continued growing market. I expect the company to continue to overperform as the market continues to expect a massive AI boom.

Forward-Looking Conclusion

Over the next five years, the analysts who follow this company are expecting it to grow earnings at an average annual rate of 46.35%.

In addition, the average one-year price target for this stock is $120.82, which is about an 8.3% decrease in a year.

The Expected Annual Compounding Rate of Return is 19.79%.

Does Nvidia Pass My Checklist?

- Company Rating 70+ out of 100? Yes (84.25)

- Share Price Compound Annual Growth Rate > 12%? Yes (72.54%)

- Earnings history, mostly increasing? Yes

- ROE (5-year average 16% or greater)? Yes (33.55%)

- ROIC (5-year average 16% or greater)? Yes (25.26%)

- Gross Margin % (5-year average > 30%)? Yes (61.48%)

- Debt-to-Equity (less than 1)? Yes

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? Yes

- Do I think this company will continue to successfully sell the same main product/service for the next 10 years? Yes

Nvidia scored 10/10 or 100%. Therefore, Nvidia is definitely worth considering as an investment. But we still need to determine if it’s selling at a bargain price.

Is Nvidia currently selling at a bargain price?

- Price Earnings less than 16? No (77.16)

- Estimated Value greater than the Current Stock Price? No (Value $82.80 < $132 Stock Price) and (Detailed Valuation Analysis $85 < $132 Stock Price).

Nvidia has a strong balance sheet and a growing product portfolio. The AI industry and growing cloud infrastructure continues to drive meaningful growth in sales. Nvidia also has better-performing chipsets than anyone currently in the industry, and it could take many years for competition to catch up. Aside from some recent supply shortages and increased research and development costs to maintain its competitive edge, Nvidia has maintained strong fundamentals even with decreases in the chart. I expect a large rebound as the sales growth from 2023 are considered. The price-to-earnings ratio is considerable for this company, but is still farther below its nearest competitor, AMD. Overall, there is nothing not to like about the fundamentals of Nvidia at this time, but I would still proceed with caution.

I cannot recommend entering a position into this company currently unless you are a momentum trader. The current stock price has baked in massive growth, and we have already seen a recent quarter with declining revenue. Logically, it makes sense that there should be a correction so that the stock price would more closely represent the stock value. However, the market and investor behavior doesn’t always make logical sense.

I see NVDA as a great fundamental company that is currently winning a popularity contest. As the media keeps promoting the company and AI, the share price keeps rising. As the share price rises, people keep investing in NVDA to join the bandwagon and to ride that momentum.

While this pattern continues, the stock could continue to rise more and to become even more outrageously overpriced. But eventually, if the earnings don’t live up to the share price, and if NVDA becomes too overpriced, there will be a correction. That could be an ideal time to invest in NVDA. Unfortunately, I don’t see NVDA falling to a bargain price anytime soon.

A similar situation occurred with Tesla (TSLA). Tesla’s share price rose to levels that didn’t make logical sense years ago. Then, eventually, it corrected to more reasonable levels. Long term, I believe that NVDA is a winner and will be a staple in portfolios like Apple, Google, Amazon, etc. My advice is to wait for an entry point when the stock falls to a more reasonable level and to hold long term and watch it grow with the AI industry. On a side note, you could also look for tertiary stocks which will benefit from the AI industry that have not caught this upswing yet.

In closing, I will add Nvidia Corporation stock to my watch list, but I’m not ready to invest in this company until it comes back down, to at least a fair price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.