Summary:

- Nvidia Corporation overtook Apple Inc. by market cap to become the second-largest company in the world. How much more growth is there?

- The company’s strong position in AI infrastructure and its potential for market growth indicate stability and high revenue potential.

- However, even with optimistic assumptions that Wall Street is wrong again, Nvidia may still be overvalued by 8-25%, based on my DCF model.

- Don’t burn your hands by buying Nvidia stock at its current peak. I suggest taking a wait-and-see approach and waiting for Nvidia to fall at least 20-30% from current levels – only then should you look for “but-the-dip” opportunities.

Tim Robberts/DigitalVision via Getty Images

Introduction

While everyone is discussing Nvidia Corporation (NASDAQ:NVDA) overtaking Apple Inc. (AAPL) by market capitalization to become the second largest company in the world, and how bearish a sign – CEO Jensen Huang’s autograph – can be, I decided to take a sober look at what is happening and understand how justified the recent rally was from a fundamental perspective.

I want to make a disclaimer right at the outset: I have long been skeptical about how high NVDA could go in the short term. Unfortunately for my coverage history – and fortunately for buyers of Nvidia stock – my bearish rating aged like milk.

Seeking Alpha, my coverage of NVDA

My last article was based on the construction of a discounted cash flow, or DCF, model that included what, I thought, were the most optimistic /realistic assumptions at the time – even considering the bullish view, the stock seemed too pricey back then, which didn’t stop it from increasing its market cap by another 1/3. If you think about it, in the last 6 months, NVDA has added a market cap equivalent to Amazon’s (AMZN) current market cap. This is absolutely insane and probably indicates that the market no longer wants to be wrong with its predictions about NVDA’s growth rates, repricing it daily.

Now, let me update my DCF model with new, fresh data and see if much has changed in the last quarter and how it affects the output.

Is Nvidia Really That Overvalued Today?

First off, let’s figure out why NVDA is growing like crazy lately. After the major product announcements at Computex Expo, BofA analysts (proprietary source) noted that NVDA’s strong leadership in AI infrastructure is driven by the following factors:

- GB200 NVL2 Platform: Featuring two Blackwell GPUs and two Grace CPUs, suitable for mainstream large language model (LLM) inference applications and scalable configurations.

- MGX Modular Reference Design: Now supported by over 90 systems, up from 14 last year, including upcoming AMD and Intel CPUs.

- New AI offerings including Blackwell Ultra for 2025 and Rubin for 2026, alongside new CPU, SuperNIC, and switch products.

This is significant information for us because on its basis we can assume that NVDA’s market position is likely to remain stable for longer than many previously expected, looking at the competitive offering from Advanced Micro Devices (AMD) or assuming in-house progress made by some MAG 7 companies.

Okay, let’s assume that this will be the case. But how big is the market we’re referring to? According to a study by Statista (very recent data – from May 29, 2024), the GPU market is expected to be worth ~$274.21 billion in 2029.

In other words, the market size is, roughly speaking, the annual turnover of all GPU manufacturers at a given point. But how much from it will NVDA earn by then? Wall Street predicts that about 89%:

In fact, it’s not just about GPUs – the expansion of the offering suggests that Nvidia’s total addressable market (TAM) will grow much faster. At the February earnings call, management predicted that generative AI will drive a “doubling of the world’s data center infrastructure installed base”, basically bringing in hundreds of billions in annual sales.

Generative AI has kicked off a whole new investment cycle to build the next trillion dollars of infrastructure of AI generation factories. We believe these two trends will drive a doubling of the world’s data center infrastructure installed base in the next five years and will represent an annual market opportunity in the hundreds of billions.

Analyst Decoder Ring quickly calculated that the company’s TAM for data center semis will grow from $250 billion this year to $500 billion in 5 years in that case, with $250 billion primarily in AI, representing massive market growth. From the latest IR presentation, NVDA’s appetite seems to be growing, and the company sees about $1 trillion in TAM over the long term, which looks like something unattainable today.

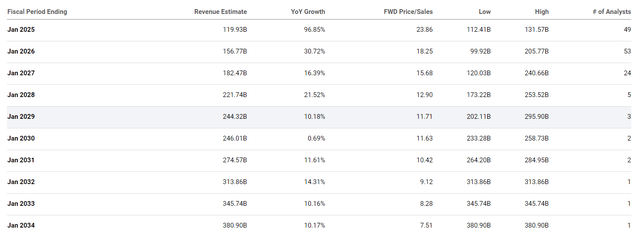

Let’s assume once again that Wall Street is still underestimating the company’s sales growth potential in much the same way as before, despite a number of positive sales revisions in the last three months.

Seeking Alpha, NVDA’s sales revisions

According to Seeking Alpha, Wall Street expects NVDA’s revenues to grow at a CAGR of 12.25%. Let’s assume that the average annual revenue estimate surprise will hold at around 2% – that’s precisely the premium on the revenue growth forecast that I will add to the current expected growth rates in my DCF model.

Even though Nvidia operates in a cyclical industry with constantly changing market conditions, let’s assume that the current cycle turns out to be very long and constant – this will enable the company to achieve consistently high EBIT margins.

To maintain a leading position in the high-tech industry, constant expenditure on R&D and CAPEX is necessary – I therefore expect the CAPEX-to-sales ratio to level off at around 2% of sales.

This is what my DCF model looks like at this stage:

Now let’s talk about the discount rate. Today, Nvidia’s liquid bonds are trading at a yield of ~4.7% (bid/ask) – I assume this is what the company’s cost of debt would look like today. Assuming an effective tax rate of 15%, a risk-free rate of 4% (which is intentionally set lower than the current 10-year note of 4.3%), and a market return premium (MRP) of 5%, I get a WACC of 12.7%, which looks good given the Fed’s still-restrictive policy.

The most difficult thing now is to predict at what rate Nvidia’s FCF will grow eventually, or at what EV/FCF the company will trade at the end of the forecast year. I assume that the market will be saturated at some point (which is logical) and the growth rate of the forecast period will be lowered. Let it be 8-10% (or 9% in the middle). As for EV/FCF, today’s multiple of 76x seems too high to me – given that growth rates will inevitably fall by FY2028, which is implied by sales growth assumptions, I think EV/FCF should be in the 35-40x range, which is close to the 10-year median.

So, all these assumptions lead me to the following conclusions:

FinChat, the author’s notes added

In other words, if we round up, NVDA turns out to be 8-25% overvalued, even if we assume that Wall Street analysts are wrong again and their forecasts once again underestimate the company’s true growth potential (by the same amount as recently).

Why Nvidia Stock May Go Way Higher Anyway?

Nothing is perfect – my model is perhaps even more optimistic than what I offered you above. If we assume that the EBIT margin stabilizes at 75% rather than 65%, which can be considered an absolute anomaly, and the company’s FCF grows by 10% rather than 9%, then Nvidia’s stock is undervalued by about 16% according to my DCF model:

FinChat, the author’s notes added

Without changing this scenario, but assuming that the EV/FCF is around 50x by the end of 2028, the upside potential will be even higher:

FinChat, the author’s notes added

Financial modeling is always an attempt to quantitatively predict the future, which is inevitably impossible by definition. A person can’t always accurately predict tomorrow’s weather, let alone the revenue and profit margin of an individual company.

Nvidia may still be cheap today. So the analysts at BofA conclude that Nvidia is undervalued by 22.5% (the price target of $1,500), and it makes sense if you buy into their reasoning:

BofA’s report, proprietary source

If you think that the BofA analysts are too optimistic, then you should consider that the analysts at Argus Research (proprietary source) are even more bullish and see the NVDA stock “fair” price 83.7% higher than today’s price:

On our forward-looking DFCF valuation, NVDA is valued in the $2,800s, well above current prices and in a sharply rising trend. Our blended valuation is above $2,250, also in a very fast-rising trend.

If they are right, then Nvidia will have to add another $1-2 trillion to its today’s market cap.

The Verdict

Despite the upside risks and my past coverage poor performance, I believe that NVDA is approaching its local peak from a fundamental point of view. Going forward, it will definitely be very difficult to satisfy investors because even if earnings continue to outperform, the fair valuation will remain above the norm, as my DCF model showed today. I don’t see any margin of safety at the moment. The growth story seems impressive to me – especially the pace of TAM expansion – but the risks of a deep setback if Wall Street’s inflated expectations are missed even minimally have also increased significantly. I suggest taking a wait-and-see approach and waiting for NVDA to fall at least 20-30% from current levels – only then should you look for “but-the-dip” opportunities. I hope that potential buyers will have such a chance shortly.

TrendSpider Software, NVDA daily, the author’s notes added

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!