Summary:

- Nvidia Corporation’s quarterly and annual earnings were excellent, with revenue and earnings per share seeing significant growth.

- The company’s growth is largely driven by its data center segment and the increasing demand for AI processing.

- However, there are risks to Nvidia’s sustainable growth, including U.S.-China relations, competition from peers, and the cyclical nature of the semiconductor industry.

Justin Sullivan

A lot has happened since my last article on Nvidia Corporation (NASDAQ:NVDA). The last set of quarterly earnings was a true blowout. The net profit surged to incredible highs, and many investors got excited. Although the development was a positive, I would still take the results announcement with a pinch of salt. Here are my thoughts about Nvidia, its earnings and valuations.

Recap of my previous article

In my previous article on Nvidia, I wrote about the company’s high profitability in comparison to its peers. I also praised the company’s liquidity position. But Nvidia also faces numerous risks due to its reliance on China and Taiwan in terms of revenues. The U.S.-China relations might deteriorate any time soon. Moreover, the earnings surge seemed unsustainably high, whilst the valuation ratios were elevated compared to the company’s rivals.

Well, the fundamentals have not changed too much even though the general market is even more optimistic about the stock thanks to Nvidia’s impressive earnings results.

Earnings results

The quarterly and annual results were truly excellent. A lot has already been written here on Seeking Alpha about these. But I will briefly touch on the main points:

Nvidia’s revenue for the fourth quarter totaled $22.1 billion, a 22% rise from the previous quarter and an increase of 265% from a year ago. GAAP diluted EPS were $4.93, a 33% rise compared to the previous quarter and a surge by 765% from a year ago. Non-GAAP diluted EPS were $5.16, a 28% rise from the previous quarter and a 486% rise from a year ago.

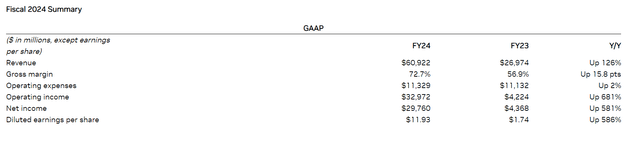

For the full 2024, sales rose by 126% to $60.9 billion. GAAP diluted EPS were $11.93, a 586% rise compared to a year ago. Diluted non-GAAP EPS were $12.96, a 288% rise from a year ago.

Nvidia’s growth was mostly due to its rapidly expanding data center department, which produces Nvidia’s popular graphics processing units (GPUs) that power generative AI and whose revenue grew 409% on yearly basis. It alone totaled $18.4 billion last quarter.

As mentioned by the management, Nvidia’s data center platform is supported by many diverse drivers, including big cloud-service providers and GPU-specialized ones, as well as enterprise software and consumer internet companies. That is because the demand for data processing, training and inference is growing fast. The AI industry is booming, indeed.

But the real earnings growth only started a few quarters ago. The past year was exceptional. As can be seen from the earnings excerpt below, the annual revenue increased by 126%, a whopping result, indeed. But the net income rise was even more impressive. It totaled 581%.

But the question is if this performance can be sustained.

Is Nvidia’s performance really sustainable?

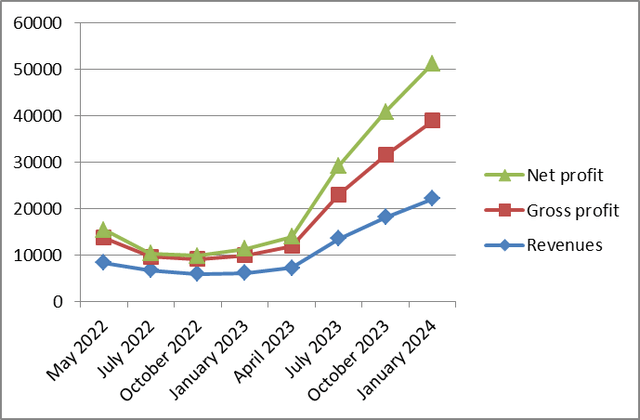

I decided to graphically illustrate the quarterly sales and earnings history. As you can see from the table and diagram below, the revenues and income figures’ performance was not excellent. The whole situation changed in April 2023.

Nvidia – quarterly earnings results

| May 2022 | July 2022 | October 2022 | January 2023 | April 2023 | July 2023 | October 2023 | January 2024 | |

| Revenues | 8288 | 6704 | 5931 | 6051 | 7192 | 13507 | 18120 | 22103 |

| Gross profit | 5431 | 2915 | 3177 | 3833 | 4648 | 9462 | 13400 | 16791 |

| Net profit | 1618 | 656 | 680 | 1414 | 2043 | 6188 | 9243 | 12285 |

Prepared by the author based Seeking Alpha’s data.

Nvidia – quarterly earnings results

Prepared by the author based on Seeking Alpha’s data

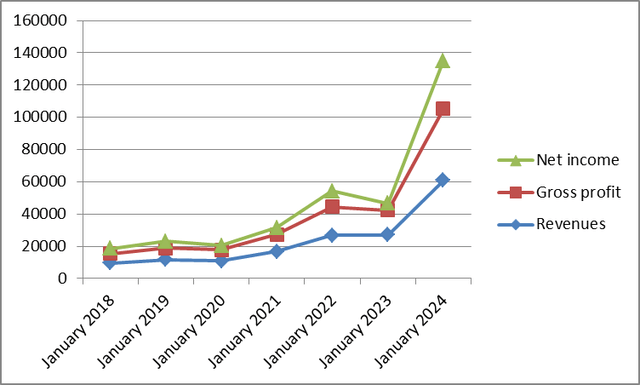

As concerns Nvidia’s annual earnings results, these only improved substantially the past year. Before that, the income and revenue growth had rather been moderate.

Nvidia – annual earnings results

| January 2018 | January 2019 | January 2020 | January 2021 | January 2022 | January 2023 | January 2024 | |

| Revenues | 9714 | 11716 | 10918 | 16675 | 26914 | 26974 | 60922 |

| Gross profit | 5822 | 7171 | 6768 | 10557 | 17475 | 15356 | 44301 |

| Net income | 3047 | 4141 | 2796 | 4332 | 9752 | 4368 | 29760 |

Prepared by the author based Seeking Alpha’s data.

Nvidia – annual earnings results

Prepared by the author based Seeking Alpha’s data

Nvidia has been improving brilliantly over the past 18 months, thanks to increasing demand for its specialized and expensive semiconductors, which are used for AI services like OpenAI’s ChatGPT chatbot. The stock has gained more than 40% since the start of the year. But its market gains are mostly due to the fact the company repeatedly exceeded analysts’ growth forecasts, a feat that is getting more challenging to repeat because these expectations are rising.

Nvidia’s co-founder and CEO Jensen Huang argues that a trend to upgrade data centers with chips needed for training powerful artificial intelligence models has only started. According to Mr. Huang, that will require spending roughly $2 trillion to supply all the buildings and computers with chips like Nvidia’s, which is an excellent growth stimulus for the entire industry, of course.

According to Hans Mosesmann, an analyst at Rosenblatt Securities, Nvidia’s potential is superior to its competitors’ due to Nvidia’s research and development. Another factor driving Nvidia’s latest sales surge is the ability of the company’s production partners, led by Taiwan Semiconductor Manufacturing Company (TSM), to increase supplies of Nvidia’s flagship AI chip, which sells for prices ranging from $15,000 to $40,000. According to Mr. Huang, the availability of those chips had improved significantly. However, the company would soon introduce new products that would again be in scarce supply.

However, high-tech giants like Amazon (AMZN), Google (GOOG) and Microsoft (MSFT) are designing their own AI chips to use instead of Nvidia’s. Rival chipmakers also design and produce their own AI products. Intel (INTC), which has long been the standard microprocessor chip industry’s leader but lags in AI, has plans to offer manufacturing services, which could boost industry capacity to build artificial intelligence chips. According to Daniel Newman, a semiconductor industry expert, “companies are kind of coming together to make sure Nvidia doesn’t get too much more powerful.” In other words, Nvidia is facing competitive threats.

Moreover, the Biden administration has placed restrictions on U.S. chip sales in China. In order to somehow evade restrictions, Nvidia has started selling less-powerful versions of some products in the market. Still, the company’s sales to China had dropped to a mid-single-digit percentage of its data center chip revenues.

So, in spite of the great performance and the industry’s bright outlook, questions remain if Nvidia can keep its great performance up.

Risks

Here are the top risks Nvidia faces:

- The first is that of an impact of the U.S.-China relationship and the resulting order disruptions. I mentioned in my previous article that tensions around Taiwan could be a real problem for Nvidia because a considerable share of its revenues is due to China. The company also relies on TSMC or Taiwan Semiconductor Manufacturing Company Limited for manufacturing. As its name suggests, the firm is based in Taiwan. So, if the conflict between the U.S. and China intensifies, there might be a real supply issue for Nvidia.

- There is also competition from Advanced Micro Devices (AMD) and Nvidia’s other peers. Other high-tech companies, including Apple and Amazon are working on artificial intelligence technologies. So, Nvidia is not absolutely unique in this field.

- The U.S. government might also further restrict U.S. advanced AI chips to China. In October 2023 the U.S. curbed exports of some AI chips, including Nvidia H800, to China. Further bans might follow.

- Let us also not forget that the nature of the semiconductor industry is cyclical. In other words, if there is a full-scale recession, the excellent growth might easily stall.

- Also, there is a risk that at some point generative AI frenzy cools off. Artificial intelligence is a promising industry but we do not know what will come next. After all, the boom might continue but Nvidia’s competitors can eventually win a much bigger share of the market.

- Then, the company is very popular and expensive. So, investors seem to be very enthusiastic about its future. But once you have climbed so high onto the cliff, any crash could be very bad. If the productivity cycle changes, the stock will likely fall down substantially.

Valuations

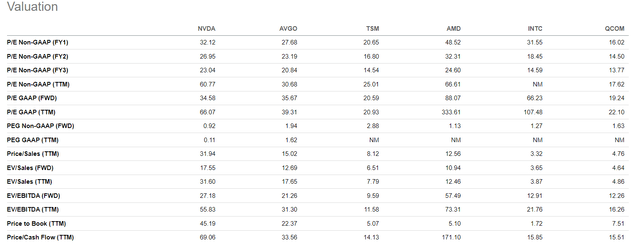

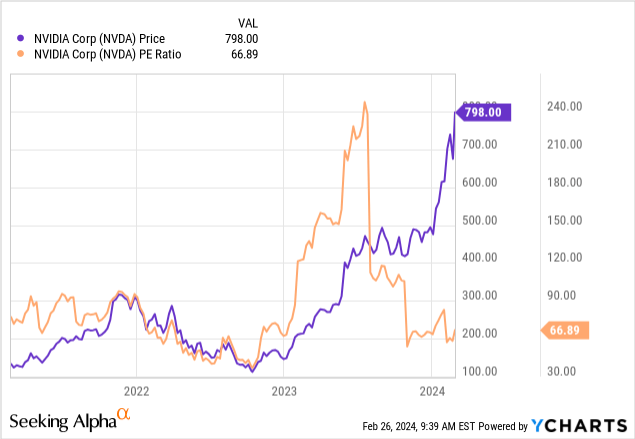

The valuations are quite high, indeed. Truth must be told. As I wrote my article on Nvidia in January this year, the recent excellent set of results was not available at the time. The record net profit made the price-to-earnings (P/E) ratio decrease somewhat. But in spite of that, Nvidia’s valuations are still too high, in my opinion.

According to Seeking Alpha’s data, the company’s P/E ratio used to be more than 240 in 2023. Right now after the excellent quarterly and annual earnings were published, it is lingering near the 67 mark, which is also high, indeed.

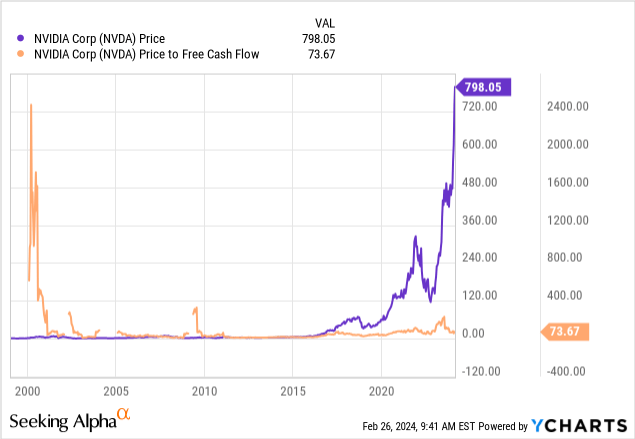

The price-to-free cash flow ratio also used to be higher than that. But even the current indicator of about 74 is extremely high too.

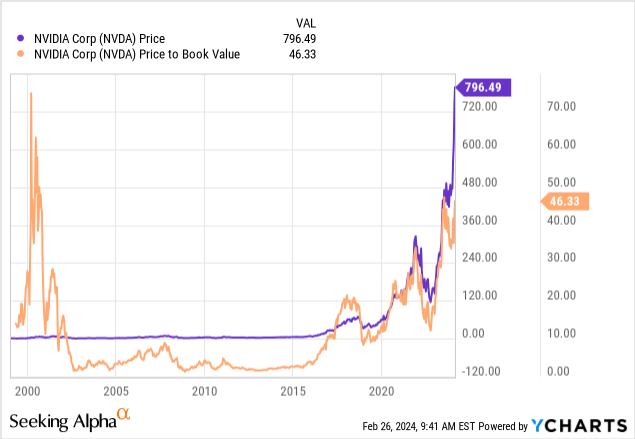

The price-to-book (P/B) ratio can be even called ridiculously high. A “good” P/B is normally between 1 and 3.

Nvidia’s valuations, comparison to peers

The table above where Nvidia’s valuation ratios are compared to these of its peers is self-explanatory. I will only add that AMD’s stock is more expensive than that of Nvidia.

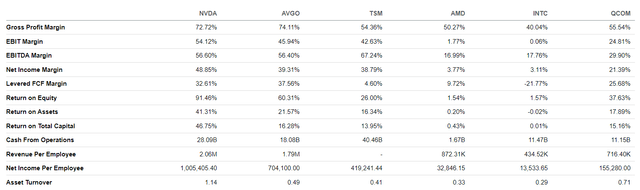

Nvidia – profit margins

Nvidia’s profit margins are excellent, nowhere near those of AMD or Intel. Only Broadcom’s (AVGO) are higher.

Nvidia’s rich valuations can be compensated with its profitability. But it still seems to me that the stock does not offer any margin of safety to those investors seeking to buy the stock now.

Conclusion

I will be more than happy if my analysis is far too pessimistic and the incredible performance of Nvidia has only started. That would mean there are still a lot of gains to be made by the company’s investors. But even the brilliant earnings Nvidia Corporation has recently reported should be taken with a pinch of salt. The risks are significant. The first is the issue of U.S.-China relations, the second is the company’s rich valuations, the third is that of competition, whilst the final is that of a likely recession ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.