Summary:

- Nvidia’s stock is highly overvalued despite its impressive growth and profitability, making it a risky buy at current prices.

- The Blackwell platform is expected to drive sales, but investor enthusiasm may be overblown given rising competition and slowing growth rates.

- Nvidia’s financial fundamentals are strong with high profitability and low debt, but its valuation ratios are significantly higher than industry averages.

- Despite its market leadership and innovative products, Nvidia’s slowing growth and high valuation suggest a “Hold” rating rather than a buy.

Antonio Bordunovi

A lot has happened since my last Nvidia (NASDAQ:NVDA) stock coverage. The company has been praised many times here on Seeking Alpha for its Blackwell platform, which many analysts argue can further increase its already substantial growth rate. However, this excessive optimism seems to be exaggerated. Nvidia is already one of the most expensive companies in the world, and its stock is extremely overvalued. I will explain why in this article.

My previous analysis of Nvidia stock

In my previous article about Nvidia’s valuations, I wrote that NVDA stock was expensive compared to its peers according to valuation ratios. To the positive factors, I added that the company’s profitability indicators were indeed high. In addition, Nvidia has recently had a great track record of exceeding analysts’ earnings expectations. The problem is that these expectations have been rising for a while. Despite Nvidia being the market leader and enjoying its FAANG customers’ loyalty, NVDA stock was not a great buy because it was expensive when I wrote the article.

My investment case for Nvidia remains broadly unchanged. However, I came to the idea to update my analysis on the corporation thanks to a lot of articles published here on Seeking Alpha describing the benefits of Blackwell for Nvidia’s success. Nothing has really changed, however. Blackwell chips were announced in March 2024, quite a while ago. But everyone predicts their imminent success and says Nvidia’s sales would be highly supported by them for a while. Let me analyze if that is true.

Nvidia’s Blackwell news

So, what exactly is Nvidia’s Blackwell, and why should it be so interesting to investors now in October 2024? Well, there was a press release published on 18 March 2024 saying that the NVIDIA Blackwell platform arrived. This platform enables organizations all over the world to build and run real-time generative AI on trillion-parameter large language models. Importantly, the platform can do so at up to 25x cheaper while consuming less energy compared to its predecessor. The Blackwell technologies are useful in areas such as data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing, and generative AI.

According to Nvidia’s CEO Jensen Huang, “Blackwell is the engine to power this new industrial revolution. Working with the most dynamic companies in the world, we will realize the promise of AI for every industry.” Among the corporations expected to adopt Blackwell are Amazon Web Services (AMZN), Dell Technologies (DELL), Google (GOOG), Meta (META), Microsoft (MSFT), OpenAI, Oracle (ORCL), Tesla (TSLA) and xAI. This indeed inspires hope of even greater sales and cash inflows for Nvidia.

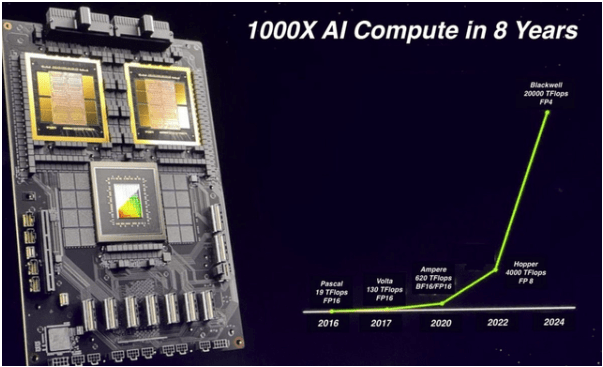

As I have mentioned before, Mr. Huang is again calling the AI race the “industrial revolution”. The growth rate in this area is indeed very high. The diagram below, borrowed from my fellow analyst Oliver Rodzianko, shows how high the AI growth rate has been in the last two years.

Seeking Alpha

But it feels like there are too much excitement and great expectations among investors. Although the Magnificent Seven is indeed buying Nvidia’s chips, the demand for these might eventually slow down. I am not sure how long this growth will last, but it would not be eternal and certainly, it will not always be as high as it is now.

Also, we should not forget that there is competition from other chipmakers, including Advanced Micro Devices (AMD). AMD has recently released its Instinct MI325X AI chip, which according to the management, outperforms Nvidia’s H200 processor in specific AI tasks. AMD also plans to release the MI350 series, an alternative to Nvidia’s Blackwell, in 2025. However, right now, Nvidia is still the market leader, but the question is how long this would last.

Nvidia’s fundamentals

Now, let us go to Nvidia’s financial fundamentals.

|

Indicator |

Nvidia’s indicator |

|

D/E ratio |

0.47 |

|

Net debt |

($7,730 million) |

|

Interest coverage ratio |

237 |

|

Current ratio |

4.27 |

|

Net profit margin (for the last quarter) |

0.55 |

Source: Prepared by the author based on Seeking Alpha’s data

Nvidia is a highly profitable and cash-rich company with little debt. This has not changed compared to the time when my previous analysis was published. Its net debt is still negative, it can pay its interest on debt 237 times, while its current ratio suggests Nvidia has plenty of idle cash. From this perspective, Nvidia is highly unlikely to go bankrupt.

Nvidia’s quarterly earnings history

Now, let us have a look at Nvidia’s earnings history.

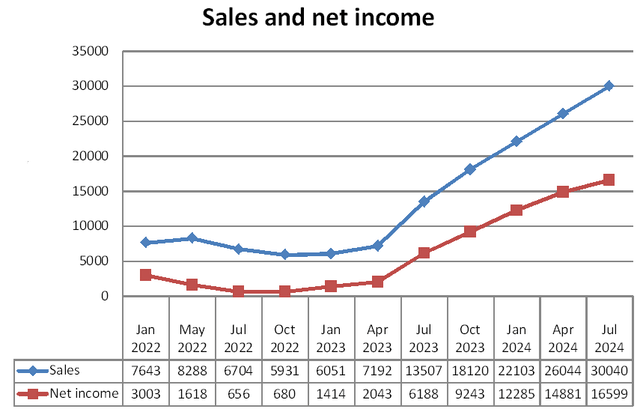

Nvidia’s quarterly sales and net income (the data are given in $ million)

|

Jan 2022 |

May 2022 |

Jul 2022 |

Oct 2022 |

Jan 2023 |

Apr 2023 |

Jul 2023 |

Oct 2023 |

Jan 2024 |

Apr 2024 |

Jul 2024 |

|

|

Sales |

7643 |

8288 |

6704 |

5931 |

6051 |

7192 |

13507 |

18120 |

22103 |

26044 |

30040 |

|

Net income |

3003 |

1618 |

656 |

680 |

1414 |

2043 |

6188 |

9243 |

12285 |

14881 |

16599 |

Source: Prepared by the author based on Seeking Alpha’s data

Nvidia’s sales and net income history (in $million)

Prepared by the author based on Seeking Alpha’s data

Interestingly, since the April 2023 quarter, Nvidia’s sales and earnings have been rising at a fast pace. However, as can be seen from the net income graph above, the growth rate has recently slowed down. This is especially true of the April 2024 and July 2024 quarters. If the trend continues, it seems likely to me that the growth rate will slow down even further. Let us have a look at Nvidia’s outlook.

Nvidia’s earnings outlook

Nvidia is set to report its next quarterly earnings on 19 November 2024.

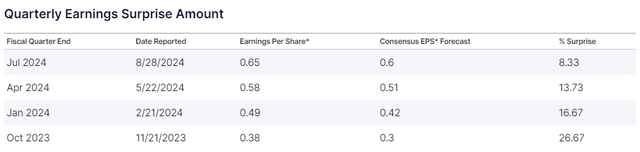

NVIDIA’s earnings outlook for the third quarter of fiscal 2025 is the following: sales are expected to be $32.5 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 74.4% and 75.0%, respectively, plus or minus 50 basis points. No EPS forecasts were given in the management’s outlook. However, it is likely Nvidia will beat its earnings estimates.

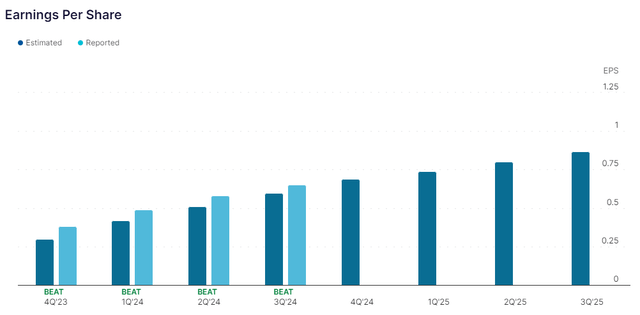

Only the expectations are growing substantially. Moreover, as can be seen from the diagram above, every single quarter the spread between the forecasted EPS and actual EPS is only getting lower. 4Q 2024 or the third quarter of fiscal 2025 will not be an exception, it seems.

Anyway, Nvidia is predicted to report $0.69 in EPS, somewhat more than the $0.65 reported on 28 August 2024. But the growth rate is slowing down.

It seems likely that if Nvidia’s growth rate slows down, investors’ enthusiasm will also decrease somewhat.

Apart from seeing the actual sales and EPS numbers, I would also like to listen to the management’s press conference, especially the company’s innovations, its position relative to competitors, the economic conditions, and the management’s outlook for the future quarters and years because it is unlikely the sales and earnings growth will last forever.

Nvidia’s valuations

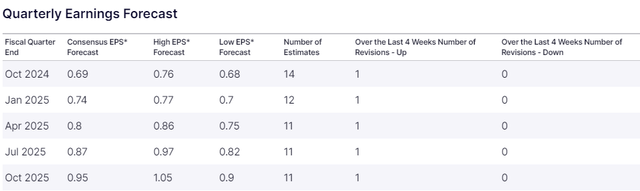

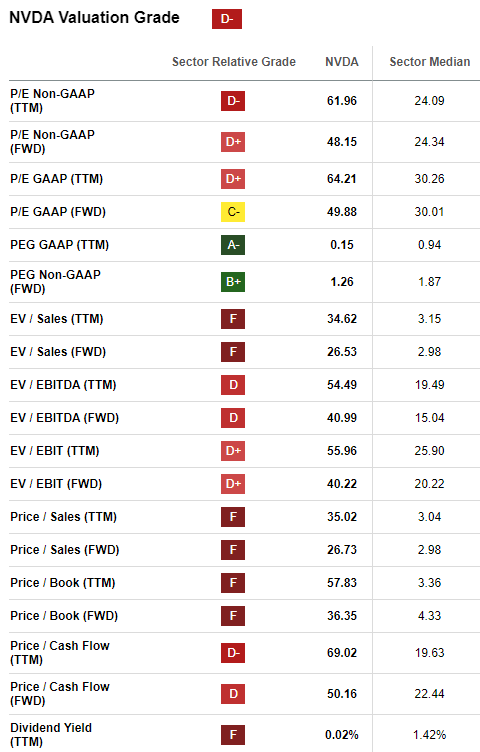

As I have mentioned before, Nvidia is a highly overvalued company, not only relative to the S&P 500 companies but also compared to its close competitors.

NVDA stock is now trading at a P/E GAAP ratio (TTM) of 61.96, substantially higher than the industry’s average of 24.09. All the indicators, including the P/B, the P/CF, the EV/Sales, and the dividend yield suggest extreme overvaluation relative to the sector’s averages. Only the PEG indicator does not suggest overvaluation because it considers the earnings growth rate. As I have mentioned before, Nvidia’s growth rate is high but seems to be unsustainable.

Seeking Alpha

Broadcom (AVGO), Taiwan Semiconductor Manufacturing Company Limited (TSM), AMD (AMD), Qualcomm (QCOM), and Texas Instruments (TXN) all on average have lower valuation ratios than Nvidia. Only Nvidia’s P/E and PEG ratios are somewhat lower than AVGO’s and AMD’s.

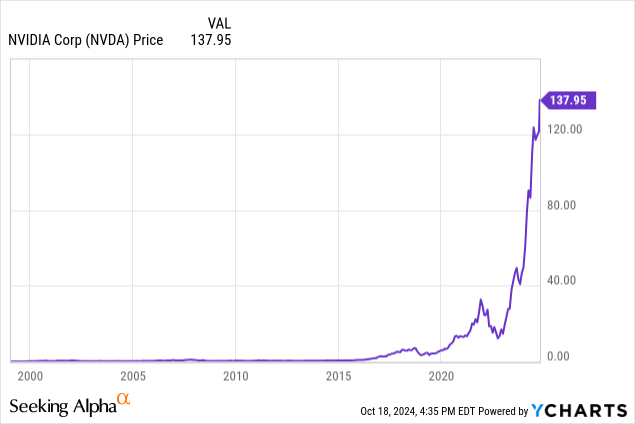

In addition to the high actual valuation ratios, NVDA stock is also trading at its all-time highs.

YCharts

So, I would say that NVDA stock is highly overvalued.

Upside factors

There are many risks to my rather cautious outlook on Nvidia. I am trying to be contrarian, while the company seems to be firing on all fronts. After all, its sales and its net profits are rising, while it regularly announces new products and technologies. Moreover, NVDA is a highly popular stock. Its loyal fans are willing to overpay for it to benefit from its exponential growth. Then, some stocks trade at a substantial premium to their peers for years, if not decades. A classical example of such a company is Amazon. Not only does the company still manage to boast good financial results, but it also has plenty of loyal investors who are willing to buy and hold its shares for a while. So, it is not worth saying that a stock like NVDA would collapse in value. That is why I would think twice before short-selling Nvidia’s shares. At the same time, it does not seem to be a good time for me to buy NVDA’s stock.

Downside risks

The downside risks are clear, in my view. To start with, NVDA shares are highly overvalued. These are not just trading at their all-time highs; these are much more expensive relative to peers. So, an investor buying a stake in Nvidia will not be enjoying a margin of safety. Moreover, Nvidia is currently enjoying very high sales growth, which only started in the April 2023 quarter. Normally, growth at a very high pace tends to be unsustainable. In addition, even though Nvidia is the market leader, it still has relatively strong competition from its rivals, including AMD and Intel (INTC). I wrote an article on the subject before. Finally, we should not forget that the leading stock indices, including the S&P 500, are trading near their all-time highs, suggesting that asset markets are somewhat overheated. Many economists are also saying a stock market correction is near. This means that most stocks, especially overvalued ones like Nvidia, are likely to plunge in value.

Conclusion

Overall, I consider Nvidia to be a highly overvalued company with brilliant, albeit slowing sales and earnings growth rates. The corporation is highly popular among investors and has leading market positions. But this does not mean it is a smart buy right now. The competition is getting tenser while the growth rate is slowing down. At the current price, you would not enjoy the necessary safety margin. So, my investment rating remains unchanged, namely “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.