Summary:

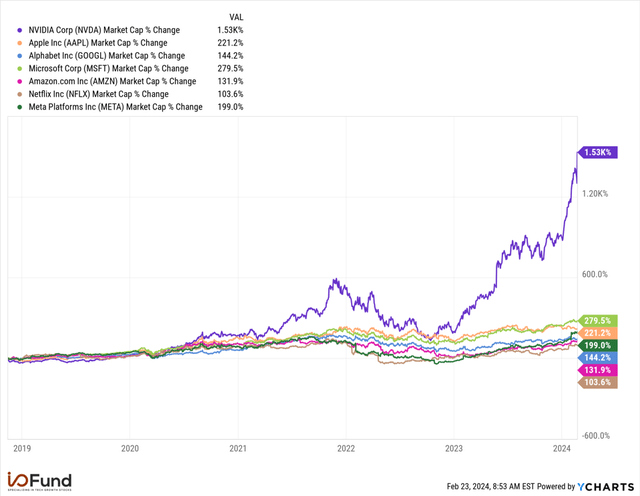

- Today, Nvidia Corporation surpassed a $2 trillion market cap compared to Apple’s $2.8 trillion. The company has surpassed Amazon, Google, Tesla, Meta and Netflix.

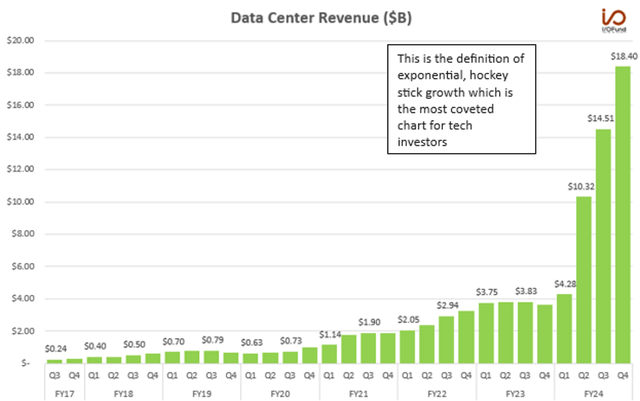

- Nvidia’s data center revenue has grown more than 676%, from $2.37 billion in fiscal Q2 2022 to $18.40 billion in fiscal Q4 2024.

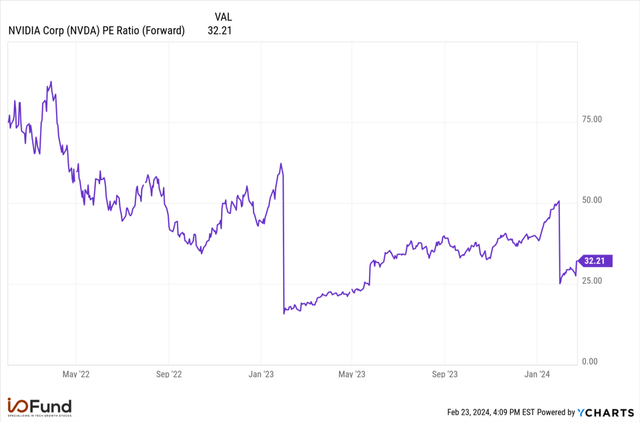

- Nvidia’s forward P/E ratio is just above 32x at Friday’s close, which compares to a forward P/E ratio of more than 75x in its November 2021 peak.

BING-JHEN HONG/iStock Editorial via Getty Images

In August of 2021, my firm made a very bold prediction that Nvidia Corporation (NASDAQ:NVDA) would surpass Apple (AAPL) (AAPL:CA) in valuation. At the time, Nvidia was at a market cap of $550 billion compared to Apple’s $2.5 trillion market cap. In the Forbes editorial “Here’s Why Nvidia Will Surpass Apple in 5 Years” I wrote the following (emphasis added):

“Notably, the stock is up 335% since my thesis was first published [my first AI thesis in 2018]

– a notable amount for a mega cap stock and nearly 2-3X more returns than any FAAMG in the same period. This is important because I expect this trend to continue until Nvidia has surpassed all FAAMG valuations.” published August 2021

Today, Nvidia surpassed a $2 trillion market cap compared to Apple’s $2.8 trillion. The company has surpassed Amazon, Google, Tesla, Meta and Netflix. The only one left standing is Apple, and we have 2.5 years left to make good on my prediction.

Notice I did not say at the time that Nvidia would double its market cap to $1 trillion or surpass one of the FAANGs. Instead, I predicted that Nvidia would surpass the world’s most valuable company to take the throne, and would do it very quickly.

Here’s what Nvidia’s increase in market cap looks like:

Since November 2018, Nvidia’s market cap has increased more than 1,500%, compared to the FAANG’s gaining 100% to 280%. (YCHARTS)

How Nvidia Surpassed Many FAANGs — and why Apple is Next

Nvidia’s rapid rise to become one of the top five most valuable companies in the world stems from its leadership position at the forefront of artificial intelligence, or AI —- which began with the A100. It was the A100 which combined training and inference that kicked off Nvidia’s strength in the data center –the H100 would come a couple of years later. The A100 left early breadcrumbs that Nvidia would see a glorious ascent to overtake Apple. Prior to the A100, there were additional clues, specifically Nvidia’s CUDA software platform, which my firm also made quite clear in 2018 would carve a deep moat for a near-monopoly.

Rapid top line growth is the primary eye-catching statistic, as no other companies in tech have reported such blistering revenue growth at a rate above 200% for multiple quarters at an annualized revenue rate near $90 billion. These are growth rates we see in small caps or mid-caps that have a mere $1 billion or less in revenue. Rarely, if ever, do we see this growth rate above $5 billion in revenue, let alone $90 billion.

The consistency and magnitude of the top line beats is impressive, however, it’s the growth further down the income statement where Nvidia’s report truly shines. Nvidia’s stronghold grip on the data center market at the moment combined with pricing power and elevated demand for its H100 GPU has allowed substantial growth in operating income and has generated robust earnings.

Let’s take a closer look as to why Nvidia has been able to surpass every FAANG except Apple, and why it’s inevitable that Nvidia becomes the World’s Most Valuable company in the next 2.5 years. We are using the date of August 2021 through the Q4 January report to evaluate the fundamental growth, since that is when we first predicted Nvidia would surpass Apple’s valuation by August of 2026.

Here are some staggering data points since that prediction:

Nvidia’s Data Center:

- Data center revenue has grown more than 676%, from $2.37 billion in fiscal Q2 2022 to $18.40 billion in fiscal Q4 2024.

- In just 10 quarters, Nvidia has taken the data center from a less than $10 billion annualized run rate to almost a $75 billion annualized run rate – no other company can boast growth at this scale. For context, Amazon’s (AMZN) AWS increased from a $12 billion annualized rate to $35 billion over 12 quarters from 2016 to 2019, but took six years to surpass $80 billion in 2022. Nvidia did the equivalent in 2.5 years.

- Data center revenues in Q4 accelerated again, growing 409% YoY compared to 279% YoY in Q3 and 171% YoY in Q1. Nvidia attributed Q4’s growth to “higher shipments of the NVIDIA Hopper GPU computing platform” alongside strong demand for InfiniBand which was up 5-fold.

To put in perspective just how rapid this ascent in data center revenues has been, this year’s $47.5 billion in revenue is 18% more than total revenues in the segment for the past five years combined. Nvidia generated a total of $40.2 billion in data center revenue between CY17 through CY22.

Nvidia’s data center revenue increased 409% YoY to $18.40 billion in Q4, compared to $2.37 billion in August 2021. (NVIDIA)

Compare this to Apple’s prized iPhone segment since our prediction:

- iPhone revenue increased 79% from $38.8 billion in fiscal Q4 2021 to $69.7 billion in fiscal Q1 2024; however, iPhone sales have increased just 12.7% to $43.8 billion in Q4 2023.

- iPhone revenue increased just 4.5% from fiscal 2021 through fiscal 2023, from almost $192 billion to $200 billion, as growth has stagnated.

Overall Revenue Growth for Nvidia of 240% Compared to Apple’s 43%:

Since August 2021, Nvidia’s revenue has grown at a much quicker rate than Apple, at a 240% total increase compared to 43% for Apple. That’s 96% growth on average for Nvidia per year and 17% growth for Apple averaged out per year – a 5.5X difference.

The iPhone’s installed base is reaching 1.5 billion and the market is showing signs of saturation. Growth stems primarily from existing devices being upgraded rather than building out the ecosystem. For data centers, we’re in the very early stages of growth, with Nvidia’s CEO Jensen Huang predicting that $1 trillion will be spent across the next four years to upgrade data centers for AI, with a majority of this spend stemming from hyperscalers and cloud providers procuring GPUs.

This massive capital spending on data centers is what will help Nvidia hammer the nail in the coffin to overtake Apple, as it will continue to drive significant growth in Nvidia’s data center revenues and thus overall revenue.

Q1’s revenue guide of $24 billion implies YoY growth of 235%, and suggests data center revenue may surpass $20 billion next quarter, for another blazing hot quarter with DC growth of 367% YoY.

Looking forward through the rest of FY25, estimates on the Street for data center revenue range from $22.8 billion to $36.4 billion by fiscal Q4 2025, with total revenue ranging between $25.7 billion to $40.3 billion.

Should Nvidia reach $29 billion in overall revenue by next January with $25 billion in data center, its data center revenue will have grown more than 950% since August 2021, with total revenue up nearly 350%. Compare this to Apple, where revenues are expected to decline (4.1%) YoY next quarter and increase just over 1% for fiscal 2024.

Nvidia has Strong Margins, But Apple Has the Cash

Nvidia’s margins are much stronger than Apple’s, but Apple leads in cash and cash generation.

Since August 2021, Nvidia’s gross margin has expanded significantly, from 66.7% to 76.7% in fiscal Q4, first topping 70% in fiscal Q2 and expanding since then as a high degree of pricing power for its ultra popular H100 GPUs is aiding margin growth.

Apple has similarly seen gross margin expansion, stemming primarily from growth in high-margin Services revenue as opposed to hardware sales — Apple’s gross margin increased from 42.2% to 45.8% over the same period.

Nvidia’s operating margin has improved tremendously in fiscal 2024, as it managed to increase operating expenses by only 2% YoY while driving a 126% increase in revenue. Operating margin has increased from 47.2% to 66.7% since our prediction. Over the past two quarters, operating margin has increased 910 bp.

On the other hand, Apple’s operating margin has improved 520 bp over the same period, from 28.5% to 33.7% — Nvidia’s operating margin is now nearly double Apple’s.

Because of this major increase in operating leverage, Nvidia has seen substantial growth in EPS. Nvidia reported $5.16 in EPS in fiscal Q4, nearly 400% growth from $1.04 reported in August 2021. Apple’s earnings growth over the same period has been just 14%, from $5.62 to $6.42 on a TTM basis.

However, Apple has the cash and cash flows, though Nvidia is quickly improving in both metrics. Apple’s cash on hand totals $172.6 billion, with over $72 billion in current cash, equivalents and marketable securities.

Nvidia has just $26 billion in cash and equivalents, an increase from $18.3 billion in Q3 and $13.3 billion in the year ago quarter, as Nvidia is pocketing more cash.

Apple leads the Mag 7 and tech in general as it generates the highest levels of operating cash flow and free cash flow. TTM operating cash flow was more than $116 billion, while FCF was more than $106 billion, or a FCF margin of 27.5%.

Nvidia’s operating cash flow grew 400% YoY to $28.1 billion, with FCF up 690% YoY to $27 billion. Nvidia’s margins here are now stronger than Apple’s, at 46% and 44%, but the scale of its revenues means it has a few more years to go before it can surpass the $100 billion threshold on cash.

While cash flows may nearly double to ~$50 billion in FY25, Nvidia’s software can complement this growth as it scales a few years in the future, much as Services is aiding Apple’s growth and margins.

How Nvidia Will Surpass Apple’s Valuation

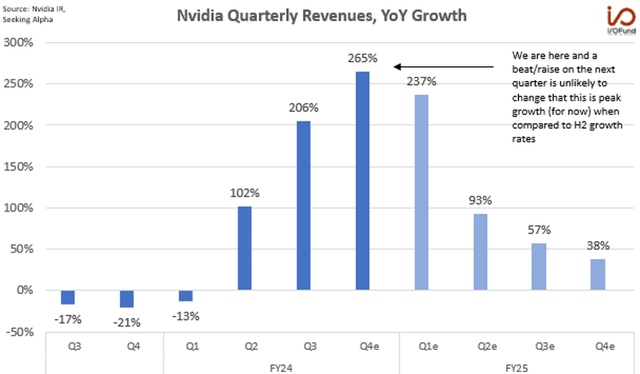

Before we go into a few reasons Nvidia has a long runway, it’s prudent to state that Nvidia has likely peaked in revenue growth (for now) either this quarter or next quarter. For revenue to peak next quarter, Nvidia has to beat by $2.2 billion or more.

Nvidia’s revenue growth rates have peaked for now at 265% in Q4, when compared to growth rates in H2. (NVIDIA, SEEKING ALPHA)

Nvidia’s post-earnings rally has taken it above a $2T valuation, as it continues to quickly close the gap with Apple. Here’s the path to Nvidia re-accelerating again sometime over the next 2.5 years to finish off Apple once and for all.

Software Opportunity

AMD’s CEO Lisa Su believes the AI accelerator market can reach $400 billion by 2027, as demand continues to far outpace supply, with cloud giants gobbling up GPUs as fast as possible. With accelerators alone, Nvidia can surpass Apple, as the company is estimated to control at least 90% of the data center GPU market. Even if Nvidia’s share slips to approximately 80% by 2027, that would be $320 billion in revenue.

Looking beyond accelerators, Nvidia’s software opportunity is a main factor in our thesis – that Nvidia will not only be the primary player for AI hardware, but simultaneously will become a predominant player for AI software. Software is the holy grail for a hardware company, especially for Nvidia; if competitors such as AMD can compete on performance and undercut on price, driving GPU prices lower over the long run, software will let Nvidia monetize its existing GPU base and generate streams of recurring revenue.

Right now, software is at a $1 billion run rate and CEO Jensen Huang stated that there is a “fundamental reason why Nvidia will be very successful in software” which is that it’s fundamentally required for accelerated computing and will be needed to open new markets. Nvidia’s Enterprise AI will “do the management, the optimization, the patching, the tuning, the installed base optimization for all of their software stacks” at about $4,500 per GPU.

This is key, as Nvidia’s current analyst estimates do not take into account that AI software will ramp over the next two to three years. At max adoption, the software opportunity would be worth $11.2 billion, but a more conservative scenario would be $5 billion. This may seem like peanuts compared to the $18.4 billion in data center revenue today, but it will be accretive to margins and accelerate YoY, whereas the data center may come under pricing pressure. To put it simply, we all know semis are cyclical and software is not – where those two meet will create fortuitous crossroads.

Accelerated Product Roadmap

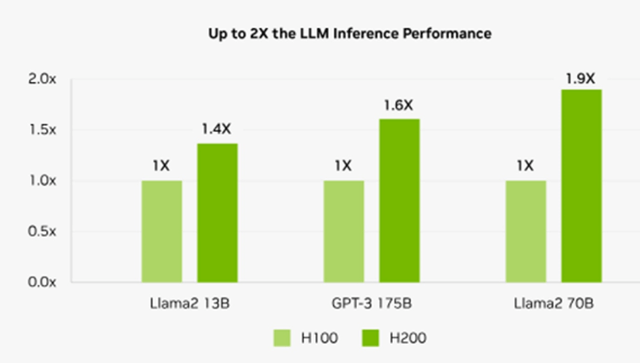

In terms of hardware, Nvidia has an ambitious AI GPU roadmap, and is expected to release the next-gen H200 and B100 GPUs later this year, just over one year after releasing the H100. The two GPUs are expected to offer another leap in performance for AI training and inference, and the H200 is already in demand by the leading CSPs – AWS will be the first to deploy the new GPU, but Microsoft, Google and Oracle will also be deploying the chips.

It’s easy to see why the cloud giants are eager to upgrade quickly — Nvidia says the H200 will boast reduced energy usage and thus a lower TCO, while the introduction of HBM3e memory will essentially supercharge the GPU’s performance. For GPT-3 175B, the H200 is expected to offer 1.4x to 1.9x faster LLM inference on the leading GPT and Llama models compared to the H100, and an 18x performance upgrade compared to the A100.

While it will be too soon to gauge what level of demand, there is for the two new GPUs from a Q1 guide, a fiscal year guide could provide insight into whether demand for the H200 and B100 can match the H100, or if Nvidia will face initial supply constraints while ramping production. Additionally, Nvidia will face competition this year from AMD’s MI300s.

Note on Automotive:

Automotive is another large, incoming segment for Nvidia with a $300 billion total addressable market by 2030. Nvidia has an enviable position with a lead across dozens of OEMs in the U.S. and China. Nvidia’s automotive suite spans nearly the entire tech stack of the car: its Drive SoCs – Orin and Thor – serve as the central computer for the vehicle, enabling OEMs to move higher up the semi-autonomous capability curve, from L2 to L2+/L3, to localized L4, and potentially L5 in the future.

Nvidia’s entire autonomous platform, called Hyperion, has not fully hit the market yet – Hyperion 8 is expected to begin shipping this year with Hyperion 9 following in 2026. Automotive’s pipeline currently sits at just $11 billion, but the shift to predominantly L2+ architectures as OEMs compete on tech and ADAS features beckons to dramatically increase this pipeline.

Valuation Eerily Low Despite 420% Rally Since 2023

Fundamentally, the rapid bottom line growth has supported this massive valuation increase – rarely do you see EPS increase 1,200% over two fiscal years at a multibillion-dollar scale. Compare this to Apple, which is expected to see just 17% total growth in EPS over the next two years.

As discussed in our pre-earnings writeup, the valuation is eerily low still, and it is very unusual for a stock to be up more than 400% in just over a year and yet be cheaper than it was at its bottom (Oct 2022 for Nvidia) – and that’s still the case after Thursday’s surge.

Nvidia’s forward P/E ratio is just above 32x at Friday’s close, which compares to a forward P/E ratio of more than 75x in its November 2021 peak, nearly 90x in March 2022, and 34x when shares bottomed in the $115 range. The valuation is what makes it a buy on any dips. However, we also won’t be shy about taking gains if we reach predefined price targets. We have one in mind for Nvidia, so let’s see if we get there for our next trim.

Conclusion:

My firm was the de facto pioneer on building an AI-focused portfolio with Nvidia at the helm, and we were bold and quite clear at a time that Nvidia would rival Apple’s valuation when the very thought was inconceivable. There are many Nvidia bulls appearing today, where were they when the stock sold off (-60%) and was at the October 2022 low. I know where we were —- writing editorials that clearly stated the stock was bottoming and issuing 10 buy alerts to our premium research members when the stock was under $210.

One of the more critical media appearances was on Real Vision, when I stated that it would take World War 3 for me to sell my Nvidia position. The stock is up 400% since that show.

Note, I did not say it would take World War 3 for me to take gains. We are not shy about putting real money into the bank if we think we can get a stock lower than where it currently trades. After all, we have been trimming Nvidia and buying lower for six years for a higher return than a buy and hold strategy. For example, entries at $210 creates returns of 281% to 627% with our lowest tranche at $108 versus 162% returns since January 1st, 2022.

The very mission we are on is to help readers safely participate in the life-changing gains that tech can offer. We want it all — put money in the bank, lock-in gains, yet also hold high-conviction stocks for the long haul at a high allocation (and hedge if tech falls out of favor).

If you own Nvidia stock, or are looking to own NVDA, we encourage you to attend our weekly premium webinars, held every Thursday at 4:30 pm EST. Next week, we will discuss our plan following NVDA’s earnings, as well as a handful of other AI plays for 2024 – what our targets are, where we plan to buy as well as take gains.

Tech Insider Network Equity Analyst Damien Robbins contributed to this report.

Recommended Reading:

- Tesla Q4 Earnings Preview: Margins Likely To Slip Again

- Palantir Stock Surges From Artificial Intelligence Platform

- AI Driving Acceleration For Big 3 Cloud Stocks

- Coinbase, Robinhood: Examining The Impact Of Spot Bitcoin ETFs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.