Summary:

- Nvidia Corporation reported strong Q3 earnings with record revenue and impressive growth in its AI efforts.

- Concerns about expanded export controls on China and a delay in launching a new AI chip have impacted the stock.

- I have doubts about future revenue and profit growth, and the seasonal factor could interrupt the stock’s rally.

- If I’m right, the most likely outcome is a sharp drop in the Nvidia Corporation share price due to multiple contraction. I reiterate my previous “Sell” rating.

Alexander Labut

Introduction

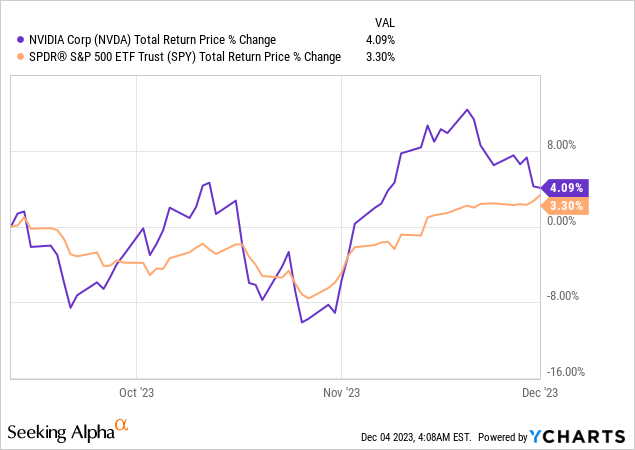

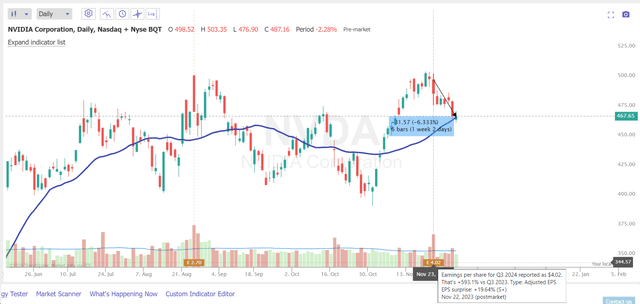

In September 2023, I downgraded the shares of Nvidia Corporation (NASDAQ:NVDA) from “Hold” to “Sell” because I expected an inevitable correction in the stock, which has not yet materialized. With a fairly high beta to the broad market, the company has not significantly outperformed the market return, but it didn’t fall, either:

Today, I see reasons to believe that my ‘Sell’ thesis could come true shortly after all.

Why Do I Think So?

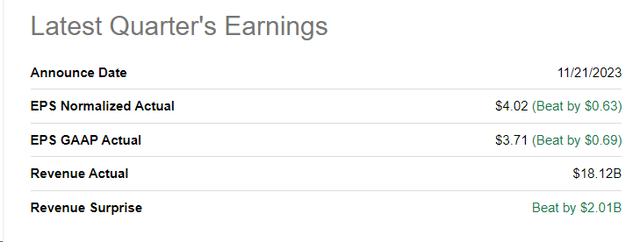

It’s hard for bears to fight the facts: Nvidia Corporation reported strong Q3 FY2024 earnings. GAAP diluted EPS for the quarter was $3.71, up over 12 times from a year ago, and non-GAAP earnings per diluted share were $4.02, up almost 6 times from a year ago. EPS of $4.02 (surpassing expectations by $0.63). The company achieved record revenue of $18.12 billion (consensus beating by $2.01 billion), marking a remarkable 206% increase from the previous year and a 34% QoQ increase.

Seeking Alpha, NVDA’s Earnings

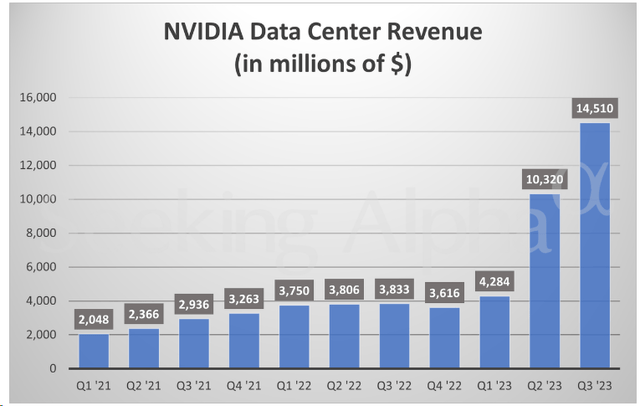

Notably, the Data Center segment [home to NVDA’s AI efforts] contributed significantly to the overall performance, with record revenue of $14.51 billion, reflecting a 41% QoQ increase and a staggering 279% YoY increase. Jensen Huang, the founder and CEO of Nvidia, attributed the impressive growth to the industry’s transition toward accelerated computing and generative AI. He highlighted the involvement of large language model startups, consumer Internet companies, and global cloud service providers as early adopters, with the potential for further waves of growth.

Huang also mentioned the increasing investment in AI clouds by nations and regional cloud service providers, the integration of AI copilots and assistants by enterprise software companies, and the development of custom AI solutions by enterprises to automate large industries.

Nvidia solidified its leadership in the rapidly evolving field of generative AI with its highly successful GPU Technology Conference (GTC) in March 2023. Throughout GTC 2023 and subsequent events, the company unveiled a series of new and upgraded products, with the latest being the DGX H200, its fastest GPU compute device to date. These offerings encompass a range of hardware components such as GPUs, CPUs, clusters, and supercomputers, as well as multiple new software products, inference platforms, acceleration libraries, and cloud services. Nvidia’s comprehensive product portfolio reflects its commitment to advancing AI development and expanding its ubiquity. Amid the rise of platforms like ChatGPT and Google Bard, Nvidia stands out as exceptionally well positioned in the competitive AI market, leveraging its strong foothold in the sector to swiftly climb the ranks and emerge as a leading global semiconductor company by revenue, a notable ascent from barely making the top 10 just two years ago.

It’s hard to deny that the company is a leader in a fast-growing niche – which is why I gave it a “Hold” ratings (until September) despite its already high valuation at the time of the coverage initiation. But all good things have their limits – including the growth in share prices that everyone is talking about and on which investors are pinning their greatest hopes.

Despite the strong Q3 report with multiple increases in earnings, the share did not react positively. On the contrary, the share price has fallen by 6.33% since publication:

TrendSpider Software, author’s notes

Why did this happen?

Bank of America’s analyst Vivek Arya highlighted concerns about expanded export controls on China as a risk, though he expected demand to outpace supply. Important note: Vivek Arya has a “Buy” rating on NVDA with a price objective of $700/sh.

Just 2 days after Vivek’s statement, NVDA informed its Chinese customers about the delay in launching a new artificial intelligence chip, the H20, designed to comply with U.S. export regulations. The launch, initially expected in November, has now been postponed to the first quarter of next year, potentially taking place in February or March. This delay is attributed to issues related to server integration. Notably, the L20 chip is proceeding with its original schedule, while information on the status of the L2 chip remains undisclosed. The delay follows recent U.S. updates to export restrictions, impacting Nvidia’s ability to sell certain chips to China.

Nvidia already holds 90% of the AI chip market in China, Seeking Alpha noted, but I think it now risks losing some of this share to Huawei Technologies and other local players.

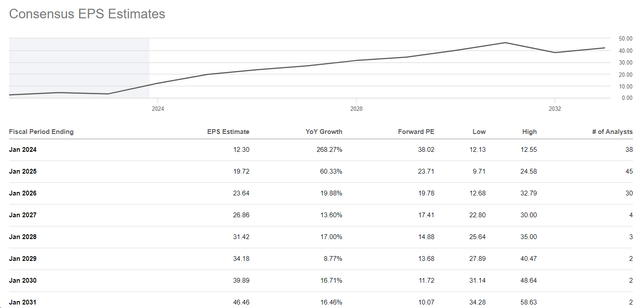

Citi analyst Atif Malik noted the possibility of the stock being “range bound” due to challenging year-over-year comparisons, particularly in the data center sector. This statement sounds quite logical, as it will be difficult to show similar YoY and QoQ momentum after a strong increase in the company’s operating metrics. What seems obvious to me, however, does not seem so for the Wall Street consensus, which expects phenomenal earnings per share growth of 60.33% in FY2025 and a subsequent CAGR of ~13% over the next 7 years [FY2025-2031].

Seeking Alpha, NVDA’s EPS estimates

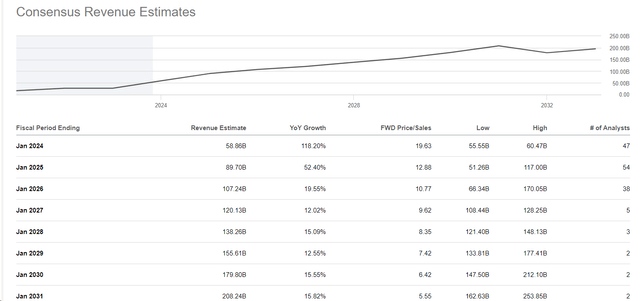

The company’s revenue should grow at approximately the same rate:

Seeking Alpha, NVDA’s Revenue estimates

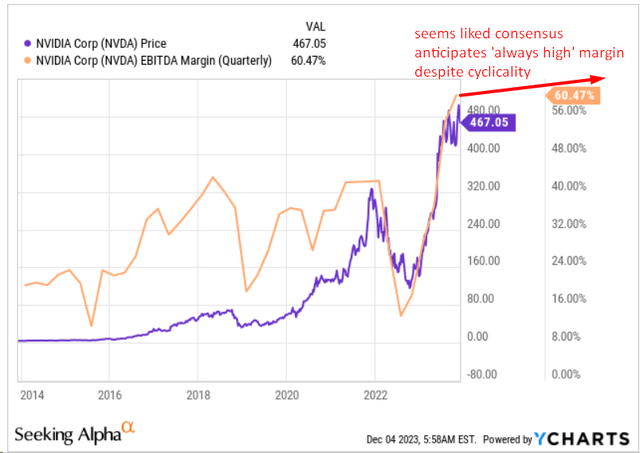

These forecasts lead me to believe that the market expects the company to achieve stable EBITDA and profit margins over the next 8-10 years, which is generally atypical for the industry in which it operates.

I understand that NVDA is more than just a semiconductor company, as it focuses on the future of AI. But there are already signs that future revenue and profit growth could slow more than is currently priced in.

More and more analysts are asking logical questions when they look at NVDA’s financial figures. For example, with sales growth of 85.5% (9-month data), “selling, general, and administrative expenses” only increased by 7% – salespeople’s commissions do not match sales growth, which is odd. Also, share-based compensation expenses related to SG&A increased by 27%, which raises questions about how the sales team is compensated.

Additionally, accounts receivable surged by 69.3% YoY to $8.3 billion, indicating potential issues with clients paying for products. The lack of a significant increase in inventory (it actually fell by ~7% YTD), despite soaring revenues and future orders, raises suspicion about the consistency of reported numbers.

I’m not saying NVDA is doing anything special with its financial reports – it’s just that the above factors make me doubt the reasonableness of today’s EPS estimates, which keep going up:

Seeking Alpha, NVDA’s EPS estimates

Therefore, I cannot upgrade the NVDA share to “Buy” or even “Hold” today – especially in view of the seasonal factor that could interrupt NVDA’s seemingly unstoppable YTD rally.

TrendSpider’s newsletter [Dec 3, 2023]![TrendSpider's newsletter [Dec 3, 2023]](https://static.seekingalpha.com/uploads/2023/12/4/49513514-170168979930395.png)

Despite an impressive +14.7% rally in November, Nvidia faces historical challenges in December, traditionally marked as its worst-performing month, according to TrendSpider [proprietary source]. Over the last decade, Nvidia’s stock has experienced a decline 70% of the time during December, with an average return of -2.43%.

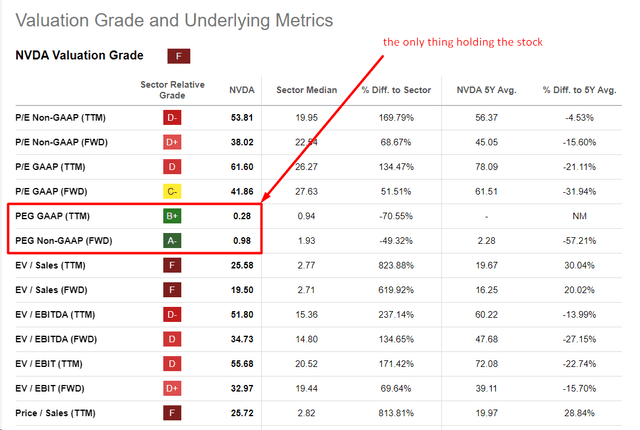

The company’s high valuation has so far been driven by high growth rates – we see the implied P/E ratio for FY2025 and FY2026 falling below 24x and 20x respectively. But what will happen to NVDA’s share price if its EPS estimates suddenly turn lower? In my opinion, the most likely answer is a sharp drop in the share price due to multiple contraction.

Seeking Alpha, NVDA’s Valuation, author’s notes

The Verdict

Based on the information analyzed today, I feel compelled to confirm my previous “Sell” rating, despite the optimism surrounding NVDA that I can see almost everywhere.

First of all, I doubt what the market expects from the company in the next few years. Yes, today the company is practically a monopolist and dictates its own rules of the game. But even those who sell shovels in the Klondike will have competitors sooner or later. I believe that the ever-increasing EPS estimates are already overvalued, and some of the financials on the company’s balance sheet clearly hint at that (at least the way I interpret it).

That is why that negative seasonal factor – the fall in December – may appear this time too.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!