Summary:

- Nvidia stock continues to rise due to generative AI sentiment, formidable market positioning, and the company exceeding expectations.

- Nvidia’s performance has prompted comparisons to Cisco during the Dot-Com bubble, but the comparison misses context.

- Nvidia doesn’t appear to be in a stock bubble, but is at risk of entering a demand bubble.

- Sky-high expectations for Nvidia and growing risks make the company a hold in my view. Betting against the company remains risky.

mikkelwilliam/E+ via Getty Images

Why Does Nvidia Stock Just Keep Climbing?

My previous article on Nvidia (NASDAQ:NVDA) back in March argued that despite the stock’s meteoric rise, the company’s quality and expected performance were reasonable enough to justify its premium price. Since then, the stock has resumed its upward march nearly 50%, briefly making Nvidia the most valuable company in the world. What keeps fueling such outperformance?

Not much has changed in the past four months for Nvidia. The three themes mentioned in my last article (euphoric sentiment around AI, Nvidia’s market positioning, and exceeding expectations), have all showed little sign of slowing.

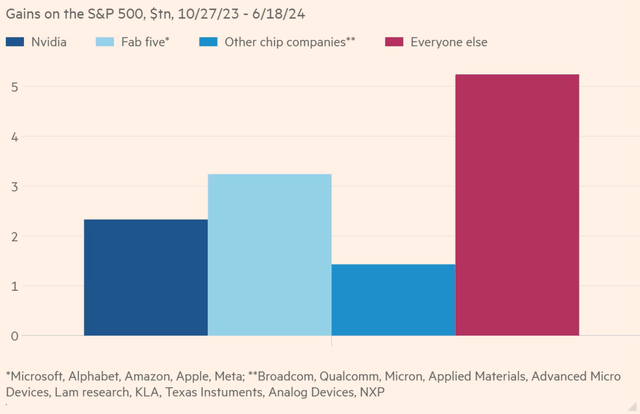

The generative AI (gen-AI) theme has been the backbone of a soaring market that is on pace to match its incredible performance in 2023, currently up 15% year-to-date (S&P 500). Despite many companies doing well the past two years, much of the market’s strength is in just a handful of mega-cap tech companies leading the AI race. Since the short-lived dip in October of 2023, over 50% of the S&P 500’s gains are attributable to Nvidia, other semiconductor companies, and the ‘Fab Five’.

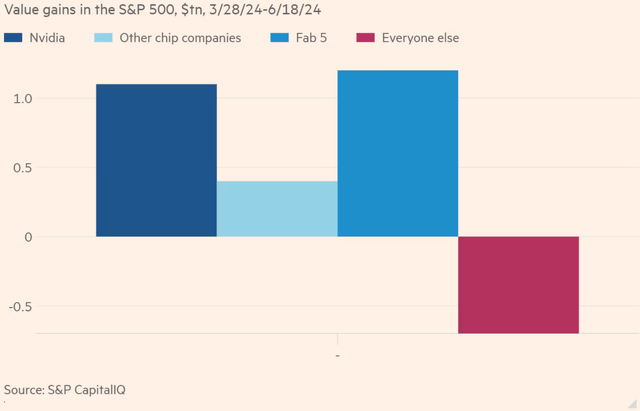

What’s more is, in the past three months alone, these large tech companies are taking credit for more and more of the rally, while the rest of the S&P 500 has been flat or giving up some gains:

Investors seem to be placing big bets that AI has the power to transform businesses and economies – and that these mega tech companies will be the primary beneficiaries. Nvidia CEO Jensen Huang, who’s become somewhat of a celebrity, has helped fuel this excitement with his rhetoric around gen-AI:

The next industrial revolution has begun… Companies and countries are partnering with NVIDIA to shift the trillion-dollar installed base of traditional data centers to accelerated computing and build a new type of data center, AI factories, to produce a new commodity, artificial intelligence. AI will bring significant productivity gains to nearly every industry and help companies be more cost and energy efficient while expanding revenue opportunities.

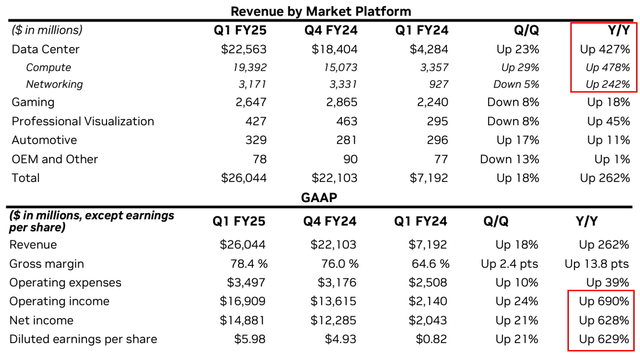

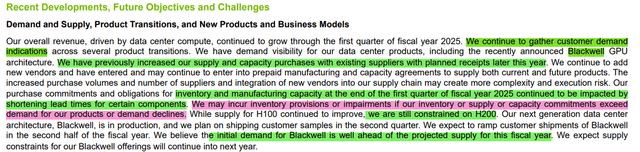

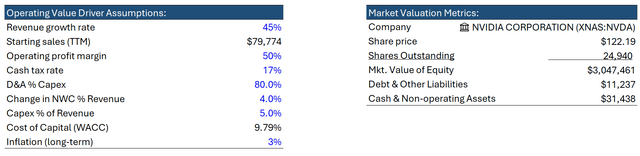

The other two themes, Nvidia’s market position and exceeding expectations, have also remained strong. Nvidia once again crushed estimates in Q1, adding to its streak of 8 consecutive quarterly beats. Data Center revenue and bottom-line profitability were the stars last quarter:

These are eye-popping growth rates for a company churning out over $25B in quarterly revenue, yet the trend isn’t stopping. Management is guiding for about $28B in Q2 revenue, representing Y/Y growth of 107%. CFO Kress said much of the quarter’s Data Center revenue came from its older Hopper GPU, the H100; yet the company is still ramping up its H200 processor, recently launched its highest performing superchip (Blackwell), and expects demand to continue outpacing supply for each product. Nvidia has not let up from dominating the Accelerated Computing market and outperforming already lofty expectations – making its stock a hot commodity.

So… Is Nvidia in a Bubble?

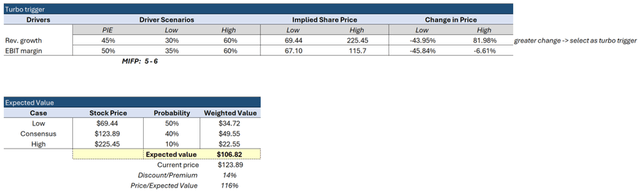

The widely understood definition of a bubble is when the price of a stock, asset, or even an entire market exceeds its fundamental value by a wide margin. Value is often measured using price relative multiples like the price-to-earnings ratio, but these aren’t useful when determining if price has disconnected from fundamental value. Fundamental value is most commonly assessed as the present value of expected cash flows through a discounted cash flow (‘DCF’) model, but this only gives us a snapshot of value at a point in time and relies on assumptions. Instead, to judge if Nvidia is in bubble territory, we can look at how price has tracked two common fundamentals over time: earnings per share (‘EPS’) and free cash flow per share. Both reflect any impacts of dilution, and free cash flow is less susceptible to manipulation.

YCharts

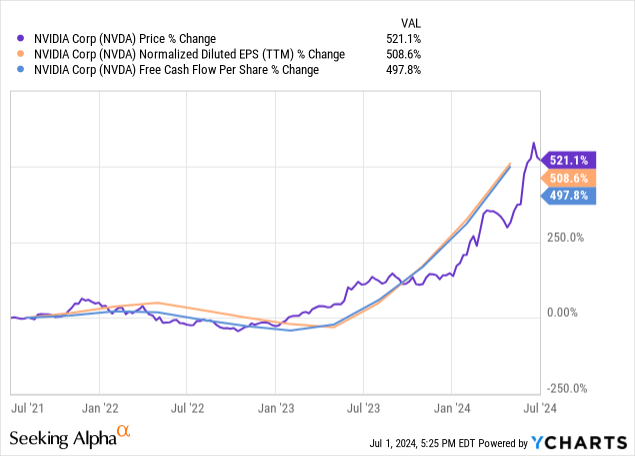

We can see from the above chart that growth in these fundamentals have held incredibly close with Nvidia’s stock price the past 3 years. Nvidia’s performance has prompted recent comparisons to Cisco (CSCO), a poster child of the infamous Dot-Com bubble which saw the NASDAQ rise 800% between 1995 and 2000, only to give up 78% off its gains by 2002. The comparison is not unfounded, as the companies do have several things in common:

- Market-wide excitement around a revolutionary technology, leading to a broader rally.

- Hardware/computing provider for the technology

- Passed Microsoft as the most valuable company

- Leader by market share in its respective market

- Benefited from investments before the industry became profitable

It’s easy to assume the companies are directly comparable, take a look at their price charts, and conclude Nvidia is in a bubble. But digging deeper, we see that Cisco’s fundamentals weren’t nearly as strong as Nvidia’s during that period:

YCharts

The time frame matters as this chart ends near Cisco’s peak, but as it shows, Cisco’s fundamentals began lagging its stock price a year or so earlier. We have yet to see this happen to Nvidia. Even though Nvidia doesn’t appear to be in a stock bubble as we have it defined, high expectations around AI’s prospects put the company at risk of entering a demand bubble.

A Demand Bubble?

The global AI market is expected to reach $800B+ by 2030 according to Statista. Though there is overlap, the Data Center market is also projected to be half-a-billion dollars by 2028. Nvidia itself projects a long-term total addressable market of $1 trillion across its product suite. Even with nearly $80B in TTM revenue, this would equate to only an 8% market penetration. The runway and optimism for AI-related markets, and Nvidia, are undoubtedly high. Even with a nearly 80% share in GPUs and a formidable competitive position, can the company continue exceeding these expectations? If not, it’s possible Nvidia could be in a demand bubble.

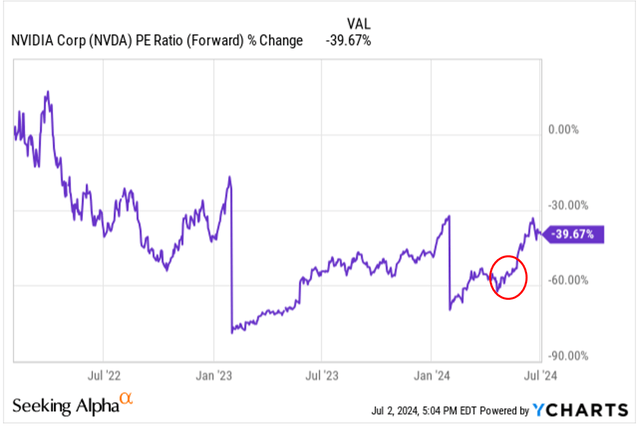

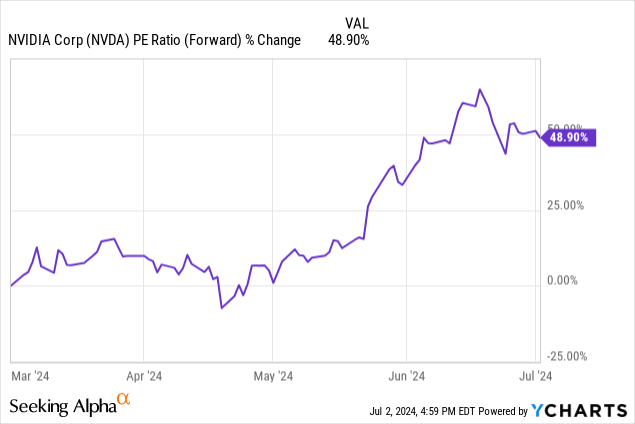

As we’ve seen, Nvidia’s stock price has been a magnet to underlying fundamentals, but this may be beginning to change. Revenue and earnings growth estimates for Nvidia look to be normalizing with analysts expecting growth between 20% and 30% by FY 2026 – quite moderate given its recent numbers. As a result, Nvidia’s forward PE ratio has jumped 50% since March, indicating valuation has recently been more influenced by multiple expansion rather than forward growth and fundamentals.

YCharts

When we look back at the ratio over three years, we can see how Nvidia’s forward growth expectations drove down the multiple (denominator got bigger), usually after the company reported earnings and guidance revisions. But this wasn’t as dramatic last quarter:

The market looks to be implying higher and higher expectations in the price, putting more pressure on Nvidia to continue outperforming in a big way. While I don’t doubt Nvidia will continue dominating its addressable market, and near-term demand continues to outpace supply, there are a handful of risks to its medium/long-term demand which could make it underperform expectations.

The first risk is uncertainty around the synergies of some AI use cases, both in terms of profitability and timeline. The predictable result would be less future demand for Nvidia, and potentially an oversupply of inventory.

Like the internet in the late 90s, many companies are touting AI’s potential to reshape their businesses and generate profits. And like the internet, there were a handful of clear winners, lots of losers, and some that succeeded over time. The market even appears to be more selective with AI stocks as of late:

About 60 per cent of stocks in the S&P 500 have risen this year, but more than half the stocks included in Citi’s “AI Winners Basket” — an index based on the names that were garnering the most excitement among the bank’s clients last year — have declined. More than three-quarters of companies in the AI basket had climbed in 2023.

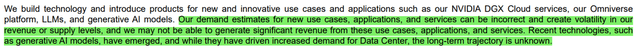

So far, the handful of winners includes Nvidia, semiconductor peers, and the ‘Fab Five’ as we saw – which actually unveils another risk to Nvidia: a large portion of Nvidia’s revenues are expenses for the ‘Fab Five’. 40% of Nvidia’s revenue comes from Microsoft, Meta, Amazon, and Google – each of which have committed billions in capex to build AI infrastructure, but not nearly enough as Nvidia’s revenues are expected to grow:

Nvidia relies heavily on these hyperscalers for growth, yet each of these firms are also investing billions in internal AI capabilities to reduce reliance on Nvidia. Additionally, most of them compete with Nvidia directly in software, gen-AI applications, or even chips like Google’s TPU. This also doesn’t include more direct competitors like Advanced Micro Devices (AMD) and Intel (INTL) which may be able to compete on price as inferencing overtakes training in AI-workloads. The reason being, inferencing generally takes less computing power than training. Should spend from these major customers dry up and competition increase, Nvidia’s future demand is at risk.

Another potential obstacle to chip demand is data center build out. A credit research report on Nvidia by Barclays pointed out that once databases are built, less compute power is required for deployment. Especially as a higher percentage of workflows move to inferencing.

AI chip demand will eventually normalize once the initial training build has been completed. The inference phase of AI is going to require less computing power than the training phase. High-powered PCs and phones could be capable enough to run inferences locally, reducing the need for growing GPU plants.

As the market sifts the wheat from the chaff in AI and data centers are built out further, Nvidia is more susceptible to swings, and possibly a cliff, in demand.

Expected Value

We have seen the market’s confidence in Nvidia as evidenced by its climbing stock price in addition to some risks to the company’s future demand, but how well exactly does the market expect it to perform? And for how long?

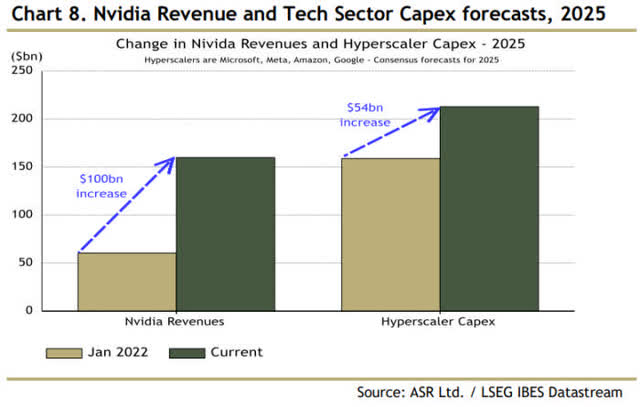

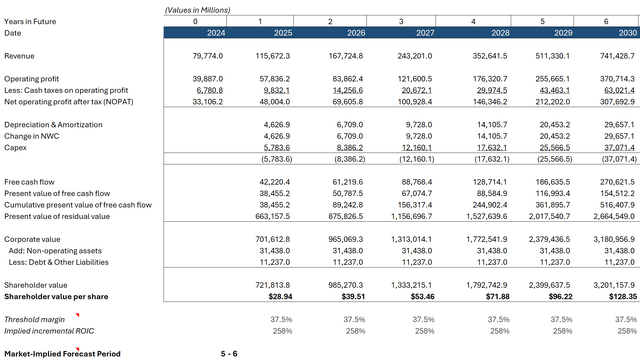

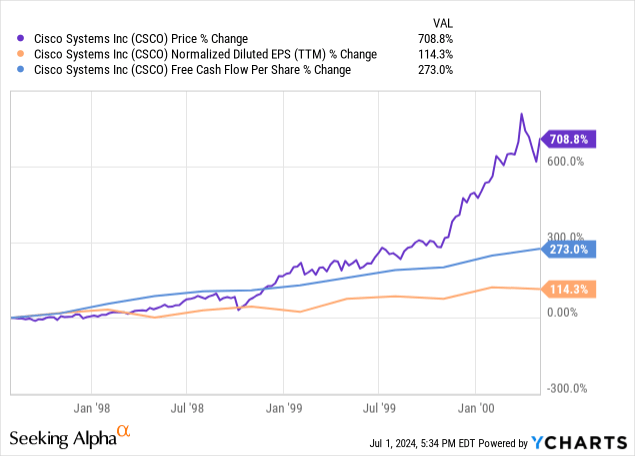

The Expectations Investing framework provides a useful methodology for measuring and judging the market’s implied expectations. Starting with the current stock price and then leveraging a reverse DCF model, we can assess the market’s expectations for Nvidia. Our starting inputs are consensus estimates for revenue growth and operating profit margin. Analysts expect revenue growth near 100% for this FY 2025 tapering down to just under 20% in FY 2027, so I used an average of 45%. Nvidia achieved an operating margin of nearly 60% the past twelve months, but I expect it to normalize around 50%. Other inputs include the cash tax rate, working capital investment, fixed capital investment, depreciation & amortization, and inflation – each of which I estimated using historical averages or most recently reported figures. I calculated the cost of capital using the CAPM model for cost of equity (beta of 1.5, risk free rate of 4%, equity risk premium of 4%), a 2.3% after-tax cost of debt, and Nvidia’s current capital structure. Here are my inputs:

These numbers then flow into a reverse DCF model which calculates the shareholder value per share for each projected year and the market-implied forecast period (‘MIFP’) or the competitive advantage period (‘CAP’). The MIFP or CAP is the number of years the market expects a company to generate returns above the cost of capital, i.e. how long the company will produce the inputted operating value drivers. For Nvidia, the MIFP is between 5 and 6 years.

This means that to justify the current stock price, Nvidia would need to grow revenues at 45% for about the next 6 years and maintain a 50% operating margin. The result would be $740 billion in revenues by 2030, or about 90% of the projected 2030 global AI market we saw earlier. And even with last year’s 125% topline growth, Nvidia averaged only 40% annual revenue growth over the last 5 years. Those are high expectations, especially at Nvidia’s current size. Operating margins of 50% for 6 years are also a big hurdle given increasing competition, which tends to eat away at margins over time.

To judge whether Nvidia is worth buying, we can calculate its expected value based on scenarios and assigned probabilities. I estimated a high and low scenario for the operating value drivers and calculated the shareholder value at 6 years for each. Then I assigned probabilities for the consensus (current stock price) and the scenarios. I view the high case as low probability given the already lofty expectations in the consensus view. Nvidia tends to outperform expectations, so I weighted the consensus at a 40% probability. Finally, I gave the low case a 50% probability, which I view as most likely given the increasing risks to demand and size limitations on Nvidia to produce such high growth. The result was an expected value of $106.82. Nvidia looks overpriced by about 14% of fair value.

A Risky Bet

On both sides of the Nvidia debate, there remains a whole lot of uncertainty. I have mentioned some risks I see to demand, but the potential of AI is not easy to estimate in the short term, just like the internet. If it happens to be the start of a new ‘Industrial Revolution’, it’s hard to project how well Nvidia could continue to do. There is also uncertainty around timing. Even if demand does drop eventually, it may take a few years or more. Or demand could pick up as use-cases evolve and Nvidia innovates.

Even though Nvidia appears to be overextended with high baked-in expectations, betting against the company is risky. The stock has shown incredible momentum and the company is high quality with a massive moat. Nvidia’s CEO Huang is a visionary, an executor, and an effective capital allocator. Nvidia’s astonishing growth and returns on invested capital averaging about 30% the past decade are all the evidence needed. The company has also stockpiled $30B in cash for further investment in growth. Nvidia has maintained a near 80% market share in GPUs with first-mover advantages. Additionally, big tech companies have increasingly become hard to displace while taking more of the pie in their respective industries.

Nonetheless, Nvidia’s growing risks and current valuation make the stock a hold in my view. A great company can be a bad investment if paid too high a price for.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.