Summary:

- Nvidia Corporation once again posted a $2 billion beat to consensus revenue estimates in Q3, reporting YoY growth of nearly 94% to over $35 billion in revenue.

- Current forecasts point to revenue surpassing the $50 billion mark one year from now, with revenue growth exceeding 40% for the next five quarters.

- Q3’s margins were relatively in line with guidance despite the $2 billion top-line beat, and for Q4, management forecast margins to contract nearly 2 points sequentially.

David Tran

Nvidia Corporation (NASDAQ:NVDA) once again posted a $2 billion beat to consensus revenue estimates in Q3, reporting YoY growth of nearly 94% to over $35 billion in revenue. Data center revenue more than doubled in the quarter to over $30 billion, with Hopper driving the second-largest data center beat in company history. This speaks volumes as to the level of demand for its GPUs, given that Blackwell will not initially ship until next quarter.

As recapped to our premium members after the earnings report, the Tech Insider Network is tracking supply chain signals. They indicate the next generation of GPUs shipping in full volume by mid-2025 (and beginning to ship in the January quarter) will far exceed the GPU sales we saw in 2023 and 2024 combined.

The Tech Insider Network is already tracking a 30% minimum difference between GB200 NVL72 orders and what the Street has estimated for next year. When adding that the DGX B200 systems will be priced 40% higher, and assuming pricing power affects more SKUs the way it will affect the DGX B200 systems, then it’s possible to see about 70% upside next year for Nvidia.

Nvidia Posts Largest Data Center Beat Since Hopper’s 2023 Breakout

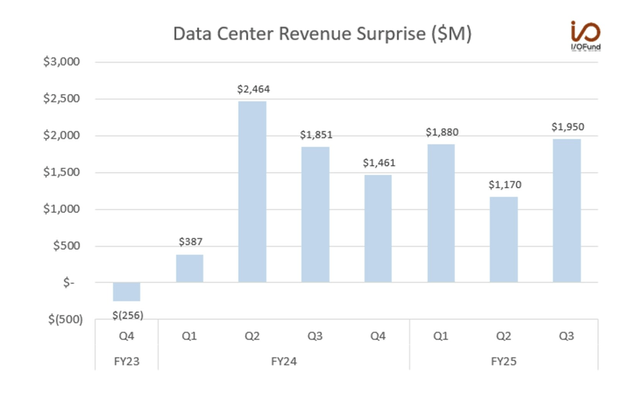

Nvidia reported $35.08 billion in revenue, versus consensus of $33.13 billion. Beating on data center revenue is becoming commonplace for Nvidia, yet what’s interesting is the data center segment posted the largest surprise relative to estimates since Hopper’s breakout quarter in FY24.

A bar graph illustrating Nvidia’s impressive revenue performance, showcasing a $35.08 billion revenue surpassing the consensus estimate of $33.13 billion. This marks the largest data center segment beat since Hopper’s breakout quarter in FY24, highlighting Nvidia’s consistent outperformance in the data center sector. (Tech Insider Network)

Data center revenue of $30.77 billion increased 112.0% YoY and 17.1% QoQ, beating estimates by $1.95 billion. This marked the largest beat since the $2.46 billion beat in Q2 FY24, as well as the two $1.8 billion beats in Q3 FY24 and Q1 FY25. This is important as this beat was driven solely by Hopper – which is in its seventh quarter with the H100s and H200s.

Blackwell’s is expected to ramp quickly in Q4 and into next year. Analysts estimate Blackwell’s volume in Q4 could be between 150,000 and 200,000, before tripling sequentially to 550,000 in Q1 FY26 (Jan-Apr quarter of 2025). The expectation for AI clusters is to go from tens of thousands, to hundreds of thousands, to millions of GPUs, indicating a long runway for Blackwell and subsequent GPU generations.

Nvidia’s Blackwell to Drive a Minimum of 50% Data Center Growth Next Year

What’s shaping up for 2025 is the convergence of multiple strong tailwinds for Nvidia to capture via Blackwell: GPU clusters this generation beginning at the upper end of Hopper’s hundred-thousand clusters, Big Tech capex continuing to increase past one quarter trillion (which we covered two weeks ago), and more importantly, Blackwell’s pricing power versus Hopper.

Q3 earnings aside, the bigger picture is that Nvidia’s Blackwell GPU sales next year will far exceed the GPU sales we saw in 2023 and 2024 — combined. 2025 is shaping up to be potentially the most important year for Nvidia since I first highlighted Nvidia’s AI GPU thesis in my free stock newsletter in November 2018 and when the Tech Insider Network entered at $3.15 for returns of 3,280%.

Including Q4’s estimate, Hopper has delivered approximately $125 billion to $130 billion in data center revenue in 2023 and 2024. Blackwell, on the other hand, is expected to deliver up to $210 billion next year alone. You may watch me discuss Nvidia on CNBC here.

Back in August, in the analysis “Nvidia Stock: Blackwell Suppliers Shrug Off Delay Ahead Of Q2 Earnings,” I wrote:

According to reports from Wccftech: “Team Green is expected to ship 60,000 to 70,000 units of NVIDIA’s GB200 AI servers, and given that one server is reported to cost around $2 million to $3 million per unit, this means that Team Green will bag in around a whopping $210 billion from just Blackwell servers along, that too in a year.

The weight of that report cannot be overstated as it implies a 26% upside to 2025’s estimates based on one SKU alone.

Despite Blackwell not yet shipping in full volume, there are multiple data points that support this ramp to $200+ billion in revenue.

Perhaps the most important quote was one that could easily be overlooked — Nvidia’s management explained in Q3’s earnings that they have:

Completed a successful mask change for Blackwell…that improved production yields. Blackwell production shipments are scheduled to begin in the fourth quarter of fiscal 2025 and will continue to ramp into fiscal 2026.

Since both Hopper and Blackwell will be shipping in tandem beginning in Q4, there’s more emphasis on supply constraints moving forward, as management was clear in saying that both products have “certain supply constraints” with Blackwell’s demand “expected to exceed supply for several quarters in fiscal 2026.” Broadly speaking, supply constraints are nothing new, as it’s been widely understood Blackwell is already sold out for next year.

By executing this mask change to improve production yields, Nvidia can theoretically get more usable chips per wafer, alleviating some supply fears and allowing it to meet higher demand levels, leading to higher revenue generation. Management already hinted at this, saying, “we will deliver this quarter more Blackwells than we had previously estimated.” CEO Jensen Huang also explained that GPU clusters with Blackwell will be starting where Hopper left off:

You see now that at the tail-end of the last generation of foundation models were at about 100,000 Hoppers. The next generation starts at 100,000 Blackwells.

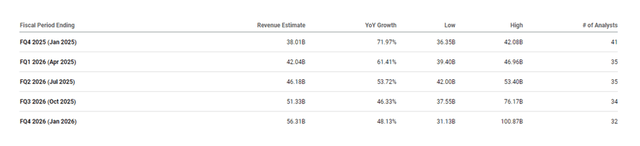

Even though Nvidia guided Q4 nearly in line with analysts’ expectations at $37.5 billion, there is still significant room for Blackwell to grow through 2025. Current forecasts point to revenue surpassing the $50 billion mark one year from now, with revenue growth exceeding 40% for the next five quarters.

A table displaying the wide range of analyst revenue estimates for Nvidia in FY26, highlighting a $40 billion range for Q3 and a $70 billion range for Q4. The potential for Nvidia to achieve over $50 billion in quarterly data center revenue is also noted. (Tech Insider Network)

Interestingly, there is still a massive disconnect in analyst estimates as FY26 progresses – estimates for Q3 have a nearly $40 billion range from the low to high estimates. When looking at Q4 of next year, there is a ridiculous $70 billion range, with some analysts predicting $31 billion at the low end while others have estimates as high as $101 billion. Should Nvidia maintain its quarterly cadence of beating by $2 billion from the midpoint of these estimates, and assuming the data center mix remains at ~90%, Nvidia could easily exit FY26 with data center revenue at >$50 billion/quarter, or $200+ billion annualized compared to data center revenue of $140 billion this year.

Big Tech’s capex supports this revenue growth story, as Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), and Alphabet (GOOG) have all accelerated capex significantly in the past couple of quarters and reaffirmed the need to continue investing aggressively in AI infrastructure moving through 2025.

Additionally, Big Tech is already spending tens of billions on Nvidia’s Blackwell lineup:

- Alphabet has reportedly ordered 400,000 GB200s worth $10 billion.

- Microsoft has reportedly ordered 60,000 GB200s worth $2 billion.

- Meta has reportedly ordered 360,000 GB200s worth $8 billion.

This is but a fraction of 2025’s estimated capex– 2024’s capex could come in at ~$240 billion with an estimated $70 billion spent in Q4, with the four currently tracking for over $270 billion in capex predominantly for AI infrastructure in 2025.

Nvidia has been capturing a lion’s share of AI spending from Big Tech, at ~80% to 85%. Assuming little change in its AI GPU market share with competition primarily arising from AMD and no one else, Big Tech’s spending implies a clear path towards $200 billion in GPU revenue in 2025.

The importance of Big Tech’s capex was also echoed, with the CEO stating we will see $1 trillion in data infrastructure rebuild before he expects to see digestion from the hyperscalers. Per Huang: “I believe that there will be no digestion until we modernize a trillion dollars with the data centers.” That would imply another 3X from here for the remaining three-quarter trillion – not in stock price, but in capex. Presumably, it would mean a higher trajectory for the stock price in terms of valuing that revenue.

Nvidia Faces Tough Comps Off Peak Growth

Hopper drove another beat, which Nvidia is becoming widely known for. It’s rare for analysts to openly expect large beats going into a print, yet UBS had correctly tagged the beat this quarter at $2 billion. However, due to a decline from peak revenue growth of 265% earlier this year, Hopper-driven growth of 94% is not what will drive the stock up for the next leg higher. Nvidia investors, such as myself, will need Blackwell’s pricing power and Blackwell’s clear demand signals to re-invigorate the stock.

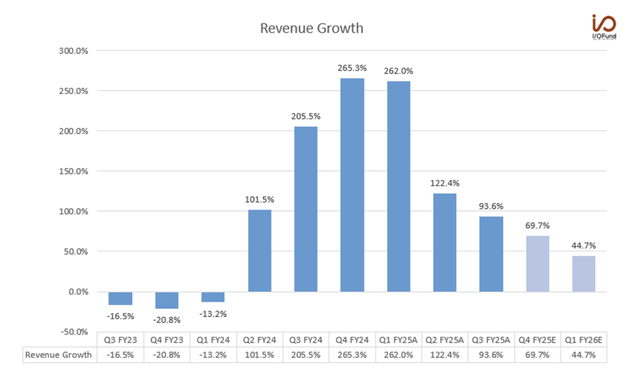

Nvidia reported 93.6% YoY growth, more than 10 points higher than consensus estimates for ~83% YoY growth. Nvidia is now lapping its peak growth quarters, Q4 FY24 and Q1 FY25, where revenue peaked at 265% growth due to Hopper ramping tremendously fast.

Growth technically is decelerating nearly 30 points in Q3 and growth will further decelerate nearly 24 points next quarter, but to be reporting above 93% YoY and almost 70% YoY versus 200-260%+ growth comps is still a very strong report, to say the least.

A graph illustrating Nvidia’s year-over-year growth rates, showing a deceleration from peak growth of 265% to current growth of 94%. The graph highlights Nvidia’s consistent beats against analyst estimates, driven by Hopper, and the anticipated future impact of Blackwell. (Tech Insider Network)

For Q4, management guided for revenue of $37.5 billion, +/- 2%, just slightly ahead of consensus estimates for $37.02 billion at the midpoint. Analysts are now expecting $38.01 billion in revenue for Q4, just a week after the report, at the upper end of the guided range. Both Hopper and Blackwell will be shipping in tandem moving forward as Blackwell ramps significantly through fiscal 2026.

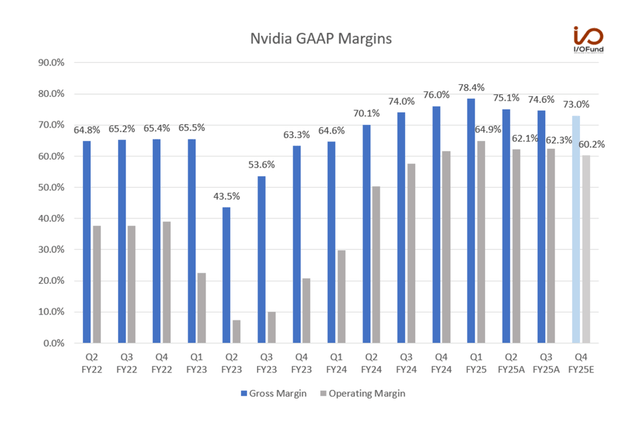

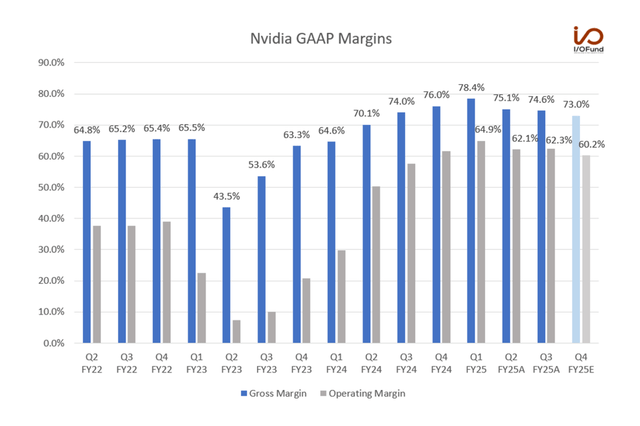

Margins Issues are Overblown

Analysts were nitpicking margins, yet this concern is overblown. Q3’s margins were relatively in line with guidance despite the $2 billion top-line beat, and for Q4, management forecast margins to contract nearly 2 points sequentially. However, CFO Colette Kress was clear that following Blackwell, gross margin will eventually return to its current percentage:

As Blackwell ramps, we expect gross margins to moderate to the low-70s. When fully ramped, we expect Blackwell margins to be in the mid-70s.”

Investors should never underestimate Wall Street’s ability to miss the bigger picture. Analysts on the call cross-examined this 200 bp sequential decline despite Nvidia having an operating margin of over 60% compared to most of the Mag 7 having operating margins at half that. It’s also completely normal for semiconductors to feel margin pressures in the initial stages of ramping a new product, especially at this scale and pace. I discuss this on Bloomberg here.

A chart showing Nvidia’s operating margins, highlighting the anticipated 2-point sequential decline in Q4 and the projected return to mid-70s gross margins with the ramp-up of Blackwell. The chart emphasizes Nvidia’s strong current margins compared to industry peers. (Tech Insider Network)

- GAAP gross margin was 74.6% in Q3, just ahead of guidance for 74.4%. Adjusted gross margin was 75%, in line with guidance. This reiterated my view from last quarter that Q1 was the peak for gross margins, as margins have contracted about 380 bp since then.

- For Q4, management guided for GAAP gross margin of 73%, +/- 0.5%, and adjusted gross margin of 73.5%, +/- 0.5%, for a sequential contraction of ~150-160 bp.

- GAAP operating margin was 62.3% in Q3, increasing slightly from 62.1% in the prior quarter but up from 53.1% in the year-ago quarter. Adjusted operating margin of 66.3% dipped slightly from 66.4% in Q2, but increased from 64.8% in the year-ago quarter.

- For Q4, similar to gross margins, management guided for sequential contraction based on operating expense forecasts. GAAP operating margin is implied to be 60.2%, while adjusted operating margin is implied to be 64.4%, or about a 200 bp sequential contraction.

A chart showing Nvidia’s operating margins, highlighting the anticipated 2-point sequential decline in Q4 and the projected return to mid-70s gross margins with the ramp-up of Blackwell. The chart emphasizes Nvidia’s strong current margins compared to industry peers. (Tech Insider Network)

GAAP gross margin was 74.6% in Q3, just ahead of guidance for 74.4%. Adjusted gross margin was 75%, in line with guidance. This reiterated my view from last quarter that Q1 was the peak for gross margins, as margins have contracted about 380 bp since then.

- For Q4, management guided for GAAP gross margin of 73%, +/- 0.5%, and adjusted gross margin of 73.5%, +/- 0.5%, for a sequential contraction of ~150-160 bp.

- GAAP operating margin was 62.3% in Q3, increasing slightly from 62.1% in the prior quarter but up from 53.1% in the year-ago quarter. Adjusted operating margin of 66.3% dipped slightly from 66.4% in Q2 but increased from 64.8% in the year-ago quarter.

- For Q4, similar to gross margins, management guided for sequential contraction based on operating expense forecasts. GAAP operating margin is implied to be 60.2%, while adjusted operating margin is implied to be 64.4%, or about a 200 bp sequential contraction.

Conclusion

The bigger picture for Nvidia moving forward is that Blackwell holds the potential to dwarf Hopper’s revenue generation in fewer quarters. Breaking it down further on CNBC, I stated Nvidia’s trajectory will continue due to two words: pricing power I had been quite vocal before earnings that Q3’s report was nothing but a blip in the longer-term picture, with 2025 being much more important than this quarterly report.

We are already tracking a 30% minimum difference between GB200 NVL72 orders and what the Street has estimated for next year. When adding that the DGX B200 systems will be priced 40% higher, and assuming pricing power affects more SKUs the way it will affect the DGX B200 systems, then it’s possible to see about 70% upside next year for Nvidia.

Make no mistake, Nvidia is the best stock of the decade, and we are only four years in. The Tech Insider Network has an aggressive buy plan at key levels should the stock pull back, and we have a backup plan should the stock overcome the peer pressure we are seeing from the semiconductor industry and meaningfully breakout.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

Grab the Black Friday offer with savings of up to $209 before our price increase on Dec 05, 2024.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.