Summary:

- Nvidia Corporation investors have endured a recent bear market after its recent stock split in June.

- I explain why the welcomed pullback shouldn’t be construed negatively.

- Nvidia’s data center growth rates may slow down, but it’s still expected to be highly remarkable.

- Nvidia Corporation’s growth-adjusted valuation underscores why the stock isn’t overvalued.

- I explain why I bought the recent dip, even as some investors rushed out to protect their gains. Read on.

BING-JHEN HONG

Nvidia’s Outperformance Isn’t Built On Hype.

Nvidia Corporation (NASDAQ:NVDA) investors who chased the recent enthusiasm surrounding NVDA’s stock split have been battered. Accordingly, NVDA has plunged into a bear market decline, falling more than 25% from its June highs through this week’s lows. Down, but not out, NVDA has still significantly outperformed the S&P 500 (SPX, SPY) and its semiconductor peers (SMH, SOXX), as the stock notched a total return of almost 150% over the past year. Consequently, I assess that the recent battering should be considered within the framework of a welcomed pullback rather than something more “sinister,” prefacing a potentially debilitating bearish reversal.

In my previous bullish NVDA article in May, I upgraded the stock and explained how I had misunderstood its bearish thesis. The Generative AI gold rush has transitioned from initial hype into sustained AI investment spending across several sectors and industries. It has also lifted hyperscaler spending to new heights as they race to develop the most cutting-edge AI models to maintain their competitive advantages. Google (GOOGL, GOOG) highlighted the surge in AI spending, as CapEx increased by more than 90% in Google’s Q2 earnings release.

The momentum is expected to continue, emphasizing the need to invest heavily in AI infrastructure to maintain its leadership. Google CEO Sundar Pichai’s commentary underscores the monetization potential of its AI investments, articulating that they “have already generated billions in revenues and are being used by more than two million developers.” ServiceNow’s (NOW) solid earnings performance demonstrates the immense AI opportunities for leading SaaS companies. CEO Bill McDermott telegraphed the significant influence of its GenAI products, contributing to its solid execution, emphasizing that the “extraordinary results” wouldn’t have been possible without GenAI.

Nvidia’s AI Growth Prospects Broadening

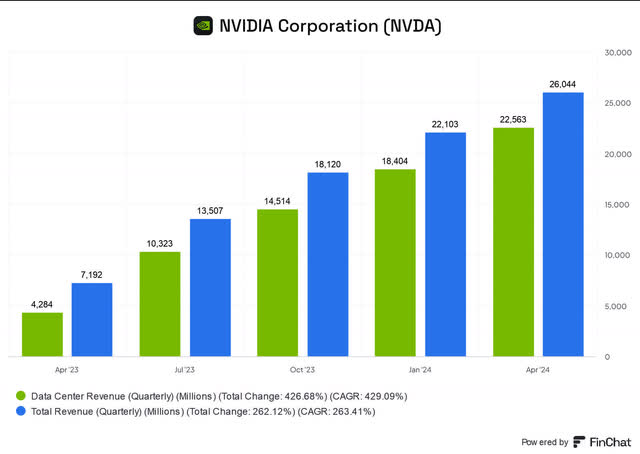

Nvidia data center revenue (FinChat)

Consequently, I believe it sets the stage for Nvidia investors to have the confidence to buy significant dips in its stock price. I also expect Huang and his team to clarify the momentum of its upcoming product launch cadence, lowering execution risks in the second half.

Unless you live in a cave, I believe you would have known about the criticality of the data center segment to the company’s stellar performance. The segment accounted for over 85% of its FQ1 revenue base, as Nvidia’s data center revenue surged by 427% YoY and 23% QoQ. As a result, investors need to temper their expectations of another similar increase, even as the company prepares for a pivotal second half as NVDA begins to ship its Blackwell platform.

Nvidia emphasized that Blackwell has moved into “full production and forms the foundation for trillion-parameter scale generative AI.” Nvidia’s full-stack ecosystem approach is predicated on the hardware foundation “of Grace CPU, Blackwell GPUs, NVLink, Quantum, Spectrum, mix and switches, and high-speed interconnects.” The company’s robust software ecosystem underpins its competitive advantage, which is bolstered by the development of the Nvidia AI Foundry. As a result, the company is committed to scaling its partner ecosystem across the stack to “support AI-driven digital transformation projects.”

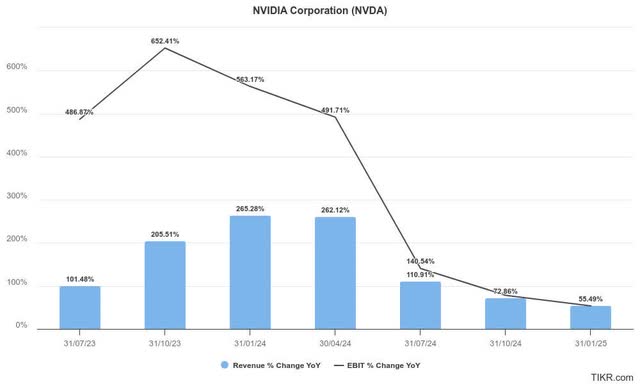

Nvidia’s Data Center Growth Rates Slowdown Likely

Notwithstanding my optimism, Nvidia investors must be prepared for an extended normalization phase, as its YoY growth momentum could have peaked in FQ1. As seen above, the company is expected to report a potentially sharp slowdown in revenue growth at Nvidia’s upcoming FQ2 earnings release on August 28.

However, the magnitude of the company’s growth prospects is still remarkable, with revenue and adjusted EBIT anticipated to increase more than 100% in FQ2. Hence, I don’t expect semiconductor investors to jump ship, even though they shouldn’t expect similar valuation re-rating opportunities over the past two years (it gained almost 600% on a total return basis).

Nvidia investors must also consider inherent risks to the company’s thesis. Tight demand/supply dynamics in TSMC’s (TSM) ability to produce its leading AI chips could hamper a more successful rollout of its next-gen architecture. The leading foundry has indicated tight supply through 2026, although I have not assessed imminent risks to Nvidia’s shipments cadence.

Arch-rival Advanced Micro Devices (AMD) is also anticipated to make further progress through its MI300 series AI chips in its attempt to unhinge Nvidia’s dominance. AMD’s open standards approach could be more favorable in helping customers avoid potential lock-ins and align with the FTC’s Open AI models framework. As a result, it could weaken the ability of dominant players like Nvidia to lock up the AI ecosystem.

In addition, the subsequent growth phase through AI factories and Sovereign AI is still nascent. Given the unprecedented surge in Nvidia’s AI data center growth, the company increasingly relies on the segment to drive its valuation. Therefore, unanticipated execution risks in the emerging growth vectors could hamper its ability to maintain its current momentum, potentially impacting its valuation.

NVDA Stock: Not Overvalued When Adjusted For Growth

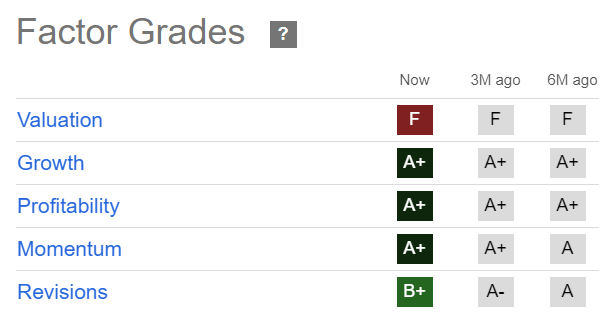

NVDA Quant Grades (Seeking Alpha)

Don’t be fooled by glancing over NVDA’s supposedly “expensive” valuation because that was what I did in the past. Ask yourself why NVDA has outperformed the market over the past two years. Is the market really that dumb that it couldn’t differentiate between hype and reality?

Furthermore, Nvidia’s demonstrated revenue and profitability growth metrics should have silenced the bearish investors who thought it was only pure hype. The growth prospects for increased hyperscaler spending, Sovereign AI growth, and AI factories developments are needed to push the GenAI boundaries further. Coupled with NVDA’s solid execution (“B+” earnings revisions grade), the AI chips leader also boasts best-in-class profitability.

I urge investors to consider the growth-adjusted valuation metrics for such growth stocks. NVDA’s adjusted PEG ratio of 1.25 is more than 30% below its tech sector median. In addition, it’s also markedly below its 5Y average of 2.1. Therefore, I don’t consider NVDA overvalued when incorporating its growth prospects. In contrast, the market seems to have already reflected potential execution risks in the company’s next growth phase as it looks to broaden the AI growth vectors further.

Is NVDA Stock A Buy, Sell, Or Hold?

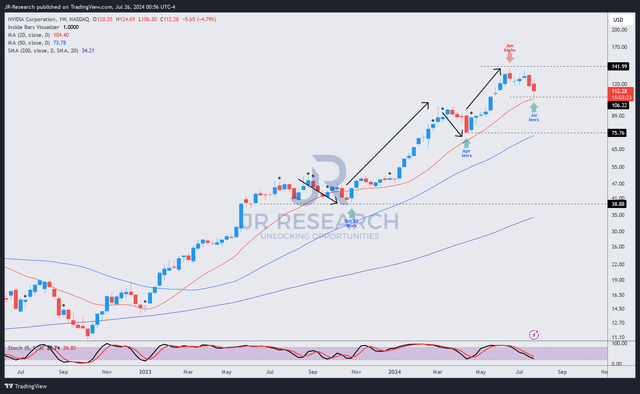

NVDA price chart (weekly, medium-term, adjusted for dividends) (TradingView)

NVDA’s price action remains incredibly resilient, with no signs of a bull trap. Previous pullbacks have led to solid dip-buying enthusiasm at its lows in October 2023 and April 2024. Subsequent rallies followed, helping NVDA to maintain its incredible market outperformance.

The stock has recently dropped into a bear market following its split in June 2024. However, it shouldn’t be construed negatively, as the stock remains in an uptrend bias. There’s a possibility of a bottom above the $110 level, although we don’t have a bullish reversal validation yet.

A further drop to a support zone between the $75 level and $110 level is also possible, but not my base case for now. As a result, I view the pullback in NVDA constructively, corroborated by the stock’s remarkable “A+” buying momentum.

Stock rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something significant that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, SMH, AMD, GOOGL, NOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.