Summary:

- In my view, the market’s excitement about the company’s future EPS growth is unrealistic. Read on to learn why.

- The upcoming Q2 FY2024 quarterly report has the potential to provide a touch of reality and may lead to a correction in the stock.

- But I like the long-term prospects. Maybe after a solid correction, I’ll reconsider my thesis once again.

David Becker

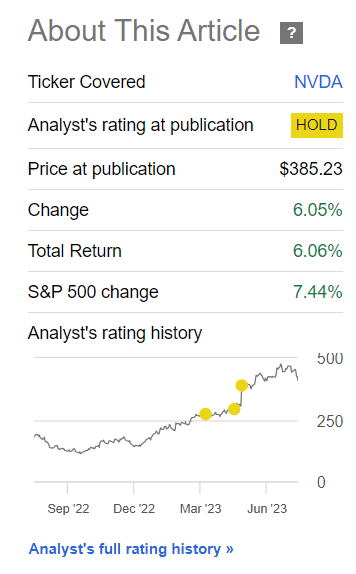

I first wrote about Nvidia Corporation (NASDAQ:NVDA) in early April of this year, when artificial intelligence (“AI”) stocks were on the upswing, which remains the case today. NVDA seemed to me to be one of the most innovative companies in the industry, with a strong moat that could lead to phenomenal growth over the long term. But like many skeptical analysts, I noticed at that moment that the market was too quick to get carried away with NVDA’s lofty earnings-per-share expectations for the next 5-10 years, prompting me to issue a “Hold” rating. I reiterated that rating two more times, and since the last article in which I wrote about the approaching profit-taking, the stock is up 6.06% versus the S&P 500 Index (SP500, SPX) gain of 7.44%:

Seeking Alpha, my last NVDA article

So far, my thesis remains “Hold,” but now I’ve become even more skeptical about the stock’s continued growth. In my opinion, the market’s excitement about the company’s future EPS growth seems too unrealistic now, and the upcoming Q2 FY2024 quarterly report has a chance to provide a touch of reality.

Why Do I Think So?

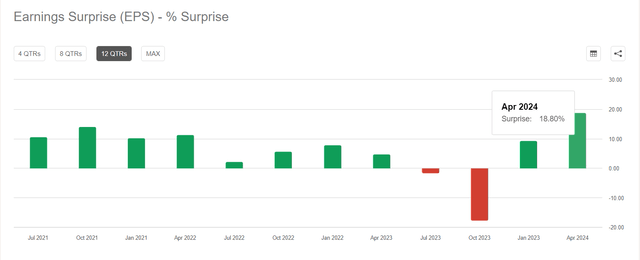

As I wrote last time, Nvidia’s Q1 FY2024 results were indeed outstanding, with earnings of $1.09 per share and revenue of $7.19 billion, surpassing expectations by healthy margins.

Seeking Alpha Premium, NVDA EPS surprise Seeking Alpha Premium, NVDA Revenue surprise

The growth was fueled by strong performances in Data Center, Gaming, Pro Visualization, and Automotive segments. Margin expansion, cost management, and solid financials indicated a promising path, as the company projected Q2 FY2024 revenue of $11.00 billion and continued margin growth.

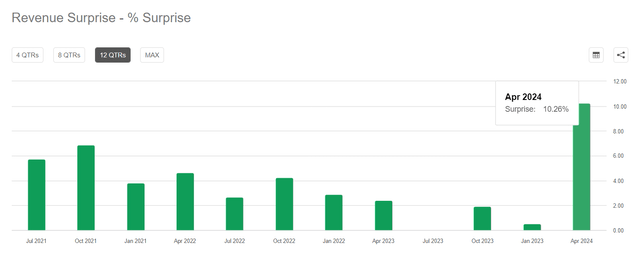

Analysts were in no doubt about the company’s ability to beat quarterly guidance again, and so we now see a consensus revenue forecast of $11.06 billion for the second quarter of FY2024 and a subsequent YoY doubling of revenue for the next two quarters:

Seeking Alpha Premium, NVDA’s Revenue consensus estimates

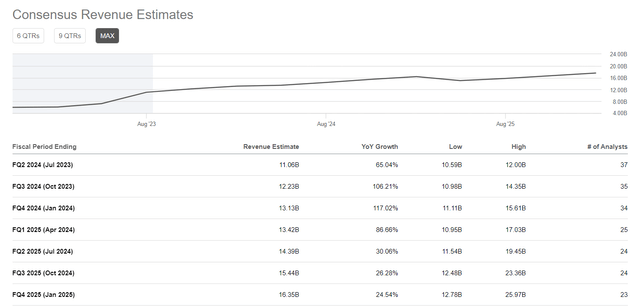

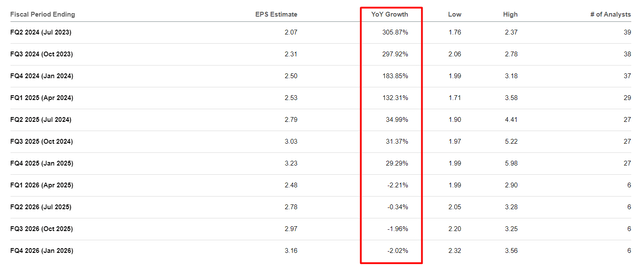

Due to the expectation of further margin expansion, EPS should grow much faster in calendar years 2023-2025 before reaching a plateau in 2025-2026:

Seeking Alpha Premium, NVDA’s EPS consensus estimates

During the Nasdaq London Investor Conference Call on June 14, 2023, Colette Kress, Nvidia’s Executive Vice President and Chief Financial Officer, indicated that the increased demand for AI and generative AI, as well as ongoing interest from various customer segments, contributed to Nvidia’s positive outlook that caused the one-time spike in EPS guidance for the upcoming quarter. Kress was also asked about the balance between unit growth and average selling price (ASP) growth. She clarified that the growth was driven by an increased volume of customers interested in leveraging generative AI.

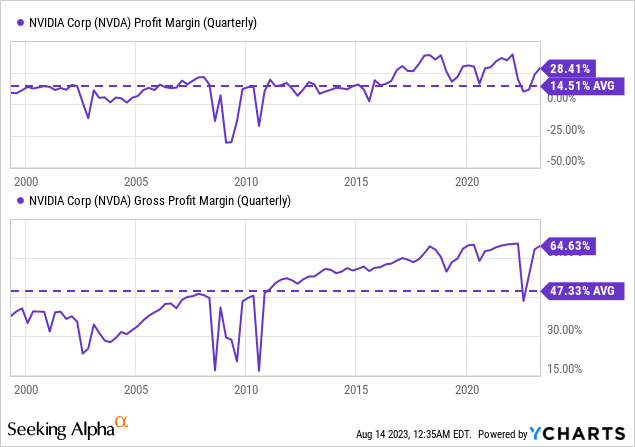

I think NVDA is already pretty close to its historical records in terms of profit margins, and its capacity to continue to build on those is diminishing quarter by quarter.

Demand will certainly continue to drive sales, but since the bulk of NVDA’s revenue comes from the sale of its GPUs to other companies, manufacturing costs will not go away no matter how fast inflation drops and how much the company raises prices on its products. There is a limit to GPUs’ price increases, as price elasticity of demand sets in at some point.

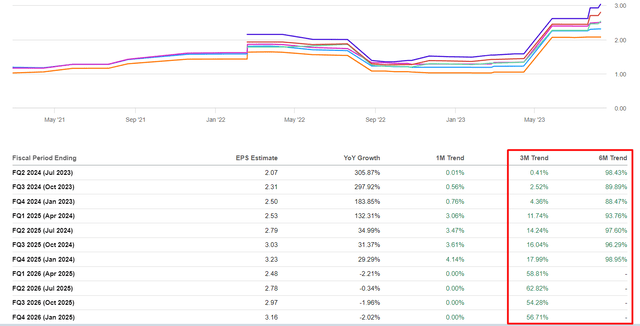

When we see actual growth on a low base, as it is now, and when it becomes very difficult to argue with global technology trends, the real possibilities of companies in the medium term are very often greatly overestimated. This is exactly what seems to have happened with NVDA.

Seeking Alpha, NVDA, Earnings Revisions

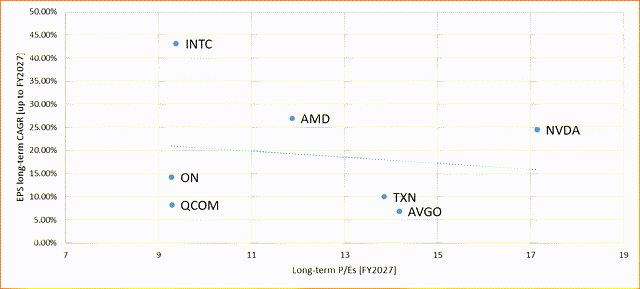

If we go to the page with the already high EPS growth forecasts of NVDA and its competitors and try to calculate their CAGRs, and then compare the resulting values with the implied price-earnings ratios of the last forecasted year [in our case FY2027], we will clearly see that NVDA’s FY2027 P/E ratio of ~23x is too high compared to others:

Author’s work, Seeking Alpha Premium’s data

I realize that NVDA is the leading provider of GPUs for the gaming and AI markets, but the company faces significant competition from Advanced Micro Devices, Inc. (AMD), Intel (INTC), Qualcomm (QCOM), and Broadcom (AVGO), so it would be wrong to exclude these companies from the valuation analysis.

The average long-term P/E ratio for the selected group (ex-NVDA) is ~11.3x, while NVDA has a ratio of ~17.14x – that’s a premium of ~52%. At the same time, the average ex-NVDA EPS CAGR is 18.21% while NVDA holds a CAGR of 24.53%. There is no obviousness here. Any valuation model is by and large subjective and based on the pessimism or optimism of the analyst. Personally, the premium NVDA has over AMD seems unreasonably high to me.

The way I see it, the upcoming Aug. 23 earnings release could lead to a typical “sell the good news” scenario, as SA fellow analyst Paul Franke suggested in his recent assessment of NVDA, which I agree with. This could mark the peak in growth rates, as excitement over remarkable AI-related chip growth is already priced into the value of the stock.

The Bottom Line

Investors need to understand the difference between a company and a stock when making investment decisions. My long-term outlook for the stock has not changed: NVDA’s business will continue to grow by leaps and bounds over the next few years as more companies digitize and adopt new AI technologies. But the stock can also go through periods of correction, and now we’re likely facing another one.

The upcoming fiscal Q2 report (expected post-market August 23rd) has set the bar very high for NVDA – it’s hard to argue against that, as analysts are setting their consensus higher than management’s guidance, which rarely happens. If NVDA doesn’t beat those forecasts, there is a big risk that the stock will correct sharply, as profit takers will think the growth cycle is over and it’s time to get out. From a risk and reward perspective, I think this is an issue for buyers.

But of course, I can be wrong, as I was back in April when I wrote about NVDA being too hot to touch. Turns out it wasn’t too hot for everyone, as the stock continued to rise. Those who sell at today’s prices risk incurring opportunity costs. Short sellers are even more at risk, as no one knows how far AI trends will take us.

But again, in terms of risk-reward, I think Nvidia Corporation stock is unfavorably positioned today. Too many hopes have already been priced in and the current comparative valuation suggests downside potential.

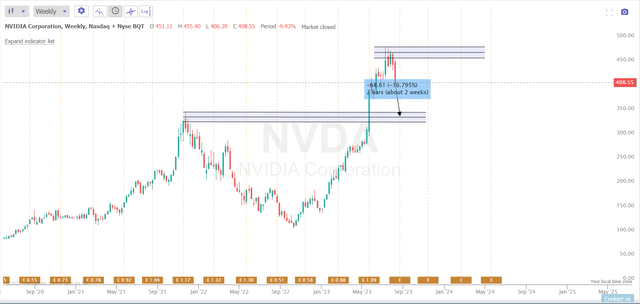

TrendSpider Software, author’s notes

I don’t advise buying more Nvidia Corporation stock before the report is released if you already hold a long position. But shorting before the report is also dangerous. I’ll continue to watch the stock from the sidelines.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!