Summary:

- Nvidia Corporation’s strong demand drove significant revenue growth and raised expectations for continuous high growth, but I believe the current stock price is largely driven by sentiment and momentum.

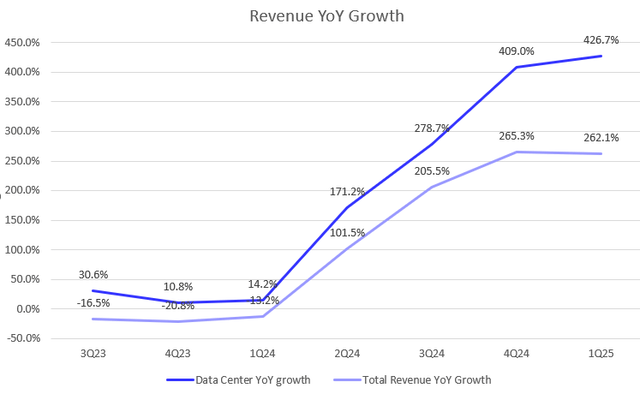

- Despite Nvidia’s 423% YoY growth in Data Center and 262% YoY in total revenue in 1Q FY2025, its EV/Sales TTM of 41.5x is approaching all-time highs.

- Market consensus on Nvidia’s future growth may be overly optimistic, with potential risks including pull-forward demand, competition, and geopolitical tensions.

- Investors prioritize future growth over past gains. Despite Nvidia’s revenue tripling over the past three years, any deviation from its current growth trajectory could trigger a deep selloff.

zirconicusso

How Can NVDA Rally So Much?

It’s difficult to imagine how much that the sentiment of the entire U.S. market is heavily influenced by one stock, Nvidia Corporation (NASDAQ:NVDA). I acknowledge that NVDA’s growth outlook has surpassed my expectations over the past year. The recent jaw-dropping rally is driven by two factors: tremendous demand for GPU chips for training AI models amid the GenAI boom, and significant expansion in its valuation multiples due to continuous upward revisions in the company’s growth outlook. Essentially, NVDA appears to be undervalued if a 100% rally in stock price can be fundamentally justified by a 100% YoY growth in revenue or earnings. It seems undervalued because investors haven’t fully considered that the company’s future growth could be much stronger than expected, which would justify even higher valuation multiples.

The hype is also fueled by momentum traders who couldn’t care less about the company’s fundamentals. They will continue pumping up the price as long as its strong momentum persists. However, long-term investors should be aware that a sudden change in growth dynamics could swiftly reverse the stock price. At the current price level, I remain bearish on the stock for four reasons: potential pull-forward demand, increasing competition, geopolitical risk, and optimistic market consensus.

Fundamentals Are Incredibly Solid

If you want to understand why NVDA has rallied so much over the past year, just look at this one chart above. NVDA’s core data center business grew +400% YoY in the last quarter. Can you find another exciting mega-cap company that can generate over 250% YoY growth in total revenue? The answer probably is no. While many tech companies are focusing on their growth rebound roadmaps, NVDA has already maintained over 100% YoY growth for the past four quarters, with growth rates significantly higher than the previous quarter. This tremendous growth is flashing a strong bullish signal, encouraging investors to pile into the stock, even at the current level.

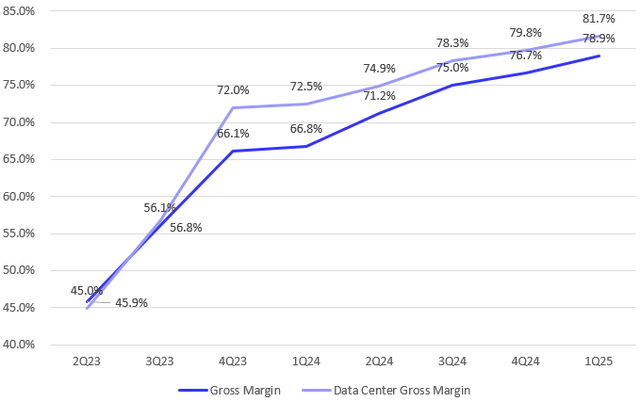

In addition to its tremendous growth momentum, NVDA has also seen significant expansion in its margins. It’s also remarkable to see a mega-cap company achieve over 3000 bps of gross margin expansion in less than two years. As shown in the chart, its overall gross margin has consistently expanded over the past 8 quarters, mainly driven by strong expansions in the Data Center segment.

The company model

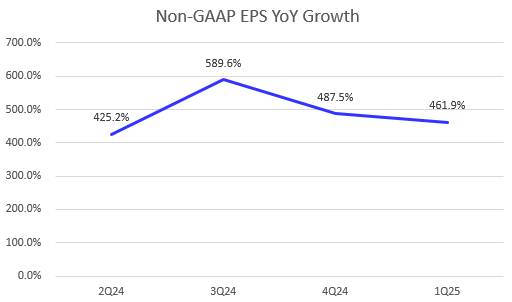

This has led to a significant increase in its bottom line, as NVDA’s non-GAAP EPS has maintained a +400% YoY growth trajectory over the past 4 quarters. This should have been a significant factor in reducing its P/E multiple on a TTM basis. However, despite a strong increase in the denominator of the multiple, the P/E is still expanding significantly. This suggests that the market is betting on this current growth trajectory to continue in the upcoming quarters.

Is Market Consensus Too Optimistic?

Due to NVDA’s solid track record, it’s unsurprising that sell-side analysts continue to revise their market consensus upward as the stock climbs. I understand that the upward earnings revisions are assuming that the current demand trajectory will continue into the future. However, here’s a question we need to consider: While NVDA hasn’t provided FY2025 guidance, the market expects the company to deliver over 80% YoY growth in FY2025 and around 20% YoY growth in FY2026. Are these upward earnings revisions solely due to strong demand dynamics, or could sell-side analysts feel “pressured” to raise growth outlooks because the stock price has surged too fast?

At the GTC event in March, NVDA unveiled Blackwell, its latest AI platform. According to the earnings call, Blackwell’s GPU architecture allows for training speeds up to 4x faster and inference speeds up to 30x faster than the H100 model. This advancement enables real-time use of generative AI on large language models with trillion parameters. Since then, the stock has rallied an additional 48%, adding to the already incredible 86% YTD return since the beginning of 2024.

I understand that there is a significant increasing demand for NVDA’s superchips ahead, as CEO Jensen Huang stated, “The next industrial revolution has begun.” However, I believe the recent surge in demand driven by the GenAI boom could lead to a pull-forward demand similar to what we saw during the pandemic. Stocks that benefited from the pandemic saw a significant surge due to accelerated demand growth, but later reversed course when faced with negative YoY revenue growth a year later.

“Pandemic” Pull-Forward Demand?

We know that many stocks doubled or even tripled their prices during the pandemic, driven by accelerated digitalization and structural changes in consumer behavior. Meanwhile, we also saw a strong rally in renewable energy stocks, driven by secular growth in clean energy industries. For instance, Cathie Wood’s ARK Innovation ETF (ARKK) and iShares Global Clean Energy ETF (ICLN) surged dramatically — ARKK rose by 300% before declining 72%, while ICLN increased by 281% and then dropped 58%.

Companies within these ETFs enjoyed significant revenue growth boosts from strong demand, prompting the market to anticipate they would sustain high-growth trajectories and adjust their growth outlooks for the coming years accordingly. However, some of these companies later revised down their growth guidance as the demand that had driven their performance forward slowed down.

Some argue that these secular growth tailwinds, unlike the semiconductor sector, represent a new AI revolution poised to transform the world. Let’s look back at the dot-com bubble in 2000, which was like an industrial revolution for the internet. Cisco Systems (CSCO), similar to NVDA, sells networking equipment to power Internet connectivity. Investors should remember that CSCO’s shares surged by over 700% from the beginning of 1998 to its peak in March 2000 in two years. However, the stock later plummeted by nearly 90%.

Investors Only Focus on Future Growth

It’s interesting to note that despite these beneficiary stocks achieving strong growth reacceleration during the pandemic and avoiding negative YoY growth afterward, their stock prices still declined by over 50%. This suggests that investors prioritize future growth potential over past achievements. Even though NVDA’s revenue has tripled over the past three years, its stock price could still potentially halve, even if the company continues to maintain positive YoY growth in the future.

I admit that NVDA is still leading the AI race and remains an unbeatable leader in the chip industry, with other players currently far behind. Companies like Microsoft (MSFT), Google (GOOGL), and Amazon (AMZN) are designing their own chips. This increasing competition will likely pose challenges to NVDA’s growth trajectory.

Moreover, geopolitical tensions between China and Taiwan could also create significant risks for NVDA, as the company relies on Taiwan for chip manufacturing. If these tensions worsen, it could lead to serious disruptions. Bloomberg reports that top chipmakers have a “kill switch” to disable their technology if a country invades, which could also impact NVDA’s growth momentum. Therefore, from a risk and reward standpoint, I think continuing to hold NVDA stock at the current price level remains risky.

Valuation

Despite a +400% YoY growth in revenue and EPS in recent quarters, NVDA is currently trading at a 41.5x EV/Sales TTM, which is approaching its historical high. Due to its revenue growth consensus over the next 12 months, this multiple is expected to come down to 27.6x on a forward basis, according to Seeking Alpha. Meanwhile, its non-GAAP forward P/E is currently at 50x, which appears to be expensive as well.

I believe NVDA’s current valuation is justified only if the company consistently surpasses market expectations in future earnings reports. However, investors should understand that it will be increasingly challenging for NVDA to maintain this track record as market expectations continue to rise. The company must achieve significant revenue growth on an already high year-over-year basis in FY2025 and beyond.

Conclusion

In conclusion, while Nvidia Corporation has achieved a remarkable rally driven by soaring demand for AI chips, its current valuation seems justified only if it continues to exceed market expectations consistently. Despite its dominant position in the semiconductor industry, challenges loom ahead, including intensified competition from tech giants developing their own chips, potential geopolitical risks involving Taiwan, and the inherent difficulty of sustaining high year-over-year growth on an already elevated base. Keep in mind, the Wall Street touts always encourage you to be most bullish on stocks when they are hot or portrayed as the next big thing in the future.

While Nvidia Corporation’s growth story remains compelling, the stock’s elevated price levels and future uncertainties make it a risky investment to hold over the long term. Therefore, I remain bearish on the stock unless you’re a momentum trader looking to capitalize on short-term gains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.