Summary:

- I am correcting my last ‘Sell’ view on NVIDIA; despite Q2 FY25’s result and guidance playing out as per expectations, the stock has not moved down materially as expected.

- Capex spending expectations from NVIDIA’s top customers such as MSFT, META, AMZN, GOOGL and TSLA are broadly stable, unlike a few months ago when there were broad downward revisions.

- Chinese players are reducing reliance on NVIDIA by developing their own chips in response to government’s moves to reduce US chip reliance and save costs.

- The recent correction in NVDA stock is driven by valuation multiple contraction as earnings growth expectations are still present. I expect this contraction to revert given easing of rates.

- Relative technicals of NVDA vs SPX point to a pause amid a broader uptrend, suggesting a period of ranging action ahead (i.e. a time correction).

PM Images

Performance Assessment

After merely in-line guidance for Q3, I thought NVIDIA (NASDAQ:NVDA) would start to sell off. This was partly because I noticed a similar setup for Micron (MU) had led to an eventual 30% fall after its Q3 results. However, what I anticipated has not panned out as NVDA stock has slightly outperformed the market, rebounding after a brief correction:

Performance since author’s last article on NVIDIA (Seeking Alpha, Author’s last article on NVIDIA)

Thesis

NVIDIA’s stock has not played out as per my expectations. I believe my ‘Sell’ was premature, especially since the broader bullish trend is still very much intact. I am revising my view to a ‘Neutral/Hold’ based on the following:

- Spending expectations from top customers are broadly stable

- Chinese players are reducing reliance on NVIDIA

- Correction in stock is driven by valuation multiple moderation rather than a downgrade of earnings expectations

- Relative technicals point to a pause rather than a meaningful downturn

Spending expectations from top customers are broadly stable

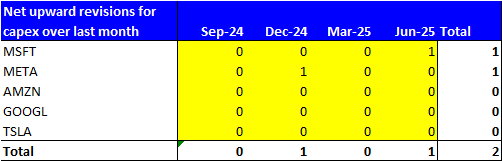

In my past coverage of NVIDIA, I’ve noted that hyperscalers Microsoft (MSFT), Meta (META), Amazon (AMZN) and Google (GOOGL) (GOOG) make up ~40% of NVIDIA’s revenues. Tesla (TSLA) is also a known major customer. The revenue for NVIDIA falls comes under capex spending for these customers. Hence, I have started to periodically track the capex spend expectations to inform my view of NVIDIA’s revenue growth revisions:

Net upward revisions in capex from NVIDIA’s major customers over the last month (Capital IQ, Author’s Analysis)

As the table above shows, the net upward revisions for capex have been broadly flat to a slight increase over the next 4 quarters ahead. This shows a stabilizing outlook compared to about 4 months ago when there were broad downward revisions, which helped correctly anticipate that NVIDIA’s Q2 FY25 results may not lead to a meaningful revenue guidance beat.

Overall, I view this as a bullish argument for NVIDIA, undermining my earlier bearish view.

Chinese players are reducing reliance on NVIDIA

NVIDIA has had to work around US export restrictions that have banned the sale of its most advanced chips to China. NVIDIA has done this by designing less advanced chips such as the H20 AI chip for the Chinese market. Compared to the more advanced H100, H20 has weaker specs with 41% fewer GPUs and 28% lower performance.

More recently, to reduce dependency on US technology, China too has been trying to discourage local companies from purchasing even the H20 chips in an effort to grow the market shares of domestic AI chipmakers such as Cambricon and Huawei. This has prompted companies such as Bytedance (parent company of TikTok) to design their own AI chips, using TSMC (TSM) to manufacture them at scale by 2026. These chips are supposedly similar to NVIDIA’s latest Blackwell technology and the move to self-reliance is expected to save the company many billions of dollars.

In other news this week (24 September 2024), according to dealers of NVIDIA’s H20 chip in China, orders for the H20 chip have ceased since August 2024. It looks like companies are starting to think the price-performance combination may not be worth it:

…due to the poor performance of the H20 chip and the high price, it has received less attention, and some people even described it as “tasteless”

– Chinese distributor’s Google-translated quote

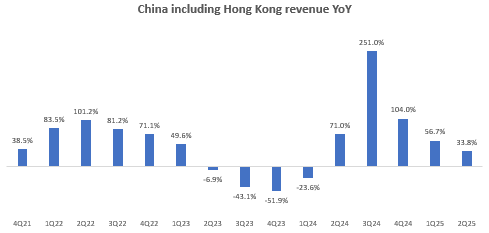

Overall, I view these are immediate headwinds for NVIDIA’s China business. I expect this to flow through in the financials via a slowdown of growth from China-related business in the upcoming quarters ahead:

China including Hong Kong revenue YoY (Company Filings, Author’s Analysis)

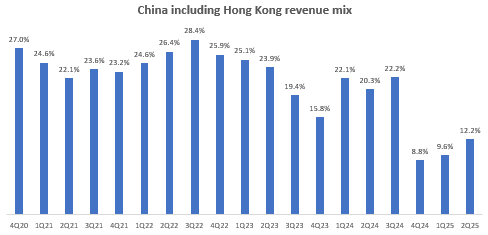

From an overall impact perspective, I don’t think this is a big immediate blow to NVIDIA since China and Hong Kong revenues make up a mere 12.2% (and lower as the growth here declines as expected) of the overall revenue mix.

China including Hong Kong revenue mix (Company Filings, Author’s Analysis)

But I believe may foreshadow a greater cause of worry is more companies even outside of China eventually jumping on the self-reliance trends to save costs and reduce dependency. Developments around this are a key monitorable going forward.

Correction in stock is driven by valuation multiple moderation rather than a downgrade of earnings expectations

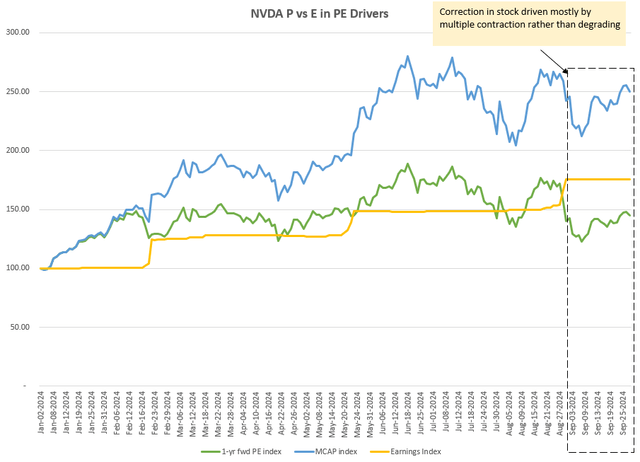

NVIDIA’s 1-yr fwd PE stands at 44.2x. An analysis of the 1-yr fwd PE multiple vs E (earnings) drivers of P (MCAP) shows that NVIDIA’s recent stock price correction has been driven mostly by a contraction in the multiples as earnings expectations have gone up:

NVDA’s PE Drivers (Capital IQ, Author’s Analysis)

I would be more worried of earnings downgrades as that tends to be a better indicator of long-term stock performance.

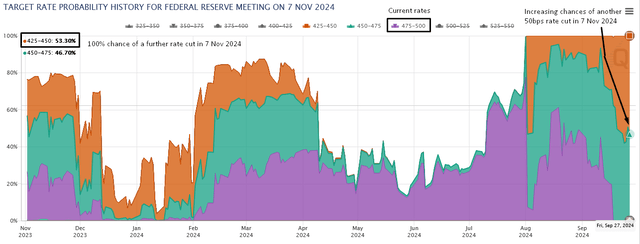

Fed Funds Rate Probabilities for Nov 2024 Decision (CME FedWatch, Author’s Analysis)

I believe multiple contractions despite earnings growth and despite a dovish rates outlook ahead (see chart above) is more likely to be a temporary phenomenon. Hence, I expect the valuation multiples to revert and re-rate upward soon, especially since the leading demand indicators of key customers’ capex expectations are stable to slightly increasing.

Relative technicals point to a pause rather than a meaningful downturn

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

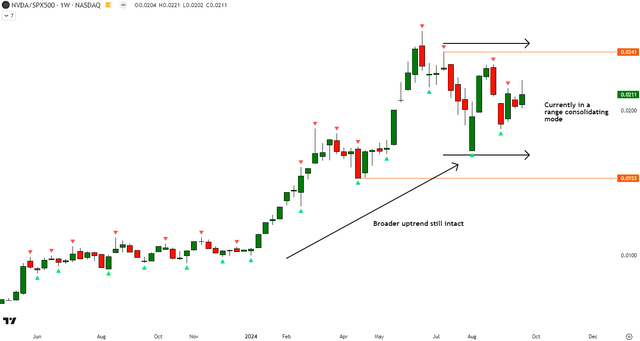

Relative Read of NVDA vs SPX500

NVDA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative technical analysis of NVDA vs the S&P500 (SPY) (SPX) (VOO) (IVV), I was too focused on short term movements in my earlier analysis, making the transition from a bullish to bearish stance premature.

Now, I note that despite current range consolidation, the broader uptrend is still intact. Making a neutral stance more appropriate.

Key Monitorables

I continue to track news around Blackwell order uptake, keep tabs on capex spend outlooks of NVIDIA’s major customers and watch for news on China dynamics and other self-reliance trends by other companies to monitor my fundamental view. Note that I don’t expect the self-reliance trends to have a dent on NVIDIA until 2-3 years later as it would take time for companies to develop and also mass-produce chips with fabs such as TSMC.

Takeaway & Positioning

The capex spend expectations of NVIDIA’s top customers have stabilized to slightly increased for the next 4 quarters ahead. I view this as a bullish sign since my earlier analysis of this leading indicator (which helped warn about a lack of a revenue guidance beat in NVDA’s Q2 FY25 results) pointed toward broad downward revisions.

Recent developments show that Chinese firms are starting to develop and mass-produce their own chips to supposedly match NVIDIA’s Blackwell technology by 2026. Commentary from dealers of NVIDIA’s H20 chips in China also suggest stagnant order intake due to high prices and lower performance. In terms of immediate direct impact, I expect revenues from China to slow down, although this is probably not a major needle-mover for the overall company since NVIDIA’s revenue exposure to China is only 12% and lower. What I am more cautious about and watchful for is more instances of companies starting to develop their own chips.

On valuation drivers, I note that NVDA’s recent correction is price is driven by multiples contraction since earnings expectations are still showing growth. Given the context of a dovish rates environment and stabilizing demand outlook as indicated by leading indicators, I think the 1-yr fwd PE multiples are likely to re-rate again, making a case for upside.

Technically vs the S&P500, NVDA is still in a broader uptrend but is consolidating in a weekly range, suggesting a time-correction pointing to performance more or less in-line with the broader market going ahead.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, META, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.