Summary:

- Nvidia is the poster-child for today’s hype in Artificial Intelligence. Shares are trading at exceptionally high levels. Properly framing Industry Structure, particularly entry-barriers, is key to determining Nvidia’s staying power.

- Nvidia has a set of unique attributes such as Domain Experience that sets it apart from most companies.

- The company’s been able to raise Switching Costs via its CUDA platform and its data-center software stack.

- 2Q’25 financial performance disappointed investors who are worried over Blackwell’s (next-generation GPU) effect on profitability.

- Nvidia’s phenomenal business performance has placed a target on its back from a host of VC funded competitors, chipmakers and even its own customers.

BING-JHEN HONG

Thesis

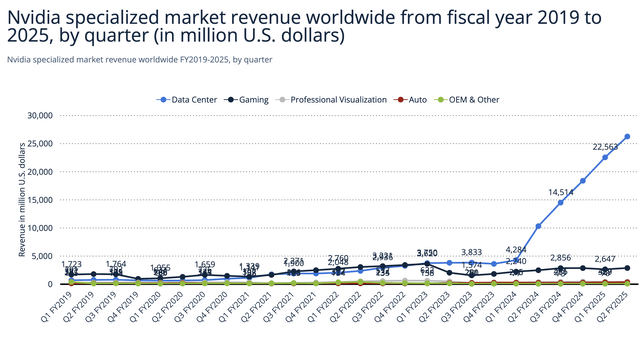

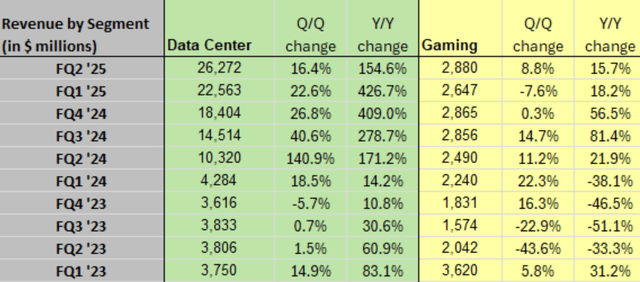

Nvidia (NASDAQ:NVDA) has come a long way since its founding in a Denny’s diner. Now the company’s at the forefront of Generative AI (“AI”). On 5/23, Nvidia had its iPhone Moment when its 1Q’24 (see “Data Center” in chart) results squashed revenue & earnings estimates. It issued 2Q’24 revenue guidance of $11Bn, vs. just $7Bn analysts were expecting. Nvidia found that they could repurpose their gaming GPU towards AI, and boy did they! This article tries to determine if Nvidia’s share price momentum can continue by determining if it has a wide moat. If it does, then Nvidia’s a secular growth story like Cisco (CSCO) of the 1990s, else Nvidia may just be reminiscent of Zoom’s (ZM) 2020 ephemeral experience.

Introduction

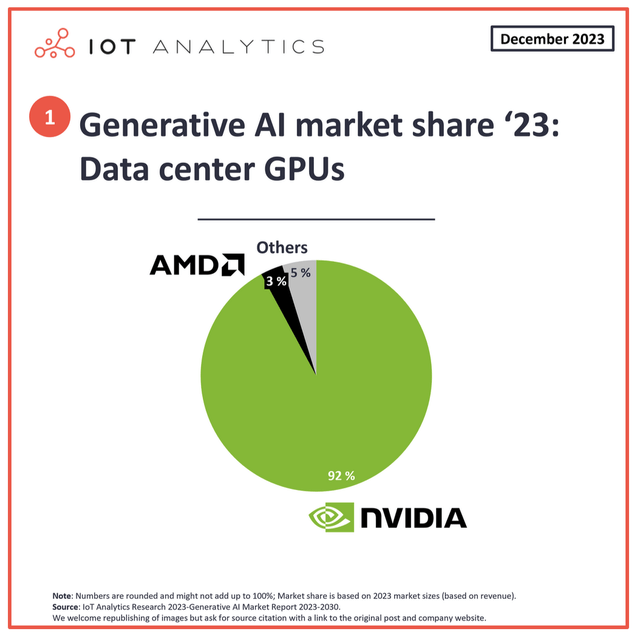

Nvidia’s a name everyone knows, I’ve known Nvidia since its IPO, AI is an acronym that everyone knows. What we don’t know is how sustainable are Nvidia’s growth and profitability. Nvidia must have a deep & wide moat in order to maintain its high P/E ratio (and valuation). Hence, this article will focus solely on Nvidia’s positioning (see market share pie chart) within the semiconductor industry.

The growing TAM

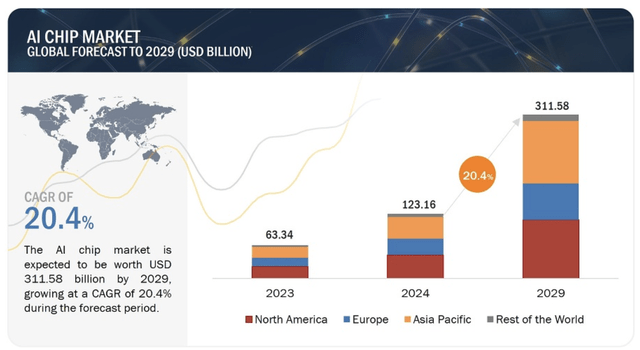

The benefits of AI can clearly be seen by anyone that has ever used Gemini, ChatGPT or Perplexity. But the bigger TAM will be corporate enterprises. According to a study by Morgan Stanley, there’s about $38 trillion in costs that could be reduced by corporate adoption of AI.

The overall AI chip market size in 2024 ranges from $30T to $123T, depending on how the market is defined (the broadest TAM is included in the chart below). The CAGR is 20.4%, but I’ve seen projections as high as 30%.

Presently, most companies utilizing AI are using some form of Gen-AI Copilot, such as Salesforce’s (CRM) Einstein. Atlassian (TEAM) and GitLab (GTLB) are using AI to speed-up developers’ programming. Given that Copilot is the first successful use-case and a potentially high return on investment, I expect the TAM to be larger and last longer than first estimated a year ago.

Industry Structure

The industry, as well as its share prices, are highly volatile and subject to boom-bust periods. Each decade there is a segment that is hot such as CPU (“Intel inside”) DRAM memory, Flash and Graphics Cards. Today’s shiny object is AI. However, I would argue that it’s not a “flash in the pan” given that Nvidia’s business position is quite strong. Some of these supporting factors (based on Michael Porter’s framework) are: high Entry Barriers, weak Bargaining Power of suppliers, Low-to-moderate Bargaining power of buyers (high demand, double-ordering) and Low-to-moderate threat from Substitute Products. Focusing in on Entry barriers (the key determinate of earnings sustainability in my view) it is characterized as the following:

- High Capital Requirements and Economies of Scale: New competitors would require significant capital, Intellectual Property related to GPU design, and a build-out could take years.

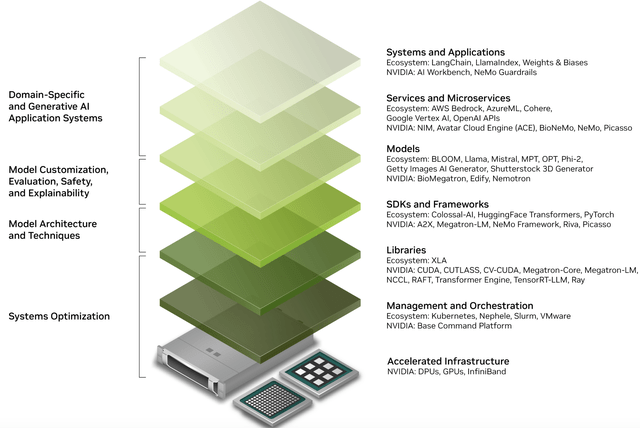

- Technological Expertise: Nvidia’s domain experience is huge, not just in chips, but in the surrounding Stack.

- High Switching Costs: Heavy use of software and partnerships (Dell, HP, Accenture, Deloitte, KPMG…) make it very difficult for customers to leave the Nvidia ecosystem. Nvidia’s reputation for making high-performing GPUs contributes to customer loyalty.

- Ability to Execute: Nvidia’s continued to introduce new versions of chips faster than is typical for the semiconductor industry.

For example, let’s look at two of Nvidia’s software offerings. The first one, CUDA, is a parallel processing platform that allows developers to use GPUs for general purpose processing. It supports multiple languages and includes a toolkit that provides libraries, debugging tools etc. Nvidia also developed a software stack for data centers that helps companies quickly assemble GPUs, communications (i.e., networking) and related supplies so that everything works well together. I like to think of Nvidia’s solution akin to building a modular house that can be built quickly and everything works seamlessly together.

Recent Financial Performance

On 8/24, Nvidia reported yet another earnings and revenue beat and raised guidance. However, shares declined sharply on delays to the next gen GPU (“Blackwell”) and gross margin headwinds. The FY’25 GPM guide is about 75% (just 50bps below consensus estimates) but this is down from a 78% quarterly peak. Other detractors were U.S. restrictions on the Chinese market, shortages of data-center space and electric power.

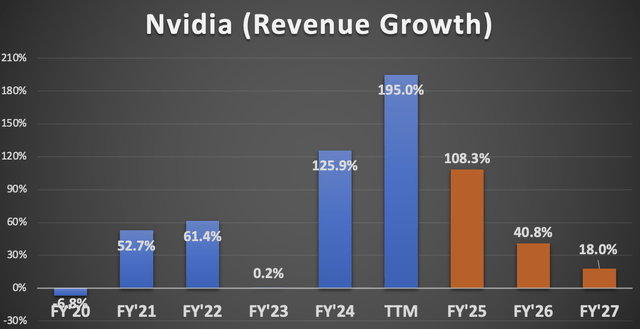

The declining rate of revenue growth (which is normal for a company of this scale) may have worried investors (see table). Given the huge TAM and CEO Jensen Huang’s recent comments that demand is “insane” alleviates any growth worries in my view.

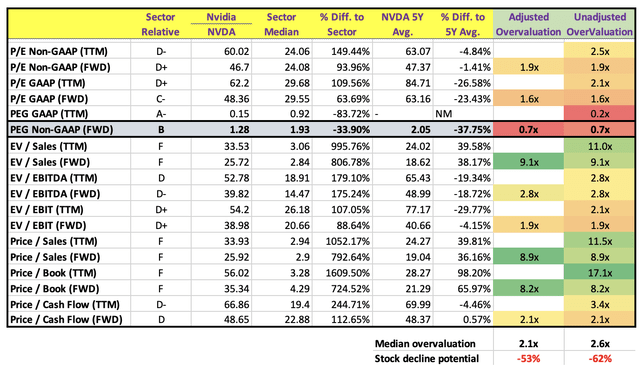

Conventional Valuation measures for Nvidia

At first glance, Nvidia’s valuation is extremely high, with SA assigning a “D-“ rating and my “Adjusted Overvaluation” is 53%. (The Adjustment excludes duplicate metrics.). Note that the PEG ratio (1.28) is below the sector median (1.93). This is astonishing when one realizes that most chip companies are selling commodities in a boom-bust industry – this usually translates to low PEG ratios for the sector.

Author’s creation, Seeking Alpha data

Price/Earnings Ratio of Nvidia (High Moat vs. No Moat)

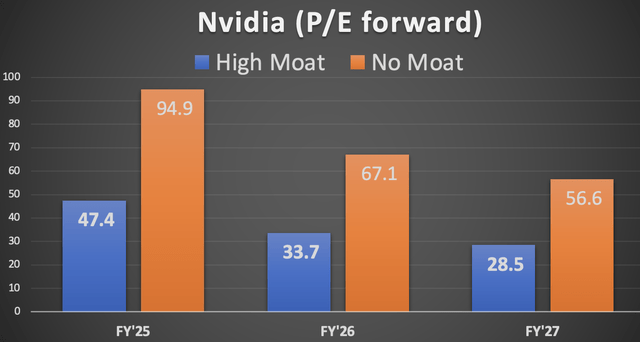

By using Nvidia’s forward revenue estimates, I was able to calculate forward earnings/share and forward P/E ratios. Shares outstanding were lowered slightly every year. The tables below show Nvidia’s revenue growth and its P/E ratio (for High Moat and No Moat). The “High Moat” ratios maintain Nvidia’s TTM profit margin, while the “No Moat” ratios are based on a five-year average of profit margins prior to the company’s FY’24 iPhone moment.

As you can see, there is a huge difference in the two ratios, as the No Moat ratio is sharply higher due to earnings compression (so the denominator is getting reduced). What is not shown in the chart is that in a No Moat environment, Nvidia would simply be another commodity player among many. Consequently, its P/E premium would no longer exist, and we would need to benchmark the P/E ratio to a much lower level. It’s worth repeating that we have two moving parts in a “No Moat” environment: 1) earnings would compress and 2) the P/E benchmark (about 20x) would be reduced to reflect higher earnings volatility and a commodity end-market.

Author’s creation, Analysts’ estimates

Risks to my bullish thesis

It’s possible that Nvidia’s huge profit margins make it a target for both competitors and customers, as well as the involvement of venture capitalists. In fact, VCs are pouring money into the space and the Magnificent 7 are working on their in-house solutions. Competitors, ranging from sleepy stalwarts like Intel to a reinvigorated AMD, are aggressively introducing AI chips. What’s more, the industry’s “usual-suspects” have formed an open-source consortium (“UXL Foundation”) to compete with Nvidia’s closed CUDA software system. My view is that collectively these efforts will “chip away” at Nvidia’s dominance over time with little threat of replacing Nvidia.

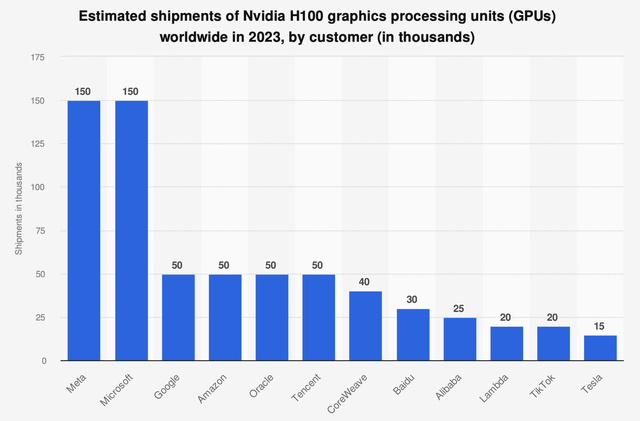

Another risk is Nvidia’s dependence on the Magnificent 7 (and China) so customer diversity is very low. The flip-side is that Nvidia isn’t dependent on risky internet startups, as was the case for Cisco Systems in the 1990s.

Conclusion

Long-term, I expect AI native SaaS companies to be the largest beneficiaries of the AI revolution. However, Nvidia’s clearly the best situated company in the space right now. Given Nvidia’s high moat, I believe it will easily meet analysts’ revenue growth targets, as well as maintain high profit margins. Hence, Nvidia’s shares seem underpriced considering that its forward P/E ratio is below 50x in spite of 108% projected revenue growth and 138% EPS growth. Nvidia remains a “Buy.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.