Summary:

- Nvidia’s dominance in the market is unparalleled, contributing significantly to the S&P 500’s returns and capturing public sentiment akin to a cultural phenomenon.

- Despite a strong performance, Nvidia’s valuation remains just above historical averages, making it an attractive investment with solid financial metrics and growth potential.

- Competitors like AMD pose minimal threat, with Nvidia’s comprehensive solutions and market leadership keeping it far ahead in the accelerated computing space.

JHVEPhoto

Introduction

Nvidia (NASDAQ:NVDA), one could argue, has been the single most important stock of the past few years, both in terms of dominating sentiment and driving returns at the index level. The numbers are pretty staggering, according to one piece of research in H1, Nvidia delivered about 5% of the 14.6% ytd return for the S&P 500 overall. A single stock delivered over a third of returns, with 499 stocks making up the rest, this is truly differentiated performance.

For me, nothing quite illustrates how they have captured public sentiment like the earnings watch party held by so-called superfans in New York earlier this year. When a corporate earnings call is being followed in a manner more akin to the Super Bowl, I think it’s safe to say6 Nvidia has captured the public’s imagination and then some.

Looking ahead to 2025 and beyond, I believe the stock is still in a position to deliver solid returns for investors. 2025 will be the year of Blackwell and the firm is already making strides to progress to their next layer of technology known as Rubin. Recent commentary from their nearest competitor AMD (AMD) suggests Nvidia’s lead in the accelerated computing remains miles ahead of the competition despite some inroads.

Heading into 2025 I am reiterating a buy position on Nvidia. Despite an epic run in 2024 I still believe we have a road to run. Despite the firm producing financial metrics like never before in the firm’s history, the valuation is only just above historical averages.

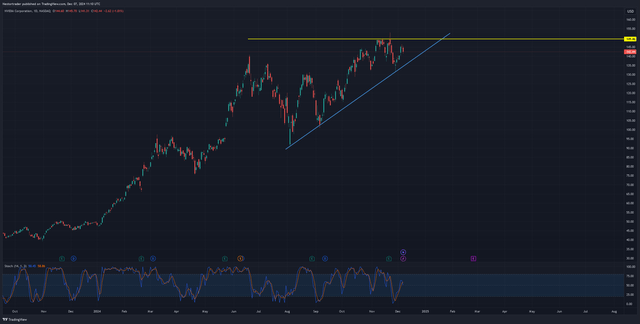

Market Pricing

From a technical analysis perspective, the stock looks to be setting up in a wedge pattern with the potential for an upside break above $150. The price action recently suggests a local bottom with support around the $135 level, which was the prior resistance level back around mid-year. The dynamic of resistance turning into support is a well observed pattern in markets, and it can help guide us in determining suitable entry points and market price signals.

I anticipate a decisive break above the $150 would be a clear signal that the bull run is set to continue, with the likelihood that $150 would become our new support level and a nice entry point for investors. If prior to that we see a pullback to the $135 level, I would advise investors to watch for the stock holding firm at this level, if it does, this would be a clear signal that buyers are in control and a good point to either initiate or add to existing positions.

Competition

Speaking at the recent UBS tech conference, Forrest Norrod, an executive from AMD’s data center segment, spoke about the firm’s attempt to challenge Nvidia in the GPU space. Naturally, he talked up his book of business, but a few things stood out to me as they highlighted the gulf between Nvidia and their nearest peer.

Firstly, he said that AMD would be targeting roughly 20% of the accelerator market in a few years for AI inferencing. Today AMD’s share is a mere 10% of the market, and remember they are the second-largest player in the space. This type of gulf between market leading and the next is akin to the gap between Google in search and everyone else.

The reality is that even with great execution, AMD will likely only be able to shave a few points of market share from Nvidia in what is an expanding TAM. The likely end result is that Nvidia will continue to dominate the market. In relation to AMD’s complete package offering vis-à-vis Nvidia, Norrod had the below to say.

“We don’t have the same level of vertical solutions that NVIDIA has for that. We’re really focused on working with the other members of the ecosystem to develop those” (Forrest Norrod, AMD Executive)

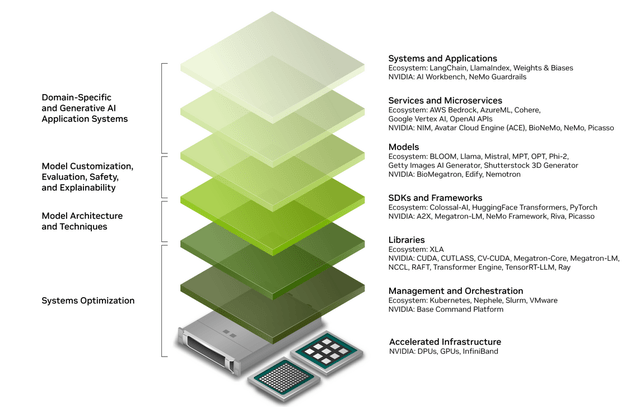

The reality is no other industry player can match the full-stack solution on offer at Nvidia, from the logic chip to the NVLink networking solutions to the CUDA software operating layer. Other players can compete at individual attributes, such as AMD for the chip or Broadcom for the networking, but Nvidia is the clear one-stop shop solution for customers.

Valuation

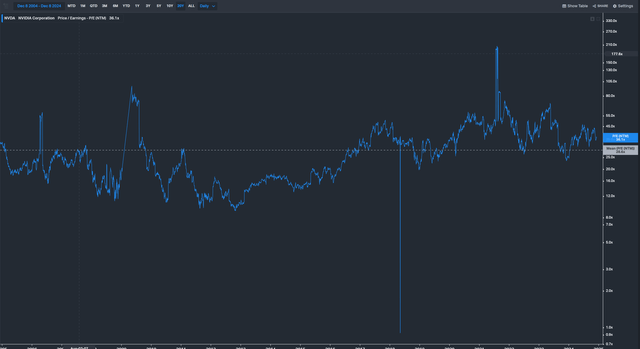

The company’s valuation has gotten more expensive in recent months, having traded down close to a 30x forward P/E in early September. However, looking at valuation relative to the long-term history, in this case 20-years, we see Nvidia trading at 36x which is expensive but not egregiously so. The current valuation is not even a single standard deviation above the mean, which means that it is above average but still far from an extreme level.

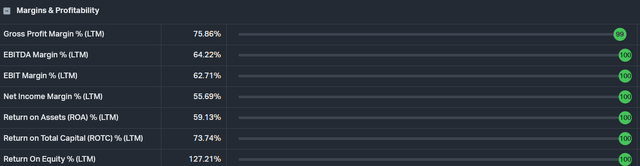

In fact, if we look at how the business is performing relative to its history in terms of profitability, we can see below that margins and returns on capital are at all-time highs on a percentile basis. Essentially, the underlying business is doing the best it has ever done and investors are paying just an above-average valuation for a piece of that. Setting the valuation in that context makes it look attractive in my opinion.

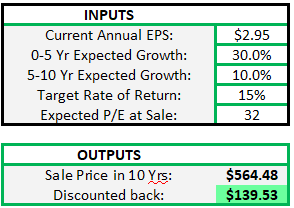

I previously wrote about NVDA and ran a DCF to estimate the current fair value for the stock. I adopted what I consider to be conservative numbers, using a 30% first stage EPS growth stage vs medium term analyst consensus of 36%, a 20% haircut to consensus. The second stage of growth uses 10% EPS growth for, which is akin to the long term EPS growth rate of the S&P 500.

My updated DCF suggests the stock is currently fairly priced based on an expected return level of 15%. This is certainly an attractive level of potential return and my model anticipates both slowing growth and a contraction of the valuation, both of which are prudent.

Given the margin profile of Nvidia, a c75% gross margin business, I believe a long-term valuation multiple of 32x is not unreasonable. For example, consider a longer established business such as Moody’s (MCO) which also boasts a gross margin in the mid-70s. MCO trades on a fwd P/E of 40x. Hence, I think a longer-term estimate of 32x for Nvidia is entirely reasonable.

Author Calculations

The one concern I have with my DCF is the sheer size of the Nvidia market cap if we run it out for ten years. If we assume a 15% return for ten years on the current market cap of $3.5T, we arrive at Nvidia being valued at over $14T in 2035. For context, only China and the US currently have GDPs which are higher than $14T. Instinctively, I balk at such a high number given where we sit today, but it’s important to remember the effects of cognitive biases, in this case anchoring bias, whereby we overweight current information and our imagination becomes anchored to the present.

In order to remind myself of the pernicious effect anchoring can have on future forecasting, I examined Apple’s (AAPL) market cap from 2016 when it sat at $510B. I’m sure at the time one would have had a tough case arguing for the stock growing to $3.7T in a mere eight years, and yet, the stock delivered a 30% CAGR over the period and stands where it is today.

If anything, stock valuations in the trillions have become somewhat normalized and no longer seem remarkable. Hence, if Nvidia does go on to deliver a 15% CAGR over the next decade, it probably shouldn’t be a major shock despite the absolute numbers looking punchy today.

Risks

A new potential risk that investors need to watch attentively is the potential hitting of scaling limits in AI development. In essence, it is now starting to be accepted in the AI space that the big labs such as OpenAI are seeing vastly diminishing returns from scaling up about of training data fed into AI models.

As a result, we have not seen a true new generation of frontier model since GPT 4, which is almost two years old at this point. The argument goes that if scaling laws have been hit, then the chatter in markets about companies like Meta (META) or xAI building hundreds of thousands of GPU super clusters might run into trouble.

When asked about this concern in the firm’s recent earnings release, Jensen Huang had the following to say

“You see now that at the tail end of the last generation of foundation models were at about 100,000 Hoppers. The next generation starts at 100,000 Blackwells. And so that kind of gives you a sense of where the industry is moving with respect to pretraining scaling, post-training scaling, and then now very importantly, inference time scaling. And so the demand is really great for all of those reasons. But remember, simultaneously, we’re seeing inference really starting to scale up for our company. We are the largest inference platform in the world today because our installed base is so large.” (Jensen Huang, Q3 earnings call)

What struck me was the reference to the company’s installed base. Installed base is not the type of language we would typically associate with a computer chip, it is more akin to the lingo of the software industry. However, I think it is appropriate given a large portion of Nvidia customers are choosing a full-stack offering which creates immense stickiness, including, of course, the software component provided by CUDA. The software stickiness that comes from a developer base already versed in CUDA creates a resistance to change, similar to what one might expect from a SaaS firm like ServiceNow (NOW).

Conclusion

As we look to 2025 with anticipation, I am reiterating my prior buy rating on Nvidia as I continue to see a constructive set-up. Valuations look reasonable relative to history and especially when accounting for the strength in the underlying business. Competitors such as AMD are making some progress but remain a huge distance behind, so competitive threats remain muted for now. With Blackwell moving into mass shipping in 2025, I expect Nvidia to continue to deliver, realistically a repeat of 2024 is too much to expect, but I am expecting solid performance not withstanding.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.