Summary:

- At a forward P/E of over 50, Nvidia Corporation is not cheaply valued.

- The buzz surrounding AI has been the driving force behind Nvidia stock this year.

- Nvidia recently made a groundbreaking announcement, unveiling its latest and most powerful AI chip, the GH200 Grace Hopper Superchip.

- Nvidia’s strategic partnerships with tech giants open up doors for future growth.

- Much of the quantifiable growth has already been priced into Nvidia stock, but the earnings momentum is likely to take the stock much higher from here.

Justin Sullivan

Expensive stocks can remain expensive for an extended period of time. If investing in stocks was all about getting behind companies trading at cheap valuation multiples, it would have been difficult to lose money in the market. A seemingly undervalued company could be cheaply valued for a reason, ranging from a lack of growth potential to the absence of a catalyst to drive the stock price higher.

For a company that has already attracted premium valuation multiples in the market, such as Nvidia Corporation (NASDAQ:NVDA), it’s all about momentum. With Nvidia being recognized as one of the biggest winners of the AI (artificial intelligence) revolution, it doesn’t come as a surprise that NVDA stock has had a remarkable run this year, up 177%. At a forward P/E of over 50, the company is no longer cheaply valued, but I believe the stellar run is far from over as Nvidia is benefiting from strong earnings momentum.

The AI Revolution and NVIDIA

The optimism for Nvidia stems from the company’s robust revenue growth projections and the concerted efforts to ramp up the production of chips that would power the Artificial Intelligence revolution. This move is in response to the skyrocketing demand for AI technologies, which are revolutionizing various industries. Nvidia’s ascension to the coveted status of a trillion-dollar company is an inevitable outcome, given the favorable market conditions facing the company. With its innovative products and the increasing adoption of AI-powered solutions, Nvidia is well-positioned to capitalize on the growing global demand for advanced chip technologies.

The world is currently experiencing a significant shift towards AI, with companies like Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) leading the charge. However, what many people may not realize is that the success of these companies is heavily reliant on a key player in the industry: Nvidia. As a leader in graphics processing units (GPUs) and AI technologies, Nvidia has emerged as a critical enabler of the AI revolution.

Nvidia’s GPUs have become the go-to choice for AI-driven solutions. Notably, Nvidia’s GPUs played a vital role in the creation of OpenAI’s ChatGPT, which was powered in part by Nvidia’s high-performance computing accelerators. This success has not gone unnoticed by investors, who recognize the vital role that Nvidia plays in the AI landscape.

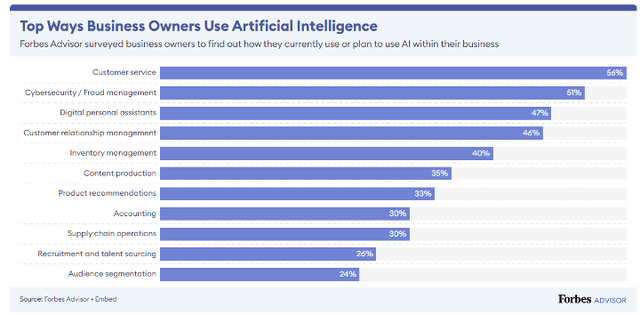

AI applications are increasingly being adopted in various industries including healthcare and autonomous vehicles. According to Statista, in 2021, AI in the healthcare market was worth around $11 billion worldwide. Grand View Research reports that AI’s transformative impact on industries is set to continue, with an anticipated annual growth rate of 37.3% between 2023 and 2030. As companies grapple with labor shortages, an IBM report reveals that 25% of them are turning to AI adoption as a solution. The potential of AI, particularly exemplified by ChatGPT, is highly regarded by business owners, with Forbes Advisor reporting that a staggering 97% of business owners believe this technology will benefit their businesses. The Forbes survey highlights that one in three businesses plan to utilize ChatGPT for website content creation, while 44% aim to generate content in multiple languages.

Furthermore, 64% of business owners have a positive outlook on AI’s ability to enhance customer relationships, indicating its potential to improve client interactions. With over 60% of business owners anticipating increased productivity, 64% specifically believe that AI will enhance business productivity, and 42% expect streamlined job processes. These statistics underscore the growing recognition of AI’s value in driving efficiency and success across various business domains.

Exhibit 1: The use of AI in business operations

This growing adoption of AI has bolstered Nvidia’s revenue prospects. The company has positioned itself to capitalize on this demand by introducing a range of new AI products and services. For example, Nvidia unveiled an AI supercomputer platform named DGX GH200, designed to assist tech companies in creating advanced AI models.

Nvidia’s Revolutionary GH200 Superchip

Nvidia recently made a groundbreaking announcement, unveiling its latest and most powerful AI chip, the GH200 Grace Hopper Superchip, which has now entered full-scale production. The GH200 Superchip is designed to power cutting-edge systems that handle complex AI workloads, including advanced generative AI models. It combines Nvidia’s Arm-based Grace CPU and Hopper GPU architectures into a single chip, leveraging the NVLink-C2C interconnect technology developed by Nvidia. This remarkable chip offers an unprecedented total bandwidth of 900 gigabytes per second, seven times more than the standard PCIe Gen5 lanes in current leading accelerated computing systems. Additionally, the GH200 operates with five times less power consumption, enabling more efficient handling of demanding AI and high-powered computing applications.

The GH200 Superchip holds significant promise for generative AI workloads. One of the first systems to integrate the GH200 Superchip is Nvidia’s next-generation AI supercomputer, the DGX GH200, which offers a comprehensive full-stack software ecosystem tailored for AI and data analytics workloads. The software stack also incorporates Nvidia AI Enterprise, comprising over 100 AI frameworks, pre-trained models, and development tools, streamlining the production of generative AI, computer vision, speech AI, and other models.

Nvidia has already secured notable customers for the DGX GH200 AI supercomputers, including Google Cloud, Meta Platforms, Inc. (META), and Microsoft. Additionally, Nvidia plans to make the DGX GH200 design available as a blueprint for cloud service providers to customize for their infrastructure.

The company will also deploy its own DGX GH200-based AI supercomputer, named Nvidia Helios, which combines the power of four DGX GH200 systems interconnected using Nvidia’s Quantum-2 Infiniband networking technology. Helios will incorporate an impressive total of 1,024 GH200 Superchips and is expected to become operational by the end of this year.

Furthermore, Nvidia’s server partners, including Quanta Computer Inc., ASUSTek Computer Inc., Cisco Systems, Inc. (CSCO), Dell Technologies Inc. (DELL), Hewlett Packard Enterprise Co. (HPE), and others, are already developing systems based on the GH200 Superchip. These partnerships are facilitated by the new Nvidia MGX server specification, a modular reference architecture enabling the creation of over 100 server variations based on Nvidia’s latest chip architecture. This specification is suitable for various AI, high-performance computing, and other workloads. By adopting the MGX specification, server makers can significantly reduce development costs by up to 75% and reduce development time by two-thirds, down to approximately six months.

Advancing In New Sectors With Strategic Partnerships

Nvidia recently announced several new partnerships that highlight its commitment to advancing AI technology in different sectors. One significant partnership is with WPP Plc (WPP), the world’s largest advertising group, to leverage generative AI-enabled content for digital advertising. This collaboration aims to reduce the cost of producing advertising content by using AI and the metaverse. Nvidia Omniverse technology will enable WPP to create virtual representations of products, allowing for easy customization of ads and minimizing the need for expensive reshoots.

HubSpot reports that the integration of AI technology into online marketing activities is widespread, with over 80% of industry experts utilizing some form of AI. In one survey, when asked about the main application areas of AI in marketing, approximately 50% of respondents from the U.S., Canada, the UK, and India identified ad targeting as a primary area where AI could be utilized. This indicates the significant role AI will play in optimizing advertising strategies and reaching targeted audiences effectively in the future.

In addition, Nvidia is partnering with MediaTek, a semiconductor company, to develop technology for advanced vehicle infotainment systems. This collaboration will integrate Nvidia’s graphic processing unit chiplet and software into MediaTek’s system-on-chips for automakers’ infotainment displays. The resulting system will enable features like video streaming, gaming, and AI-powered interactions with drivers. It will also be compatible with automated driving systems based on Nvidia technology.

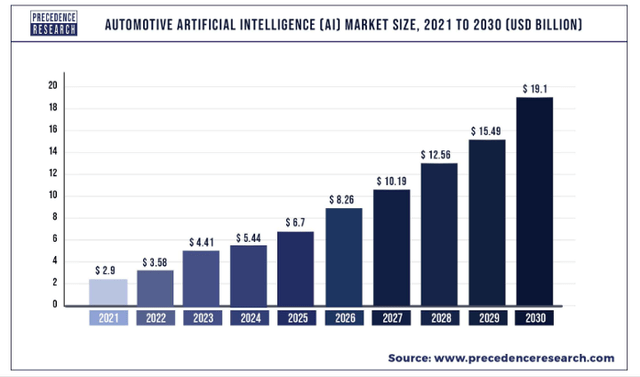

Nvidia’s CEO Jensen Huang recently emphasized the importance of strong, long-term partnerships in the automotive industry, as car makers typically have long product cycles. By joining forces, Nvidia and MediaTek aim to provide chips that can power every segment of a car, meeting the increasing complexity of in-vehicle displays and entertainment systems. This partnership expands Nvidia’s reach in the automotive industry, with a particular focus on infotainment system-on-chips. According to Precedence Research, the global automotive Artificial Intelligence market will be valued at $19.1 billion by 2030, growing at a CAGR of 23.3% from 2022 to 2030.

Exhibit 2: Automotive AI market size

While Nvidia has concentrated on premium brands like Mercedes-Benz and Jaguar Land Rover so far, MediaTek’s strength in mobile connectivity and Android systems allows the company to serve lower-priced, mass-market vehicle lines. The collaboration with MediaTek enables Nvidia to access a $12 billion market.

Building Supercomputers

Nvidia is making significant strides in the development of supercomputers to meet the growing demand for AI applications. Recognizing the need for powerful computing capabilities, the company is not only providing equipment for data centers but also constructing its own supercomputers, including two in Taiwan. Additionally, Nvidia has introduced Spectrum X to address the challenges with the speed of data transfers within data centers. This is a networking system that utilizes technology obtained through the acquisition of Mellanox Technologies in 2019. By optimizing data transfer speeds, Spectrum X aims to enhance AI performance within data centers. Nvidia is currently constructing a data center in Israel to showcase the effectiveness of this technology and recently announced the development of Israel’s most powerful AI supercomputer, named Israel-1. With an estimated performance capability of up to eight exaflops, Israel-1 is expected to become one of the world’s fastest AI supercomputers. To put this into perspective, one exaflop can perform a staggering one quintillion calculations per second. Nvidia recognizes the importance of AI in today’s world and believes that large GPUs are crucial for the development of AI and generative AI applications.

The significance of generative AI is widespread, and the demand for running training processes on large datasets is rapidly increasing. By providing access to a high-performance supercomputer, Israeli companies will be empowered to conduct training more efficiently and tackle complex problems. Nvidia’s focus on supercomputers extends beyond Israel. The company has collaborated with the University of Bristol in the United Kingdom to develop a new supercomputer using a cutting-edge Nvidia chip, positioning it as a competitor to Intel Corporation (INTC) and Advanced Micro Devices, Inc (AMD).

As Nvidia continues to push the boundaries of computing power and AI capabilities, its efforts in supercomputer development serve as a testament to its commitment to meeting the evolving needs of AI applications.

The Strong Earnings Momentum

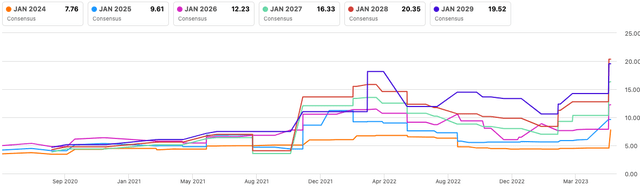

At Beat Billions, we believe earnings surprises and earnings revisions play an important role in determining long-term stock prices. In the last 90 days, Wall Street estimates for Nvidia’s fiscal 2024 estimates have been boosted 31 times against no down revisions. As illustrated below, expected earnings for the next couple of fiscal years have spiked with analysts incorporating the potential impact of the AI boom on Nvidia’s earnings in their valuation models.

Exhibit 3: Earnings revision trends

With earnings revisions continuing to trend favorably, I believe NVDA stock will gather momentum to hit new highs in the coming months.

Takeaway

Nvidia Corporation is transforming from a manufacturer of computer graphics chips to a central player in the AI boom. Nvidia’s exponential growth in the AI sector has solidified its position as a key player in the AI revolution, enabling the company to help in the transformation of several industries and shaping the future of computing.

The recent introduction of the GH200 Superchip signifies a monumental breakthrough in AI chip technology, empowering the next generation of AI systems with unmatched performance and efficiency. I believe much of the quantifiable growth has already been priced into Nvidia Corporation stock, but the earnings momentum is likely to take the stock much higher from here before we have new data to work with.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long MSFT.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!