Summary:

- NVIDIA is the innovation leader in the GPU landscape, continuing to surprise the world with cutting-edge solutions enhancing the computing capabilities of global big techs.

- The H100 GPU, with exceptional memory bandwidth and computing performance, has driven NVDA’s recent revenue growth, now to be surpassed by the superior Blackwell architecture.

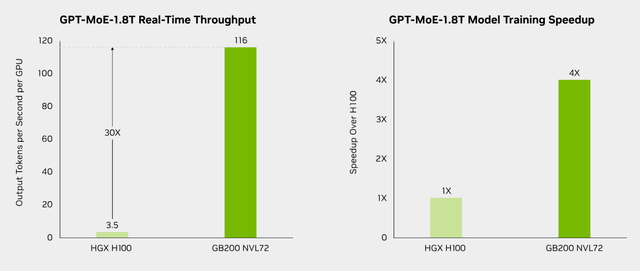

- AI demand is skyrocketing, with the Company’s Blackwell set to revolutionize the market, boasting 4x faster training speeds and 30x higher real-time throughput.

- NVIDIA’s profitability is unmatched, with EBITDA margins soaring to 65%.

- The AI revolution is not just a story – NVDA delivers the numbers and growth that justify the hype and support upside potential.

BING-JHEN HONG

Nowadays, almost two years after the release of ChatGPT that brought the Large Language Models (LLMs) to the global, widespread awareness, I believe nobody needs an introduction to the provider of the BEST HARDWARE for training artificial intelligence – NVIDIA (NASDAQ:NVDA). I don’t know about you, but during the ‘gold rush’, I’d prefer to sell shovels instead of searching for the holy grail.

NVIDIA sells the best ‘shovels’ for computing. You don’t have to just take my word for it – take a look at some of the comments of the most prominent figures in the AI space regarding the Blackwell expectations (names added):

Blackwell offers massive performance leaps, and will accelerate our ability to deliver leading-edge models. We’re excited to continue working with NVIDIA to enhance AI compute. – Sam Altman, CEO of OpenAI

We are committed to offering our customers the most advanced infrastructure to power their AI workloads. By bringing the GB200 Grace Blackwell processor to our datacenters globally, we are building on our long-standing history of optimizing NVIDIA GPUs for our cloud, as we make the promise of AI real for organizations everywhere. – Satya Nadella, CEO of Microsoft (MSFT)

AI already powers everything from our large language models to our content recommendations, ads, and safety systems, and it’s only going to get more important in the future. We’re looking forward to using NVIDIA’s Blackwell to help train our open-source Llama models and build the next generation of Meta AI and consumer products. – Mark Zuckerberg, CEO of Meta (META)

There is currently nothing better than NVIDIA hardware for AI. – Elon Musk

Before we get to the investment thesis, let’s consider why NVIDIA is the undisputed industry leader.

How Has NVIDIA Dominated The Computing Era?

To provide a brief comparison of why NVIDIA was able to benefit from the global AI boost to a far greater extent than, for example, Intel (INTC), let’s establish their key competencies. While Intel has historically concentrated on CPUs (central processing units), which are more general-purpose processors (e.g. Xeon), NVIDIA has established its focus on GPUs (graphics processing units).

GPUs are highly effective in massive, repetitive, and parallel computing tasks. Originally invented to render images on display devices, they have proven themselves key components facilitating the ongoing AI revolution with their ability to handle high throughput.

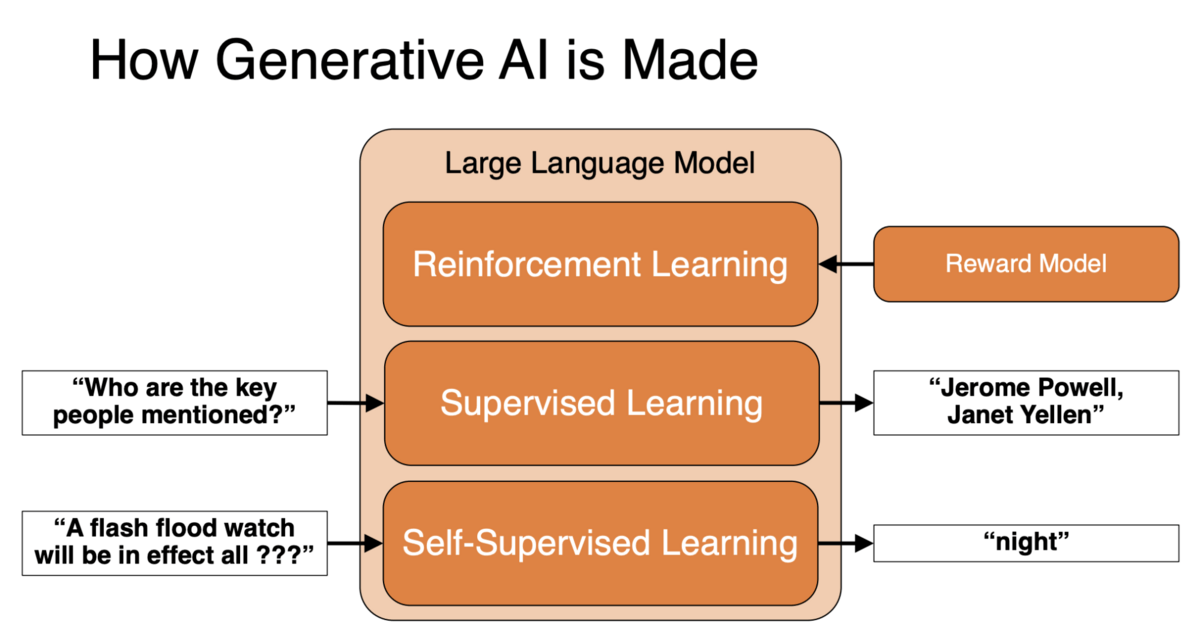

Nowadays, they are buzzwords, but AI, building LLMs, machine learning, and high-performance computing NEED to be facilitated with hardware capable of handling thousands of simultaneous calculations to train generative AI (for example, through training LLMs).

Snorkel AI

To briefly explain why NVIDIA dominated the GPU market, especially on the AI training front, let’s examine one of the most prominent chips from NVIDIA: H100 from the Hopper GPU architecture, which drove its revenue growth in recent quarters.

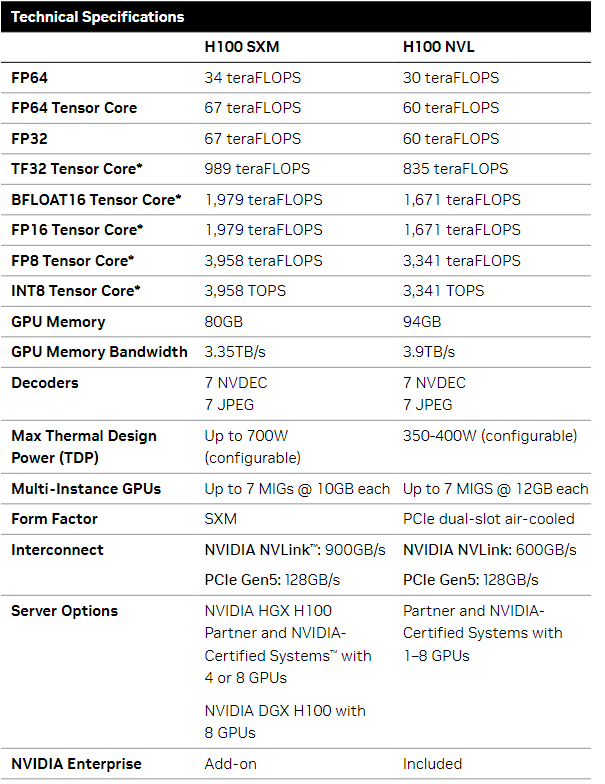

- Memory Bandwidth: H100 delivers an outstanding 3.35 TB/s (SXM), allowing for impressively dynamic data transfer, which is necessary for running large data workloads

- CUDA environment: Compute Unified Device Architecture (CUDA) is NVIDIA’s parallel computing platform that enhances the effectiveness of AI training and deep learning inference

- Outstanding computing performance: with close to 1000 Teraflops (SXM) of TF32 Tensor Core and close to 4000 Teraflops of FP8 Tensor Core, H100 was a top choice and is widely used for massive AI model development. NVIDIA still manages to speed up the training processes in a significant manner without sacrificing the necessary precision. Each of the FLOPS metrics presented below provides a very positive picture of H100’s performance depending on specific tasks

NVIDIA

To summarize, I am by no means a technological expert. I’m rather an enthusiast who trusts his research. That led me to conclude that NVIDIA’s products are perfect and the best-in-class for large-scale, simultaneous computations and AI training, where speed and memory bandwidth play the key role. Moreover, NVIDIA didn’t stop at H100 and enhanced its Hopper architecture with H200, which has products of another game-changing architecture (Blackwell) in full production.

NVIDIA Continues To Change The Game In The Computing Space

Were you impressed by H100’s performance? Well, if you weren’t, the whole cloud computing and AI community was, which was reflected in the purchasing decisions of leading global big techs. Blackwell’s architecture brings computing and AI training to the next era.

GB200 NVL72 will feature four times as fast model training speed as H100 and thirty times as much real-time throughput. Moreover, it’s worth recognising that GB200 will have 25 times higher energy efficiency than H100.

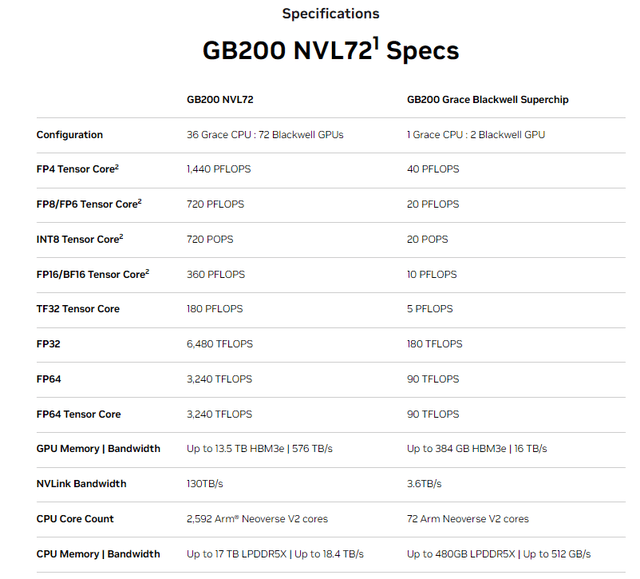

The GB200 NVL72 puts H100 into the shadow by significantly beating its metrics and delivering extremely higher memory capacity and speed, which are crucial for AI-oriented workloads.

Regarding the schedule, as Jensen Huang mentioned during the recent Technology Conference, NVIDIA will shop Blackwell in Q4 and scale it further into 2025:

And here we are ramping Blackwell and it’s in full production. We’ll ship in Q4 and scale it — start scaling in Q4 and into next year.

The AI-Driven Demand Keeps Increasing, And It Will Not Fade

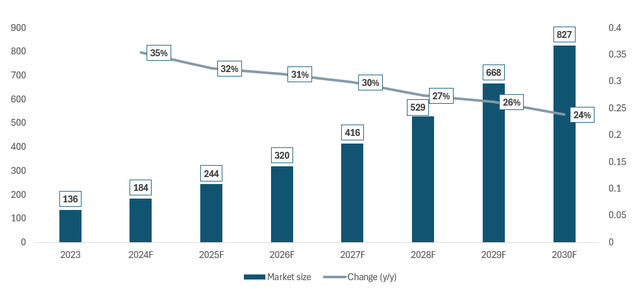

According to Statista’s research, the global AI market size will record an overwhelming CAGR of 29.4% during the 2024-2030 period (with 2023 as a base year), projected to reach nearly $827B by the end of 2030. Please review the chart below for details.

While it may be hard to believe in such an optimistic outlook, let me provide you with a few examples that make me recognise the game-changing aspect of AI in business and the fact that we are… only at the beginning of the evolution.

Within my coverage of Microsoft, I quoted some of the remarks shared during the last Earnings Call of the Company that paint a clear picture of the increasing adoption of its AI-driven Copilot for Microsoft 365:

Now, on to future of work. Copilot for Microsoft 365 is becoming a daily habit for knowledge workers, as it transforms work, workflow, and work artifacts. The number of people who use Copilot daily at work nearly doubled quarter-over-quarter, as they use it to complete tasks faster, hold more effective meetings, and automate business workflows and processes.

Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees.

Another major player in the space, Amazon (AMZN), has recently stated that over 100,00 of its customers chose its cloud environment (AWS) for its AI features:

We remain very bullish on the medium to long-term impact of AI in every business we know and can imagine. The progress may not be one straight line for companies. Generative AI especially is quite iterative, and companies have to build muscle around the best way to solve actual customer problems. But we see so much potential to change customer experiences.

And some of the most recent news on NVIDIA’s partnership with Accenture (ACN):

(…)the two companies expanded their partnership focused on artificial intelligence, including the creation of a new Accenture division, Nvidia Business Group. (…)

Nvidia Business Group will have 30,000 professionals around the world getting training to help Accenture’s clients reinvent processes and scale enterprise AI adoption with the Accenture AI Refinery platform, which uses the entirety of Nvidia’s AI stack.

There are many more testimonies available from other leading AI-driven solution providers. With MSFT being one of the top-tier players in the field, I encourage you to examine some comments from its clients on the Copilot leading the way in the AI transformation in business:

Returning to NVIDIA, I am not surprised that given:

- The ever-growing demand for AI solutions, which require state-of-the-art hardware to facilitate the massive workloads involved in the process

- The absolute game-changing effect that the Blackwell architecture will bring to the global computing table

The demand for its new technology is ‘great’, as Jensen Huang stated:

And the demand for it is so great. And everybody wants to be first, and everybody wants to be most, and everybody wants to be — and so the intensity is really, really quite extraordinary. And so I think it’s fun to be inventing the next computer era.

It’s More Than A Story, As NVIDIA Delivers The Numbers And Operates As A Profitability Beast

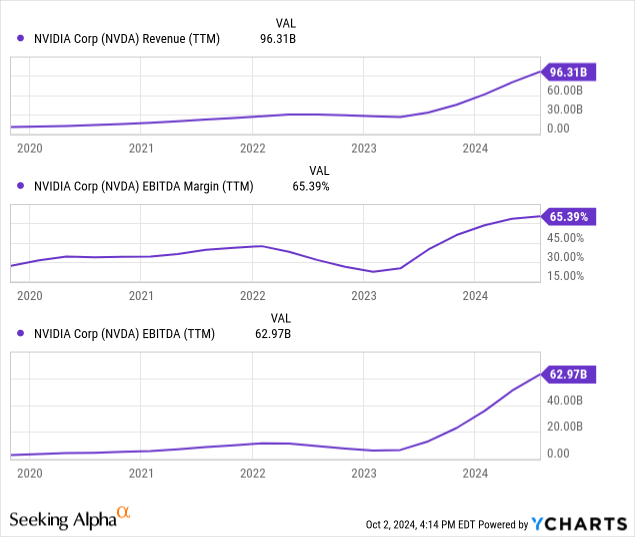

The increasing demand (mentioned earlier) constituted an unprecedented growth driver for NVIDIA as its revenue skyrocketed. At the same time, its profitability (from the EBITDA margin perspective) followed the growth of business scale to levels as high as 65%, rising from already high 30-45% levels recorded before mid-2023.

At Cash Flow Venue, we very much like highly profitable businesses that don’t fail to deliver on their promise. You have to judge the tree by the fruit it provides, and let me assure you – NVIDIA provides outstanding EBITDA margins translating into its cash flow generating potential.

Please review the charts below for details.

Valuation Outlook

As an M&A advisor (fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

I use this method because many investors fail to recognise a business’s value by concentrating too much on the stock price itself. This isn’t a reasonable benchmark, as one has to factor in changes in the business’s scale and the number of shares outstanding (due to buybacks or issues).

The multiple valuation method comes to our safety with a clear structure of referring a given ‘value’ metric (usually enterprise value) to a given ‘financial metric’ (usually EBITDA). Using an EV/EBITDA multiple is generally a rule of thumb for most sectors.

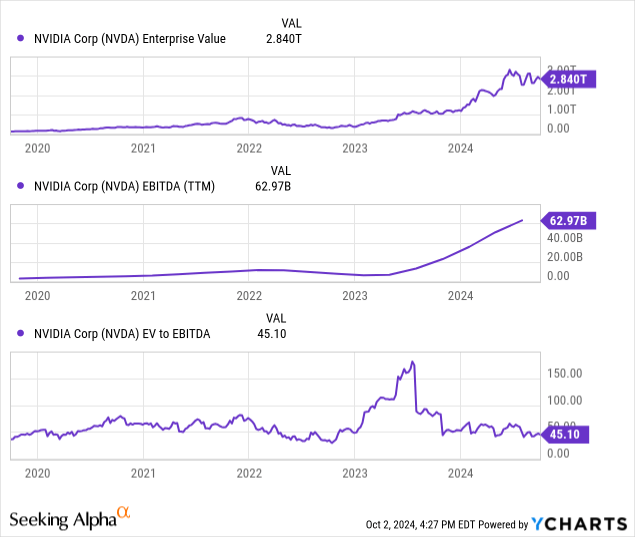

When we look at the numbers, we can see that NVIDIA’s results (EBITDA) grew into its valuation (Enterprise Value). As a result, its EV/EBITDA multiple has returned to the levels recorded in 2020-2023, leaving the period of triple-digit multiples behind.

The forward-looking EV/EBITDA stands at ~35.1x. Do I consider it ‘low’ in the broad market context? No, not at all, as many businesses leading in their fields record significantly lower valuations. However, one has to keep in mind that we have one of the most revolutionizing and dynamically growing (given that we already have large-scale) businesses on the table here.

I believe that, given the pace and scale of innovation occurring in NVIDIA and the ever-growing demand, the Company will continue to record new heights of its business scale and results, growing into its valuation and probably driving it even higher. As long as the Company continues to push the world into other dimensions of computing, the market will reward it with a high EV/EBITDA multiple. With the valuation multiple unchanged (market expectations regarding the growth and game-changing effect), each $1B EBITDA increase will drive a ~$45B Enterprise Value increase.

Investment Thesis: One Of My Favourite Growth Picks Of The Modern Economy

I believe that NVIDIA’s both current and new shareholders will benefit greatly. To briefly summarize my thoughts on the Company:

- NVIDIA is the innovation leader in the GPU landscape, continuing to surprise the world with cutting-edge solutions enhancing the computing capabilities of global big techs

- The AI-driven demand will not fade. On the contrary, it will continue to be a driving force of the demand for state-of-the-art hardware that currently – only NVIDIA delivers when it comes to the top-suitability to the massive AI training models

- Most of NVIDIA’s customers see the significantly increasing attraction of their clients to AI features, driving the demand and excitement about revolutionizing Blackwell architecture

- The AI revolution is not just a story – NVIDIA delivers the numbers and growth that justify the hype and support the upside potential

Therefore, NVIDIA remains a ‘strong buy’ for me, as I am very bullish on its further relevance in the new technological landscape. Nevertheless, there are risk factors to consider:

- a failure to deliver in a timely manner and sufficient quality on its innovative announcements would hurt the sentiment

- the geopolitical tensions may hurt NVIDIA’s performance by disrupting the supply chain, leading to significant stock price volatility

- investors should expect high stock price volatility with a technological player such as NVIDIA

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, NVDA, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.