Summary:

- Nvidia Corporation’s stock price has dropped from $140 to $104, but I believe this is just the beginning.

- Concerns are arising over AI profitability, and this may cause Nvidia’s customers to reduce demand or prices.

- Warren Buffett’s massive reduction in Apple’s stake may have bearish implications for Nvidia and the broader tech sector.

- Investors should not put too much faith in any potential Fed rate cuts to save Nvidia’s stock price.

J Studios

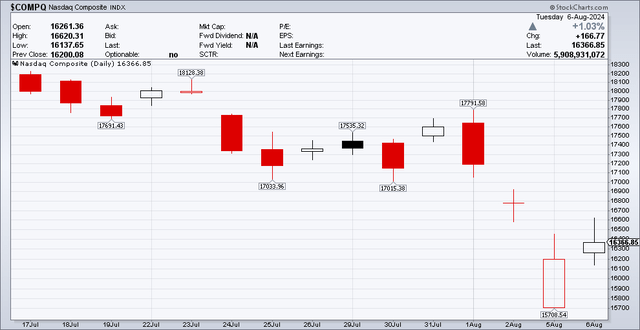

Nvidia Corporation’s (NASDAQ:NVDA) stock price has recently taken a breather, as shown below, declining from $140/share to $104/share. Is this the beginning of the end for NVDA’s bull run, or is it a chance to buy the dip?

NVDA stock price (stockcharts)

Consistent with my two previous articles on NVDA (here and here), I still hold the view that NVDA is substantially overvalued at its current market cap of $2.6 trillion. Its stock price is probably just in the early stage of coming back to earth. My reasons are as follows:

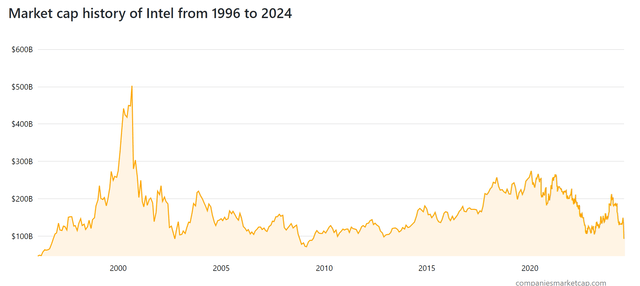

1. Intel’s (INTC) debacle last week is a preview into NVDA’s future

Many investors or analysts say that NVDA will not face any significant competition for many years. Even if that were true (and that is a big if), the bigger point is that there were plenty of companies that had a 5-year lead. But if the P/E is a 62, then what happens eventually is probably far more important than whether NVDA sustains a few more quarters of strong growth or not.

My previous article made a comparison between NVDA and Intel (INTC). I argued that INTC’s history may be a good reference for NVDA. This week, Intel shocked investors on Friday with the stock plunging 26%, the most in 40 years, as it reported poor Q2 earnings. Intel’s current market cap is only $97 billion, a fraction of its $500 billion market cap attained during the dotcom bubble. The argument could probably have been made many times during the 1990s that Intel was “many years ahead of its competition.” However, in the end, how many years Intel led the competition mattered very little as long as a competitor eventually caught up and the market for its core products stagnated. Intel’s valuation eventually reverted to levels that reflected its profits and profitability at a “normal” level of market demand.

Intel market cap (companiesmarketcap.com)

2. Wall Street analysts are refocusing on AI profitability

There is an increasing consternation among Wall Street analysts on the profitability of AI. As this media report summarizes succinctly:

- Morgan Stanley analyst Keith Weiss mentioned on Microsoft’s earnings call: “Right now, there’s an industry debate raging around the (capital expenditure) requirements around generative AI and whether the monetization is actually going to match with that.”

- UBS analyst Steven Ju asked Google CEO Sundar Pichai how long it would take for AI to “help revenue generation … (and) create greater value over time, versus just cutting costs?”

- And a Goldman Sachs report last week asked if there was “too much spend, too little benefit” on generative AI.

While these questions are rather common sense, they were probably de-emphasized when AI was the new darling buzzword, but now the focus is coming back on to the numbers. While there are many potential uses of AI eventually (maybe calculate coordinates for hyperspace jumps as in the Star Wars franchise?), in the short run, the monetizable applications are decidedly less impressive, especially after the initial novelty and buzz wears off. To give a few examples:

If we think about Microsoft Office products and how we see them being used daily in personal and work life, most people probably haven’t materially changed how they use Word, Excel, or PPT in present day than 20 years ago. Sure, they are more collaborative now and there’s the cloud, but if you work with many large corporations, the Excels and PPTs look the same and haven’t changed much (unless it is investment banks that have applied more of the bells and whistles in their modeling).

More broadly speaking, if we consider the Magnificent Seven as a whole, many of their key products have not changed in essence, whether it’s Google Search, YouTube, Amazon, or Facebook. More time might be spent on YouTube (and the videos are more entertaining than those from 15 years ago) and more products might be purchased from Amazon, but what these platforms are offering essentially has not changed. So I would expect the impact of AI on these products to be more marginal rather than revolutionary. YouTube will still suggest videos and Amazon will still suggest products you might be interested in. Maybe it’ll be a little better and there might be some new products, but it won’t be materially different. And these are the 10 companies accounting for 60-70% of Nvidia’s revenues, which ties into my next point.

3. Sales heavily reliant on corporate customers

As I discussed in depth in my previous article, NVDA is at the mercy and whim of large corporate customers such as Microsoft, Apple, Meta (Facebook), Google (Alphabet), Amazon etc. and its business model is fundamentally different:

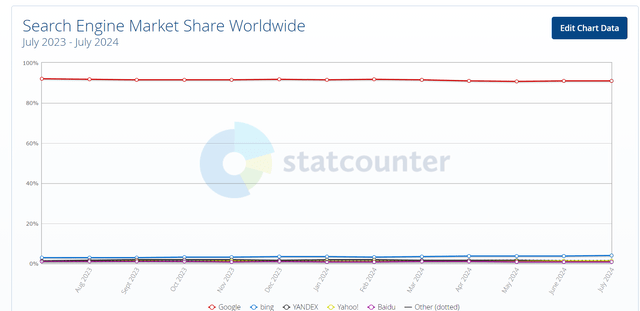

- Google, etc., tech giants make money from customer stickiness and inertia, e.g., Google’s c. 90% market share in search engines.

search engine market share (statcounter)

- Whereas NVDA sells to these tech giants (which are constantly pressured to optimize costs and are probably racing to figure out or build alternatives to NVDA).

- This means Google, etc. have a recurring, stable stream of revenue that has lasted for the past decade and will most likely continue to last for the foreseeable future. NVDA faces the risk of a severe decline in revenues and/or profitability the moment Google, etc. develop credible alternatives (either in house or through third parties such as AMD).

4. Buffett massively reduces stake in Apple

Warren Buffett sold nearly half his stake in Apple (AAPL) in Q2-2024, as he unloaded nearly $75 billion in equities in this quarter. This may have contributed to a mini-crash in stocks on August 5, 2024, as shown below.

Remember when Buffett sold Apple in Q1-2024 and said it was for tax reasons? He praised Apple in May 2024 as “even a better business” than American Express (AXP) or Coca-Cola (KO). Then he promptly turns around and sells half of his stake (worth about $80 billion) in Q2-2024.

While Buffett does not directly own NVDA, his sale is likely prescient given his track record and may have bearish implications for the broader sector. If the Magnificent Seven stock prices see large declines, this may also hit NVDA as (1) overall sector valuations decline and (2) the Magnificent Seven reduce their capex spending to boost their earnings in an attempt to maintain their stock prices.

5. Interest rate cuts are unlikely to help

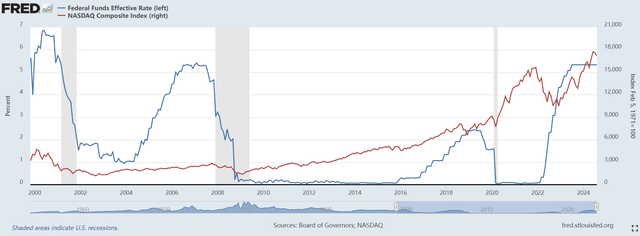

The poor non-farm payrolls data on Friday, August 2 has accelerated expectations of lower interest rates. However, lower interest rates themselves do not guarantee stronger stock prices. If we take a look at the last three previous cycles, as shown below:

- In 2000 Nasdaq (red line) dotcom bubble collapsed aggressive interest rate cuts (blue line) and

- In 20008, similarly, stocks did not recover for quite a while despite the Fed shifting into an easing cycle.

- In 2020, the Nasdaq zoomed quickly after the interest rates went to zero from the COVID-19 pandemic. However, the tech sector was boosted as COVID accelerated demand for tech products and reverted lower in 2022 once the COVID one-time impact wore off.

S&P 500 and Fed rates comparison (FRED)

Risks to bearish thesis:

Despite the above, it is still possible that NVDA could continue to power ahead. After all, the bull market in the tech sector has continued to defy skeptics for well over a decade, as shown in QQQ’s long-term trajectory below. If demand for NVDA’s AI chips continues to see strong growth, it is possible the current decline in NVDA’s stock price is just a blip before it continues the uptrend (though for the reasons above, I would tend to believe otherwise).

Conclusion:

Based on the above, I continue to believe that NVDA is likely to undergo a large decline in its stock price and market cap. When or how is less certain, though considering Warren Buffett’s recent massive offloading of Apple stock, I believe this might happen sooner rather than later.

Therefore, I still see a long-term market cap for NVDA of several hundred billion dollars or less (Intel is not even worth $100 billion 20 years after the dotcom bubble) and am bearish on the current valuation ($2.6 trillion as at August 6, 2024).

Again, I would strongly caution investors who are investing money they cannot afford to lose (e.g., retirement savings) to be careful with NVDA, or at least consider keeping risk exposure to a manageable level. If an investor has life-changing sums of money in NVDA, it may be worth considering selling, even if at a small loss.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.