Summary:

- Nvidia Corporation’s performance over the past year has been exceptional, with a focus on AI and data centers driving revenue growth.

- The company’s financial position is strong, with high margins and impressive returns on capital.

- The outlook for future growth is uncertain, with analysts’ estimates varying widely, but the company’s new products and software offerings could contribute to continued revenue growth.

Justin Sullivan/Getty Images News

Introduction

I wanted to go over Nvidia Corporation (NASDAQ:NVDA) performance over the last year now that Fiscal Year 2024 (mostly for calendar year 2023) numbers are out, to see how well it did, and give a couple of sentences on how the company may perform going forward, given such high expectations being priced in already. The difference in performance YOY is day and night. 2023 was the company’s transition year away from just some gamer company to a data center juggernaut with a focus on AI performance and cutting-edge technology, which made it the top name in this AI hype, driving the company’s revenues to new heights.

Since my first article on the company, when I assigned it a hold rating where I had my worries in the long run about sustaining such revenue growth going forward, Nvidia stock has more than doubled. However, I believe now more than ever that the company needs to perform extremely well going forward simply to justify its valuation. Tensions may be high as many people are sitting on huge gains in a short time, and if anything goes wrong, they are the ones to pull the trigger and protect their gains.

Briefly on Performance

As of hFY24 ended January 28th 2024, published on 21st of February ’24, the company had around $26B in cash and short-term investments, against around $8.5B in long-term debt. The financial position of NVDA is outstanding. The company balance sheet is flush with cash, and there is a minuscule amount of debt that is not going to break it. Safe to say, NVDA is at no risk of insolvency, when it generated over $28B in cash from operations and has a decent cushion in liquidity on hand. Let’s look at how the company’s other metrics performed throughout the year, starting with margins.

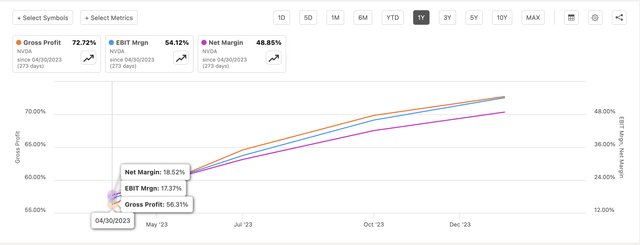

The company has been performing fantastically and has turned itself from a gaming-focused company to a completely new beast in such a short span. Ever since the turn to data centers, the company’s profitability and efficiency has exploded. Margins across the board skyrocketed, and it looks like it is going to continue, although I’ll touch on that in a later section.

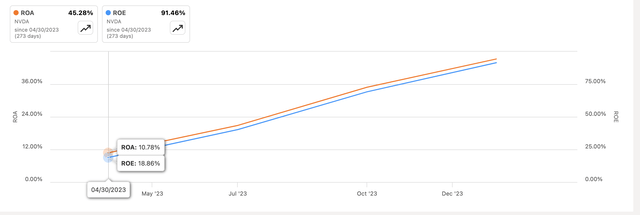

Naturally, the company’s ROA and ROE have also skyrocketed, since its bottom line more than 5X’ed in a year. The management has done a commendable job of utilizing the company’s assets and shareholder equity efficiently, thus creating value, which was recognized very quickly by the market.

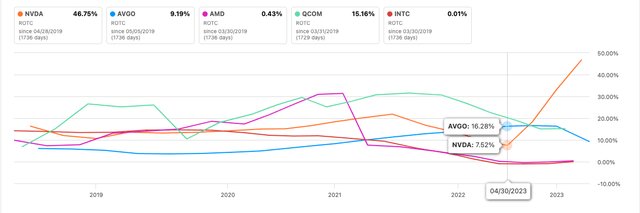

Regarding competitive advantage against some of its peers, NVDA stands head and shoulders above the rest, with over 46% ROTC, up from around 7.5% at the end of April ’23. Clearly, NVDA set itself apart early in the AI race and currently dominates the market. If I were to bet on who will win or has already won the AI race, it would be the dominant player that is NVDA. With such an impressive return on total capital, I am willing to pay a premium to own it. The question, though, is how much of a premium that would be, but I will cover that also in a later section.

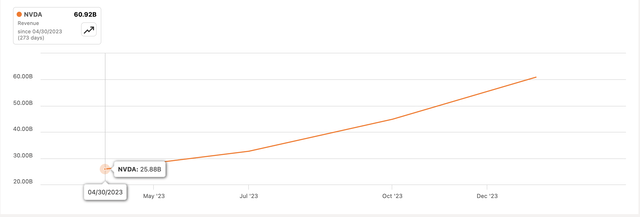

In terms of revenue, which is what driving this whole transformation of the company, is up 135% y/y, with some quarters showing almost a 300% increase y/y. This improvement in the top line performance sent the shares up 260% in 1 year, and 93% YTD.

Overall, as I mentioned earlier, NVDA is a different beast altogether. It is amazing. How quickly the company has managed to shift its top line priorities, how deftly the management got in front of the AI revolution, and how solidly the company cemented itself as THE company to help many different enterprises achieve their needs in Gen AI and other similar experiments technologies.

Comments on the Outlook

The biggest question for the company is how long it can sustain such revenue growth. Another year? Two or three? If it can double every year for the next three years, the company will be close to a half-a-trillion revenue company by FY27. By that time, the company’s value would be probably around $7T, and CEO Jensen Huang will most likely be the richest man in the world by then. According to Fortune, Mr. Huang holds around 86m shares of NVDA, or around 3.5%, so if the company is worth $7T, the CEO’s stake is worth $245B. That is, if he doesn’t buy more or sell off some and not count his other ventures.

So, let’s look at some analyst estimates of the company’s future potential. For FY25, the average revenue estimate out of 46 analysts is around 83% growth YOY, which is around $111B in revenues. The variance of analysts’ estimates is wide. The lowest is $103B, while the highest is $155B. The growth the following year slows down to around 20%, while the variance between estimates widens further. The lowest is $98B while the highest is $199B. This tells me that no one really knows how well the company is going to perform going forward. The drop-off from 82% growth to 20% is staggering, but I take these with a grain of salt and try to come up with my conservative estimates for the company to give myself a reasonable margin of safety, and not give in to FOMO (fear of missing out).

My concern right now is not FY25, but the year after. $111B in revenues is still fantastic growth of 83%, but once the “low” comparisons are out of the way, the growth is not as impressive as it has been over the last 3 quarters when looking at YOY numbers. In the latest quarter, Collette Kress, the CFO of NVDA, during the conference call guided the next quarter’s top line to be at around $24B. YOY that is around 233%, while sequentially at around 8.5%. I would say the quarter after Q1, we will see around 100% y/y growth, which will gradually continue to come down and give us that growth of around 83% for the year. If the year after FY25 the company cannot sustain such growth, I would expect the share price to come down to more realistic levels, and I will touch on those numbers in my valuation analysis section However, to justify the price, NVDA needs to grow at around 32% CAGR over the next decade, which would bring its top line to around $850B, and I don’t know if that is a very realistic assumption to have. And that is with very little margin of safety assigned on top.

The new products and innovations introduced in the recent GTC event look very promising and will certainly play a large role in keeping the company’s top line growth exceptional. The new GPU Blackwell will continue to push the computational power further and is already 4 times better at training than the company’s H100 GPU while using less energy, too. They didn’t stop there, the company paired two of these beasts to create an extremely powerful and efficient AI processor, that will bring in a lot of customers who want to be at the cutting edge of everything AI. Hopper GPUs are still the most powerful products out there and have a lot of demand from AI startups to big players in the AI space like Alphabet (GOOG), Meta Platforms (META), and Amazon (AMZN). Once Blackwell GPUs come out, which offer a big leap in performance compared to Hopper, I expect the demand to shoot up, and Hopper will continue to perform well, as not every company is looking for the most performance.

The issue with growth right now is not in the demand. It is still coming from supply chain issues. Mr. Huang mentioned during the call that the supply is ramping up and the supply chain is doing very well, but it will take time to ramp up, as it doesn’t happen overnight. This could mean a more consistent but slower growth over a longer period.

The combination of hardware with its software at NVDA is going to be very powerful in terms of the company’s top line growth.

I could see a lot of potential for the company’s software side of its business. Even though right now, the software side is only at a $1B annual run rate (as mentioned in the latest earnings call), it is impressive how quickly it got to that point, and with further integration of NVDA’s hardware across the world, NVDA AI enterprise will become a massive top line growth generator. This addition of software and the ramp-up in hardware supply will take quite some time in my opinion, which will weigh on the company’s top line growth. If NVDA isn’t growing at breakneck speeds in the next couple of years, I could see a crash coming for the share price, as it is priced to perfection right now.

So, in summary, I believe the company is going to continue to grow at a substantial rate, as more and more enterprises get their skin in the game of gen AI and ML, which require a lot of computational power, and NVDA being at the top of the conversation, it will be the first one to continue to reap rewards. Furthermore, an additional focus on the software side of the business over the upcoming years will create substantial revenue growth complementing its hardware performance, which may not grow as quickly as it has in the recent past. Additionally, if the company underperforms in terms of growth, there is a substantial risk to the downside as the company seems to be priced for perfection.

Valuation

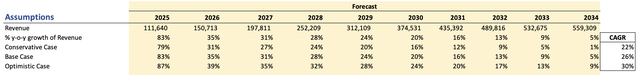

Let’s look at some numbers of where the company might be over the next decade. Starting with revenue. For the next year, I took the analysts to be somewhat aligned with my assumptions. It turned out to be around 10% sequential growth every quarter to arrive at around 83% growth for the full year. The next years are where me and analysts take slightly different approaches.

I decided to be a little more optimistic, which is unlike me, as I like to have a bit more margin of safety built-in, however, I wanted to look at some more positive numbers to see how realistic it would be for the company. For the base case, NVDA will grow at 83% for FY25, drop to 35% the next year, and linearly grow down to around 5% growth by FY34. This way, the company has grown at around 26% CAGR for the decade. With these estimates, NVDA’s top line is around $560B by FY34.

How realistic is this? One can only speculate, as we are in completely uncharted territories right now concerning AI and how far in its evolution we are, but I don’t think it is out of the realm of possibility that the company could reach those numbers. I also modeled a more conservative and more optimistic case to give myself a range of possible outcomes. Below are those estimates, and their respective CAGRs.

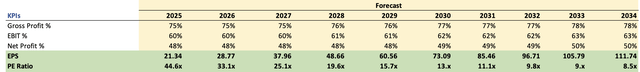

For margins and EPS, I modeled a slight improvement of around 300bps over the next decade to gross margins and 200bps to EBIT margins. I don’t think there is a lot more room for improvement here, but once the company’s software side of business properly takes off and starts contributing more to the overall operations, I believe that this will add positively to the efficiency and profitability of the company. Below are those estimates.

Margins and EPS assumptions (Author)

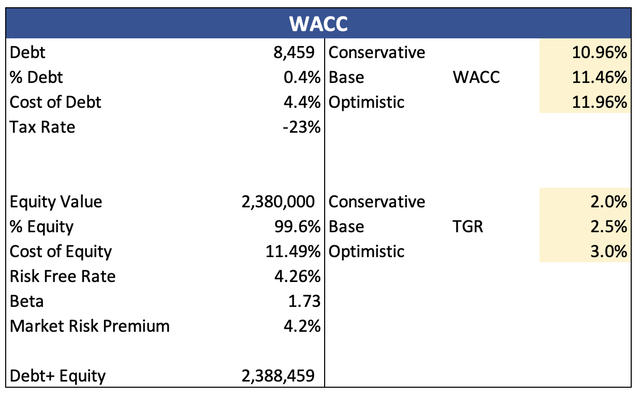

For the discounted cash flow (“DCF”) model, I went with the company’s WACC of around 11.5% as my discount, which is well above the minimum I’d like to use of 10%. This will add more to my margin of safety and appease my conservative mindset a bit more. Additionally, I am using a 2.5% terminal growth rate.

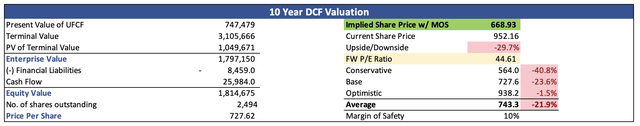

Moreover, as I mentioned earlier, the company’s competitive advantage and strong moat call for a premium on share price. The way I do this is by adding a smaller discount to the final intrinsic value. Here, I went with a 10% discount, which is think is sufficient enough given the company’s dominant position in the sector. With that said, NVDA’s intrinsic value is around $670 a share, which means it is not a good time to start a position right now.

Closing Comments

26% CAGR is an impressive growth for such a company, but I don’t think it’s unreasonable given the fact that AI is still in its infancy. However, 26% CAGR doesn’t support the company’s current share price. To be valued fairly, the company would need to grow at around 32% CAGR, as I mentioned earlier. I want to be a little more conservative to give myself more room for error, and it is best not to be overly optimistic when it comes to uncertainties like NVDA’s sustained high growth levels. The volatility of the market and the company, in general, will probably bring the shares down sometime in the near future, as all it would take is for people to get a hint of the company’s worse-than-expected top-line growth potential, and the shares slide 30% in one day.

This is a very tough company to value. I will have to pay close attention to see how the company’s demand for products performs, and how quickly the company is ramping up to meet this demand. Any slowdown in these numbers will change the value dramatically, and I would like to be on top of that. There aren’t any news or events scheduled until the next earnings report, but I will continue to monitor anything that comes through that could give us a hint about the company’s performance going forward, for now, I will continue to sit on the fence.

NVDA managed to transition away from a gamer-centric company to a data center, and AI juggernaut and investors rewarded it. The Nvidia Corporation share price melt-up was justified, however, it is a little overstretched right now, in my opinion, and if you are going to start a position now, I think the risks are much higher now, as tensions are very high. The moon has been priced in, and if the company doesn’t deliver us the moon, look out below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.