Summary:

- NVIDIA is continuing to report impressive quarterly results, but growth rates are slowing down.

- But we see signs of troubles ahead – aside from the recession on the horizon, analysts are getting more pessimistic and the CEO is selling shares.

- And even when calculating with optimistic growth assumptions, NVIDIA remains to be overvalued.

BING-JHEN HONG

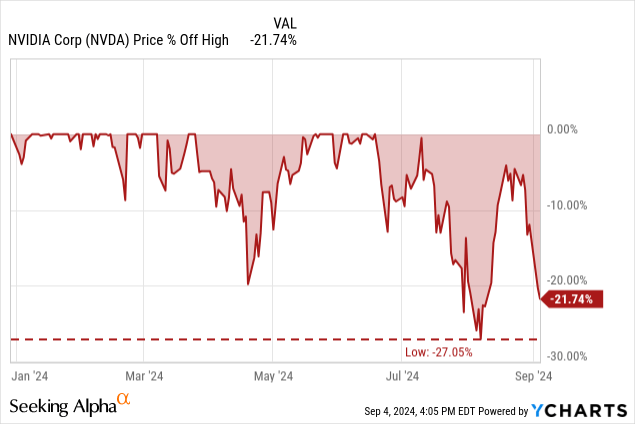

In the past two months, it seems like NVIDIA Corporation (NASDAQ:NVDA) investors had to confront themselves with a chart picture that is rather unknown to them. The stock entered bear market territory two times in a row and is now trading about 21% below its previous all-time high. Considering that the stock increased more than 10 times in value in only a few quarters, this might feel strange for investors. Suddenly, Nvidia is generating different headlines like “NVIDIA is now in bear market territory” and the recent drop was the biggest single-day market cap drop in history.

The question right now is, whether this 20% decline is only a pullback and therefore a buying opportunity that we should take advantage of, or if this is the beginning of the end. Or to put it less dramatically: Did we see the bubble peak for Nvidia already, and will the stock continue to decline further? In the following discussion, we will answer the question if you should buy Nvidia stock now.

The Last Few Years

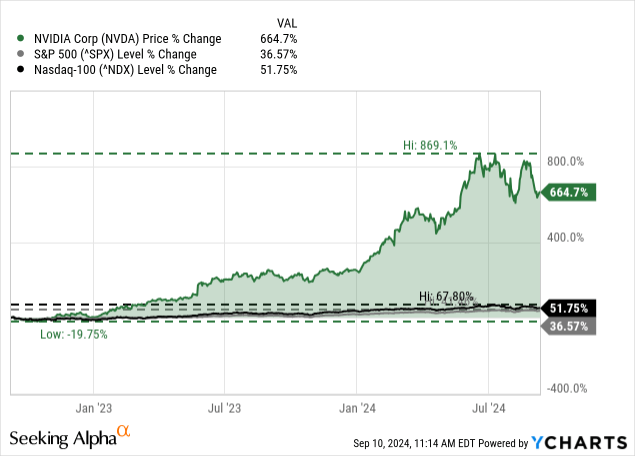

We start by looking at the last few years and try to look at the bigger picture. As already mentioned above, Nvidia profited like almost no other company from the AI hype that started in late 2022 when OpenAI released a much-improved version of ChatGPT. Since then, the stock increased more than 10x and Nvidia became the darling of Wall Street and outperformed the S&P 500 (SPX) or the Nasdaq-100 (NDX).

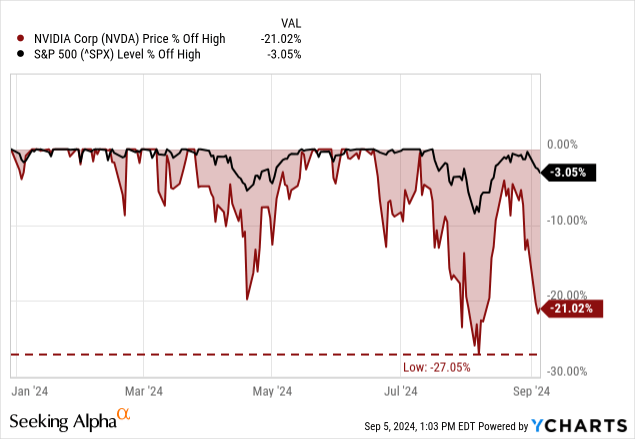

But in the last few weeks, the picture suddenly turned, and Nvidia was not rushing from an all-time high to an all-time high. Instead, Nvidia was declining rather steeply. This is not astounding, as the overall stock market also declined in July and early August, and Nvidia just declined steeper than the overall market. And companies like Nvidia which are trading for higher valuation multiples and increased at a much higher pace than the overall market often decline much steeper in such a scenario. Simply put: Companies like Nvidia are much more volatile than the overall market – meaning in a bull market these companies clearly outperform, but in a bear market such stocks typically decline very steeply in a very short timeframe.

And while corrections are a natural part of the stock market and should be nothing to worry about, we can at least point out that the current decline was the steepest for Nvidia since 2022 when the rally began.

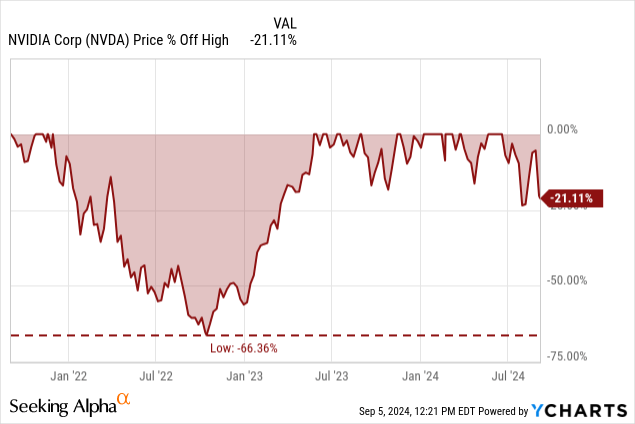

I wrote my first article about Nvidia in June 2022 at a point when the stock price was already cut in half and Nvidia was already in its 66% decline (see chart above). In the article, I argued that the decline was more than justified and did not really see any upside potential for Nvidia. Back then, the stock was trading for $15.36 (or pre-split for $153.60). In December 2022, I wrote a second article when Nvidia was trading more or less for the same price (meanwhile, the stock declined to about $10). And while I wrote about the huge downside risk I saw for Nvidia, the stock was already in the early stages of the massive rally we saw over the last two years.

I don’t know how many people already saw what was coming, but I was clearly wrong in December 2022 and could not foresee the huge demand and exploding revenue Nvidia would report in the coming quarters.

And while I still rated the stock a “Hold” in previous articles, I wrote my first article about Nvidia in which I rated the stock as a “Sell” in March 2024. The article was titled “Nobody rings a bell at the top” and in the article I indicated that a top might be very close. Meanwhile, the stock increased 58% and right now, the stock is still trading about 20% higher. In June 2024, I wrote another article called “This could be the top.” Since then, the stock has declined about 14%.

Quarterly Results

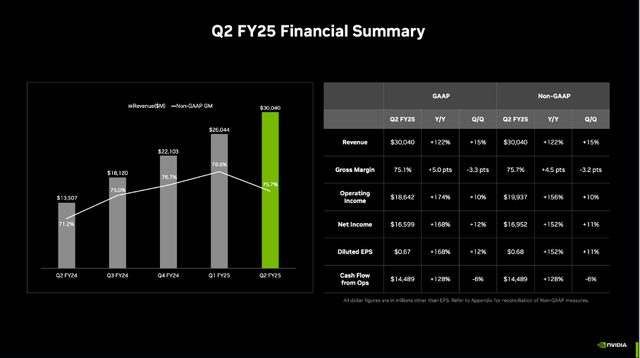

Now let’s look at the last quarterly results Nvidia reported on August 28, 2024. And not only did Nvidia beat analysts’ estimates once again – revenue by $1.31 billion and non-GAAP earnings per share by $0.04 – but the company is also growing in the triple digits year-over-year. Revenue increased from $13,507 million in Q2/24 to $30,040 million in Q2/25 – resulting in 122% year-over-year growth for the top line. Operating income increased 174% year-over-year from $6,800 million in the same quarter last year to $18,642 million this quarter. And diluted earnings per share increased from $0.25 in Q2/24 to $0.67 in Q2/25 – resulting in 168% year-over-year bottom-line growth.

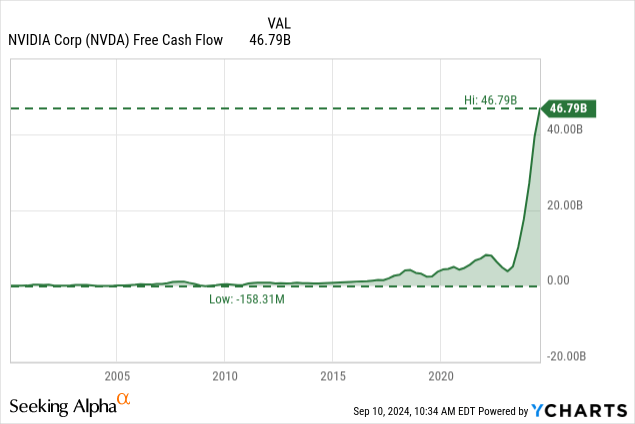

And finally, free cash flow increased from $6,048 million in the same quarter last year to $13,483 million this quarter – resulting in 123% growth year-over-year. While most metrics also improved quarter-over-quarter, free cash flow declined compared to the previous quarter.

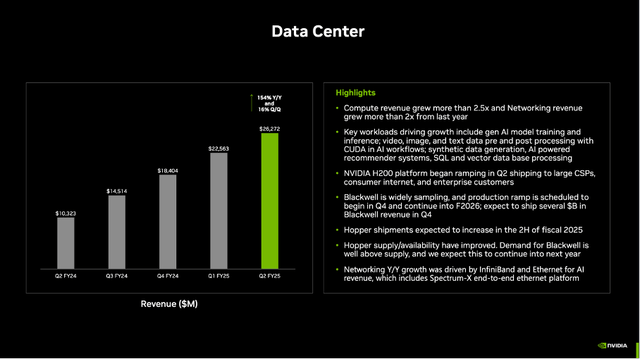

When looking at the different segments – or revenue by market platform – we can see that all five contribute to growth in the second quarter. And when looking at the smaller segments, Gaming is the most important as it is generating $2,880 million in revenue in Q2/25 and grew 15.8% year-over-year. Professional Visualization generated $454 million in revenue in the second quarter and grew 19.8% compared to the same quarter last year. And although both segments are responsible for only about 1% of total revenue, Auto increased revenue from $253 million in the same quarter last year to $346 million this quarter – 36.8% year-over-year growth. OEM & Other grew 33.3% year-over-year, but it is responsible for only $88 million in quarterly revenue.

But like in the last few quarters, it is especially one segment which is responsible for the triple-digit revenue growth in the last few quarters – Data Center. And in Q2/25, the segment once again reported extremely high growth rates. The segment generated $26,272 million in revenue and compared to $10,323 million in the same quarter last year it resulted in 154% YoY growth. And at this point, the segment is responsible for 87% of total revenue.

Signs For Trouble

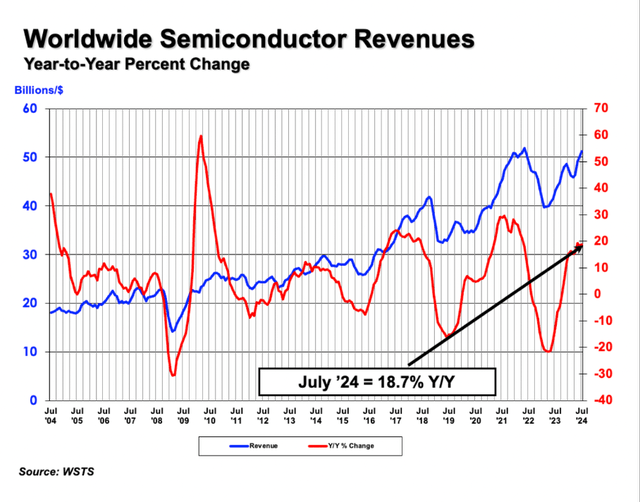

And when looking at the numbers the Semiconductor Industry Association published recently, semiconductor sales are growing at a solid pace. In July 2024, global semiconductor sales grew 18.7% year-over-year with Europe lagging but especially America growing at a high pace (40% YoY growth).

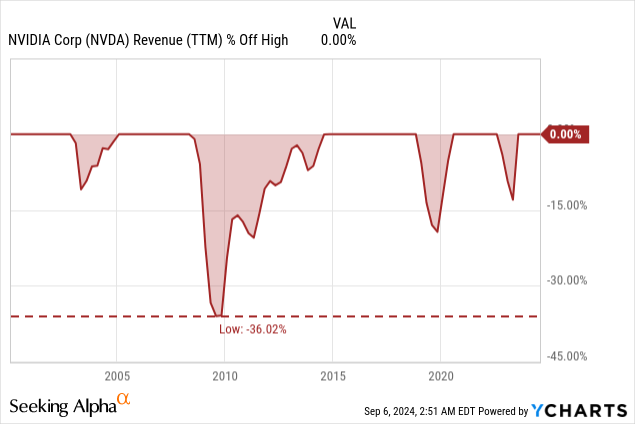

And it is nonsense to interpret some weakness in the current numbers. Growth rates are rather accelerating right now. Nevertheless, we can clearly see in the chart – if we did not already know this beforehand – that the semiconductor industry is extremely cyclical and declines of 10% or 20% are not uncommon. Currently, declining sales for Nvidia seem to have many bulls like putting a quart into a pint pot, but it would be extremely foolish to think Nvidia overcame the cyclicality of the semiconductor industry.

And just because Nvidia was at the right place at the right time and profited from the AI hype like no other business does not mean it will be able to overcome the cyclicality in the semiconductor industry. When looking at Nvidia numbers in the past few quarters, we see growth rates slowing down for revenue, operating income and earnings per share. Of course, we should not ignore that we are still talking about triple-digit growth rates.

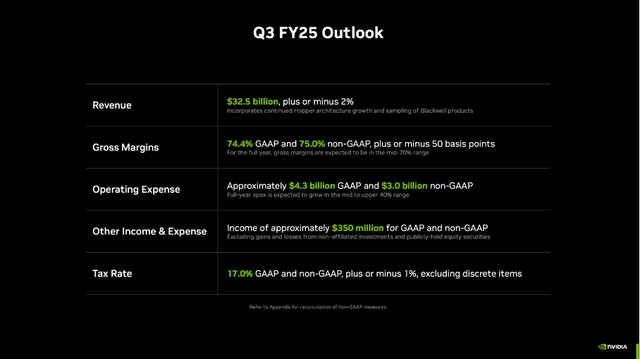

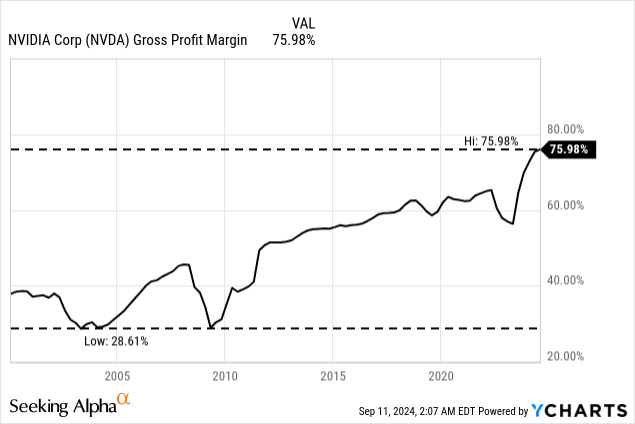

For the third quarter, Nvidia is expecting revenue to be around $32.5 billion, which would result in about 80% top-line growth and still about 8% quarter-over-quarter growth. And not only are growth rates slowing down (which is not surprising, as these extremely high-growth rates are unsustainable), but the gross margin is also declining: It already declined in the second quarter and will probably continue to decline in the third quarter.

Looking at earnings and revenue revisions, it might also seem like analysts are turning on Nvidia and are starting to lower expectations for the years to come. At this point, it is difficult to tell, and it rather seems like fishing for negative clues, but analysts lowering expectations might go hand in hand with sentiment turning. It also seems worth mentioning that Wall Street is still extremely bullish about Nvidia (46 out of 60 analysts still see Nvidia as a “Strong Buy”). Seeking Alpha authors seems more realistic (at least in my opinion) and rate the stock rather as a “Hold” at this point.

It was also reported recently that CEO Jen-Hsun Huang sold millions of shares. While the first impulse would be that selling shares is a bearish sign, we should not ignore that management is usually rewarded with stock options and receiving shares, which are often sold now and then. Interpreting the selling of shares every time as a bearish signal would be a huge mistake.

Valuation Multiples

But the biggest remaining problems for Nvidia are the valuation multiples and price the stock is trading for. It is seldom a concern if growth rates slow down (and Nvidia is still growing at extremely high rates). And cyclicality by itself also does not make stocks a bad investment. The issue is always the fundamental picture in combination with the stock price. Only when the stock price can’t be justified anymore it will become problematic.

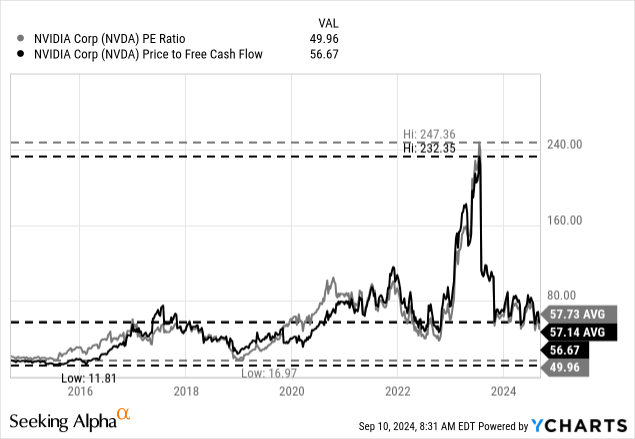

As always, we can start by looking at the simple valuation multiples to get a first feeling if a stock is expensive (and if so, how overvalued a stock actually is). In the case of Nvidia, we can clearly argue that the business was growing into its sky-high valuation multiples and the stock is now trading for much more reasonable valuation multiples than a few quarters ago.

Nevertheless, Nvidia is still trading for 50 times earnings and for 57 times free cash flow. Although we can argue that this is slightly below the 10-year average for the P/FCF ratio as well as the P/E ratio, I would argue that Nvidia is still rather expensive.

But as always, simple valuation multiples can only give a first hint of what an intrinsic value for the stock might be. For a more precise number, we should rather use a discount cash flow calculation to determine an intrinsic value the stock should trade for. As always, we are calculating with a 10% discount rate (as 10% annual return is what we like to achieve at least). Additionally, we calculate with the last reported number of diluted shares outstanding (24,848 million), and as basis for our calculation, we can use the trailing twelve months free cash flow (which was $46.79 billion).

Usually, we now must make assumptions about growth rates and the free cash flow the business can generate in the years to come. But in the case of Nvidia, we can once again look at the stock from the opposite direction. To be fairly valued, the company has to grow its free cash flow between 22% and 23% in the next ten years, followed by 4% growth until perpetuity. In the past, I often calculated with 6% growth until perpetuity (and I still think it is possible to justify these higher terminal growth rates for high-quality businesses). Nevertheless, it also seems reasonable to be a little more cautious and follow the recommendations of the CFI (and others) and use a lower terminal growth rate, but due to the high-quality business, 4% seems certainly reasonable.

When looking at the last ten years, Nvidia was growing its revenue with a CAGR of 30.88% and earnings per share grew 51.69% on average in the past ten years. Keeping these growth rates in mind, 23% growth in the next ten years should be reasonable. However, we must not forget that Nvidia is a cyclical business, and the last two years were an exceptional opportunity for Nvidia (and one which probably won’t repeat in the foreseeable future). Competition will increase, and demand from companies will likely decline (especially with the risk of the United States headed for a recession). And a huge problem for Nvidia will be the contracting margins. It seems likely that Nvidia will return to about 60% gross margin and not almost 80% as in the last few quarters.

And when taking all these aspects into account, I don’t think Nvidia will grow the bottom line (or free cash flow) by 23% annually for the next ten years and the stock is just overvalued at this point.

Conclusion

Let’s pick up the question from the beginning again: Is Nvidia at a buying point, and should we use the current setback to load up the truck and participate in one of the best investments of the last few years? Or has the bubble reached its peak already, and we will only see the unwinding of the bubble in the upcoming years.

The question is extremely difficult to answer. We know that hypes and irrational exuberance can last longer than anticipated and ruin people shorting against. But I certainly know that I don’t want to buy the stock as the risk of a “lost decade” for Nvidia is extremely high and people holding the stock might consider selling (at least a part of) the position. And if sentiment turns, it is also extremely difficult to determine how far the stock might fall. Stocks that are driven by sentiment extremely are often exaggerated in both directions – a bubble peak is followed by a complete (and also unjustified) collapse of the stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.