Summary:

- Nvidia’s share price has been stagnant over the past three months, but recently shares came close to a break-out.

- The publication of Q3 earnings in November, where guidance for the Q4 quarter will be revealed, could provide the needed inflection point to get over the $140 mark.

- Current market estimates call for a seemingly conservative Q4, which could lead to a meaningful reset of medium-term expectations if the major beat I expect comes to fruition.

Ivelin Denev/iStock via Getty Images

Introduction and Investment thesis

Nvidia’s (NASDAQ:NVDA) shares moved sideways over the past three months since I’ve published my latest article on the company (Nvidia: Swimming In Catalysts). I’ve argued that several catalysts are in play that could fuel the continued increase in the share price over the rest of the year. Of course, the most important one is the ramp of Blackwell GPUs in H2, which coincides with the steep acceleration of Ethernet related networking revenues, the revival of the Chinese market, increasing demand for sovereign AI, and some other important factors. Although the Q2 earnings release and the accompanying earnings call provided important details on the progress of these catalysts, the market reaction has been disappointing in my view.

Taking a quick look over the past months, we could witness some notable highs and lows in the company’s shares. At the end of July and at the beginning of August, general market turbulence resulting from the strengthening Japanese yen impacted the share price heavily, sending shares below $100 for a short period. Leveraged positions financed from the cheap yen have been closed suddenly as margin calls activated, resulting in a final capitulation on the 5th of August. This has been more pronounced in the most heavily traded names, like Nvidia. After a swift rebound, there has been another leg down despite a relatively strong earnings print, which has been followed by a gradual increase in the share price since then.

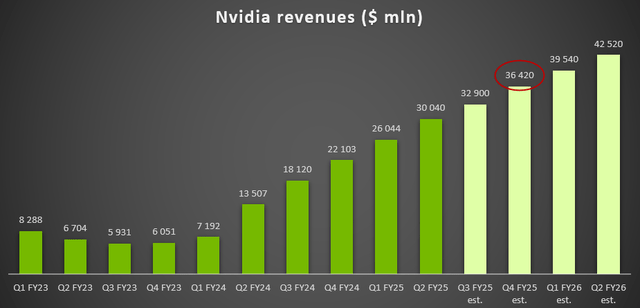

Thanks to this sideways movement over the past months, my year-end target of $170 became harder to reach, but I believe it would be premature to give up on it at this point. I believe the market underestimates the impact of Blackwell revenues over the upcoming quarters, which will come in addition to increasing H200 revenues in H2. The current $36.4 billion analyst estimate for Q4 seems overly conservative to me, which could be confirmed in the upcoming Q3 earnings release in November, when management provides guidance for the upcoming quarter. I believe a close to 10% upside surprise to this estimate will provide the next inflection point for shares leading to a breakout above $140, if this doesn’t happen until then.

Q2 earnings: Important message behind the scenes

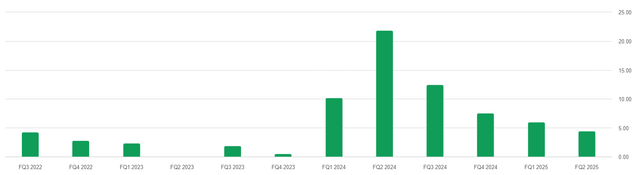

Nvidia managed to surpass the $30 billion revenue threshold in its recently closed FY25 Q2 quarter, beating the average analyst estimate by 4.5%. The share of Datacenter revenues increased to 87.5%, dominating the company’s topline to an even greater extent. The magnitude of revenue beats continued to decline slightly showing that topline growth figures are becoming more predictable:

This could be the result of continuing supply chain bottlenecks, which artificially constrain the fulfillment of strong demand. Forecasting supply for the upcoming quarter should be easier than forecasting demand. Based on management comments, Hopper supply and availability have improved recently, but supply of incoming Blackwell platforms is well below demand. Based on this, I believe investors can count on continued topline beats of 4-5% over the upcoming quarters. What really matters will be the guidance for next quarter, as this represents the truly moving piece. Based on current trends and the ramp of Blackwell GPUs over the upcoming quarters, I believe there could material upside to current estimates.

Currently, market consensus for Q3 revenue calls for $32.9 billion, which is anchored by management’s guidance of $32.5 billion. Based on recent trends and continued supply constraints I mentioned above, a 4% beat is realistic in my opinion, calling for a revenue figure around $34 billion. In the light of this, the current $36.4 billion consensus estimate for the Q4 quarter seems overly conservative in my opinion:

Created by author based on company data and analyst estimates

Based on management communication, it was clear from the Q2 earnings call that revenues from the H200 architecture should continue to grow over the second half, which will be aided by significant amount of Blackwell revenues already in Q4:

In Q4, we expect to ship several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025. – Colette Kress, Executive Vice President and Chief Financial Officer on Q2 earnings call

Looking at current estimates for the upcoming quarters, it seems to me that incoming Blackwell revenues from Q4 are not properly factored into these estimates, although there is increasing conviction that the ramp up in production is quite strong. Assuming that my $34 billion Q3 estimate includes only a few hundred million dollars of Blackwell revenues (only in sampling phase over the quarter) and that H200 revenues continue to grow into Q4, the current $36.4 billion estimate seems achievable without taking Blackwell into account. Adding the “several billion dollars” Blackwell estimate to this should result in Q4 revenues of ~$40 billion.

If management publishes such a strong guidance for Q4, I think it should serve as the next inflection point for shares. I’m not talking here about the same inflection point that could have been witnessed with the publication of FY24 Q1 earnings, when management guided for $11 billion of revenues after a ~$7 billion quarter, but it has the potential to materially reset current expectations in my opinion. Besides optimistic reports on Blackwell ramp and positive management commentary going into the year end there are other encouraging signs that the Q4 guidance could be market moving.

On the one hand, networking revenue received a strong boost recently, thanks to the launch of Nvidia’s Ethernet-based networking platform, Spectrum-X. According to management, it could be a multibillion product line within a year, which is a realistic estimate considering the $18 billion datacenter ethernet switching market, which grew 70% YoY in 2023 and is expected to maintain its strong growth in 2025 after an impressive 2024. Partially, thanks to this networking revenues grew 16% sequentially after a flat Q1 (which has been supply constrained), where Ethernet related AI revenues doubled as Spectrum-X ramped. It’s important to add that the growth in networking revenues is still mostly driven by InfiniBand technology, which Nvidia acquired with the well-timed acquisition of Mellanox in 2019 (see my previous article on Nvidia for more technical details on the topic: “Nvidia: Diving Deep Into Its Technological Supremacy”).

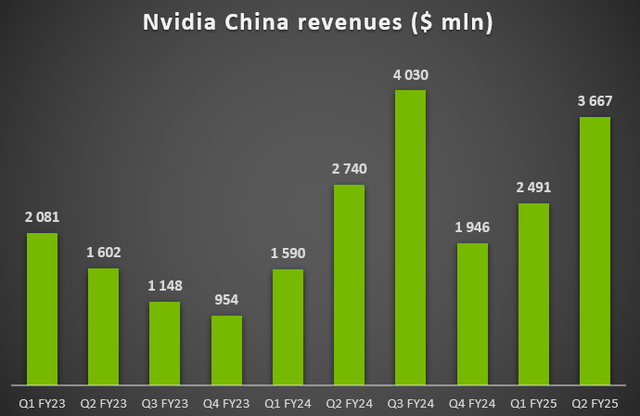

On the other hand, revenues from China began to materially increase again after the successful launch of the company’s H20, L20, and L2 GPU product line, which complies with the U.S. government’s export restrictions. In Q2 revenues from China reached $3.7 billion almost doubling from FY24 Q4 levels, when the newly introduced export restrictions took their toll on the company’s sales:

Created by author based on company data

From a topline growth perspective, increasing sales in China are a strong positive, but their overall impact on Nvidia’s margin profile could be viewed as negative. The Chinese market is characterized by strong price competition set by Huawei, which made Nvidia reduce the selling price of its GPUs. This could be one reason that gross margins declined to 75.1% in Q2 from 78.4% in Q1. However, at the end, what really counts is the addition of fresh margin dollars to the bottom line.

Another important catalyst for Nvidia on the short run is sovereign AI, where opportunities seem to materialize faster than expected. Management increased its previous guidance for FY25 from high-single-digit billion dollars to low-double-digit billion dollars of revenue, which could equal to a few million dollars this year weighted towards the back half.

Finally, opportunities from software revenues could be also an important building block of Nvidia’s future growth, but their current annual revenue run rate of $2 billion makes up only a tiny fraction of total hardware sales. However, as the installed continues to grow in a rapid pace, I expect software related revenues to materially increase from current levels.

I’ve covered some of the most important aspects of Nvidia’s near-term growth potential, but I think it’s important to take a step back and look at the long-term roadmap. A recent chart from Nvidia’s October investor presentation summarizes well that AI is revolutionizing a significant part of our world, which should provide strong demand for the company’s technologies over the upcoming years:

Nvidia Investor presentation

Risk factors

The most important risk factor for Nvidia shareholders is a possible Chinese military intervention in Taiwan, which would lead to significant supply chain disruptions. Nvidia’s key supplier, Taiwanese TSMC tries to diversify its operations around the world, but this will take several years to execute.

Another company-specific risk factor for Nvidia is a possible strengthening of export controls to China. Even though the Chinese market makes up only about 10% of the company’s revenues and probably significantly less of operating income, it still provides a strong long-term growth opportunity.

Strengthening competition from rivals like AMD (AMD) and Intel (INTC) is also a threat on the longer run, but currently, Nvidia’s CUDA ecosystem is the obvious choice for developers, which will be hard to challenge. Custom chips developed by hyperscalers are also a competitive threat, but these are mostly used for in-house tasks for now.

Finally, a possible U.S. recession could be also an important risk factor for Nvidia shareholders, but this wouldn’t meaningfully slow down the proliferation of AI-assisted technologies in my view. However, as recessions typically coincide with significant double-digit declines in the stock market, it’s something to look out for. Currently, recession probabilities for next year seem to decline as recent labor market data confirmed a still-solid jobs market.

Valuation

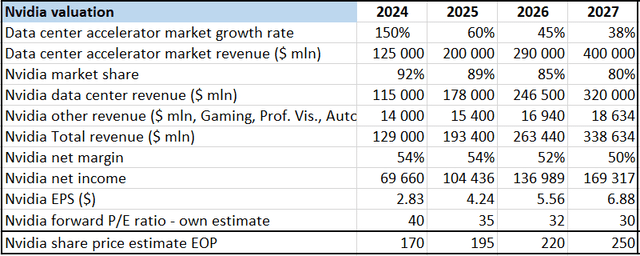

Based on the developments over the past three months I didn’t alter my inputs for Nvidia’s valuation framework, my year-end price target still calls for $170/share:

Created by author based on own estimates

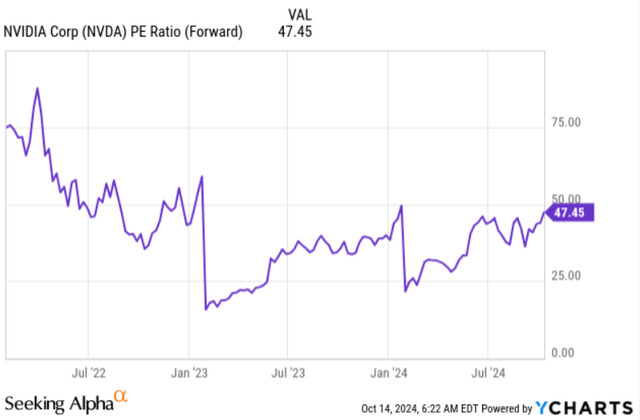

My $170 year-end share price estimate is based on a forward P/E ratio of 40 combined with a calendar year 2025 (~FY26) EPS estimate of $4.24. Currently, Nvidia’s shares trade at a forward P/E ratio of 47.5 based on FY25 earnings:

As earnings roll over to the next financial year on the 1st of February, when Nvidia’s new financial year begins, the ratio will drop by ~30% (see similar drops in 2023 and 2024) as the current $2.84 analyst estimate for FY25 rolls over to the current $4.01 estimate (both are subject to change until then). This means, that the forward P/E based on FY25 earnings should increase to 57 from the current 47.5 in order to reach my estimate of 40 after earnings roll over to FY26. In my opinion, the publication of Q3 earnings in November will be the inflection point that gets us to a forward P/E of 57, which is 20% above the current level.

As I detailed before, I expect Q4 guidance coming in significantly higher than current market estimates, leading to a rally into the year-end. The main reason I believe that the announcement of a significant Q4 guidance beat should be market moving is, that it has the potential to significantly increase FY26 earnings estimates, making analysts re-evaluate how they thought about Nvidia’s financials over the medium term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.