Summary:

- Data center revenue grew 154% from the prior year to $26 billion, largely driven by strong demand for Hopper, GPU computing and networking solutions.

- Blackwell is expected to now start production ramp in the fourth quarter, and this will continue into FY2026.

- With the next generation models requiring 10 to 20 times more compute to train given significantly more data put into the model, the trend of continued purchases of the best-in-class compute for AI will likely continue.

- Currently, cloud service providers make up 45% of Nvidia’s data center revenue, with consumer, Internet and enterprise companies making up more than 50% of Nvidia’s data center revenues.

- Management highlights two major computing transitions: accelerated computing and generative AI, justifying ongoing capital expenditures and long-term sustainability of GPU demand.

wellesenterprises

Nvidia (NASDAQ:NVDA) published results that beat expectations, but still a touch below the sky-high expectations of investors.

Realistically, there were no significant holes to poke, with Hopper continuing to see strong demand, and customers getting ready to deploy Blackwell.

The issues with Blackwell have been resolved, and management expects several billions of revenue from Blackwell still in FY2025, with Blackwell starting production ramp in the fourth quarter, and continuing into FY2026.

Investors have been questioning the return on investment of capital expenditures spent on AI and the sustainability of this trend, with multiple questions being asked on this topic during the earnings call.

Management assured investors that we are seeing two big transitions happening in the world of computing: the transition towards accelerated computing and the transition towards generative AI applications.

I have written about Nvidia on Seeking Alpha, which can be found here. In the previous article, I stated that demand continues to outstrip supply well into 2025, with the customer base broadening out and that I expect Nvidia to remain ahead of competition in the near to medium term given the pace of innovation the company is bringing.

I continue to reiterate this view in this article, as Nvidia continues to be ahead of competitors still trying to match Nvidia’s offering and ecosystem. The only difference is that with 2025 coming into view, Blackwell becomes even more important, as its ramp will determine the trajectory of Nvidia stock in the next year.

Business review and outlook

I’ll just very briefly review the recent results and outlook, given that I must cover this before I cover the opportunity for Nvidia moving forward.

Nvidia saw revenue grow 122% from the prior year to $30 billion, 5% ahead of consensus expectations.

Gross margin came in at 75.7%, down 300 basis points, in-line with consensus expectations.

The lower gross margin reflects the increased mix of new data center products, with higher HBM memory costs and greater complexity.

In my opinion, this is somewhat expected given the ramp of Blackwell family of chips, and I expect this trend to continue into FY2026.

EPS grew 153% from the prior year to $0.68, 6% ahead of consensus expectations.

FY3Q25 revenue is expected to be at $32.5 billion at the midpoint, up 79% from the prior year, 3% ahead of consensus. Data center growth is once again expected to be the primary driver of the growth, backed notably by the growing generative AI demand of GPUs and networking products.

Gross margin for FY3Q25 was guided to a 75%, 30 basis points above consensus.

FY2025 gross margin is expected to be in the mid-70% range, while operating expenses are guided to grow in the mid-to-upper 40% as the company works on developing its next-gen products. This was revised up from low 40% earlier.

Data center strength

Data center revenue grew 154% from the prior year to $26 billion, largely driven by strong demand for Hopper, GPU computing and networking solutions.

Hopper has seen strong demand in the quarter, as customers continue to accelerate their purchases of Hopper, and customers are also preparing to purchase and adopt Blackwell next.

The H200 platform started ramping in FY2Q25, with shipments to cloud service providers, consumer Internet and enterprise companies.

China data center revenue grew sequentially in FY2Q25, and a significant contributor to data center revenue, but it still remains below the levels seen before the export controls were imposed.

Networking is one area that Nvidia has been investing in, and network revenues increased 16% sequentially.

The Ethernet Networking Platform for AI revenue, which includes Spectrum X end-to-end platform, doubled sequentially, with hundreds of customer adopting Nvidia’s networking offerings.

Nvidia noted that xAI was one of those customers buying Nvidia’s networking offerings to connect the largest GPU compute cluster in the world.

Nvidia expects to continue to launch new Spectrum-X products on a yearly cadence, and it expects Spectrum-X to be able to become a multi-billion dollar product line within a year.

Inference continued to drive more than 40% of Nvidia’s data center revenues.

With strong demand for Nvidia’s Hopper GPUs from frontier model makers, generative AI startups, consumer Internet companies, amongst many others, cloud service providers are seeing very broad adoption of Nvidia GPUs and likewise, they too are growing their Nvidia capacity to meet this high demand.

With the next generation models requiring 10 to 20 times more compute to train given significantly more data put into the model, the trend of continued purchases of the best-in-class compute for AI will likely continue.

Hopper and Blackwell

Nvidia continued to see strong demand for Hopper, but Blackwell is on most investor’s mind.

Blackwell is currently widely sampling.

Nvidia has made a change to the Blackwell GPU mass to improve the production yields on Blackwell.

In terms of timeline, Blackwell is expected to now start production ramp in the fourth quarter, and this will continue into FY2026.

At the Goldman Sachs Communacopia + Technology conference, Nvidia CEO Jensen Huang provided more updates on Blackwell:

And here we are ramping Blackwell and it’s in full production.

We’ll ship in Q4 and start scaling in Q4 and into next year.

And the demand on it is so great.

And everybody wants to be first, and so the intensity is really, really quite extraordinary.

The expectation in the fourth quarter is to ship about several billion dollars worth of Blackwell revenue, and for Hopper shipments to continue to increase in the second half of FY2025.

In terms of the supply and demand dynamic, Hopper and Blackwell are in different places.

Given Hopper has been shipped for some time now, the supply and availability for Hopper has improved.

For Blackwell, given that it has yet to ramp production, demand for Blackwell is well above supply, and I expect this dynamic to continue into FY2026.

Both Hopper and Blackwell platforms did well in the latest round of MLPerf inference benchmarks, highlighting Nvidia’s inference leadership.

Opportunity set

Currently, cloud service providers make up 45% of Nvidia’s data center revenue, with consumer, Internet and enterprise companies making up more than 50% of Nvidia’s data center revenues.

Sovereign AI opportunities continue to grow for Nvidia as countries see the importance of building AI infrastructure.

Nvidia expects sovereign AI revenues to be in the low-double-digit billions in 2024.

For example, Japan’s National Institute of Advanced Industrial Science and Technology is working with Nvidia to build its AI bridging cloud infrastructure 3.0 supercomputer.

Another area of opportunity for Nvidia is the enterprise AI wave.

Nvidia is currently working with most Fortune 100 companies on their AI initiatives, which includes use cases like generative AI chatbots, copilots and agents to improve productivity and develop new business applications that can be monetized. Examples of some of these companies include ServiceNow (NOW) and Snowflake (SNOW).

Automotive is one of the key growth drivers in the quarter as Nvidia sees strong demand from many automakers wanting to develop autonomous vehicle technology, which will require more compute. Nvidia expects automotive to become a multi-billion dollar revenue business over time as on-premises and cloud consumption continues to grow as autonomous vehicle technology improves.

Another area or vertical that Nvidia finds promising is healthcare, which is on track to become a multi-billion dollar business. Within the healthcare space, AI is used to improve medical imaging, drug discovery and surgical robots, amongst others.

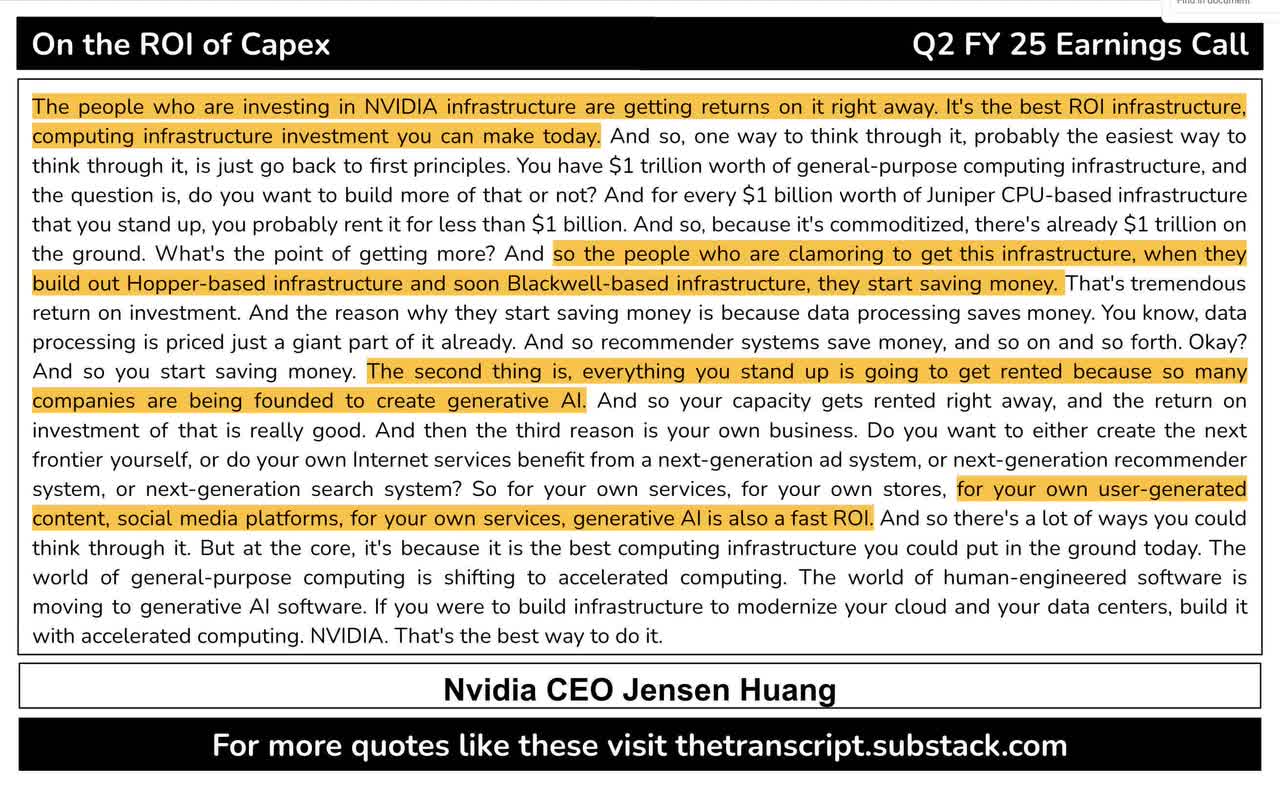

The ROI question

CEO Jensen Huang was asked repeatedly about the return on investments customers are seeing with the significant increase in purchases of Nvidia GPUs and the sustainability of the capital expenditures of these large customers going forward.

You can see his typical reply below.

The idea here is that computing is going through two huge platform transitions, and these two transitions will drive long-term sustainability in capital expenditure spend.

The first computing platform transition is the shift from general-purpose computing to accelerating computing.

With CPU scaling known to be slowing for some time, and computing demand continuing to grow, the transition from general-purpose computing to accelerating computing is necessary. By moving from CPUs to GPUs, companies save costs and reduce energy consumption, which is helping drive down costs dramatically.

With trillion dollars of general-purpose computing infrastructure out there today, Jensen Huang argues that general CPU-based infrastructure is commoditized and that for every $1 billion invested, companies can probably rent it for less than $1 billion.

As a result, the ROI on accelerated computing makes sense because of the higher performance, better efficiency of Hopper-based infrastructure and soon Blackwell-based infrastructure, that helps customers start saving money.

The second computing platform transition is the shift from human engineered software to generative AI learned software.

With accelerating computing, generative AI applications are now possible given the lower costs of training large language models.

As such, the world is transitioning to large scale models with billions and trillions of parameters, trained on very large data sets.

The thing about this transition to generative AI applications and software is that the best, frontier models continue to push the envelope and go to new boundaries, doubling and tripling the models. With larger models, this means it requires a larger dataset and more compute resources are needed.

As such, with each new generation of models developed, the compute needed will grow 10 or 20 times more, if not more, than earlier generations of models.

Thus, with the transition to both accelerating computing and generative AI software being two huge waves that are coinciding today, the amount of capital expenditures being spent today on Nvidia’s GPUs will continue to grow.

I think there is another very important point Jensen Huang said in the earnings call about the return on investment and demand for Nvidia’s GPUs.

Firstly, while the cloud service providers are buying large amounts of GPUs today, the GPU capacity they have today available for external use is very small. The reason for this is that these cloud service providers are using these GPUs internally or to accelerate their own internal workloads.

I think this speaks volumes about the opportunity set available because with GPUs being so scarce today, these cloud service providers know the huge benefit these top-end Nvidia GPUs bring, and that’s why they use it internally first.

Secondly, after meeting the demands of their own internal workloads, these cloud service providers can then have renting capacity for their GPUs. These GPUs can be rented to model makers or generative AI companies, and the demand for these is so high now that any GPU capacity that is put out there will be taken up very quickly.

Lastly, this mainly applies to the top end of the AI and big tech space, but these companies that are at the top are willing to spend large amounts of financial resources for the best Nvidia GPU so that they can be the first to roll out new products, the first to roll out new applications and the first to roll out the best models.

By being the first company to scale up on the best Nvidia GPUs gives the company a huge first mover advantage.

Gaming, Professional Visualization and Automotive

Together, the three segments below make up 22% of revenues, so I will be elaborating more on them in this section.

Gaming revenue grew 16% from the prior year due to strong growth in console, notebook, and desktop revenue, while channel inventory remains healthy.

Professional Visualization revenue was up 20% from the prior year. The growth was driven by strong demand for AI and graphic use cases, which includes model fine-tuning and Omniverse-related workloads. The key verticals driving growth were the automotive and manufacturing verticals.

Companies are digitalizing workflows to drive efficiency in their operations. Several large global enterprises signed multi-year contracts for Nvidia Omniverse Cloud to build industrial digital twins for factories, one of which is Mercedes-Benz.

Automotive revenue was up 37% from the prior year, driven by new customer ramps in self-driving platforms and growing demand for AI cockpit solutions.

Valuation

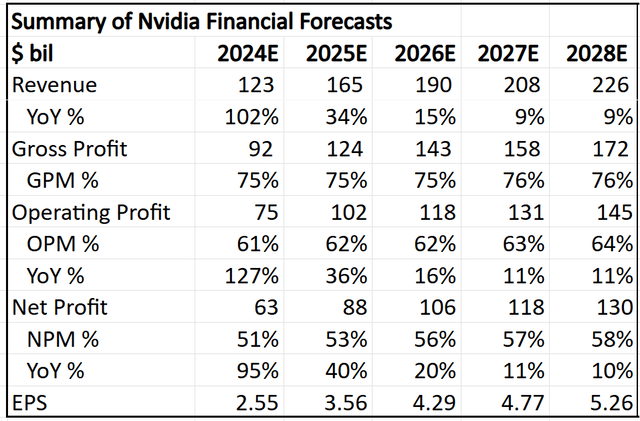

For FY2025, I revised revenue growth up marginally by the 5% beat from this quarter, while I maintain the gross margin given that I already forecasted 75% gross margins, which is in-line with guidance. Operating profit margin was reduced from the earlier 66% to 61% to incorporate the higher costs required to develop its next-gen products.

While Nvidia may be growing very strongly in the past few years, to forecast such growth will continue in the long term is not wise in my view. I assume this growth tapers in 2026, and we may even see cutting of capital expenditure spend by its largest customers, which will lead to a change in valuation for the company. As such, from 2026, I am assuming a conservative 11% revenue CAGR on a very large $190 billion revenue base. On the profitability front, I assume continued margin expansion for both gross and operating profits, as Nvidia continues to improve production efficiency and organizational efficiency.

Summary of my 5-year financial forecasts for Nvidia (Author generated)

My intrinsic value for Nvidia is $115. This assumes a terminal 2028 multiple of 35x and cost of equity or discount rate of 12%. Again, I am unwilling to go above 35x P/E for the terminal multiple, given 35x P/E is in-line with Nvidia’s 5-year average P/E, and it is in a highly cyclical industry.

My 1-year and 3-year price targets are $142 and $167, and they imply a 40x and 35x 2025 and 2027 P/E respectively.

Conclusion

With Nvidia showing very significant beats in the prior quarters, this FY2Q25’s smaller beat was not enough for investors.

That said, the business continues to be doing well, with Hopper continuing to see strong demand and Blackwell ramping production in the fourth quarter.

The fact that Nvidia has Blackwell under control is also a positive, given that this has been a concern for investors in recent weeks.

Nvidia’s customers continue to want to buy Nvidia’s GPUs in large numbers, with the largest customers like cloud service providers currently mostly using GPUs bought for their own internal workloads and the remaining GPU capacity rented out sees very strong demand.

I do not expect Nvidia’s demand to fall off the cliff just yet, as demand remains very strong, and with the next-generation Blackwell to ramp production, this will only grow in 2025.

While the degree of beats and number of beats will likely be smaller in the future, the business fundamentals of Nvidia remains strong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.