Summary:

- Nvidia’s financials results tumbled in the recent quarter, while sequential gross margin improvement is delineated.

- Prospects appear significant as enterprises initiate the deployment of AI solutions at scale.

- The current valuation of NVDA is unsustainable in the future when looking through the prism of a 30% growth reversion angle.

Justin Sullivan

Against the backdrop of high macro uncertainty, the semiconductor industry as a whole is going through difficult times, which was reflected in Nvidia Corporation’s (NASDAQ:NVDA) weak financials and not the most optimistic forecasts. In the meantime, the long-term prospects for the industry look good. With technological progress, the need for GPU-powered solutions could grow exponentially. I am bullish on NVDA stock’s future, as the company is well positioned in the segments that are expected to perform with outpacing growth. I believe that Nvidia is taking a good takeoff run, and once enterprises start deploying AI-applications at scale, the monetization of Nvidia’s new offering may become more prominent due to the significant torque in the higher margin data center and AI-focused software and services.

Financials and outlook

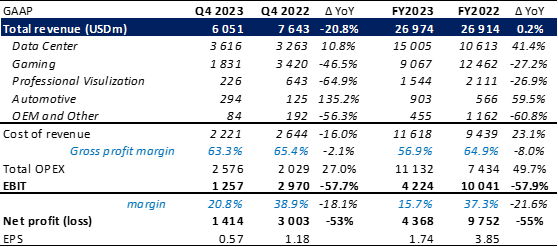

NVIDIA’s revenue in the fourth quarter of fiscal 2023 took a dip by 20.8% YoY to $6.1 billion, due to weak performance of the gaming division, while EPS fell 53% YoY to $0.57. On the positive side, the gross margin recovered to 63.3% (up 9.7 p.p. QoQ), exhibiting an upward pattern. The management’s outlook for the current financial quarter assumes a slight increase in revenue in quarterly terms, while significantly negative annual dynamics. Meanwhile, the company’s balance sheet remains strong, which allows to direct significant funds to buyback.

Financial results (company reports)

Going forward, the upcoming few quarters are likely to be difficult for Nvidia, in line with the entire semiconductor industry, which is currently experiencing a cyclical slowdown amid heightened macro uncertainty and other risks. Overall, the semi-market is expected to weaken by 4.1% due to the integrated circuits forecasted to drop by 5.6%, while other major categories should exhibit low single-digit growth. At the same time, the long-term prospects for the industry look good. Technological progress in the world remains intact, and the demand for ICs could merely grow. Moving to the point, Nvidia’s advantage lies in its solid position in the segments that are expected to outperform.

Emerging prospects for Data centers

Let’s start with the data center solutions. Despite the budget constraints, enterprise IT spending is expected to remain solid. However, data center spending is not a bullish area, evidenced by the 0.7% forecasted growth in 2023. In my view, this assumption may not count the generative AI potential, which along with other fast-growing areas such as deep learning and supercomputing could bring some double-digit pattern. The use of GPU’s in the latter areas is becoming more common due to the less efficient x86 CPU-based solutions, and I believe this may augment the enterprise IT system refresh cycle, in order to meet the future computing demand. I will share the following quote from my article on XLK:

…cloud computing looks to contribute substantially to the IT sector’s performance, as the significant spending on data center systems, we witnessed last year, should provide for a boost in cloud solutions implementation.

In addition, hyperscale cloud providers should continue to update and expand their cloud offerings with AI-based solutions in order to compete for superiority in the market. The hype around ChatGPT is prompting a surge in the generative AI market, which indeed is expected to grow at a CAGR of 34.3% in the current decade and could create a sustainable demand for HPC. As a result, the training market and model complexity growth could trigger a new round of infrastructure buildouts by data center providers, and provide for a strong adoption of the NVDA’s flagship H100 data center GPU.

On the downside, the supply restrictions of HPC processors in China could continue to have a deterrent effect on further revenue growth in the data center business line. However, global demand for these chips is expected to be very strong, and I believe NVDA will be able to offset the losses by diverting supplies to other markets.

Sustainable growth from the Gaming Segment

NVIDIA is the leader in the gaming GPU market, where its GeForce series accounts for over 70% of the market. The segment is exhibiting an improving (on sequential basis) pattern with revenue growth up 16% QoQ in the recent quarter due to the strong uptake of the 40-series of RTX GPUs and channel inventory recovery.

Moving forward, the revenue of the gaming segment appears to keep on underperforming on a YoY basis in the coming few quarters due to the expensed device refresh cycle. However, I expect demand for the company’s GPUs to stabilize beyond, underpinned by the increasing availability of video cards on the market based on the new generation of graphics chips of the GeForce RTX 40 family. Moreover, the new version of DLSS does absolutely amazing things and, in the maximum mode, it can render 7 pixels out of 8, thanks to the efficient combination of powerful hardware with software and neural networks. These 3 pillars, in my view, provide for more sustainable revenue growth in the gaming segment, following the sunset of the crypto-induced volatility in volumes.

Next-level of Self-driving

Another potential growth story could be the autonomous vehicle segment. Although the market is at the nascent stage, it has a stellar prospect, where a number of IT corporations and auto giants have already presented prototypes of self-driving vehicles. The DRIVE Thor seems to me as a small revolution, with the ability to reach the 5-th level of self-driving capabilities. For reference, Tesla’s (TSLA) self-driving feature remains at level 2. Given Nvidia’s experience and strategic partnerships with the leading players in the automotive industry, the company could be able to take a strong position in this area.

Nvidia’s solutions for infotainment and navigation systems, digital dashboards and advanced driver assistance systems on the basis of the Tegra, are already used by Audi, Mercedes-Benz, Tesla, BMW, Honda and others. As a result, further implementation of the DRIVE platform as a computing system for autonomous vehicles could mean a decent subscription revenue stream from advanced ADAS.

In addition, the first Grace-based products are expected to hit the market later in the year, thus NVIDIA may be able to impose direct competition on the server processor makers soon. Furthermore, NVIDIA is counting on the development of omniverse. In simple words, it is like a high-tech sandbox in which one can simulate or create anything at all, and this could become a future for manufacturing planning, engineering and a key for cost optimization.

And aligning it all together – powerful hardware for gaming/training, neural network competencies, omniverse – the circle is closing, providing a perfect combination to perform well in the key markets and drive future revenue growth.

Valuation and reversion angle

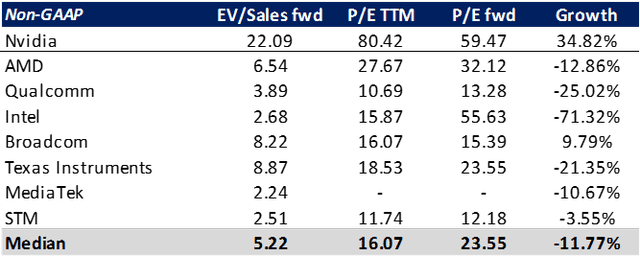

Looking at the valuation, NVDA stock is clearly trading at relatively overvalued levels. In terms of EB/EBITDA and P/E ratios, the company appears to be significantly more expensive than the peer group. At the same time, such a high premium on financial multiples could be generally justified, given Nvidia’s leading position in the GPU market, high profitability, as well as superior growth prospects.

Peer comparison (Seeking Alpha)

NVDA is currently trading at a P/E of 80.4x on a TTM basis, which is roughly a 5x premium in comparison with the peer group median of 16.1x. However, the company’s decent growth opportunities should not be ruled out, and I decided to implement them in order to get an idea on the reversion angle. But let’s start with the forecasts.

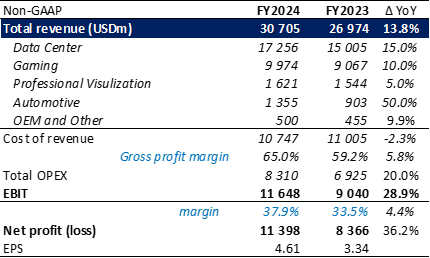

I expect Nvidia to book $30.7 billion in revenue for FY2024, which represents a 13.8% YoY growth. In particular, revenue from the Data Center division is forecasted to grow by 15% YoY ($17.3 billion) mainly on the back of hyperscale customers. From the Gaming line, I expect 10% growth, underpinned by the upcoming new offerings in the RTX 4000 lineup, such as 4070 and 4060. The automotive business is the most growth-intensive, in my view (50% growth for FY2024), and I believe that Nvidia has a potential to expand this line by $0.5 billion on annum for the next 5Y period.

Moving forward, the gross margin is forecasted at 65% in line with a 2.3% decrease in cost of revenue, as last year’s figure included $2.2 billion of inventory charges. With above expectations, we are bringing $11.4 billion to the bottom-line, of EPS of $4.61.

FY2024 expectations (company reports; author’s estimates)

As a result, the forecasts indicate a 36.2% YoY earnings growth for the year ended Jan 2024, which contras with the overwhelmingly negative growth outlook for completion. This could wipe out almost half of that valuation premium, and bring the P/E ratio down to 57.9x.

Analysts estimates (Seeking Alpha)

Looking at the analyst’s estimates above, Nvidia has a significant growth potential of 30% going forward. The last column delineates a prominent downward trend for the P/E, where the reversion angle of 30% growth could further work out the denominator and bring the ratio from 44.5x in FY2025 down to the low 20s.

I am bullish on NVDA, as in my view, once enterprises start deploying AI applications at scale, the higher margin data center and AI-focused software and services could underpin the aforementioned reversion angle.

Risk factors

The expectation of further interest rate hikes could keep technology stocks highly volatile. In case the global macro environment continues to deteriorate, we can expect a slower recovery in the semiconductor industry and, hence, a slower recovery in demand for NVIDIA products. In addition, this could hurt the adoption of the company’s new offering, shift the market and trim the company’s competitive position.

Conclusion

I believe that the current premium valuation of NVDA stock is not sustainable going forward when taking the significant earnings outlook of the company. I will summarize the main future prospect for Nvidia with the following question: What does the rapid development and adoption of AI mean for the company? My answer is that it may be thought of as deja vu, as the AI applications require enormous computing power, meaning that the new cycle of demand for high performance GPUs may yet to start. The previous one was when the mining was hot. In the meantime, progress is clearly evidenced by the ChatGPT 3 evolution from supporting 175 billion parameters, to ChatGPT 4 with up to 1 trillion parameters. The result is, that the data centers could start updating their server’s infrastructure with more powerful GPUs in order to handle more demanding next-generation AI technologies.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.