Summary:

- My previous thesis about Nvidia Corporation has aged well, as the stock has appreciated by 18% since February 7, outperforming the S&P 500.

- Nvidia Corporation delivered strong fiscal Q4 financial results with revenue growth of 265% YoY and a significant EPS improvement.

- The company’s investments in R&D, dominance in the GPU space, and new Blackwell platform position it well for future growth.

- My valuation analysis suggests that Nvidia stock is 34% undervalued.

Daniel Chetroni

Introduction

I shared a thesis about NVIDIA Corporation (NASDAQ:NVDA) in early February 2024 with a “Strong Buy” rating. It appears that my optimism was justified because the stock has appreciated by 18% since February 7, while the S&P 500 (SP500) was flat. Today I want to share my insights about recent developments around NVDA from the fundamental analysis perspective.

The demand for GPUs, where Nvidia dominates, appears to be still robust. Nvidia continues investing heavily in innovation, which will likely help the company maintain its position at the forefront of the AI revolution. My discounted cash flow (“DCF”) analysis suggests that the stock is still attractively valued, and I am inclined to reiterate a “Strong Buy” rating for NVDA.

Fundamental analysis

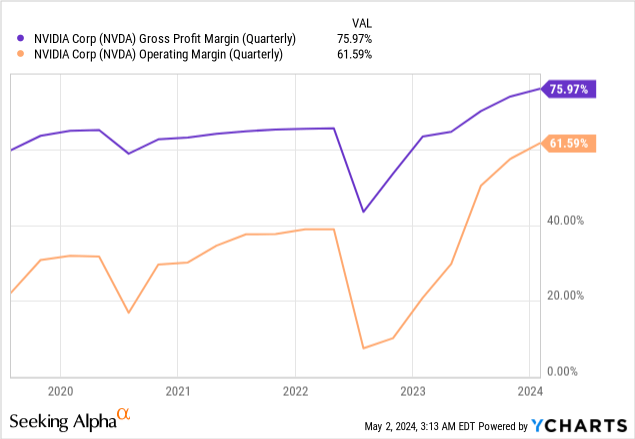

NVDA delivered another staggering quarter on February 21 with a $1.5 billion revenue beat against consensus estimates. The positive EPS surprise has also been wide from the company. Revenue grew by 265% YoY and the non-GAAP EPS skyrocketed from $0.88 to $5.16. The EPS profile improvement was achieved thanks to a massive operating leverage as NVIDIA’s profitability ratios demonstrated strong improvements shown below.

The company continues capitalizing on its dominance in the GPU space, where NVDA holds an 80% market share. The demand for GPUs is still robust as software companies continue their artificial intelligence (“AI”) battle. For example, a couple of weeks ago, Meta Platforms, Inc. (META) introduced its Llama 3 large language model (“LLM”). This model was trained on Nvidia’s H100 Tensor Core GPU’s.

Another big positive sign is that Nvidia does not only provide hardware for Meta’s LLM, but provides a comprehensive solution which also includes software and libraries. The fact that Nvidia partners with giants like META as an ecosystem, and not just a hardware provider, makes META’s switching costs much higher and provides NVDA with a moat.

However, Nvidia does not only aim LLMs, but also has a solid footprint in a domain called “real-world AI.” During the latest Tesla, Inc. (TSLA) earnings call, Elon Musk shared insights which seem very beneficial for NVDA. He said that his company plans to become the third-largest Nvidia customer because his AI initiatives like autonomous driving (“FSD”) and Robotaxi require loads of computing capacity.

Tesla might ultimately deploy 85,000 Nvidia H100 chips by the end of 2024 to train its AI models. This acknowledgement from the world’s largest EV company and the most technologically advanced automotive manufacturer is an obvious indication of Nvidia’s dominance from the technological perspective.

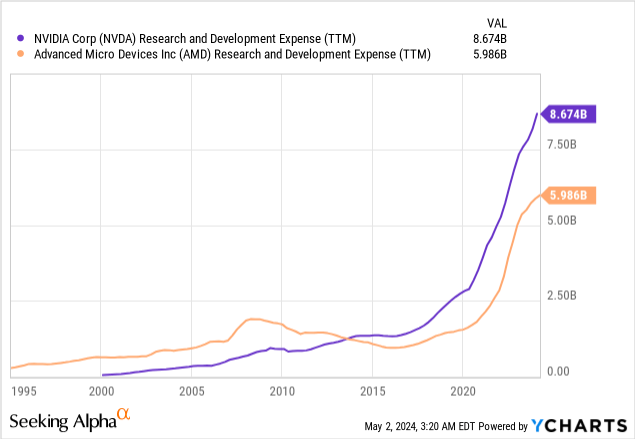

These are massive positive news for NVIDIA which happened just within the last two weeks, indicate that the momentum in AI is still robust. What is most important is that Nvidia likely remains at the forefront of this secular shift. According to wccftech.com, Advanced Micro Devices, Inc. (AMD) increased its GPU market share in Q4 2023 by two percentage points at Nvidia’s expense. However, as the gap between these two companies’ investments in R&D is widening and the difference amounts to billions of dollars, I think that AMD has a limited potential to further expand its market share against NVDA. Furthermore, I have confidence in Nvidia’s positioning against AMD not only due to higher R&D spending, but also due to the visionary talent of the company’s management.

In my previous thesis, I have underlined that Nvidia CEO Jensen Huang and his team have been disrupting the GPU industry for more than the last three decades, and this year’s GTC 2024 event has increased my confidence that Nvidia will continue disrupting the way the digital world works. This is crucial because Nvidia does not want to only compete in current markets, but create new markets, “Blue Oceans” as it is called in one famous book.

I am not an AI chips expert, but the new Blackwell platform, which was presented during GTC 2024, appears to mark a significant leap in computing. According to amax.com, this solution is multiple times more powerful than the company’s legacy products and performs with much more efficient energy consumption, which will likely lead to lower cost of ownership for data centers. Blackwell’s technological superiority is also highlighted by Alex McFarland, an AI expert, who said that Nvidia is setting new industry standards in the realm of AI processing with the company’s new platform.

To summarize, Nvidia remains at the forefront of the AI innovation, and its recent release of a disrupting Blackwell architecture appears to be a new standard for the AI solutions industry. The company’s investments in R&D outweigh its closest GPU competitor, AMD, by billions of dollars, which likely helps the company to sustain its dominance in the space. I think that having a dominant position in the emerging industry will enable Nvidia to sustain its stellar pricing power, which will ultimately result in expanding profitability for longer.

Valuation analysis

Despite almost a 10% decline in the stock price over the last month, NVDA still has a strong Quant Momentum rating. After the last 12 months’ 187% rally, the company’s market cap reached $2.13 trillion, and currently NVDA is the third largest U.S. company by market cap after Microsoft Corporation (MSFT) and Apple Inc. (AAPL).

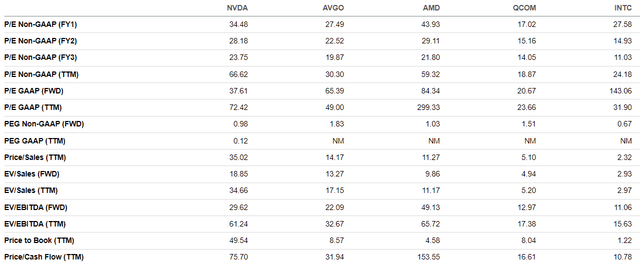

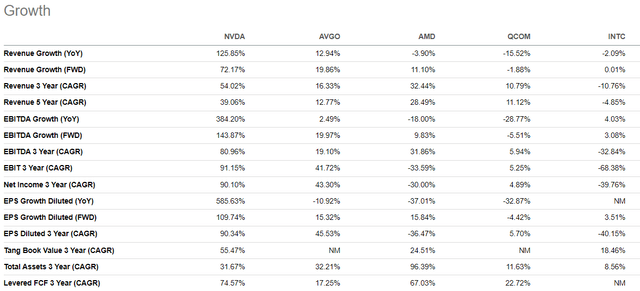

Some investors and experts consider NVDA to be substantially overvalued, but I do not think so. First, let me show you how NVDA’s forward valuation ratios look against other prominent semiconductor names. The company’s forward non-GAAP P/E ratios look in line with Broadcom Inc. (AVGO) and AMD, and the non-GAAP PEG is also sound.

Of course, Nvidia’s TTM metrics are substantially higher than all rivals. Nvidia’s all valuation ratios are also sky-high compared to QUALCOMM Incorporated (QCOM) and Intel Corporation (INTC). However, TTM ratios give us a rear-mirror view, and investing in assets is all about their future potential to deliver growth and profitability. From the perspective of growth, none of the above-mentioned rivals are anywhere close to Nvidia. Therefore, I think that Nvidia’s high TTM metrics are justified, which we see from sound long-term forward metrics.

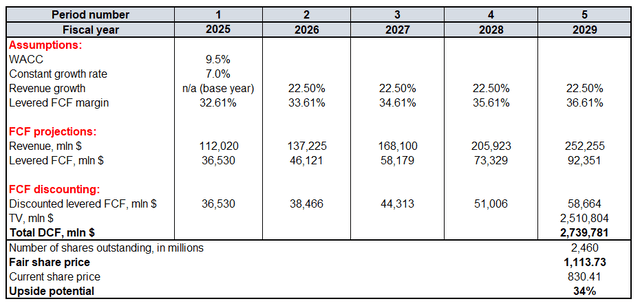

Now I must figure out my target price for NVDA, which I will do with the help of the discounted cash flow (“DCF”) model. Future cash flows will be discounted with a 9.5% WACC. Due to the positive factors for NVDA’s long-term prospects which I share in “Fundamental analysis,” I reiterate my aggressive 7% constant growth rate assumption which I used last time for the terminal value (‘TV’) calculation. From the revenue perspective, I rely on consensus estimates for the base FY 2025 and project a 22.5% CAGR for the next five years. I use a 32.61% TTM levered FCF margin and expect NVDA to be effective in exercising its pricing power, which will help in expanding its FCF margin by 100 basis points yearly. According to Seeking Alpha, there are 2.46 billion outstanding NVDA shares.

My DCF model suggest that NVDA’s shares are 34% undervalued and the target price for the next twelve months is $1,114. That said, the stock is still very attractively valued. I see it both from the multiples and DCF points of view.

Mitigating factors

Recent developments around other big semiconductor names suggest that investor sentiment around semiconductors is cooling down. AMD’s stock saw a notable recent sell-off, even after a solid Q1 earnings release with decent guidance on April 30. Intel also reported recently, and the stock suffered a sell-off, but INTC’s report was indeed weaker than Wall Street analysts expected. While competitors’ struggles might be good for Nvidia from the strategic point of view, as a leading semiconductor company in the world, NVDA’s share price is vulnerable to the overall sentiment around the semiconductor industry. This might be a short-term headwind for the share price, and investors should be aware of it.

The American technology sector is full of bright and ambitious, visionary leaders. Not all of them like the monopoly of Nvidia in the GPU market, and I believe that Nvidia’s success is a good role model for the new generation of visionary CEOs. For example, Sam Altman from OpenAI wants to build his alternative to Nvidia in GPUs and reshape the industry. While his initiative apparently does not look like an overnight venture, I think that even potential positive headlines regarding Mr. Altman’s initiatives developing in this direction might be absorbed by the market as a mounting threat to Nvidia’s long-term prospects which will likely undermine the stock price.

There is a great deal of geopolitical uncertainty not only caused by the complex relationships between China and the U.S., but also due to the historical tensions between China and Taiwan. This factor is crucial because Nvidia outsources its manufacturing to the Taiwan Semiconductor Manufacturing Company Limited (TSM) and the supply chain heavily depends on the stability of TSM’s operations. I agree that the probability of an armed conflict between China and Taiwan is extremely low, but recent years taught us that even non-military measures like economic sanctions might substantially disrupt business operations. I think that this risk should also be weighted by investors before they decide to opt into NVDA.

Conclusion

Nvidia is likely to remain the dominant force in the emerging advanced chips industry, thanks to its heavy investments in R&D and the visionary talent of its management. The demand for the most powerful GPUs appears to remain strong for longer, which is a big tailwind for NVDA. I think that NVDA is still a “Strong Buy,” also because of its still attractive valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.