Summary:

- Recent developments in the technology sector suggest that the AI revolution is at an early innings of growth.

- NVIDIA dominates the market of AI chips and invests vast amounts in R&D to protect its technological edge.

- Despite a significant rally in stock price, NVIDIA is still attractively valued with a potential upside of 34%.

Justin Sullivan

Investment thesis

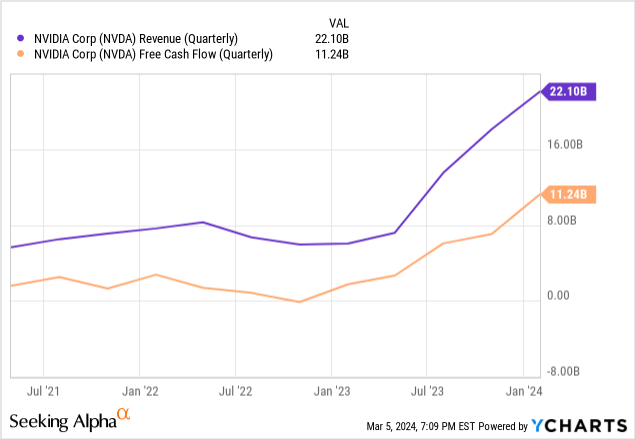

I had a few solid calls since I became a Seeking Alpha analyst last year, but NVIDIA (NASDAQ:NVDA) was my big mistake, which was also painful for me as an investor since I have missed an excellent investment opportunity. I underestimated NVIDIA’s potential because it was very difficult to imagine that a company worth hundreds of billions USD will be able to multiply its revenue and free cash flow [FCF] by factors of 2 to 3 within just couple of quarters. The spike in the quarterly revenue and FCF can be seen below.

The demand for graphic processing units [GPUs] is indeed massive, which provides NVIDIA with wide opportunities to continue capitalizing on the demand spike. Today I want to admit my 2023 mistakes and explain why I think NVDA is able to deliver more stock price growth even after becoming a $2 trillion company. The AI race seems to be just starting, and the wealthiest American corporations seem to be ready to fire all cylinders in this race because generative AI will likely unlock massive potential to enhance efficiency of various business processes across different industries. My valuation analysis suggests that the stock is currently undervalued by 34%. All in all, I upgrade my rating for NVDA to “Strong Buy”.

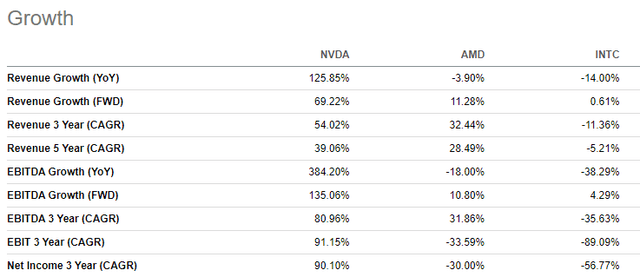

Recent developments

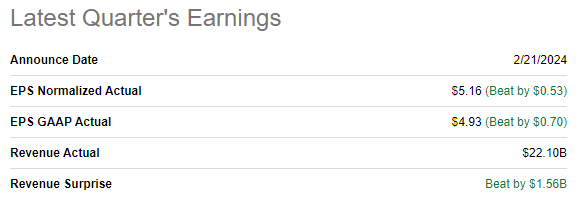

NVIDIA delivered another staggering quarter on February 21, topping consensus estimates by a wide margin. Revenue almost quadrupled on a YoY basis, from $6 billion to $22 billion. So did the adjusted EPS by expanding from $0.88 to $5.16.

Seeking Alpha

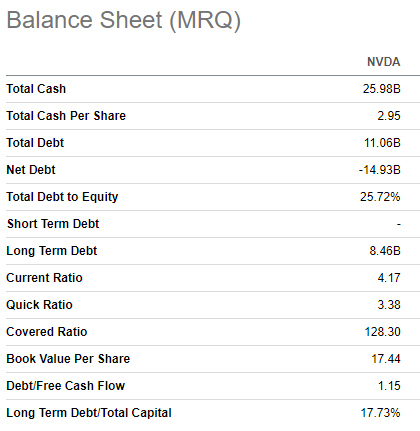

Delivering such a quarter enabled NVDA to generate $7.1 billion in levered free cash flow. To add context, previous annual FCF record was delivered in FY 2022 with a $6.5 billion level. The Q4 FCF contributed substantially to improving the balance sheet, and the company had $26 billion in cash as of the year-end. With only 26% leverage ratio and a massive cash pile, NVIDIA’s balance sheet is literally a fortress.

Seeking Alpha

Now let me proceed with the forward-looking analysis. But before I begin, I want to remind readers that I never defined NVIDIA as a weak business. On the contrary, I have consistently emphasized its stellar profitability and its capability to drive revenue growth. My mistake lay in underestimating the pace of artificial intelligence adoption. Therefore, I will base my forward-looking analysis mostly on the discussion of the sustainability of this growth trajectory.

It seems like the rapid adoption of ChatGPT in recent years opened eyes to corporate leaders on capabilities of AI algorithms, and now we are in a big “AI race”. We can understand how intense the AI race is since even Apple (AAPL), one of the undisputed technological leaders of the couple past decades seem to be getting heat from investors for being not enough AI-committed. Apple even halted its decade-long electric vehicle development project to reallocate human capital to the AI development.

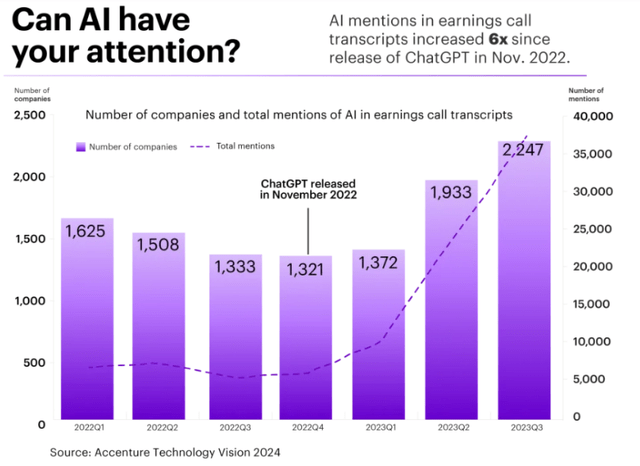

Another hyperscaler, Amazon (AMZN) is also investing heavily to avoid lagging in the AI race. Apart from its last year’s $4 billion investment in Anthropic, last week AMZN’s management decided to add another $1 billion to invest in startups that combine AI with robots. Microsoft (MSFT) seems to be at the forefront of the generative AI revolution, thanks to its strategic partnership with OpenAI, the company which developed ChatGPT. But Microsoft highly likely desires to expand its leadership in generative AI, as it continues to invest in other AI startups. Last week, there were news that MSFT will invest in a promising European generative AI startup called Mistral. Tesla (TSLA) continues investing heavily in its Full-Self-Driving [FSD] and Humanoid Robot projects, which is not a generative AI, but is still AI-backed and requires vast amounts of computing capacity. And this trend is common for loads of businesses across the U.S., just look at the below chart.

And the trend does not look like just a hype but means that businesses are indeed very interested in rapid adoption of generative AI. The reason why companies are rushing to ramp up penetration of AI capabilities into their processes is on the surface: to drive efficiency. According to McKinsey, up to 70% of business activities across almost all occupations can be automated with the help of generative AI. This massive automation potential means that companies can save trillions of dollars, and I hesitate that businesses will lose this opportunity.

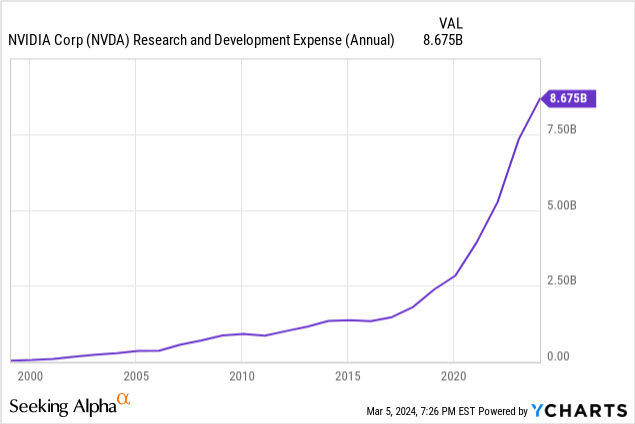

NVIDIA dominates the GPU market with a staggering 82% market share. This positions the company in an almost monopolistic position as AI chips supplier because GPUs are the best fit for machine learning. And NVIDIA’s H100 GPUs are even called the “gold standard” of generative AI workloads. To protect its technological edge, NVDA reinvests billions of dollars in R&D. For example, in FY 2024 the company reinvested almost $9 billion in innovation, which will highly likely help NVDA to sustain its technological dominance in GPU domain.

That said, I believe that widespread adoption of generative AI functions into business processes is a new reality which will ensure sustainable rapid revenue growth for NVDA for next several years. It is also important that NVDA is not only a company that sells AI chipsets, but provides an ecosystem with software, tools, and libraries. Providing ecosystem instead of just selling chipsets increases switching costs for customers, which adds to my optimism about the ability of NVIDIA to sustain its GPU leadership.

Valuation update

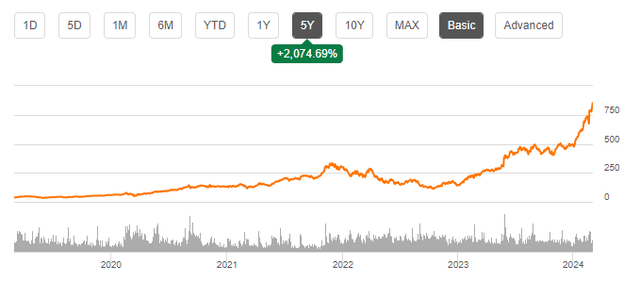

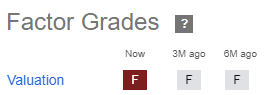

NVDA share price increased by more than three times within the last twelve months, and a YTD 72% rally is massive. Valuation ratios are inherently high for NVDA, which has been common for the stock over multiple timeframes.

Seeking Alpha

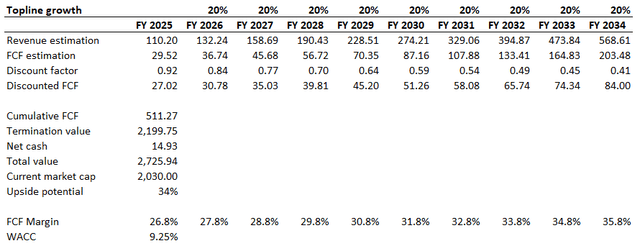

It is apparent that NVDA’s valuation is built on expectations of future free cash flows, which means I need to simulate the discounted cash flow [DCF] analysis to measure the fair value. Today, I am using an updated 9.25% WACC, which is the last time’s 10% discount rate adjusted for three expected Federal Funds rate cuts in 2024, each by 25 basis points. An FY 2025 consensus revenue estimate is based on the management’s guidance, which I consider to be reliable for the DCF model. For the long-term revenue CAGR I use 20% rate. This might look like an unrealistic growth rate, but Precedence Research are much more optimistic than I am with their 34% projected CAGR for the global GPU market. I am using a TTM FCF ex-SBC margin of 26.8% and expect one percentage point yearly expansion.

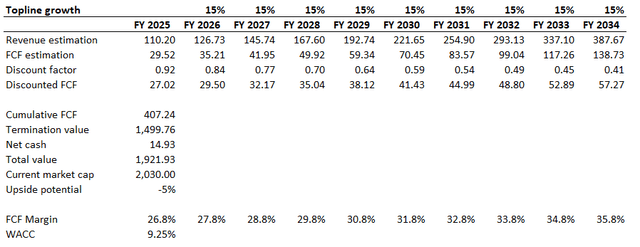

According to my DCF simulation, the business’s fair value is $2.7 trillion. This represents a 34% upside potential from current levels. But let me also assume that 20% might be too optimistic, and NVIDIA will only deliver a 15% CAGR over the next decade. I expect other assumptions to remain unchanged.

As we can see above, even with a much slower revenue growth assumption, NVDA is only 5% overvalued. This looks like a very modest premium for a company like NVDA. I think that the stock is very attractively valued, and my target price is $1,140, which is the current $852 price adjusted up by 34%.

Risks update

Buying any stock after such a massive rally is inherently risky. It is difficult to estimate reliably, but I think it is likely that the notable portion of a recent bull run was driven by FOMO-investors. That said, there is a significant risk that these investors might start realizing their gains, which will put downward pressure on the stock price.

Discussions that the current situation in the stock market reminds experienced investors of a dot-com bubble seem to become louder every time major stocks refresh their historical highs. While I do not share this view, the history teaches us that the stock market will inevitably face a downturn sometime in the future. It is hard to forecast the black swan event, which can bring substantial panic to the stock market. I think that the COVID-19 pandemic or a full-scale Russia-Ukraine war shocked the world, and these events were impossible to forecast. In the case of a black swan, NVIDIA is likely to become the stock which can drop rapidly. The stock tanked by more than two times between November 2021 and October 2022 due to adverse changes in the macro environment.

Should a GPU market expand with a 34% CAGR, as it was mentioned above, this field will inevitably become increasingly appealing for other big tech players. Intensifying competition will likely exert downward pressure on NVDA’s market share and its pricing power. At the same time, it is crucial to understand that building the new NVDA is not an overnight process, and recent comments from Sam Altman suggest that it would take $7 trillion to reshape the AI chips industry.

Apart from potential competition from big tech, NVDA already has large competitors with solid experience in building advanced chipsets as well. Advanced Micro Devices (AMD) and Intel (INTC) are considered to be the closest rivals of NVIDIA. However, as Intel’s revenue and profitability has been stagnating for the last five years, I think that INTC is struggling to adapt to the evolving technological landscape and the biggest potential threat to NVDA’s dominance in GPU is AMD. In late 2023 AMD released its new chips which are aimed to power faster AI training. Despite AMD’s market share in GPU looks tiny compared to NVDA, I would not discount AMD’s technological potential. Out of the Top500 list of supercomputers, number of AMD-powered rose by 39% in 2023 to 140. This indicates that AMD is indeed a strong rival from the technological perspective, and its new AI accelerators can compete with NVDA’s offerings. Losing market share to AMD will not only mean decelerating revenue but also will likely put downward pressure on NVDA’s stellar profitability metrics.

As we all know, NVIDIA is focused on designing chips and mostly outsources production process. Taiwan Semiconductor (TSM) is a large manufacturing partner that produces substantial portion of chips designed by NVDA. Historical territorial disputes between China and Taiwan is a factor that adds uncertainty to long-term prospects of TSM. While I do not believe that there might be a military escalation, there is a probability that some time in future Taiwan’s government might be led by people who are keen on improving relationships with China. If this is the case and China increases its political influence over Taiwan, this might disrupt TSMs relationships with its American counterparts like NVDA.

Bottom line

It is never late to admit mistakes and my valuation analysis suggests that there is still a room to enjoy potential NVDA stock price appreciation. The company is at the forefront of the AI revolution and its 80% GPU market share suggests that competitors are way behind from the technological perspective. My valuation analysis suggests that the fair share price is 34% higher than the last close and I believe that this upside potential outweighs potential risks. Therefore, I am upgrading NVIDIA’s stock to “Strong Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.