Summary:

- Nvidia is the best-performing S&P 500 Index stock this year, delivering a massive above 100% rally year to date despite softening earnings thanks to the AI mania.

- Recent developments in the macro environment indicate that everything is against the further rally for Nvidia stock.

- My bearish thesis is also backed by my valuation analysis, suggesting the stock is massively overvalued.

Justin Sullivan

Investment thesis

My bearish thesis about Nvidia (NASDAQ:NVDA) stock, which I shared over two months ago, did not work well during this short-term period. The share price increased more than 30% since March 7, adding to the massive year-to-date rally of 118%! At the same time, earnings are expected to demonstrate the third in a row YoY decline, and the macro environment remains harsh. In March, I underestimated the extent of the hype around artificial intelligence [AI]. But nothing is infinite, and I have a high conviction that valuation will return to normal under a harsh macro environment that is highly likely to worsen.

Recent developments

The stock continues its rally amid the AI frenzy, delivering more than a 10% rally quarter-to-date. The stock is now traded at levels that are very close to all-time highs [ATH].

In late 2021, when NVDA stock was at ATH, there was no war in Ukraine, Fed funds rates were close to zero, there were no serious talks about the recession, and the future seemed cloudless for the U.S. banking system. We all know that the reality in May 2023 is very different compared to late 2021. A couple of days after my initial thesis went live, the Silicon Valley Bank collapsed. Unfortunately, regional banks’ failures did not stop there, with many other relatively large banks halting operations. The credit crunch is looming, and one of the greatest investors of all time, Warren Buffett, is very cautious about the U.S. Banking sector.

A potential credit crunch increases the probability that the Fed finished its cycle of interest rate hikes. However, still, rates are currently at the highest levels since the global financial crisis, which also should be a big red flag for growth companies like Nvidia. And I consider Fed funds rates to stay high this year, since inflation is still flying much higher than the Fed’s target rate of 2%. The war in Ukraine seems to be far from the end, and other geopolitical tensions also add inflationary pressure.

Last but not least about the bad news for Nvidia, BofA securities calls the US recession “imminent” suggesting that markets are currently near their peak. In my opinion, the probability of a “soft landing” is not zero. Still, the number of uncertainties and unfavorable trends in the macro environment suggest that this probability is not very far from zero.

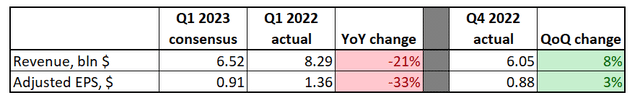

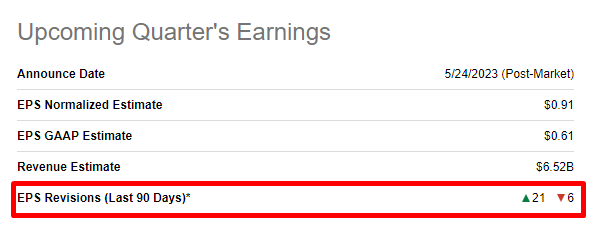

The company is expected to announce its Q1 earnings this week, on May 24. Quarterly revenue is expected at $6.52 billion, more than 20% lower YoY. The EPS is projected to decline even more, by 33%, on a YoY basis. Though sequentially, both metrics are expected to deliver growth.

Nvidia quite rarely misses consensus estimates, according to earnings history. But, I would like to underline here, that there were 21 upward revisions for NVDA earnings during the last 90 days. For me, it indicates that consensus forecasts for the upcoming earnings might be too bullish to beat for the company.

Seeking Alpha

Overall, I believe that even if Nvidia delivers quarterly solid results compared to consensus estimates, the macro environment is way too unfavorable to fuel further growth for the stock.

Valuation update

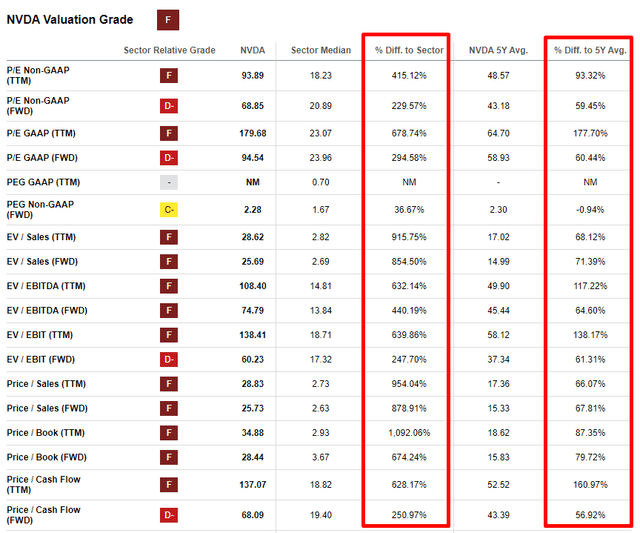

Nvidia historically has been a company with massive valuation metrics, but these days it went ridiculous. If you refer to Seeking Alpha Quant, you can see that multiples are nothing but immense. I usually don’t compare market leaders like Nvidia to sector median multiples due to such companies’ uniqueness, but the gap is too big that I cannot ignore it. Comparison to the company’s 5-year average valuation ratios also suggests overvaluation.

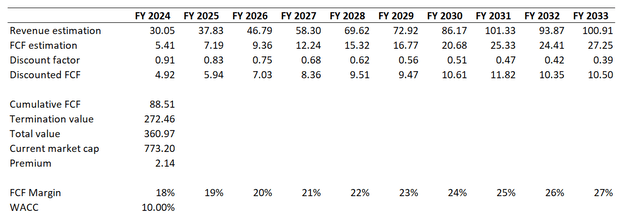

To cross-check multiples analysis, I would like to exercise a discounted cash flow [DCF] analysis. I will discount future cash flows at 10%, derived from a WACC range provided by valueinvesting.io. For future cash flows, I would simulate two scenarios. The first would be a “base case scenario” with consensus revenue estimates underlying. As we have seen in valuation multiples, NVDA is very aggressively valued so for free cash flow [FCF] margin, I use last year’s 18% levered FCF margin without stock-based compensation [SBC] deducted. Since my thesis is bearish, to be conservative, I have to simulate very optimistic projections for NVDA. So, I expect the FCF margin to expand by one percentage point per year.

Incorporating all these vastly optimistic assumptions suggests that the business is more than two times overvalued at current levels.

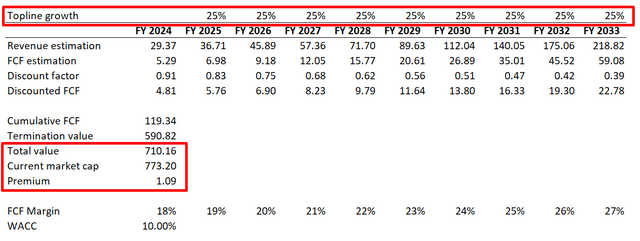

Nvidia bulls might argue that about 13% revenue CAGR, which is projected by consensus, is too low. They might refer to the words of Nvidia’s CEO, who said that we are currently facing the “iPhone moment for AI”. Okay, let me check the pace with which the revenue of Apple (AAPL) grew since the iPhone launch. With all the vast cross-selling and up-selling opportunities for iPhone given the Apple’s ecosystem, the topline of Apple grew at about 25% CAGR during the decade after iPhone was launched. So, let me implement a 25% revenue CAGR for Nvidia’s next decade with other assumptions remaining unchanged.

As you can see from the above calculations, even if Nvidia outpaces consensus topline growth estimates twice, the stock is still overvalued by about 10%.

My DCF analysis and valuation ratios analysis suggest that way too optimistic expectations are priced into current stock price levels.

Risks to my thesis

Given Nvidia’s valuation, which is not even close to underlying fundamentals, I see the continued hype around AI as by far the most significant risk for my bearish thesis. We can see that Jensen Huang, the CEO, continues to fuel the AI frenzy. He made a lot of very bullish statements regarding the AI future prospects during the ITF World, which took place last week.

Another risk is short-term arising from the upcoming earnings. During this earnings season, we have seen tech stock prices climbing even after slightly beating consensus estimates. But it seems that the public forgot that many tech companies’ earnings estimates were downgraded multiple times, making them easier to beat, in my opinion. So, if Nvidia delivers above-consensus earnings, the stock might also surge in the short term.

Bottom line

To conclude, NVDA stock is massively overvalued and expectations that are priced in are very far from consensus earnings estimates. I see the risk that AI mania might continue, but this will not last infinitely. Given the extent of overvaluation together with the current challenging macro environment, which is expected to worsen, I consider that unfavorable factors vastly outweigh the potential of an AI frenzy to fuel further stock price growth. Thus, I reiterate sell for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.