Summary:

- NVIDIA is bringing more innovations to its market every day than many other tech companies have in recent decades.

- However, I think the astronomical rally in NVDA stock that we have seen since early 2023 has gotten ahead of itself.

- The stock has sucked up all the positive expectations too quickly, leaving the company no margin for error (and thus no margin of safety for new investors).

- NVDA’s fair value per share should be $234-257.4, according to my calculations. This suggests a downside of 5 – 13.5% from the closing price.

- Therefore, I rate the stock as “Hold” and recommend selling call options or waiting for a better entry price.

David Becker

Introduction

Nvidia Corp. (NASDAQ:NVDA) is a $677-billion market cap firm that specializes in visual computing and has a global presence, is headquartered in Santa Clara, California. It has 2 business segments: Graphics (44.2% of total sales) and Compute & Networking (55.8%), and its primary end-markets include gaming, professional visualization, data center, and automotive.

NVDA’s end-markets [IR materials]![NVDA's end-markets [IR materials]](https://static.seekingalpha.com/uploads/2023/4/7/49513514-1680843151377491.png)

Since the beginning of 2023, NVDA stock has gained 84% at the time of writing – the largest gain to date within the structure of the NASDAQ 100 Index:

Given all the hype surrounding the company, I decided not to pass by and try to assess NVIDIA’s medium-term prospects – after such strong YTD growth, does it still make sense to buy NVDA stock at current levels?

Based on the title and my rating, you can already see what conclusion I will come to – at the end of this article you will learn the reasons.

NVDA’s Recent Financials And Prospects

On February 22, 2023, the company reported Q4 GAAP revenue of $6.05 billion, up 2% QoQ, but down 21% year-on-year. The full-year GAAP revenue of $27 billion was flat from the prior year. Despite the revenue decline in Q4 YoY, the company reported growth in its data center segment (+11% YoY), which includes GPU infrastructure for cloud service providers. NVIDIA saw strong sequential growth in hyperscale customer revenue, although the growth was short of expectations due to some cloud service providers pausing to recalibrate their build plans at the end of the year.

According to Colette Kress [EVP & CFO], the adoption of NVIDIA’s new flagship H100 data center GPU is strong, as it is up to 9x faster than the A100 for training and up to 30x faster for inferencing of transformer-based large language models. The company’s expertise in AI algorithms, data processing, and training methods can bring the capabilities of generative AI to enterprises. Generative AI applications will help almost every industry become faster, and NVIDIA looks pretty well-positioned to use the generative AI opportunities more and more companies now talk about.

NVIDIA is engaged with many consumer internet companies, enterprises, and start-ups, which are significant opportunities that will accelerate the growth of the data center. The company is also expanding its software and services, releasing version 3.0 of NVIDIA AI enterprise, with support for more than 50 NVIDIA AI frameworks and pre-trained models. Upcoming offerings include the NeMo and BioNeMo large language model services, which are currently in early access with customers.

As you can see from the infographic at the very beginning of this article, the company has shifted its focus to data centers – since 2019, this segment has grown from 25% to 56% of total revenue. This market is expected to grow at ~15% per year [CAGR] over the next few years, according to Mordor Intelligence. And Nvidia’s dominance in this market continues, with the company showcasing the performance of its new H100 GPU and the recently launched L4, which is replacing the T4 [Source: HPCwire.com]. The company claims that the H100 and L4 are faster and more efficient than previous versions, with up to 54% and over 3x performance gains, respectively.

Despite these positive developments, there are some potential pitfalls for NVIDIA. The company’s total data center sequential revenue decline was driven by lower sales in China, reflecting COVID and other domestic issues. Moreover, the company faces competition from other GPU manufacturers, such as Advanced Micro Devices (AMD) and Intel Corp. (INTC).

Additionally, the company’s dependence on cloud service providers for revenue growth poses a risk, as cloud adoption may slow or shift towards in-house infrastructure for some companies. Google (GOOG) published a research paper saying that its custom fourth-generation Tensor Processing Units (TPUs) are faster and more power-efficient than Nvidia’s A100 chips when training artificial intelligence models. Google’s chips are said to be 1.2-1.7 times faster and up to 1.9 times more power efficient than Nvidia’s chips.

Despite some challenges to NVDA’s future development, the company is bringing more innovations to market every day than many other companies have in recent decades, according to Jim Kelleher, CFA, an analyst at Argus Research [proprietary source].

Argus Research believes that Nvidia stands out in the AI market, not just because it participates in many parts of the industry, but because it offers a unique AI-as-a-service delivered through the cloud. Jim Kelleher has previously suggested that cloud computing would become the primary way for companies to use AI, due to the significant computing and software resources required. All three of Nvidia’s AI foundations announced at GTC 2023 are delivered via DGX Cloud, and the company is partnering with major cloud service providers, such as Microsoft Azure (MSFT), to host Omniverse Cloud. Omniverse Cloud is an AI-based version of Omniverse, which allows companies to design and model human and machine processes in virtual facilities before creating a physical plant.

Due to the versatility of its offerings, NVDA has access to a wide range of markets – the total addressable market [TAM] is estimated at approximately $1 trillion, which should allow the company to grow relatively comfortably in the coming years, even against the backdrop of existing competition in this market.

NVDA’s end-markets’ TAM [IR materials]![NVDA's end-markets' TAM [IR materials]](https://static.seekingalpha.com/uploads/2023/4/7/49513514-16808476567384336.png)

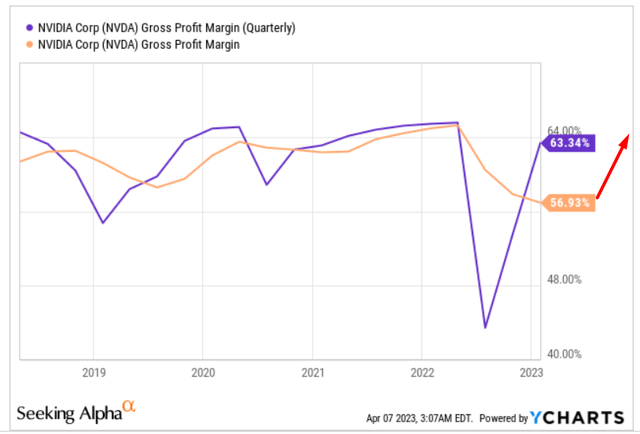

I expect the company to smoothly return to its previous gross margin levels – new projects and expanding relationships with existing customers will allow the company to do so relatively quickly.

However, NVDA stock’s valuation deserves special attention – to what extent is everything described above priced in by the market, and what is left for newcomers?

NVIDIA: Valuation and Expectations

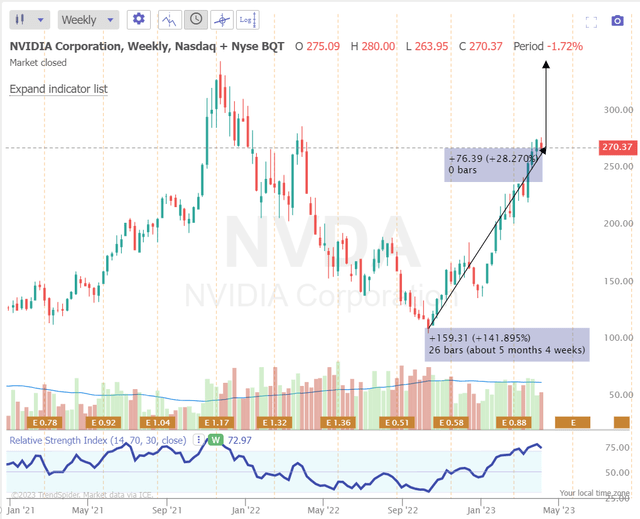

From its local bottom in October 2022, the share has soared by > 140% in less than 6 months – about 29% are still missing to reach the all-time high level:

TrendSpider Software, author’s notes

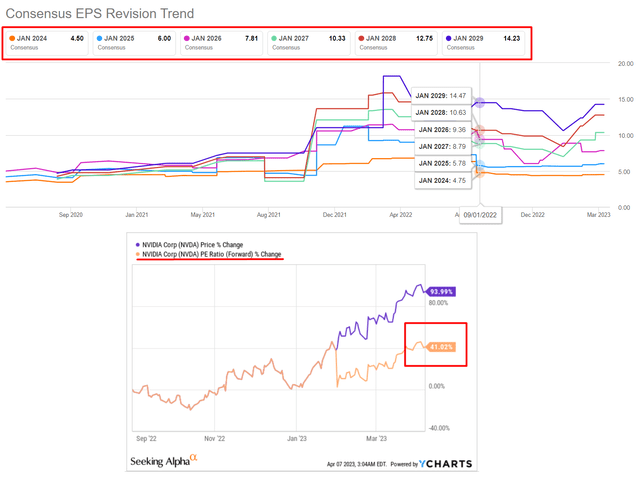

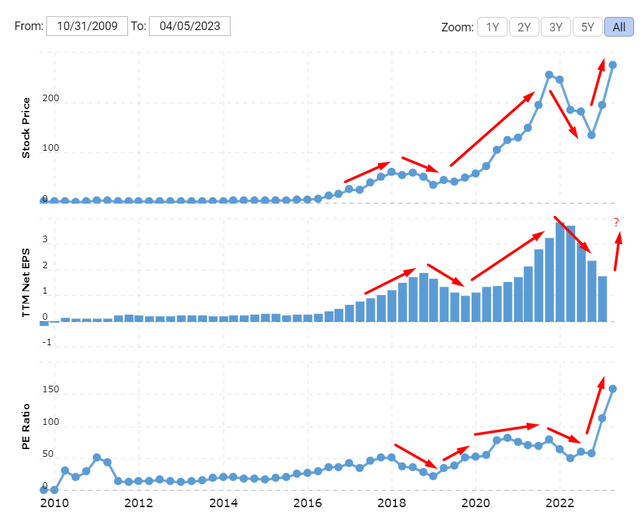

At the same time, it is important to understand that we are talking about a fast-growing company whose EPS growth has increased at a CAGR of about 27.9% over the last 9 years.

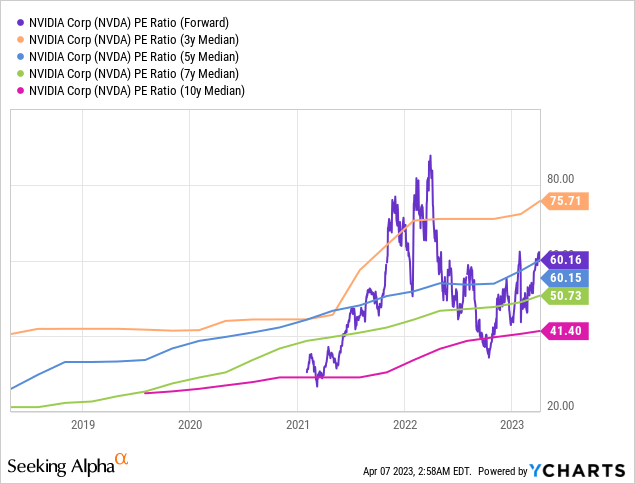

As the business cycle reaches maturity, growth companies like NVDA should experience multiple contractions – market valuations become less optimistic and P/E and other price ratios start falling year over year, pricing in lower financial growth going forward. This was the case in the 2017-2019 and 2020-2022 periods, and as history shows, not every multiple contraction leads to a decline in share price.

MacroTrends.net, author’s notes

The increase in the P/E ratio in the chart above should not scare you. According to Seeking Alpha, the market currently pricing the company’s EPS growth over the next 6 years at 25%. That’s a pretty generous estimate in my opinion – but implied P/E multiples are expected to drop to 60x by the end of FY2024 and 21.2x by FY2028. However, in the context of long-term median P/E ratios, NVDA’s FY2024 looks quite high in my opinion:

Beyond that, I am puzzled by one more thing. In early September 2022, the market was predicting about the same EPS growth rates for the coming years as today (+/-). However, at that time, the forwarding P/E ratio was 40% lower than today. So it seems that NVDA’s recent rally has sucked up all the positive expectations, leaving a little margin of safety for new buyers.

I think that given the new wave of AI developments, the fair price-to-earnings forwarding ratio should be in the 50-55x range. If the company again beats FY2024 EPS expectations, as it has 100% of the time over the last 8 years – say by 4% (close to average) – then fair value per share should be $234-257.4, according to my calculations. This suggests a downside of 5 – 13.5% from the closing price [of April 6, 2023].

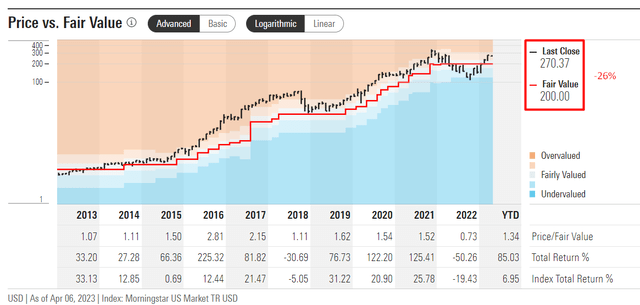

Morningstar Premium’s valuation system sees a much deeper downside for NVDA than the worst of my 2 scenarios:

Morningstar Premium, NVDA, author’s notes

Summary Thesis

I think the astronomical rally in NVDA stock that we have seen since early 2023 has gotten ahead of itself – the stock has sucked up all the positive expectations too quickly, leaving the company no margin for error (and thus no margin of safety for new investors in the company). However, the downside I calculated (5-13%) is not deep enough for me to issue a “Sell” rating – there is always the risk that I missed something or did not fully understand the issue of evaluating the company’s prospects (I usually assign a “Sell” rating at an overvaluation of 15% or more). NVIDIA seems to me to be one of the clear market leaders in terms of innovation and coverage for expanding AI solutions on a global scale. Therefore, I rate the stock as “Hold” and recommend selling call options or waiting for a better entry price.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!

![Bloomberg [March1, 2023]](https://static.seekingalpha.com/uploads/2023/4/7/49513514-1680842803341767.png)