Summary:

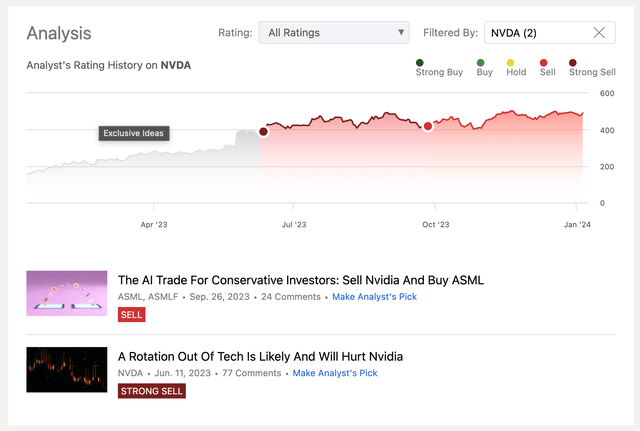

- I have been bearish on Nvidia since it reached above the $400 level and have suggested buying ASML Holding instead.

- But the company’s ability to deliver positive EPS surprises has increased my confidence in its ability to reach its ambitious forecast.

- I discuss key factors that will determine earnings growth beyond this year and upgrade the stock to a HOLD.

da-kuk

Dear readers,

I have been fairly bearish on Nvidia (NASDAQ:NVDA) ever since the stock reached $400 per share, following the incredible guidance that management issued in their Q1 2023 earnings call. The reason has primarily been valuation and some level of doubt whether the company could actually deliver on such aggressive guidance.

Most recently I published an article in September, where I urged investors to join me in a pairs trade – selling NVDA and buying ASML Holding (ASML). I considered ASML to be a much safer investment due to a lower P/E and a much less ambitious growth forecast. To date, the trade has paid off, with ASML returning 24.2%, while NVDA has “only” returned 18.8% over the same period.

Seeking Alpha

Nvidia has surpassed Wall Street’s and my expectations

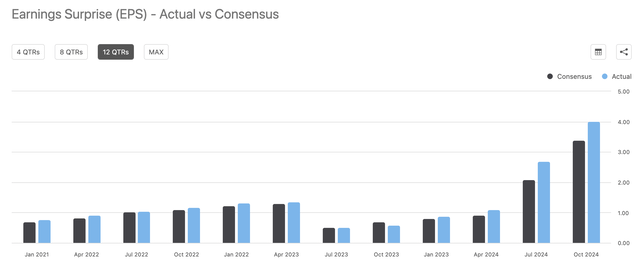

Since those articles, however, NVDA has published additional earnings reports (most recently Q3 2023) and has consistently beat consensus estimates. And we’re not talking small beats either as the company followed an 18% beat in Q1 by a 29% beat in Q2 and an 18% beat in Q3.

Seeking Alpha

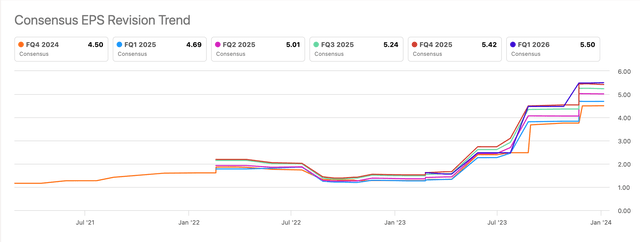

Moreover, with every earnings release, management has upped their forward guidance and analysts have increased their forward consensus expectations. In particular, following the Q2 earnings release, forward earnings expectations have increased by about 60%. More recently, following the Q3 results announcement, they jumped by additional 20%.

Seeking Alpha

Because NVDA’s earnings have grown so fast, the stock no longer trades at 50x 2023e earnings as it did when I wrote my first article. In fact the P/E relative to 2023e earnings has dropped to 39x.

And while that’s still high, if we look out one year and assume that NVDA will deliver on the consensus forecast for 2024 of additional 66% growth, the forward P/E stands at just 25x. That’s significantly below ASML’s forward P/E of 34x and a bargain for a company of NVDA’s caliber.

Because NVDA has been able to deliver significant positive EPS surprises in Q2 and Q3, my conviction that NVDA will reach the ambitious forecast EPS of $20 per share next year has increased significantly. I’m far from jumping all in here, but I have to admit that my head has turned a little bit on NVDA.

Key risk factors

There are several factors that will determine whether NVDA hits the 2024 forecast and more importantly what happens to earnings beyond, these are:

1 – Demand for chips

There is no doubt that NVDA’s chips are second to none when it comes to training AI models. That’s why they have a nearly 90% market share. But there is a worry that the recent hype has led NVDA’s customers to over-order well over their short-term needs to make sure they have the GPUs needed for projects in the future. While the exact impact of this is hard to estimate, if it is the case, then NVDA could see much lower earnings growth post-2024 and earnings might even decline somewhat which could make the forward P/E relative to 2024e skewed to the downside.

2 – Competition

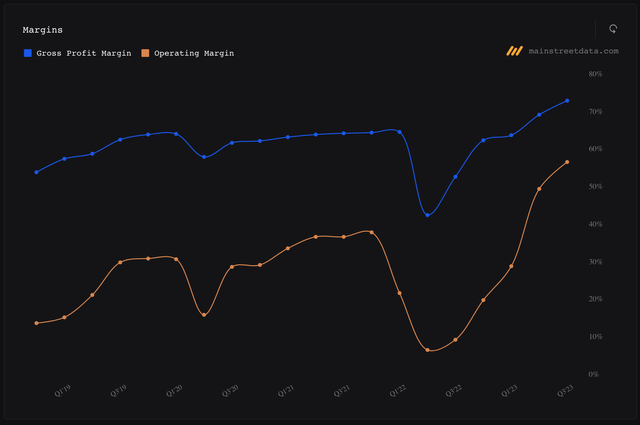

AI is the talk in town right now and understandably competition will try to capture some of NVDA’s market share which is likely to put pressure on NVDA’s industry leading margins. Advanced Micro Devices (AMD) is likely to be strong contender with their Mi300x chip and most big tech firms, including Alphabet (GOOGL) and Microsoft (MSFT) have already announced that they will be developing their own chips.

Main Street Data

3 – Use cases for AI

One of the biggest deciding factors for NVDA’s future earnings will be actual AI use cases. This will determine if the recent hype has been a bubble or the real thing. Over the course of last year, the number of viable use cases has surpassed 100. As we enter 2024, it will be interesting to see companies talk about ways to implement AI into their process to drive additional profitability and it will be even more important to see these starting to be implemented. It’s too early to tell which way it will go, but it sounds plausible that AI could lead to significantly higher productivity and earnings. Moreover, data centers give a solid indication that companies are getting ready to launch their AI applications, as capacity demand at most data centers has been strong lately.

4 – Geopolitical risks

AI could be very powerful and therefore countries are understandably fighting to keep it within their own borders. Nowhere is this more evident that the tensions between the U.S. and China. The U.S. government prohibited chip companies, including Nvidia, from exporting cutting-edge technology chips to China. This is obviously not good for business, but just like AMD with their RX7900 chip, Nvidia has been working on designing a slightly weaker chip specifically for the Chinese market. While the risk is hard to ignore, it’s not a dealbreaker in my opinion, especially if you believe that AI and its use cases are going to drive vast productivity improvements.

Bottom line

Evaluating Nvidia is tricky, because the decision whether to buy depends on your view of future earnings, especially beyond 2025. I was skeptical at first that the company may not deliver on the 2023 and 2024 forecast, but following strong earnings beats and increased guidance and consensus on every call in 2023, I have grown more bullish.

I do believe that AI will allow for many useful use cases, but I do see over-ordering as a real risk to earnings beyond 2024. As a result, I don’t think investors should put too much weight on the forward P/E of 25x, because it may rise next year if in fact it becomes clear that over-ordering was an issue.

For this reason, I’m no ready to issue a BUY rating on Nvidia, but I do upgrade the stock to a HOLD for the reasons discussed and I will be watching Q4 2023 results closely on February 21 to confirm my view that the company can deliver on its ambitious forecast.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.